Employers juggle many responsibilities, including calculating and withholding payroll taxes and other deductions. But, what exactly does payroll taxes include? And, how do you know how much to withhold from employees’ wages? If you’re wondering about understanding payroll taxes, never fear. Your payroll taxes breakdown is here.

- Payroll taxes refer specifically to FICA: Social Security and Medicare taxes withheld from wages and matched by employers.

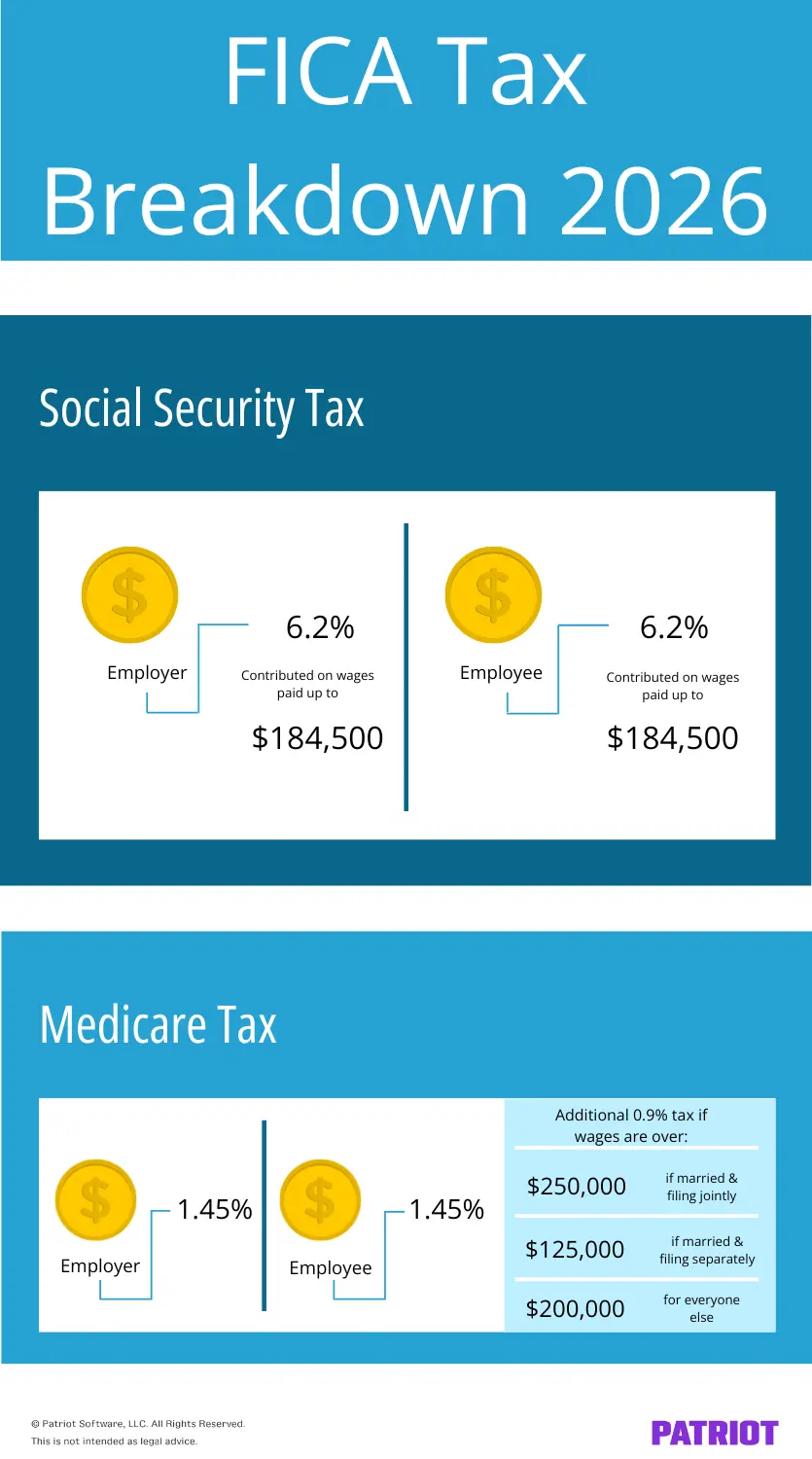

- Social Security tax is 12.4% total, split 6.2% employer and 6.2% employee, up to the annual wage base.

- Medicare tax is 2.9% total, split 1.45% each, with an additional 0.9% on employee wages above filing-status thresholds.

- Self-employed people pay SECA tax equal to the full FICA rates (15.3%), covering both employer and employee shares.

- Other employment taxes (federal/state/local income, FUTA, SUTA) differ in who pays; employers often cover unemployment taxes. Terminology note: Many sources use “payroll taxes” broadly to include FICA, income tax withholding, and FUTA/SUTA. In this article, “payroll taxes” refers to FICA specifically, and “employment taxes” covers the broader set.

What are payroll taxes?

How do payroll taxes work? Payroll taxes are a specific type of employment tax. Not all employment taxes are payroll taxes. Instead, payroll taxes consist of the Federal Insurance Contributions Act (FICA) tax. So, what is FICA tax?

FICA tax is the combination of Social Security and Medicare taxes. The government uses funds from the two taxes for different programs:

- Social Security tax: Funds benefits for retirement, dependents of retired workers, and the disabled and their dependents.

- Medicare tax: Funds medical benefits for people age 65 and older, the disabled, and individuals with qualifying health conditions.

Social Security and Medicare tax have different tax rates. And, there is an additional Medicare tax for qualifying employees (we’ll get to that later).

What are payroll taxes levied on? Employers must withhold these taxes from their employees’ wages. But, do not withhold the entire amount of each tax from the employee. Employers share the responsibility of paying FICA taxes with their employees. Show payroll taxes on employee pay stubs.

Self-employed individuals are not exempt from paying federal payroll taxes. Instead of paying FICA tax, they must pay self-employment tax. The Self Employed Contributions Act (SECA) tax requires self-employed individuals to pay Social Security and Medicare taxes. SECA does not split the tax between employee and employer. Instead, self-employed individuals must pay the entirety of the tax themselves. Terminology note: Some government publications and advisors may refer to all taxes calculated in payroll (e.g., FICA, income tax withholding, FUTA/SUTA) as “payroll taxes.” For clarity, this article distinguishes FICA payroll taxes from other employment taxes you also handle during payroll.

Payroll tax services

If you want help calculating, withholding, and remitting payroll taxes, Patriot Software offers payroll options that handle FICA calculations every pay run. And with Full Service Payroll, we also file and deposit federal, state, and local payroll taxes (e.g., Form 941, Form 940, and state unemployment), plus year-end W-2s.

Other taxes in payroll

Again, not all employment taxes are payroll taxes. People commonly refer to all taxes deducted in payroll as payroll taxes. But, there are many types of employment taxes.

Employment taxes include:

- Federal income tax

- State income tax

- Local income tax

- Federal unemployment (FUTA) tax

- State unemployment (SUTA) tax

Employees do not pay all employment taxes. And likewise, employers do not pay all employment taxes.

Income taxes only come out of the employees’ wages. Federal unemployment taxes are employer-only taxes. State unemployment taxes are typically employer-only, but some states require both employers and employees to contribute to the tax (e.g., Pennsylvania).

State and local variations:

- Nine states do not have a broad wage-based state income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire, and Tennessee.

- Some cities and localities assess local income taxes (e.g., New York City, Philadelphia, and Detroit).

- Certain states require employer withholding for state programs such as paid family leave or short‐term disability (e.g., CA, NJ, NY, RI).

- Check your state agency for specifics.

Payroll tax rates

Employees pay the same amount of FICA payroll tax as employers because the total amount is split evenly. Self-employed individuals must pay the entire amount of both taxes. So, how much are payroll taxes for employees, employers, and self-employed workers?

Social Security and Medicare tax rates

To know how much FICA tax to pay or withhold, break it down into the two parts of the tax: Social Security and Medicare.

Social Security tax has a higher tax rate. It is a flat 12.4% but only applies up to the Social Security wage base, which typically changes each year. The 2026 Social Security wage base is $184,500. Equally divide the total percentage between you and your employees. Withhold 6.2% from your employees’ wages and contribute 6.2% as the employer (12.4% / 2).

Medicare tax has a flat tax rate of 2.9%. Like Social Security tax, employees and employers equally share the total tax. So, employers and employees each pay 1.45% (2.9% / 2). Unlike Social Security, there is no wage base or cap to the wages subject to the Medicare tax. Instead, there is an additional Medicare tax of 0.9% once employees earn above a certain amount.

Additional Medicare taxes apply to employees based on filing status:

- Married filing jointly: $250,000

- Married filing separately: $125,000

- Single: $200,000

Employers must withhold the additional Medicare tax after an employee earns above $200,000. Employees who earn above the threshold must pay 2.35% for Medicare tax (1.45% + 0.9%). Employers continue to pay 1.45% because the additional Medicare tax rate only applies to employees.

Quick FICA calculation example

Example: An employee earns $2,000 in a biweekly pay period and is below the Social Security wage base.

- Social Security: $2,000 × 6.2% = $124 withheld; employer matches $124.

- Medicare: $2,000 × 1.45% = $29 withheld; employer matches $29.

- Total FICA withheld from the employee: $153; total employer FICA expense: $153.

Self-employment tax rate

SECA tax is basically the same as FICA tax, except one person pays the total amount for each tax.

Social Security tax is 12.4% and Medicare is 2.9% total. So, the combined rate for SECA tax is 15.3%.

Self-employment Social Security taxes only apply up to the Social Security wage base.

A self-employed individual must also pay the full 2.9% of Medicare tax. Self-employment wages are also subject to additional Medicare tax (0.9%). If the additional Medicare tax applies, the total tax rate is 3.8% (2.9% + 0.9%). There is no maximum amount of Medicare tax an individual can pay.

Self-employed individuals calculate SE tax on Schedule SE and can deduct half of their SE tax as an above‐the‐line deduction on Form 1040 (this does not reduce net earnings for SE tax itself).

How to calculate and remit payroll taxes

Follow these steps each pay run and throughout the quarter/year.

How to calculate and remit payroll taxes:

- Collect forms and set up

Get a completed Form W‐4 from each employee; register for federal and state tax accounts.

- Calculate gross pay

Hours × rate for hourly; salary / pay periods for salaried; include taxable benefits/pretax adjustments as required.

- Withhold employee taxes

Federal income tax (per W‐4), state/local income taxes (if applicable), FICA (6.2% Social Security up to the wage base; 1.45% Medicare; plus 0.9% Additional Medicare over thresholds.

- Compute employer taxes

Match FICA; calculate FUTA and SUTA based on your assigned rates and wage bases.

- Deposit taxes

Use EFTPS for federal deposits on your assigned schedule (monthly or semiweekly). Some states/localities require separate portals and schedules.

- File returns

File quarterly and annual payroll tax forms and furnish year‐end statements to employees.

Key forms and deadlines

- Federal deposits: Monthly or semiweekly depending on IRS lookback; if $100,000 or more in accumulated liability, deposit next business day. Use EFTPS.

- Form 941 (quarterly): Report federal income tax withheld and employer/employee FICA. Due by the last day of the month after the quarter ends.

- Form 940 (annual): Report FUTA. Due January 31 (February 10 if you deposited in full and on time).

Forms W‐2 and W‐3 (annual): Provide W‐2s to employees and file with the SSA by January 31. - State/local returns and deposits: Vary by jurisdiction (income tax and unemployment). Check your state agency for rates, wage bases, due dates, and electronic filing requirements.

Payroll tax FAQs

Still have some questions about payroll taxes? Take a look at some frequently asked questions.

Federal withholding is a tax calculated during payroll, but it’s not technically a payroll tax. Instead, federal withholding is an employment tax. Another name for federal withholding is federal income tax.

No. Federal law requires employers to evenly split FICA tax with their employees. Only self-employed individuals pay the entirety of Social Security and Medicare taxes.

If an employee meets the Social Security employee tax wage base in the middle of the pay period, only calculate the tax on wages up to the amount.

Say an employee receives biweekly paychecks and hits the wage base at the end of the first week of the pay period. The employee’s total paycheck is $6,000. Divide the gross pay by two and apply the Social Security tax to the first half of the gross wages ($6,000 / 2 = $3,000).

Employers and employees pay Social Security and Medicare taxes. Only employers pay self-employment tax.

Only employers pay FUTA tax, and typically only employers pay SUTA tax (except in Alaska, New Jersey, and Pennsylvania, where SUTA is shared).

Only employees pay federal, state, and local income taxes.

FUTA and SUTA are employment taxes calculated and paid as part of payroll, but in this article we reserve “payroll taxes” for FICA tax (Social Security and Medicare). Employers pay FUTA; most states require employers to pay SUTA, and a few also require employee contributions.

Generally, no. You do not withhold or pay FICA, FUTA, or SUTA on non‐employees properly classified as independent contractors. Instead, you need to issue Form 1099‐NEC if you pay a contractor $600 or more in a year.

Payroll tax (FICA) funds Social Security and Medicare and is split between employers and employees. Income tax is based on earnings, filing status, and allowances/credits and is paid only by employees (withheld by the employer).

Who pays what? [Cheat sheet]

Still not sure what taxes employers and employees pay? Use our cheat sheet to stay on top of your responsibilities.

| Employment Tax | Employer & Employee Taxes | Employer-only Taxes | Employee-only Taxes |

|---|---|---|---|

| Social Security | ✓ | ||

| Medicare | ✓ | ||

| Additional Medicare | ✓ | ||

| Federal unemployment | ✓ | ||

| State unemployment | ✓* | ||

| Federal income | ✓ | ||

| State income | ✓ | ||

| Local income | ✓ |

* Employees must also pay SUTA tax in Alaska, Pennsylvania, and New Jersey.

This article is updated from its original publication date of October 20, 2015.

This is not intended as legal advice; for more information, please click here.