Fewer employers plan to give pay raises in 2024 than in 2023, according to SHRM. Even so, 79% of businesses plan to dole out pay raises.

To avoid losing your top employees, you might consider offering pay raises. Learn about criteria for raises, when to give salary raises, and how to calculate a raise percentage.

Skip Ahead

- Criteria for a salary increase

- How much should a raise percentage be?

- How often should an employee get a salary raise?

- How to calculate a salary pay raise

- What to do if you forget to account for a raise

- What if you can’t afford a raise increase?

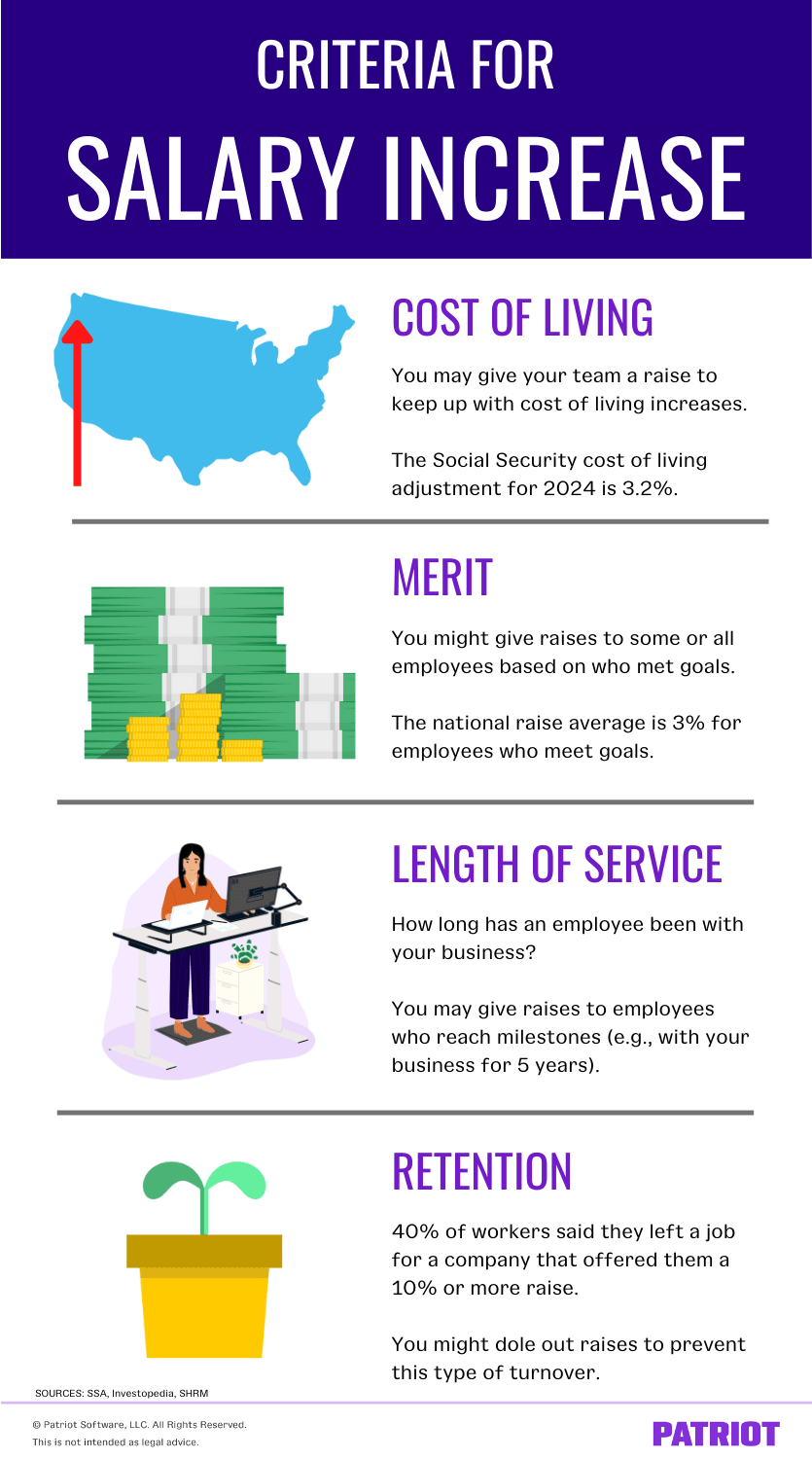

Criteria for a salary increase

Before handing out raises to employees, most employers create a list of salary increment criteria to establish a standard basis for salary increases. This helps you decide between different types of pay raises.

Your basis for salary increase might depend on one or more of the following factors.

Cost of living raises

When inflation drives up the price of goods and services, currency has less value, and the cost of living increases. Because the cost of living is always changing, the wages you offer your employees might, too.

You may offer a raise so your employees can keep up with increases in the cost of living. A cost of living raise is widespread among your team, regardless of performance.

To determine the cost of living, you can look at the Social Security Administration. The cost of living adjustment (COLA) is an increase in Social Security benefits to adapt to the economy. For 2024, the COLA is 3.2%. Offering a 3.2% raise would match this annual cost of living adjustment.

Merit raises

You might also offer a salary increase based on merit. Maybe you have an employee who took on new responsibilities or added a new skill or title. For example, you would probably give a raise to an employee who becomes a CPA.

Merit-based raises might not be widespread. If you do give raises to all your employees, the amounts might differ based on performance. Carefully calculate raises based on merit. Determine which employees best met your company’s goals, who added the most value, and who went above and beyond their regular job duties. Keep detailed documents backing up your decision.

One benefit of merit-based raises is to encourage other employees to pick it up a notch. If an employee doesn’t receive a raise, they might wonder how they can improve their work.

Length of service raises

Raises can also depend on an employee’s length of service. How long have they been with the company?

You might give a raise to employees who reach milestones, like being with your company for five years. This shows employees you value their service and want to keep them around for years to come.

Retention raises

You can also dole out raises to prevent turnover. Turnover can have a negative impact on your business. It can cost you time and money. And, it can lead to a decrease in employee morale. It’s important to do what you can to prevent turnover from impacting your business.

Although giving out raises won’t necessarily prevent turnover, it’s a tactic many businesses use.

Some employees leave because of money (40% of surveyed workers said they left their job for a company that offered them a 10% or more raise), while others leave for personal reasons or to search for a new growth opportunity.

Have regular employee performance reviews and meetings to determine if finances contribute to why an employee is disengaged or looking for other work. Determine whether offering a raise makes the difference between retaining and losing top talent.

How much should a raise percentage be?

Deciding amounts for employee raises can be a difficult process. To help you determine employee raise percentage amounts, use data:

- The national average raise percentage is 3% for employees who meet their goals and their employer’s expectations

- U.S. employers plan to give employees a raise of 3.5% for merit increases and 3.9% for total salary increases for non-unionized employees

- The cost of living adjustment (COLA) is 3.2% for 2024

- The consumer price index (CPI) rose 3.2% year-over-year

You might decide to give employees more or less than these percentages, depending on factors like location, merit, and what you can afford.

Location: Where is your business located? What about your employees? Consider the average cost of living for any applicable locations and how that may impact raise amounts.

Merit: How much value does your employees add to your business? What is their return on investment (ROI)? Use human capital metrics to compare how much an employee is bringing in to how much you spend on their compensation.

What you can afford: The raise amount you give also depends on your business. If profits are high, you might decide to give more. If you are having trouble paying business expenses, you should probably hold off on giving raises to employees.

How often should an employee get a salary raise?

The frequency in which you give employees raises can also vary. Some businesses choose to schedule annual or semiannual raises. Others give raises based on when employees earn them. Other businesses wait until employees have been with the company for a certain amount of time before offering a raise.

Again, make sure you consider your business’s profits before giving frequent raises.

How to calculate a salary pay raise

Ready to learn how to calculate a pay raise? You can use one of two methods:

- Flat raise

- Percentage increase

1. How to calculate salary pay increase: Flat raise

With a flat raise, you determine how much additional money you want to give the employee and add it to their annual salary.

To figure out how much the raise increases the employee’s weekly or biweekly gross pay, you can divide the annual salary by 52 (weekly), 26 (biweekly), 24 (semimonthly), or 12 (monthly).

Example

Let’s say an employee’s annual gross wages are $40,000. Their gross weekly wages are $769.23 ($40,000 / 52). You decide to give them a flat raise of $4,000 annually. You want to determine how much their new weekly paycheck will be and how much more they will receive per week.

- First, add the raise to their gross wages: $40,000 + $4,000 = $44,000

- Now, divide their new gross wages by 52 weeks: $44,000 / 52 = $846.15

- Lastly, subtract their previous weekly wages from their new weekly wages: $846.15 – $769.23 = $76.92

The employee’s new annual wage is $44,000. Their new weekly paycheck is $846.15, which is $76.92 more than their previous weekly wages.

2. How to calculate salary pay increase: Percentage

So, ready to learn how to calculate an employee’s raise using the percentage method? With a percentage increase, you might:

- Know the raise percentage you want to give

- Know the new salary you want the employee to receive

You know the salary raise percentage you want to give

If you know what percentage you want to give, calculate how much the raise will be and add that amount to the employee’s current wages. Multiply the raise percentage by the employee’s current wages, then add it to their annual gross wages. Here is the formula:

New Salary = (Old Salary X Raise %) + Old Salary

Again, you can determine how much the employee’s paycheck increases by dividing their annual salary by 52 (weekly), 26 (biweekly), 24 (semi-monthly), or 12 (monthly).

Example

Let’s say you decide to give an employee a percentage raise of 3%. The employee currently earns $50,000 annually and $1,923.08 biweekly ($50,000 / 26).

You want to determine how much the raise is, what their new annual wage will be, what their new biweekly paycheck is, and how much more they will receive per paycheck.

- First, multiply the percentage by the employee’s current annual wages: $50,000 X .03 = $1,500

- Next, add the employee’s current annual salary to the raise amount: $50,000 + $1,500 = $51,500

- Take the employee’s new annual salary and divide it by 26: $51,500 / 26 = $1,980.77

- Subtract the employee’s previous biweekly paycheck amount from their new biweekly paycheck amount: $1,980.77 – $1,923.08 = $57.69

The employee’s 3% increase is a flat increase of $1,500. Their new annual salary is $51,500. Their new biweekly paycheck is $1,980.77, which is a $57.69 increase from their previous biweekly wages.

Just want to find the employee’s biweekly raise amount? Look at the employee’s previous biweekly paycheck and:

- Take the employee’s previous biweekly paycheck and multiply it by the raise percentage: $1,923.08 X .03 = $57.69 (biweekly raise amount)

- Now, add the biweekly raise amount to the employee’s previous biweekly paycheck: $57.69 + $1,923.08 = $1,980.77

Use whichever method you feel most comfortable with. Keep in mind that you may see slight rounding discrepancies (e.g., $0.01).

You know the new salary you want the employee to receive

You might determine how much you want the employee’s new wages to be, but you want to know how much of a raise percentage increase that is.

To calculate the employee’s raise percentage, use the following formula:

Percent Raise = [(New Salary – Old Salary) / Old Salary] X 100

Example

Let’s use the same example as above. An employee currently earns $50,000 a year. You want their new annual salary to be $52,000. You want to determine their raise percentage using the above formula.

- [($52,000 – $50,000) / $50,000] X 100 = 4%

Here’s a step-by-step process:

- First, determine the difference between the employee’s old and new salary: $52,000 – $50,000 = $2,000

- Next, divide the raise amount by their old salary: $2,000 / $50,000 = .04

- To turn the decimal into a percentage, multiply by 100: 100 X .04 = 4%

Your employee receives a 4% raise.

What to do if you forget to account for a raise

What if you forget to increase an employee’s wages after you issue a salary adjustment? You need to provide retroactive (retro) pay to the employee.

Retroactive pay is when you paid an employee a different amount of wages than what they should have been given in a previous pay period.

To find the retroactive pay, determine the difference between what the employee should have received and what you paid them.

Example

Let’s say an employee’s previous wages were $1,923.08, and their new wages are $2,000. You forgot to include their new wages in one pay period. To determine how much you owe them in retro pay, find the difference.

- $2,000 – $1,923.08 = $76.92

The amount you owe the employee in retro pay is $76.92.

If you forget to include the employee’s raise in multiple pay periods, multiply the pay periods by the difference between their new and old paychecks.

For example, you forget to include their new wages in three pay periods. Their retro pay would be:

- $76.92 X 3 = $230.76

You would owe the employee $230.76 in retro pay. Remember to withhold taxes from the retro pay.

What if you can’t afford a raise increase?

Raises aren’t the be-all and end-all for workers. Many employees value other types of benefits, including:

- Work-from-home opportunities

- Flexible schedules

- Paid time off

If you don’t want to give a raise but do want to give your employees a financial benefit, you might consider bonuses or a profit-sharing plan.

Don’t forget to update an employee’s wages after a raise. Run payroll correctly with Patriot’s online payroll software. Update your employee’s hourly or salary rate within the system so they receive their raise in each paycheck. Try it for free today!

This article has been updated from its original publication date of March 14, 2018.

This is not intended as legal advice; for more information, please click here.