Expanding, downsizing, or simply relocating? If you change your business address, you need to let people know.

From notifying the IRS to updating your small business website, find out where and how to change your business address.

Why it matters

When you move your residence, you have to let people know. And, you must update your address through the post office if you want your mail forwarded. The same is true for business—but even moreso.

When you change business address, you need to update it everywhere. You need a current business address for:

- Remitting tax documents

- Listing your business

- Receiving invoices and statements

- Keeping business licenses and permits applicable

- Protecting your storefront (e.g., insurance)

Whether you are changing business locations or deciding to work exclusively remote, you need to update your address to keep things legal. So, do you want to ensure your business is findable, compliant, and current?

Who to change your business address with

More people use your business address than you may think.

When you move your business, list out all the people you send and receive documents to and from. Consider the places customers turn to to find out how to shop with you in-person. And, think about things like insurance coverage.

Take a look at where you need to update your business address. Keep in mind that this may not be an all-inclusive list.

- IRS

- State and locality

- Insurance agents

- Financial institutions

- Vendors

- Post office

- Website and social media accounts

- Online listings

IRS

When it comes to updating your business address, the IRS should be at the top of your list. You include your business address on every form you send to the IRS, including your small business tax return and payroll tax forms. As a result, the IRS needs to have the right address on file.

To update business address with IRS, file Form 8822-B, Change of Address or Responsible Party – Business.

Complete the IRS business change of address form when you change your business mailing address or location. Where you mail the form depends on your old business address.

State and locality

In addition to sending tax-related documents to the IRS, you also send them to your state and locality. And, each form you send must list the address that matches what these agencies have on file.

If your business is structured as an LLC, you filed Articles of Organization with the state. And if your business is structured as a corporation, you filed Articles of Incorporation. Your state must update your business address on either document, if applicable.

Also, talk with your state and local agency if you need to change your business address on state and local licenses or permits.

Insurance agents

You must also let your insurance agents know about a change in business address to retain property insurance coverage.

Financial institutions

Remember to notify your financial institutions if your business moves, including your:

- Banks

- Lenders

Even if you receive online statements from your banking, credit, and loan institutions, you have to let them know you have a change in address.

Vendors

Do your vendors ship inventory to your business address? If yes, give vendors your new address as soon as possible to avoid shipping delays.

Do your vendors mail invoices to you? Even if you’re enrolled in e-invoicing, don’t forget to update your address with your vendors.

Post office

You may miss a few people when going through your list of places and people to notify about your change of address.

If you want to ensure you still get your business’s mail, go online or head to the post office. That way, you’ll continue receiving your mail—even if you forgot to tell the party—and can give them the updated address when you do.

Website and social media accounts

If you have a small business website, you probably have a page devoted to your business’s contact information. Likewise, you likely list your address on your social media accounts.

Remember to change your business address anywhere it appears on your website and social media accounts.

You may also consider adding something like, “We’ve moved!” to your website and social accounts to let customers know you have a new business address.

Online listings

Your business’s website and social media accounts aren’t the only places that have your address. Other pages, like review sites (e.g., Yelp) and partner websites, may also list your website. Notify them about your new address.

Do you have a Google My Business account that lists your address? To update your address on your Google My Business account, first sign in. Then, go into the address field and enter your updated business address.

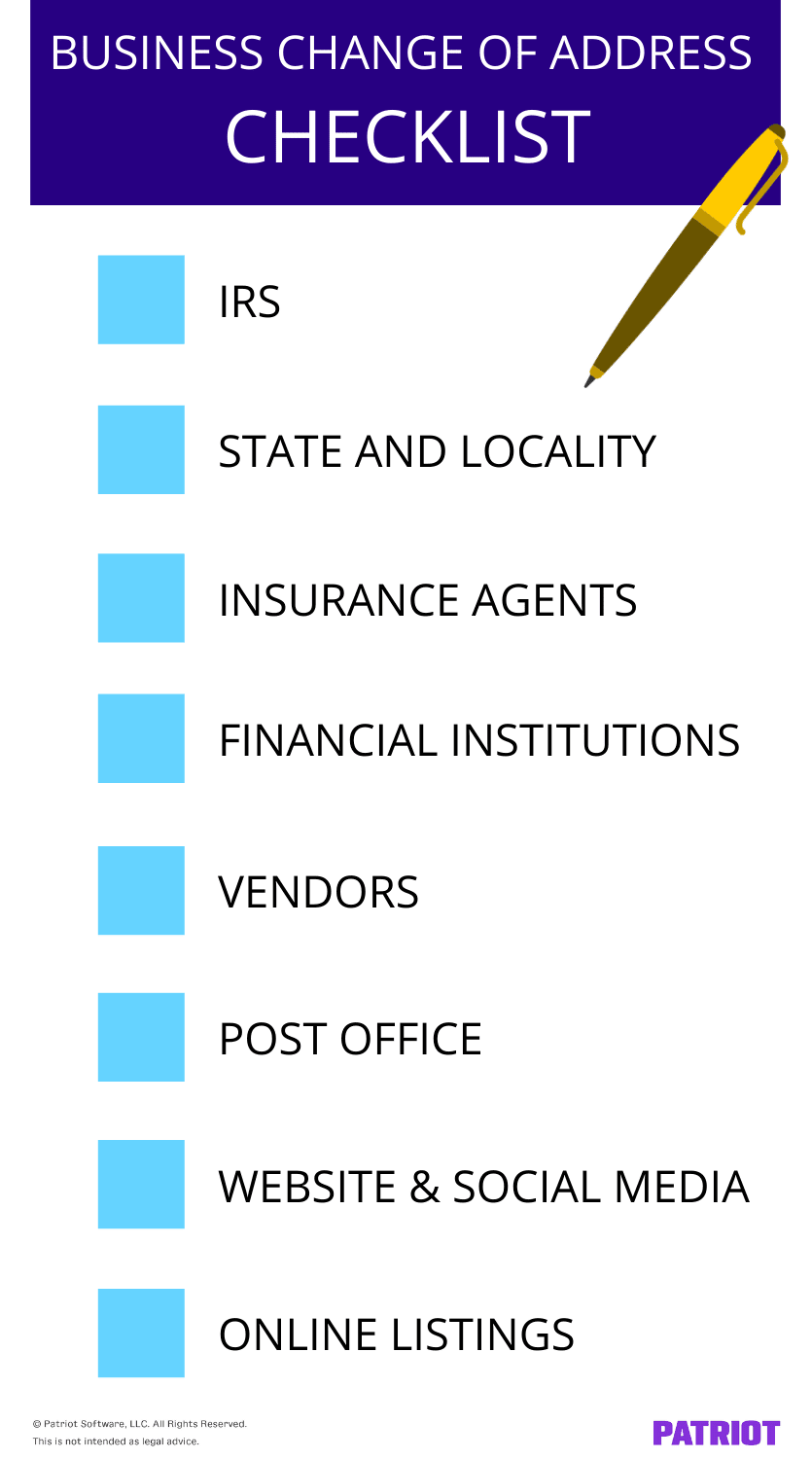

Business change of address checklist

Need help staying on top of all the places you need to update business address with? Check out our business change of address checklist.

Looking for an easier way to manage your business’s books? The search stops here. Patriot’s accounting software lets you receive and record payments, import bank transactions, send estimates, and so much more. See for yourself by starting your FREE trial!

This is not intended as legal advice; for more information, please click here.