Employers often want to offer attractive compensation packages to bring in good employees. But, compensation goes beyond an employee’s hourly or salary wages. It also includes additional small business employee perks, known as fringe benefits. So, what are fringe benefits? And, what are the types of fringe benefits?

What are fringe benefits?

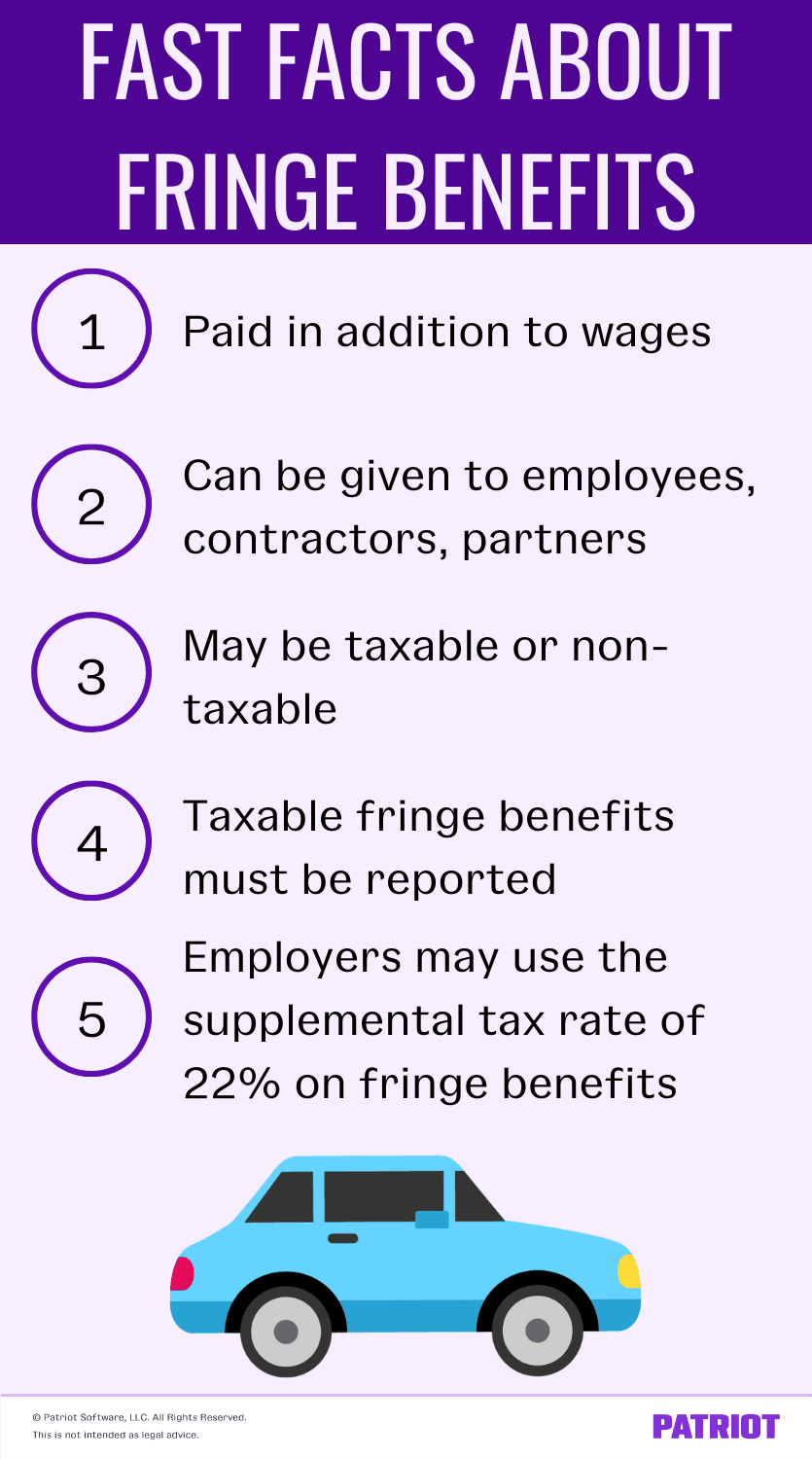

Fringe benefits are benefits in addition to an employee’s wages. So, any monetary benefit an employer offers in exchange for an employee’s services that does not include their salary is a fringe benefit.

Fringe benefits examples include:

- Personal use of company car

- Health insurance

- Life insurance coverage

- Retirement plans

Generally, employers offer competitive employee benefits to attract job hunters. And, there are quite a few types of fringe benefits to offer employees.

But before you go offering these benefits to your employees, you need to know whether they’re taxable. Typically, fringe benefits are taxable. But, some fringe benefit options are nontaxable.

Fringe benefits for non-employees

Fringe benefits aren’t only for employees. You can also offer fringe benefits to independent contractors. Because independent contractors are hired only for specific jobs, you do not include them on your payroll. And, you do not withhold taxes from their pay.

But because you pay for the work they perform, you can offer fringe benefits to contractors, too.

Business partners can also receive fringe benefits.

Fringe benefits given to independent contractors and partners are not taxed. But, you should report the benefit:

- Independent contractor: Use Form 1099-NEC, Nonemployee Compensation

- Partner: Use Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc.

Fringe benefits for S corporations

S corporations should not include 2% shareholders as an employee of the corporation for the purpose of fringe benefits. Instead, treat 2% shareholders as a partner in a partnership for fringe benefit purposes. And, do not treat the benefit as a reduction in distributions to the shareholder.

Taxable fringe benefits

Some fringe benefits are taxable, so you must report the amount unless the IRS explicitly excludes the fringe benefit from taxes. Calculate, withhold, and report federal income, Social Security, and Medicare taxes on the fringe benefits. And, calculate, remit, and report federal unemployment taxes on the fringe benefits, too.

Some taxable fringe benefits include cash bonus pay, paid personal time off, and personal use of business vehicles.

Determine the value of the employee fringe benefits by January 31 of the year after you give them to your employees. That way, you can report fringe benefits on Form W-2, Wage and Tax Statement, for all employees who receive them.

For federal income tax withholding, you can add the value of the fringe benefits to the employee’s regular wages. Or, you can withhold at the fringe benefit tax rate of 22% (the same rate for supplemental pay).

And, calculate and withhold Social Security and Medicare taxes on the total compensation after adding the value to the employee’s wages. Include fringe benefits in the employee’s total compensation to determine the amount of the employer portion of Social Security and Medicare taxes.

Because the employer, not the employee, pays FUTA tax, use the employee’s total compensation (up to the FUTA tax threshold) to determine your FUTA liability.

Nontaxable fringe benefits

Some fringe benefits are not part of a worker’s taxable compensation. That means the benefits might not be subject to federal income tax withholding, FICA, and FUTA tax. In most cases, they are not included on the employee’s Form W-2.

List of fringe benefits for employees

Some benefits have exclusion rules. The rules for exclusions state that all or part of the value of the benefit is excluded from wages. So, the benefits are excluded from some or all taxes, including federal income, Social Security, and Medicare taxes. Do not list the excluded benefits on the employee’s Form W-2.

The following list of fringe benefits is subject to exclusion rules:

- Accident and health benefits

- Achievement awards

- Adoption assistance (only exempt from federal income tax)

- Athletic facilities

- De minimis (minimal) benefits

- Dependent care assistance

- Educational assistance program

- Employee discounts

- Employee stock options

- Employer-provided cell phones

- Group-term life insurance coverage

- Health savings accounts (HSAs)

- Lodging on business premises

- Meals

- Moving expense reimbursements

- No-additional-cost services

- Retirement planning services

- Transportation (commuting) benefits

- Tuition reduction

- Working condition benefits

Some fringe benefits are only nontaxable in certain situations. Some taxes could apply. For example, group-term life insurance coverage is only exempt from FICA tax up to the cost of $50,000.

Check IRS Publication 15-B for more information on fringe benefits and exemptions.

Section 125 cafeteria plan

A cafeteria plan allows employees to choose the benefits they want. Employees receive benefits as pre-tax deductions, meaning they reduce their taxable income, which could lessen their tax liability.

When establishing a Section 125 cafeteria plan, you must let your employees choose between taxable and nontaxable benefits. The qualifying benefit comes from the list of excludable (from taxes) fringe benefits as well as flexible spending accounts (FSAs). Some nontaxable fringe benefits are not allowed in a cafeteria plan.

You can include the following benefits in a cafeteria plan:

- Accident and health benefits (not Archer medical savings accounts)

- Adoption assistance

- Dependent care assistance

- Group-term life insurance coverage (including costs that cannot be excluded from wages)

- Health savings accounts (HSAs)*

*The IRS lets employees use HSA distributions to pay eligible long-term care insurance premiums or qualified long-term care services that are otherwise excluded from cafeteria plans.

Do not include these benefits in a cafeteria plan:

- Archer medical savings accounts

- Athletic facilities

- De minimis (minimal) benefits

- Educational assistance

- Employee discounts

- Employer-provided cell phones

- Lodging on business premises

- Long-term care insurance

- Meals

- No-additional-cost services

- Retirement planning services

- Transportation (commuting) benefits

- Tuition reduction

- Working condition benefits

To ensure cafeteria plans don’t favor highly compensated or key employees, include the value of taxable benefits in their wages.

For more information on cafeteria plans, consult the IRS.

Simple cafeteria plan

If you employed an average of 100 or fewer employees during either of the two previous years, you can establish a simple cafeteria plan. If you’re a new business owner, you are eligible if you expect to only employ an average of 100 or fewer employees in the current year.

A simple cafeteria plan acts like a cafeteria plan: employees can choose the benefit(s) they want to receive. But for simple cafeteria plans, contribute benefits on behalf of each qualifying employee.

With simple cafeteria plans, you do not need to worry about the plan favoring IRS highly compensated employees or key employees. Consult the IRS for contribution requirement rules.

Fringe benefit statement

You can provide your employees with an annual fringe benefit statement to show them their total compensation (regular wages + fringe benefits).

For example, you might break down the cost of each fringe benefit and find that the total fringe benefit value is $14,000. Then, you can add that to the employee’s yearly salary.

Providing a fringe benefit statement shows your employees how much they really receive from your business.

This article has been updated from its original publication date of May 22, 2017.

This is not intended as legal advice; for more information, please click here.