Whether you’re a new startup or you’ve been in business for decades, your company needs capital to grow and thrive. And, having a solid understanding of capital and how it can benefit your company can help you regardless of what stage your business is in. So, what is capital?

Capital definition:

So, what does capital mean? Capital is anything that increases your ability to generate value. You can use capital to increase value in your business’s financial assets. Generally, business capital includes financial assets held by your company that you can use to leverage growth and build financial stability.

Capital and cash are not one and the same. Capital can be stronger than cash because you can use it to produce something and generate revenue and income (e.g., investments). But because you can use capital to make money, it is considered an asset in your books (i.e., something that adds value to your business).

So, how does capital work? Companies can use capital to invest in anything to create value for their business. The more value it creates, the better the return for the business.

Capital examples

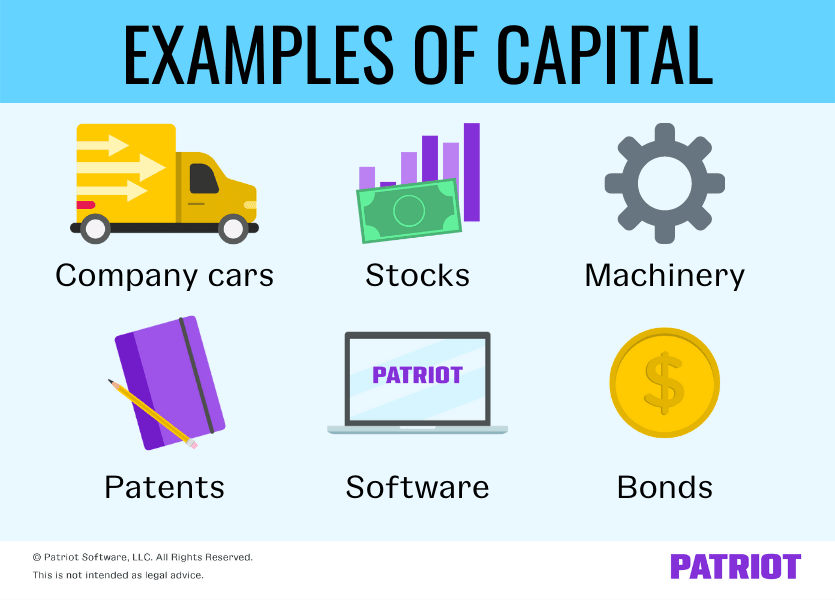

So, what does capital include? Capital can expand to a variety of things in business, both tangible and intangible. Here are a few examples of capital:

- Company cars

- Machinery

- Patents

- Software

- Brand names

- Bank accounts

- Stocks

- Bonds

There are also different types of capital in business, including:

- Working capital

- Use this capital to pay for day-to-day business operations

- Converts into cash more quickly than other investments (e.g., a new oven at a bakery)

- Debt capital

- Capital a business earns from taking out loans and debt

- Equity capital

- Comes in several forms, including public equity and private equity (e.g., shares of stock in the company)

- Trading capital

- Amount of money available to a company for purchasing and selling assets

Capital gains and losses

When you make an investment, the goal is to generate wealth for your business to help it grow and expand. And as your investments grow your business, the capital itself can increase in value, which can result in capital gains.

Capital gains

When your capital’s worth increases, you see a capital gain. A capital gain occurs when your investment is worth more than its purchase price.

For example, say you buy a machine for $1,500. The machine needs work, but you fix it without needing any new parts. You then turn around and sell it for $2,000 because you gave it a higher value by fixing it.

To calculate the gain in your business accounting records, take the final sale price of the machine ($2,000) and subtract the initial purchase price ($1,500). Your accounting records should reflect a gain of $500.

Capital losses

Not every investment is going to be worth it in the end. This is where capital losses come into play. With a capital loss, your investment is worth less than its initial purchase price.

Let’s take a look at the machine example again. You purchase the machine for $1,500, but you spend $600 on new parts to fix the machine before you sell it for $2,000. Between the cost of the machine and its new parts, you spend $2,100. This is considered a capital loss of $100 because you spent more money on the total investment ($2,100) than you received for the sale ($2,000). In your books, record a capital loss of $100.

How to grow capital

So, how do you go about growing capital? There are a number of ways you can increase your capital, including:

- Apply for a small business loan

- Find an angel investor

- Ask friends and family for a loan

- Use crowdfunding

- Look into SBA loans and programs

Growing your capital can take time and a whole lot of dedication. To ensure you have a good shot at growing your capital, develop and refine your business plan. And, practice pitching why investors and lenders should invest in your business.

Once you establish your company and get it off the ground, you can typically gain funding from other sources. You should gain capital primarily from your profits. And as you gain equipment, property, and other assets, your capital grows. When it grows, the financial worth of your business grows.

Capital in accounting

Business owners can use their capital records to make savvy investments and help make smart financial decisions. But in order to do that, your accounting records need to be as accurate as possible.

To easily track capital, make smart financial moves, and avoid major mistakes, record your investments in your books regularly. And, be sure to examine them to see what’s working and what isn’t.

To easily track capital in your books, you can opt to use accounting software. That way, you can record your capital quickly and avoid making accounting mistakes yourself. Plus, you can access numerous reports and financial statements to help make investments and decisions.

To determine if an investment was worth it, examine your books and ask yourself the following questions:

- Did the capital I invested in help grow my company?

- Am I in a good place financially that I can invest more in my company?

- Which investments were not worth it?

When your capital is growing, so is your business. So to keep your business prospering, build a solid strategy for tracking, using, and gaining investments.

Want to spare yourself the time and frustration involved in keeping track of your business capital and other transactions? Give Patriot’s online accounting a whirl to keep your books in order. Try it free for 30 days today!

This article has been updated from its original publication date of January 15, 2016.

This is not intended as legal advice; for more information, please click here.