If you’ve seen a recent Form W-4 (i.e., 2020 and after), you know the IRS removed personal allowances. But, some states still use personal allowances on the state W-4 forms.

What are personal allowances? Why do personal allowances matter to employers? What are your responsibilities as an employer? Find the answers to these questions and more below.

What are personal allowances?

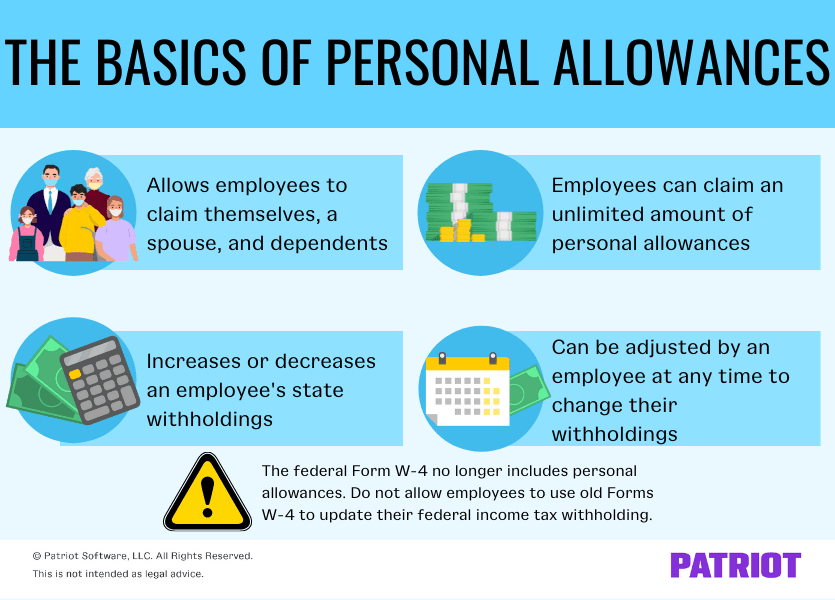

Before 2020, employees claimed personal allowances (aka withholding allowances or W-4 allowances) on their federal Form W-4, Employee’s Withholding Allowance Certificate. Personal allowances let employers know how much federal income tax to withhold. Starting in 2020, the IRS removed personal allowances and created Form W-4, Employee’s Withholding Certificate.

But, personal allowances live on for employees who have not updated their federal W-4 form since before 2020. And, some states still use personal allowances on their state W-4 forms.

Employers use allowances to determine how much federal or state income tax to withhold from an employee’s paychecks. The more allowances an employee claims, the less income tax you withhold.

Employees can claim allowances for:

- Themselves

- A spouse

- Dependents

In place of claiming basic personal allowances from federal income tax, employees can now:

- Claim dependents

- Report multiple jobs or a working spouse

- Use the deductions worksheet

- Request that employers withhold more in federal income taxes

What is the federal personal allowances worksheet?

Only use the personal allowances worksheet to determine withholdings for employees who use a 2019 or earlier Form W-4. If an employee changes their withholding, they must provide you with an updated Form W-4 that does not use personal allowances.

Use Publication 15-T to calculate the withholdings for all employees, including those with pre-2020 W-4 forms.

Can employees still adjust their federal allowances?

Simply put, no. Employees cannot adjust their federal allowances if they currently use a Form W-4 from before 2020. Instead, an employee must fill out and return a completed Form W-4 for the current year.

Because the new forms do not use tax withholding allowances, employees can only adjust withholdings by claiming dependents, completing the deductions worksheet, etc. Do not allow employees to return an outdated W-4 form. All new employees and those updating their W-4 information must complete the current year’s W-4.

What is exemption from withholding?

Some employees may be completely exempt from withholding. What does claiming exempt mean?

Tax-exempt employees do not claim any withholdings on their Form W-4. To claim exemption from withholding on the updated Form W-4, employees write “Exempt” in the space under Line 4(c). On the pre-2020 W-4 form, employees checked a box specifically for tax exemption.

If an employee is tax exempt, do not withhold federal income tax from the employee’s paychecks. Tax-exempt employees must submit a new Form W-4 each year, so you likely won’t have pre-2020 Forms W-4 for tax-exempt employees.

Use the instructions on Form W-4 to learn more about tax exemptions from federal income tax withholding.

State withholding allowances

Again, some states use personal allowances on current state W-4 forms.

Not all states have state income tax, including:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Other states have state income taxes but choose to use the federal Form W-4 to calculate state income taxes, including:

- Colorado

- New Mexico

- North Dakota

- Utah

So, which states still use personal allowances? The following states use personal allowances for state income tax calculations:

- California

- D.C.

- Delaware (employees could use either the federal or Delaware’s state W-4 form)

- Georgia

- Hawaii

- Idaho*

- Illinois

- Iowa

- Kansas

- Maine

- Minnesota

- Montana

- Nebraska

- New Jersey

- New York

- North Carolina

- Oklahoma

- Rhode Island

- South Carolina

- Vermont

Check with your state for more details.

Like with the former federal withholding allowances, employees can use personal allowances to reduce their state income tax withholdings.

The more regular withholding allowances an employee claims, the less state income tax you withhold. The fewer allowances an employee claims, the more you withhold for state income tax.

Can employees adjust their state allowances?

Yes, employees can adjust their withholding allowances if their state uses allowances.

How many allowances can an employee claim?

There is no limit to the number of allowances an employee can claim.

If an employee is unsure about the number of allowances they should claim, have the employee speak with their accountant or financial advisor.

What are the employer responsibilities?

As an employer, you are responsible for withholding and remitting federal, state, and local income taxes from all of their paychecks on behalf of your employees. Collect federal and state W-4 forms from your employees when they begin working for you and withhold all taxes, starting with the first paycheck.

If an employee uses a pre-2020 federal Form W-4, require a current year W-4 form if they want to adjust their federal income tax withholdings. Again, do not accept or use an outdated W-4 form. After the employee gives you the new income tax withholding form, put the new information into effect no later than the first payroll ending 30 days or more after the employee turns in the form.

Always use the current W-4 form for the state, too.

If you do not receive a federal or state withholding form, withhold the maximum amount of income tax from your employees. The maximum amount is single with zero allowances or zero dependents.

If employees do not claim the maximum amount of allowances or dependents they are entitled to claim, you do not have to refund over withheld income tax. Instead, the employee must wait to receive a refund when they file with the IRS or the state.

Generally, you do not have to send the W-4 forms to the state or IRS. However, if the state or IRS contacts you and requests the forms, follow the instructions.

In some cases, the IRS sends what is known as a lock-in letter. This lock-in letter gives your specific instructions on how much to withhold from an employee’s paychecks (typically, the maximum amount). If you receive a lock-in letter, follow the instructions until you receive a notice telling you otherwise.

This article has been updated from its original publication date of December 26, 2014.

This is not intended as legal advice; for more information, please click here.