The IRS has released the 2024 tax brackets, along with updated income tax withholding tables for employers. Use these updated tax tables to calculate federal income tax on employee wages in 2024.

Staying on top of changing employment tax rates can be an overwhelming but necessary task, especially if you manually do payroll yourself. Rates impact the amount of money you withhold from employee wages.

If you aren’t familiar with the 2024 income tax withholding tables, say no more. We’ve got the scoop on how tax withholding tables work.

What are income tax withholding tables?

Federal withholding tables determine how much money employers should withhold from employee wages for federal income tax (FIT). Use an employee’s Form W-4 information, filing status, and pay frequency to figure out FIT withholding.

New hires must fill out Form W-4, Employee’s Withholding Certificate, when they start working at your business. The IRS designed a new W-4 form that removed withholding allowances beginning in 2020. You must use this updated Form W-4 for all new hires or employees who want to update their W-4 form. This updated version of Form W-4 lets employees enter personal information, declare multiple jobs or a working spouse, claim dependents, and make other adjustments.

Once you have an employee’s Form W-4 information, refer to the federal income tax withholding tables in IRS Publication 15-T, which include:

- Percentage method tables for automated payroll systems

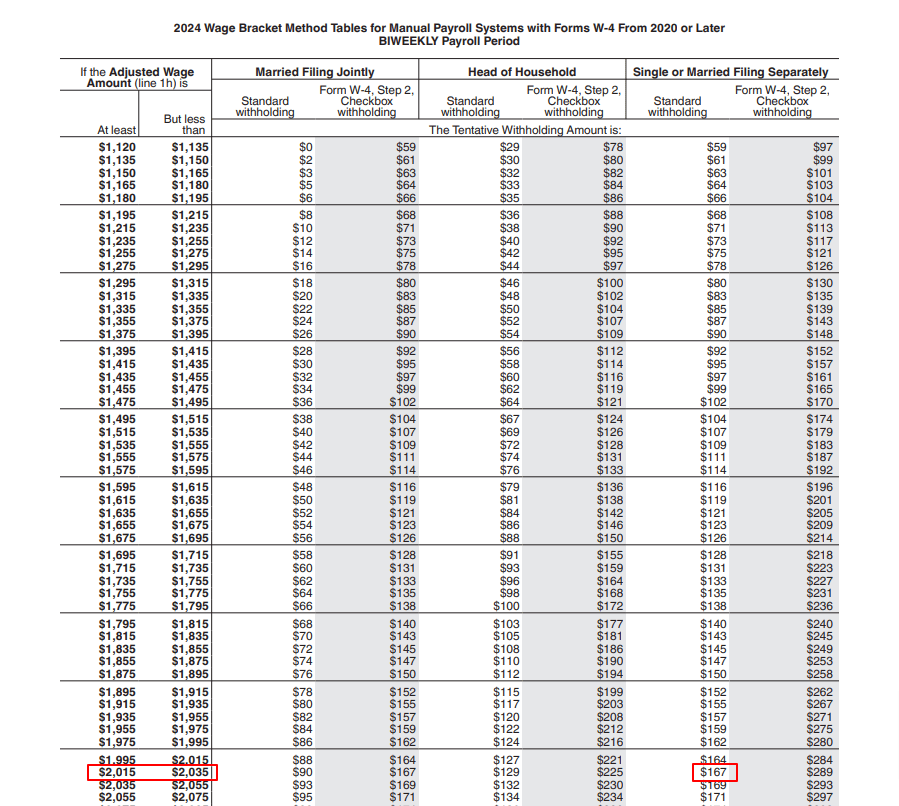

- Wage bracket method tables for manual payroll systems with Forms W-4 from 2020 or later

- Wage bracket method tables for manual payroll systems with Forms W-4 from 2019 or earlier

- Percentage method tables for manual payroll systems with Forms W-4 from 2020 or later

- Percentage method tables for manual payroll systems with Forms W-4 from 2019 or earlier

The IRS also offers alternative methods for figuring withholding and tables for withholding on distributions of Indian gaming profits to tribal members.

These tax withholding tables provide federal income tax ranges based on pay frequency, filing status, which version of Form W-4 you have on file, and how the employee fills out Form W-4. You may need to use multiple tax withholding tables for different employees if you have both 2019 or earlier Forms W-4 and 2020 or later W-4s on file.

Find the employee’s adjusted wage amount to use these income tax withholding tables that correspond with the new Form W-4. You can do this by using the IRS worksheet in Publication 15-T.

Here is a closer look at the two main methods for determining an employee’s federal income tax withholding—wage bracket and percentage methods.

Wage bracket method

If you use the wage bracket method, find the range under which the employee’s wages fall (i.e., “At least X, But less than X”).

Then, find the amount to withhold based on the information the employee entered on Form W-4 (e.g., standard withholding or withholding based on adjustments).

IRS Publication 15-T has two wage bracket method tables for income tax withholding. The section you use is based on the version of Form W-4 you have on file for the employee:

- Manual payroll systems (2020 and later Forms W-4)

- Manual payroll systems (2019 and earlier Forms W-4)

The wage bracket method tables only give tax rates for employees earning up to around $100,000 annually. You also cannot use the wage bracket method if you’re using a 2019 or earlier Form W-4 and the employee claimed more than 10 allowances.

Percentage method

The percentage method is a little different than the wage bracket method. Like the wage bracket method, there is a range that an employee’s wages can fall under. But unlike the wage bracket method, there is a flat dollar amount and a percentage calculation to add together.

So, how exactly does this work? There are two steps to using the percentage method:

- Find the employee’s range (i.e., “At least X, But less than X”) to get the tentative amount to withhold

- Add a percentage of the amount that the Adjusted Wage exceeds to Step 1

There are three sections in IRS Publication 15-T for the percentage method:

- Automated payroll systems

- Manual payroll systems (2020 and later Forms W-4)

- Manual payroll systems (2019 and earlier Forms W-4)

The percentage method works in all situations, regardless of wages or allowances (if using a 2019 or earlier W-4). Automated payroll systems use the percentage method.

2024 income tax withholding tables

The following are key aspects of federal income tax withholding that are unchanged in 2024:

- No withholding allowances on 2020 and later Forms W-4

- Supplemental tax rate: 22%

- Backup withholding rate: 24%

- Personal exemption remains at 0

- Optional computational bridge still available

So, what changed? The updated 2024 income tax withholding tables have new withholding amounts to adjust for inflation. Adjust your payroll tax withholding to reflect annual changes to income tax withholding tables. If you use online payroll software, the information automatically updates.

The IRS also provides a federal tax calculator for tax withholdings each year. Individuals can use this tax calculator to determine their tax liabilities.

You can view all of the changes to the income tax withholding tables in IRS Publication 15-T.

How to use the optional computational bridge

The computational bridge involves “converting” 2019 and earlier Forms W-4 into 2020 and later Forms W-4.

Of course, it’s not entirely a conversion process. But, the computational bridge does help you treat 2019 and earlier forms like 2020 and later forms for income tax withholding.

This feature, originally released in tax year 2021, is completely optional.

If you decide you want to treat all Forms W-4 like the 2020 and later versions for consistency, get out the employee’s 2019 and earlier Form W-4. Also, refer to a 2020 and later Form W-4 for the “conversion.”

Computational bridge steps

To use the computational bridge, you must:

- Choose a filing status in Step 1(c) (2020 and later Form W-4) that reflects the employee’s marital status checked on Line 3 (2019 and earlier Form W-4)

- If the employee checked “Single” or “Married, but withhold at higher single rate” on the 2019 and earlier Form W-4, treat them as “Single” or “Married filing separately” on a 2020 or later Form W-4

- If the employee checked “Married” on the 2019 and earlier Form W-4, treat them as “Married filing jointly” on a 2020 or later Form W-4

- Enter an amount in Step 4(a) (2020 and later Form W-4) based on the applicable filing status you selected:

- $8,600: “Single” or “Married filing separately”

- $12,900: “Married filing jointly”

- Multiply withholding allowances claimed on Line 5 (2019 and earlier Form W-4) by $4,300. Enter the total into Step 4(b) (2020 and later Form W-4)

- Enter any additional withholding amounts requested on Line 6 (2019 and earlier Form W-4) into Step 4(c) (2020 and later Form W-4)

Yes, this is a lot to take in. You can make sense of these steps by referencing a 2019 and earlier Form W-4 and 2020 and later Form W-4 while going through the steps.

Example of how to use a withholding tax table

Let’s say you have a single employee who earns $2,025 biweekly. They filled out the new 2020 Form W-4.

The employee has a relatively simple tax situation. On Form W-4, they did not claim dependents or request any extra withholding.

For this example, use the wage bracket method tables for manual payroll systems with Forms W-4 from 2020 or later to find out how much to withhold for federal income tax. This is on page 12 in IRS Publication 15-T.

The worksheet is broken down into four steps:

- Adjust the employee’s wage amount

- Figure the tentative withholding amount

- Account for tax credits

- Figure the final amount to withhold

1. Adjust the employee’s wage amount

To use the new federal withholding tax table that corresponds with the new Form W-4, first find the employee’s adjusted wage amount. You can do this by completing Step 1 on Worksheet 2.

Because the employee’s tax situation is simple, you find that their adjusted wage amount is the same as their biweekly gross wages ($2,025).

2. Figure the tentative withholding amount

Now, use the income tax withholding tables to find which bracket $2,025 falls under for a single worker who is paid biweekly.

You find that this amount of $2,025 falls in the “At least $2,015, but less than $2,035” range.

Using the chart, you find that the “Standard withholding” for a single employee is $167. This is the tentative withholding amount to enter into Step 2.

3. Account for tax credits

Now, account for any dependents the employee claimed on Form W-4.

Because the employee didn’t claim any dependents, the employee’s tentative withholding amount is still $167.

4. Figure the final amount to withhold

Your last step for determining federal income tax withholding is to enter any additional amounts the employee requested withheld on Form W-4.

In this situation, the employee didn’t request extra withholding. So, the FIT amount to withhold from the employee’s wages each pay period is $167.

Worried about using income tax withholding tables to calculate taxes? What if we told you that payroll software can make your fears go away? Patriot’s online payroll automatically calculates taxes based on up-to-date tax rates so you don’t have to. Start your free trial now!

This article has been updated from its original publication date of January 29, 2018.

This is not intended as legal advice; for more information, please click here.