Thanks to digital payments, gone are the days where you need to carry cash with you everywhere you go. And, you don’t even have to bring your physical credit or debit cards, either.

Chances are, some of your customers have swapped their cash and cards in favor of making contactless payments, too…

…Which is why it might be time your business started accepting different types of digital payments.

What is digital payment?

Digital payments include any transaction where value (e.g., money) transfers from one account to another electronically. Unlike traditional payments made with cash, digital transfers are intangible.

Here are a few digital payment examples to consider: Send someone a payment through your phone? Digital payment. Pay a bill online? Digital payment. Use a mobile wallet to pay for your groceries? Yep—you guessed it.

Through digital payment systems, there’s no need for cash, credit and debit cards, or checks. When you use digital payment apps, everything goes through a processing system on devices like mobile phones and computers.

Types of digital payment

So, what are the different types of digital payments you might come across in your business or everyday life?

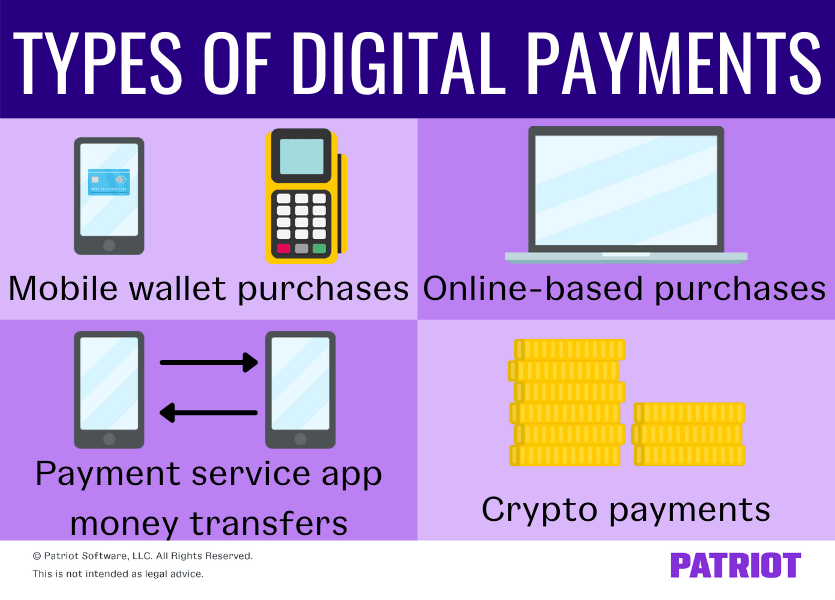

Digital payment types include the following:

- Purchases paid for through mobile wallets (cell phones and smartwatches)

- Money transfers through mobile payment service apps and QR codes (e.g., PayPal, Venmo, Zelle, etc.)

- Online-based purchases (e.g., browsers or apps)

- Crypto payments

Why should your business use digital payments?

It’s not just a small group of people who rely on digital payments to exchange funds. More than three-quarters of Americans use these types of payments.

And if you think this payment method is only reserved for sending friends money over an app, think again. Eleven financial institutions launched Zelle for small businesses in 2020, reaching 40% of U.S. small businesses.

What does this mean for your business? Mobile payment service apps are gearing up to let consumers send money directly to small businesses … Which means that digital money transfers may be the way of the future for many consumers and businesses.

Not to mention, 56% of retailers in one survey said they accept digital wallet payments on mobile phones.

If the digital payment trend continues, more consumers may expect to pay for their purchases through mobile payment service apps. So, you may consider accepting digital payments to avoid missing out on sales.

The popularity of these payments isn’t the only reason to consider adding it to your business’s acceptable payment methods. There are additional benefits of digital payments like:

- Convenience: Whether they’re placing an online order or paying you at the register, digital payments make it fast and easy for customers to pay for their purchases.

- Contactless: Thanks to the coronavirus pandemic, contact-free payment options have become the new norm. And if you really want to remove contact from the equation, accepting digital payments may be the answer.

In addition to accepting digital payments from customers, you might also consider:

- Making digital payments to vendors

- Using a mobile wallet for payroll

Implementing digital payment systems: Considerations

If you decide to move forward with accepting digital payments from customers, start by investing in digital payment technologies. And if you’re not sure where to start, you’re not alone—the choices are seemingly endless.

Before shopping around for digital payment services, consider whether your customers will use it, what types of payment methods you want to accept, and how much you’re willing to pay.

Whether customers will pay digitally

Although digital money transfers continue to become more popular, they might not be popular with your target market.

Not to mention, many individuals still have concerns about using the platforms. According to one survey, here are the top five concerns people have with digital payment platforms:

- Hacking (41%)

- Fraud (16%)

- Transaction fees (14%)

- Theft (12%)

- Overspending (7%)

Consider whether your customers would want to use digital payments to make purchases at your business. And, think about how often you lose out on sales because you don’t accept digital payments.

If you’re on the fence about whether accepting digital payments is worth it, consider digital payment alternatives, like cash, credit and debit cards, and extending credit to customers.

Acceptable payment methods

Do you want to accept a mix of cash, cards, and digital payments? The digital payment system you go with may depend on what kind of payment methods you want to accept.

Opt for a POS (point of sale) system that can handle all the types of payment methods you want to accept.

Costs

Implementing a digital payment system comes with fees. You likely need to pay at least one of the following:

- Setup fee

- Per purchase fee (e.g., percentage or flat fee)

- Flat monthly usage fee

For some businesses, the cost of offering digital payment systems outweighs the advantages. Consider your ROI (return on investment) before implementing this type of system. And, compare digital payment companies to determine the best one for your business.

What’s up next for payment systems?

Acceptable consumer payments are constantly expanding. Remember when plastic became all the rage? More than likely, debit and credit cards won’t be the most popular payment methods forever.

In addition to digital payments, pay attention to other payment system trends like:

- Contactless credit and debit cards (i.e., “tap to pay”)

- Biometric payment cards (e.g., fingerprints)

Digital? Cash? Check? Whatever types of payments you make and accept, be sure to record it in your books. With Patriot’s accounting software, enjoy an easy way to manage your books, get free USA-based support, and so much more. Get your free trial today!

This is not intended as legal advice; for more information, please click here.