The Family and Medical Leave Act (FMLA) requires certain businesses to offer employees unpaid leave for qualifying situations. But, there’s no federal law that requires you to offer employees paid family and medical leave. If you voluntarily decide to pay employees who use this type of leave, you could be eligible for an FMLA tax credit.

Read on to learn:

- What is the employer credit for paid family and medical leave

- The difference between the FMLA tax credit and the COVID-19 employer credit

- If you qualify for the credit

- How much the credit is worth

- How to claim the credit

What is the FMLA tax credit?

The Family and Medical Leave Act tax credit is a dollar-for-dollar tax liability reduction. Eligible employers can claim this credit if they choose to pay wages to employees who are away on family and medical leave.

When you claim the paid family and medical leave tax credit, you reduce your tax liability by the amount of the credit. The IRS determines the maximum credit you can receive.

Under the Tax Cuts and Jobs Act of 2017, the FMLA tax credit was originally only available in tax years 2018 and 2019. However, the Taxpayer Certainty and Disaster Relief Act of 2019 extended the credit to cover 2021 – 2025 tax years.

Keep in mind that this is not the same credit you can claim for offering paid COVID-19 leave under emergency legislation. It is a separate credit.

FMLA tax credit vs. COVID-19 paid leave credit

In 2020, the Families First Coronavirus Response Act established coronavirus-related employment credits. The Consolidated Appropriations Act and American Rescue Plan extended these credits through September 30, 2021.

Eligible employers can claim the coronavirus-related credits on their employment tax return if they offer paid sick and family leave to eligible employees.

It’s easy to confuse the paid FMLA tax credit and the COVID-19 tax credits for offering paid family and medical leave. But, the COVID-19 tax credits are only available if you provide the following:

- Paid sick leave to employees who have to miss work because they’re dealing with the coronavirus, getting vaccinated against the virus, or dealing with vaccination complications.

- Paid sick leave to employees who miss work to care for someone who must quarantine or isolate due to the coronavirus.

- Paid family and medical leave to employees who must care for a child under the age of 18 whose school or place of care is closed due to the coronavirus.

Unlike the paid FMLA tax credit, the COVID-19 paid leave tax credits are only available if you provide paid leave to employees for coronavirus-related reasons. The paid FMLA tax credit under the Taxpayer Certainty and Disaster Relief Act of 2019 is not COVID-specific.

And, employers claim the COVID-19 paid leave credits on their employment tax returns. On the other hand, employers claim the FMLA tax credit with their business tax returns.

Keep in mind that you cannot claim the FMLA tax credit and the COVID-19 tax credits on the same wages.

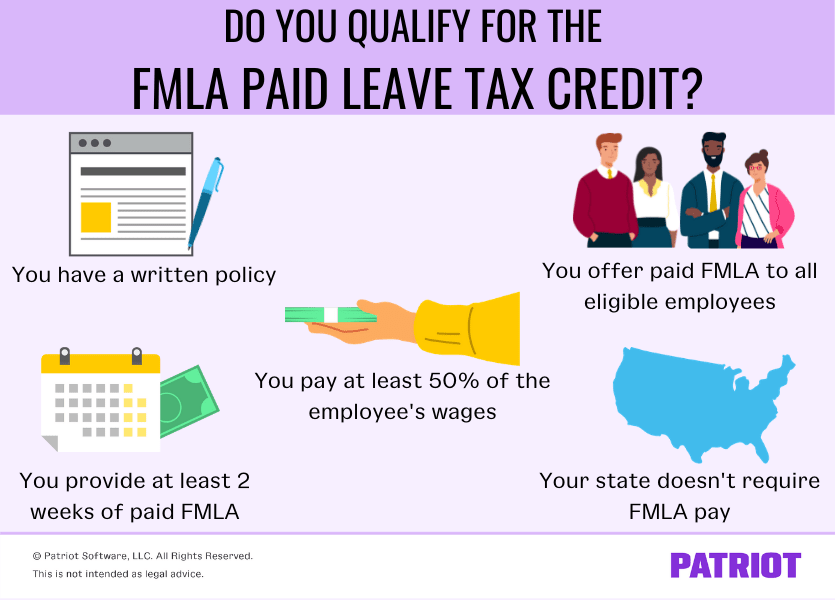

Do you qualify for the FMLA paid leave credit?

Not all employers who offer paid leave can claim the FMLA tax credit. You must meet all five of the following IRS requirements to qualify.

1. You have a written policy in place

The IRS requires that you create a written, paid FMLA policy before the employee takes their paid leave of absence.

Your written policy must address key information such as:

- How much time the employee can take as paid leave

- What percentage of their wages the employee earns

- Which workers are eligible for paid FMLA

- “Non-interference” language stating you will not interfere with, restrain, or deny employees who want to use paid leave

- Your policy’s effective date

2. You offer paid FMLA to all eligible employees

If you want to receive the FMLA tax credit, you must offer it to all eligible employees, including both full-time and part-time workers.

Under the Family and Medical Leave Act, employees become eligible for leave once they work for you for at least 12 months.

Eligible employees are also those who earn below an annual threshold. Qualifying employees in 2021 and 2022 are those who earn below $78,000 in compensation in the preceding year. You can claim the FMLA tax credit for offering paid leave to these qualifying employees.

The employee’s leave of absence must be for a qualifying FMLA reason. The following types of leave count as FMLA:

- Birth, adoption placement, or foster care placement

- Care of a spouse, child, or parent with a serious health condition

- Serious health condition that prevents the employee from performing their job

- Situation that requires the employee’s attention due to the military deployment of a spouse, child, or parent

You cannot claim the FMLA tax credit for employees who use unpaid or paid time off from work for vacations or illnesses.

3. You pay at least 50% of the employee’s wages

To qualify for the tax credit, you must pay employees at least 50% of their regular wages while they are on family and medical leave.

For example, say your employee normally earns $1,000 per week. You would need to pay them at least $500 per week during their FMLA.

4. You provide at least two weeks of paid FMLA

You must offer all eligible, full-time employees at least two weeks of paid family and medical leave annually to qualify for the FMLA tax credit. Keep in mind that you may need to offer more, unpaid family and medical leave under federal law.

Have part-time employees? You must give them at least a proportionate amount of time. Part-time employees are those who work fewer than 30 hours per week. For example, you give four weeks of paid leave to full-time employees who work 40 hours per week. You would give two weeks of leave to a part-time employee who works 20 hours per week.

5. Your state doesn’t require FMLA pay

Some states already require employers to provide paid family and medical leave to eligible employees. Under a state paid family leave program, you, your employee, or you and your employee pay into a system. The state then distributes benefits to employees who qualify for leave.

You cannot claim the FMLA tax credit on any leave that the state (or locality, if applicable) pays an employee for.

However, you can claim the credit on any additional paid leave you offer an employee if you meet the other IRS requirements.

Let’s say your state pays employees 50% of their regular wages for paid leave. Your policy also says you provide paid leave of 50% of the employee’s regular wages. The employee receives 100% of their wages—50% from the state and 50% from you. You can claim the FMLA tax credit on your 50% employer payment.

How much is the credit?

The credit you can claim for offering paid FMLA depends on the percentage of wages you provide.

The minimum tax credit you can take is 12.5%, and the maximum tax credit is 25%. The tax credit increases by 0.25% for each percentage point that exceeds 50%.

If you pay 50% of the employee’s normal wages when they are on family and medical leave, you can take a 12.5% tax credit.

You can take the maximum tax credit of 25% if you pay 100% of the employee’s wages when they take family and medical leave.

To find your tax credit for percentages of an employee’s pay beyond 50%, use the following formula:

[(Desired % – 50%) X 0.25] + 12.5%

Let’s say you want to give employees 75% of their regular wages when they use paid family and medical leave. Use the formula to determine your tax credit:

[(75% – 50%) X 0.25] + 12.5% = 18.75%

You could claim a tax credit of 18.75%.

To help you determine your tax credit, use the chart below, which increases in increments of 10%:

| % of Employee’s Pay | Tax Credit |

|---|---|

| 50% | 12.5% |

| 60% | 15% |

| 70% | 17.5% |

| 80% | 20% |

| 90% | 22.5% |

| 100% | 25% |

Claiming the employer credit for paid family and medical leave

To claim the paid FMLA credit, you must attach a few forms to your business tax return (e.g., Form 1120-S).

The form for claiming the FMLA tax credit is Form 8994, Employer Credit for Paid Family and Medical Leave. You also need to file the General Business Credit form, Form 3800.

All in all, file the following forms to claim the credit:

- Business tax return

- Form 3800 (General Business Credit)

- Form 8994 (Employer Credit for Paid Family and Medical Leave)

To claim tax deductions, you need up-to-date books. Patriot’s online accounting makes it easy to track incoming and outgoing money. And, we offer free, USA-based support. Get your free trial today!

This article has been updated from its original publication date of February 5, 2019.

This is not intended as legal advice; for more information, please click here.