Payroll has a lot of moving parts to keep track of: employee hours, gross pay, net pay, payroll taxes, employee deductions, employer contributions, and the list goes on. Seeing all of that information in one place would be a dream come true, right? That’s where the payroll register comes in. So, what is a payroll register, and what exactly does it do?

What is a payroll register?

The purpose of payroll register is to record of all the payment details for employees during a specific pay period. Generally, a payroll register lists the following information about each employee:

- Gross pay

- Net pay

- Payroll taxes

- Employee deductions (e.g., health insurance)

Also, typically at the bottom of the register report is a total for all employees during the period.

The payroll register report differs from the paycheck history report and other payroll reports, like a payroll details report.

Payroll register vs. paycheck history vs. payroll details

A paycheck history report gives the totals for an individual employee for a pay period. Paycheck history reports don’t list multiple employees because they are specific to one individual employee. You can give a paycheck history report to your employees as a pay stub. If you use payroll software, you may be able to group one employee’s paycheck history for a set period to see one total for multiple pay periods (e.g., all paychecks for the first quarter).

The payroll register file shows the totals from all employee earnings during a specific time period. The report shows employee totals, along with the total for all employees combined. The register report generally combines information from individual paycheck history reports at the bottom of the report.

A payroll details report is very similar to the register report. Both show employee paycheck details. And, you can use both to show paycheck information for a specific pay period. But, some payroll details reports go a step further by allowing you to group paychecks in more ways (e.g., by location). Typically, a payroll details report includes the employer portion of payroll taxes if the payroll register report does not list them.

| Need to gather payroll data? Make pulling payroll reports, like the payroll register report, easy with Patriot’s online payroll software. Start your free 30-day trial today! |

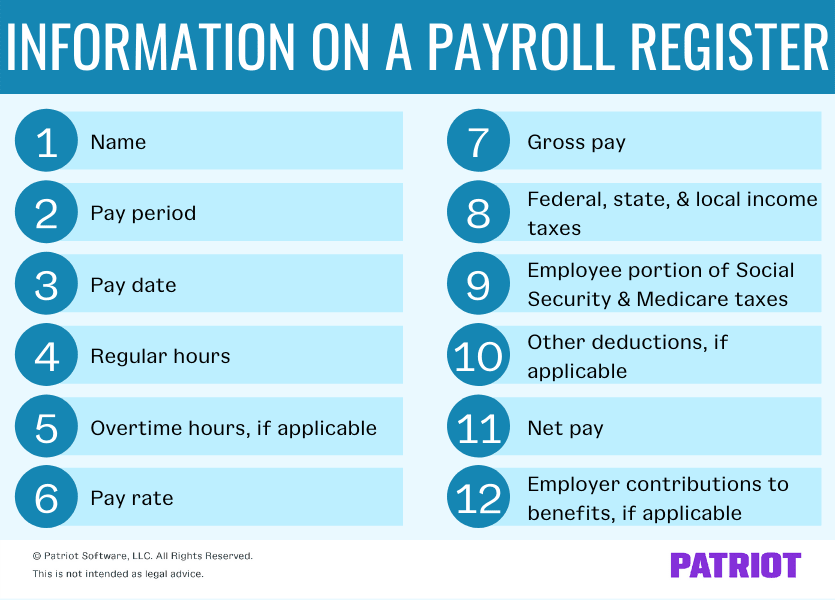

Information on a payroll register

So, what does a payroll register look like? The rows of a register have information about individual employees. They might look similar to employee pay stubs. For each employee, the summary payroll register includes:

- Name

- Pay period

- Pay date

- Regular hours

- Overtime hours, if applicable

- Pay rate

- Gross pay

- Federal, state, and local income taxes

- Employee portion of Social Security and Medicare taxes

- Other deductions, if applicable

- Net pay

- Employer contributions to benefits, if applicable

Generally, a payroll register template does not include information about employer taxes. However, some payroll registers might include:

- Employer portion of Social Security and Medicare taxes

- Federal unemployment tax

- State unemployment tax

At the end of the register, there is a totals section. This section shows a combination of all of the employees’ information. For example, you can see the total overtime hours worked by employees during the selected period. Or, you can see the total net pay for all employees.

You can adjust the time period for the payroll register. For example, you may only want to look at the last payroll you ran. Or, you might want to pull up data for the last quarter.

To streamline the reporting process, consider using payroll software. When you use payroll software, you can easily change the time period, and the software pulls up the information you want.

How to use a payroll register

According to Avner Brodsky, CEO and Co-Founder of Superwatches, the payroll register is a vital, all-encompassing document that serves a variety of purposes:

Payroll registers are so important to my business because they outline my employees’ worked hours, both their gross and net pay, any deductions, and the pay period date. This information makes it much easier for our accounting team to manage the finances of our company.

When disposing tax payments and filing for tax returns, the payroll register can provide quick information at a glance. It is also important to mention that payroll registers provide the most accuracy in regards to employee pay information and when integrated with accounting software, can make the process so much easier and more cost-efficient.”

The register can show you how much money you need to set aside for certain payments, such as employer contributions to Social Security and Medicare taxes. Because the employee portions of Social Security and Medicare taxes match the employer portions (in most cases), it’s easy to see how much the employer portion is. Seeing how much you need to set aside helps prevent you from spending that money on other things.

Along the same lines, you can use your register to deposit and file your taxes. Simply pull up the time period you are handling payroll taxes for, and use the totals to determine the amount you need to deposit or file. If your report does not include the employer portion of the taxes, you can use another report to gather totals. Or, do the calculations by hand using your state and federal unemployment tax rates.

You can also use the totals on the payroll register to reconcile your payroll accounting. If a number doesn’t match up, you can look back in your payroll records to find the problem.

Payroll register best practices

Because your payroll register is a vital part of payroll recordkeeping, it’s important to keep in mind best practices. The report is only as accurate as the data you enter. So, remember these best practices to ensure your data is correct:

- Track employee hours (e.g., using time and attendance software)

- Check your data entry, if manually entering hours

- Review gross pay, tax deductions, and net pay before approving payroll

- Audit and reconcile your payroll records frequently (e.g., every time you run payroll)

At the end of the quarter, check your payroll register against your payroll tax reports.

How a payroll register report helps legally

Now that you know what a payroll register is and what it shows you, why should you know about it legally? Beyond using it to view information, file taxes, and reconcile your books, the register may be a report you are required by law to keep.

Payroll recordkeeping laws require employers to maintain specific records for a certain amount of time. While state laws may vary, the Fair Labor Standards Act (FLSA) mandates that employers must keep payroll records for a minimum of three years.

Under federal law, payroll records include information about:

- Employees

- Taxes

- Paychecks

- Hours worked

- Wage basis (e.g., how much per hour worked)

- Pay frequency

- Date of payment

The payroll register is a good report to use because it encompasses the payroll data employers must keep on file per federal law. Keep in mind that the FLSA does not require a specific form for recordkeeping. So, you can produce a register to supply the information, if necessary.

This article has been updated from its original publication date of April 27, 2012.

This is not intended as legal advice; for more information, please click here.