Chances are, you likely have applied for a credit card to help pay off personal expenses and build credit. But, have you taken the leap and gotten a business credit card yet? If not, it’s time to buckle up and learn how to get a business credit card.

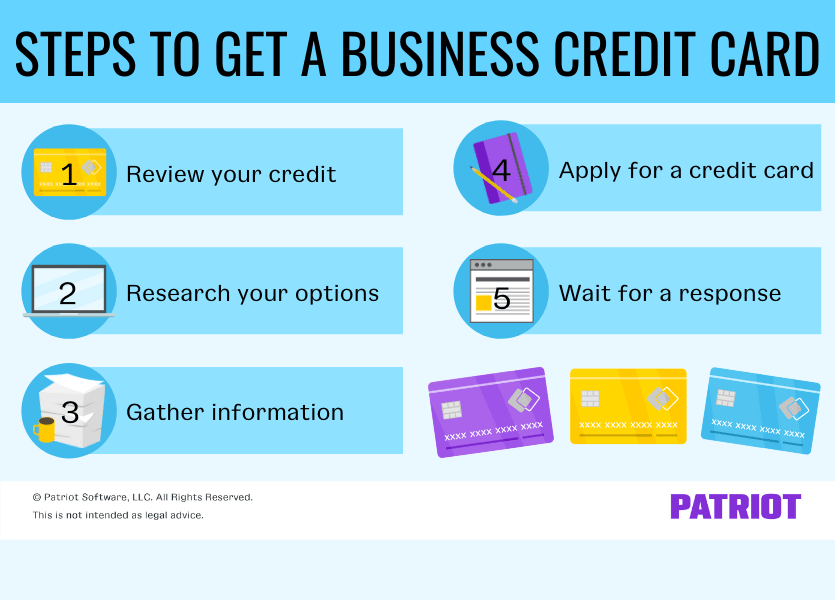

How to get a business credit card: 5 Steps

Opening a business credit card is an exciting time for your company. A credit card for business can help you build up credit, protect your company financially, access rewards (e.g., earn cash back), and simplify cash flow. Not to mention, it can help you juggle expenses.

But before you can even think about applying, you need to follow a few steps. Well, five steps to be exact.

1. Review your credit

Whether it’s your first time getting a business credit card or you’ve gone through the process a few times, it’s always a good idea to review your credit scores and reports. Before applying for a business credit card, look at your personal and business (if applicable) credit.

Both your personal and business credit can impact whether or not an issuer will accept your business credit card application. And if you don’t have business credit yet, lenders look at personal credit to determine their decision. Lenders might also look at personal income, business revenue, and expenses.

Business and personal credit matter because they show whether or not you can afford to pay off your credit card balance and are reliable with payments.

You can review your credit information by looking at credit reports, such as Experian and Equifax. When pulling credit history and providing confidential information for reports (e.g., Social Security number), make sure you use a reliable and secure credit company.

If you don’t have business credit yet or don’t have established credit, you may need to work on building up your credit before you can receive approval. To give your credit a boost, you can:

- Get an Employer Identification Number (EIN) if you don’t have one

- Incorporate your business

- Open a business bank account

- Start small (e.g., apply for a secured credit card)

- Make payments on time

2. Research your business credit card options

Once your credit is in a good standing, start doing your homework to find out which business credit card(s) you want to apply for.

There are a number of different types of business credit cards to choose from. So, do some research before filling out any applications. When researching business credit cards, look at factors like:

- Fees

- Interest rates

- Benefits (e.g., rewards)

Also, consider what you will be using the credit card for. Will you be making big purchases with the card or smaller purchases? Are you wanting a business credit card to help earn cash back for your business? Ask yourself these questions and more to get to the bottom of which card is best for your business.

After you narrow down some cards, compare their pros and cons side by side to determine which card (or cards) to apply for.

3. Gather information to apply

Have a good idea of which business credit card you want to apply for? Great! Now it’s time to gather some information.

Before you can apply for a business credit card, make sure you have the following information handy:

- Personal information

- Name

- Date of birth

- Social Security number (SSN)

- Home address

- Annual income

- Phone number

- Monthly rent or mortgage payment

- Personal debt

- Business information

- Business name

- Business legal structure (e.g., corporation)

- Industry

- Business address

- Company phone number

- Annual revenue

- Number of employees

- Years in business

- Monthly business expenses

- EIN or SSN

- Business-specific documents (e.g., articles of incorporation)

- Financial reports

- Business debt

The more information you have prepared, the better off you’ll be. And, the quicker you can fill out a business credit card application and (hopefully) get approved.

Make sure you know the business credit card application requirements before applying. That way, you know what to expect and can prepare ahead of time.

4. Apply for a credit card

After you gather all the information you need, now comes the fun part: Signing up for a business credit card.

As long as you’ve gathered the necessary information, applying will be a breeze. Most of the time nowadays, you can apply directly online. And, it typically only takes a few minutes.

In some cases, you may need to provide follow up information or documentation to the credit card company. This may be one of the steps online. Or, they may call or email you to gather the rest of your information.

For some business credit cards, you may receive a response a few seconds or minutes after applying. However, depending on the card you apply for, you may need to…

5. Wait for a response from the card issuer

Again, you generally get a quick response when applying for a business credit card. But sometimes, it may take a little longer to hear back. How quickly a credit card issuer approves or denies your credit card application can vary depending on:

- How the credit card company works

- The information you provided

- Your personal and business credit scores

- How many cards you’ve applied for in the last few months

If you don’t get a determination right away after applying, don’t panic. Just wait and see if you’re approved. Typically, the credit card issuer will reach out to you within a few business days via phone call or email with their response.

If you’re approved for the business credit card, you will receive your credit card via mail a week or two after approval (yippee!).

If you’re denied, don’t give up yet. Generally, the company gives you a reason why they rejected your application (e.g., not enough credit built up). If you really have your heart set on a certain business credit card, make some adjustments and reapply in a few months.

| Need an easy way to track income and expenses for your business? Patriot’s online accounting makes it a breeze to manage your books so you can save time for what matters most: your business. Try it free for 30 days today! |

This is not intended as legal advice; for more information, please click here.