Accounting is an essential part of running a business. But, that does not mean you have to be an accountant to understand the basics. Part of the basics is looking at how you pay for your assets—financed with debt or paid for with capital. Use the accounting equation to see the difference. What is the accounting equation? Let’s take a look.

What is the accounting equation?

Double-entry accounting uses the accounting equation to show the relationship between assets, liabilities, and equity. When you use the accounting equation, you can see if you use business funds for your assets or finance them through debt. The accounting equation is also called the balance sheet equation.

If your business uses single-entry accounting, you do not use the balance sheet equation. Why? Well, the accounting equation shows a balance between two sides of your general ledger. Single-entry accounting does not require a balance on both sides of the general ledger. If you use single-entry accounting, you track your assets and liabilities separately. You only enter the transactions once rather than show the impact of the transactions on two or more accounts.

Parts of the balance sheet equation

Before you use the accounting equation, you need to know the parts of the balance sheet used in the equation. Your balance sheet is a financial statement that tracks your company’s finances. There are three parts to the balance sheet: assets, liabilities, and equity.

Assets are any items of value that your business owns. Your bank account, company vehicles, office equipment, and owned property are all examples of assets. Do not include leased items in your assets.

Liabilities are debts (aka payables) that you owe to others. Company credit cards, rent, and taxes to be paid are all liabilities. Do not include taxes you have already paid in your liabilities.

Equity shows your ownership in the business. Sole proprietors hold all of the ownership in the company. If your business has more than one owner, you split your equity among all the owners. Include the value of all investments from any stakeholders in your equity as well. Subtract your total assets from your total liabilities to calculate your business equity.

How are these basics used in the balance sheet equation?

The basic accounting equation

In the basic accounting equation, liabilities and equity equal the total amount of assets. The accounting formula is:

Assets = Liabilities + Equity

Because you make purchases with debt or capital, both sides of the equation must equal.

Equity has an equal effect on both sides of the equation. So, you can calculate the third part of the equation if you know the other two parts. You can also write the accounting equation as:

Liabilities = Assets – Equity

OR

Equity = Assets – Liabilities

Now that we have the basics, let’s take a look at some accounting equation examples.

Accounting equation examples

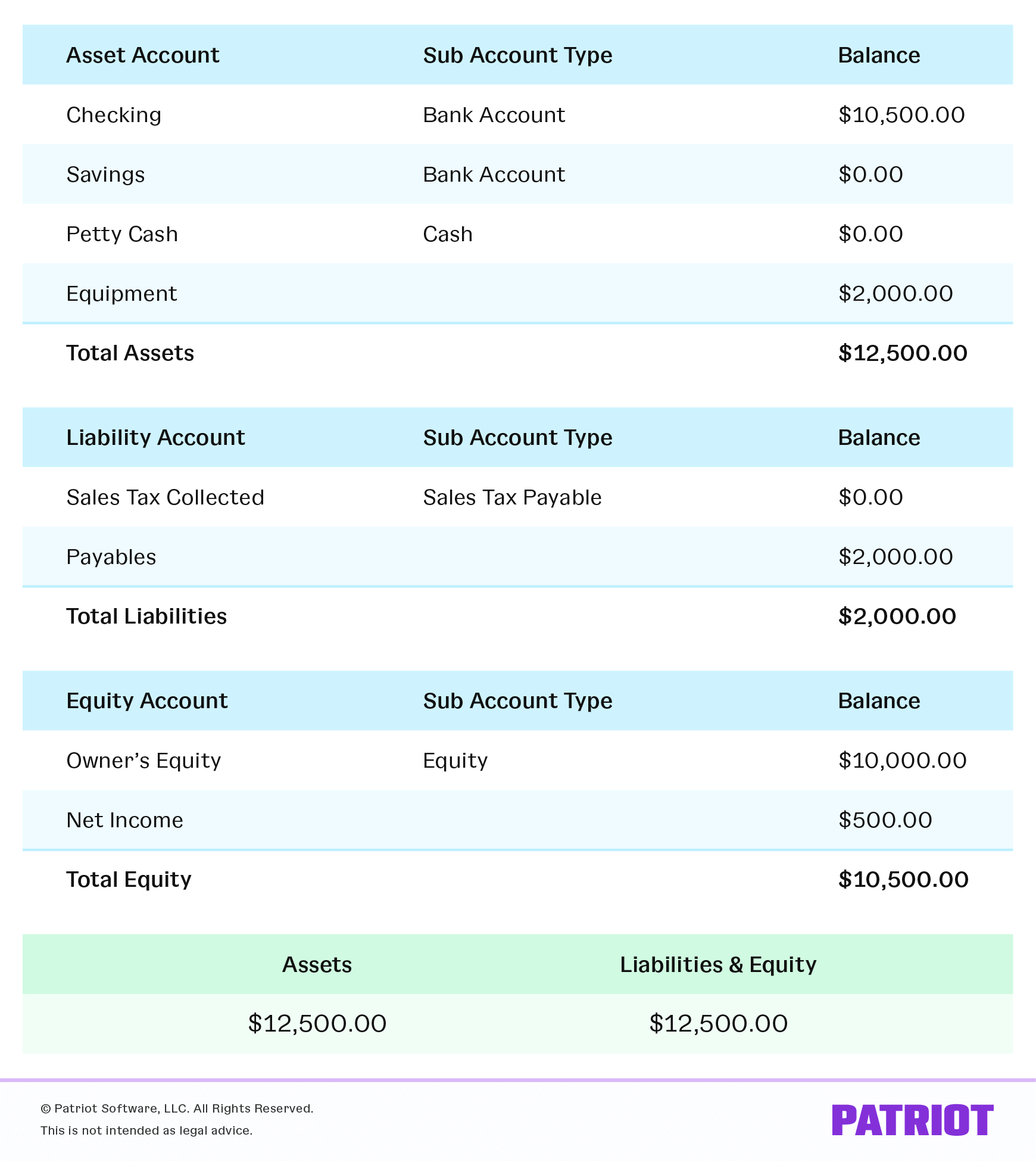

The following examples are for the same business. Each example shows how different transactions affect the accounting equations. The business’s balance sheet is at the end of the section.

Example 1

You just started your software business after a year of saving $10,000 to contribute to your new company. The $10,000 is now your equity in the business, so you also need to increase your assets. The equation looks like this:

$10,000 Assets = $0 Liabilities + $10,000 Equity

Example 2

Now that you have started your company, you need to purchase two computers and other equipment. So, you decide to purchase $2,000 worth of equipment on your company credit card. That $2,000 credit card purchase is both a liability (aka debt) and an asset. Both assets and liabilities increase by $2,000, so the equation looks like this:

$2,000 Assets = $2,000 Liabilities + $0 Equity

Example 3

Your business grew, and you now have customers. A customer decides to purchase your software for their own business’s computers. Your software is $10 per program download, and the customer needs the program for 50 computers, totaling $500. From this transaction, you gain both an asset and equity. Your accounting equation looks like this:

$500 Assets = $0 Liabilities + $500 Equity

Example balance sheet

Record each of the above transactions on your balance sheet. Again, your assets should equal liabilities plus equity. So, let’s add the three examples into one formula. Add the $10,000 startup equity from the first example to the $500 sales equity in example three. Your total equity is $10,500. Add the total equity to the $2,000 liabilities from example two. Your total assets now equal $12,500.

The full accounting equation is:

$12,500 Assets = $2,000 Liabilities + $10,500 Equity

Expanded accounting equation

The expanded accounting equation shows the relationship between your balance sheet and income statement. Revenue and owner contributions are the two primary sources that create equity.

The expanded accounting equation is:

Assets = Liabilities + Owner’s Equity + Revenue – Expenses – Draws

Revenue is what your business earns through regular operations. Expenses are the costs to provide your products or services.

Different transactions impact owner’s equity in the expanded accounting equation. Revenue increases owner’s equity, while owner’s draws and expenses (e.g., rent payments) decrease owner’s equity.

Both sides of the equation must balance each other. If the expanded accounting equation is not equal on both sides, your financial reports are inaccurate.

Why is the accounting equation important?

So, now you know how to use the accounting formula and what it does for your books. But why is it essential for your bookkeeping? The accounting equation is important because it can give you a clear picture of your business’s financial situation. It is the standard for financial reporting, and it is the basis for double-entry accounting. Without the balance sheet equation, you cannot accurately read your balance sheet or understand your financial statements.

Your accounting equation helps to answer questions like:

- Do you have enough assets to purchase more equipment or a new office space?

- Should you take out a business loan (increase both liabilities and assets) to make purchases for your business?

- Do you have enough revenue (assets) to pay down your liabilities?

The balance sheet equation answers important financial questions for your business. Use the balance sheet equation when setting your budget or when making financial decisions.

Accounting can be hard, so your accounting software should be simple to use and easy to understand. Patriot’s online accounting software lets you login from anywhere, anytime to enter your information and get back to business. Try it free for 30 days!

This article has been updated from its original publication date of September 22, 2017.

This is not intended as legal advice; for more information, please click here.