Payroll responsibilities are a crucial part of having employees. Of those payroll responsibilities, the most important is accurate payroll. After all, inaccurate payroll may lead to fines or other penalties. So, take care to avoid common payroll mistakes.

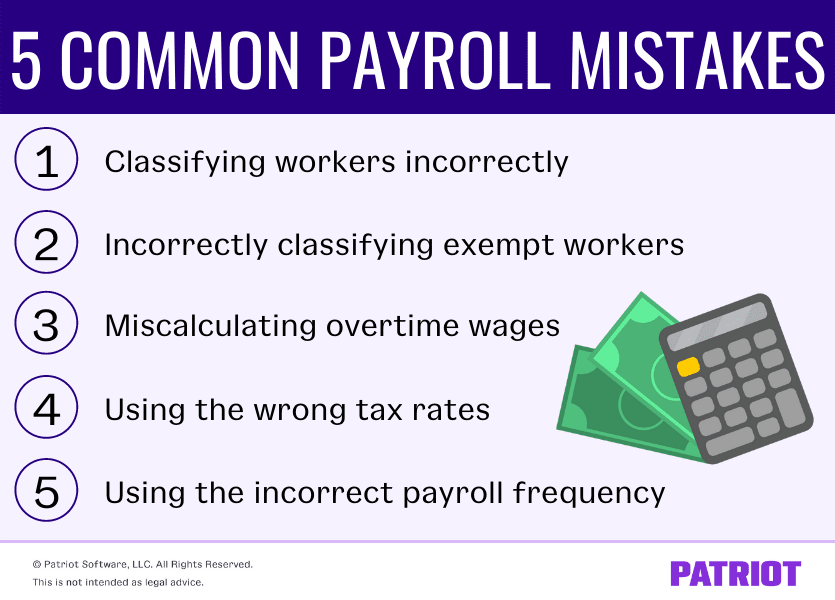

Common payroll mistakes

What are the common payroll mistakes that happen during the process? The five most common payroll errors are:

- Classifying workers improperly

- Incorrectly classifying exempt workers

- Miscalculating overtime wages

- Using the wrong tax rates

- Using the incorrect payroll frequency

1. Classifying workers incorrectly

Question: Is your worker an independent contractor or an employee? Mixing up the two can lead to fines or penalties, both of which can tally up to a costly mistake.

What are the major differences between an independent contractor and an employee? Take a look:

- Independent contractors

- Do not have to be paid minimum wage

- Are not subject to overtime wages

- Do not have employment taxes withheld from their paychecks

- Employees

- Must be paid at least minimum wage

- Earn overtime wages

- Have employment taxes withheld from their checks

If you misclassify an employee as a contractor, you will have to pay both the employee and employer’s share of taxes, plus penalties and interest. And, you may owe back wages to the employee if you paid less than the minimum wage.

Adam Garcia, Founder of The Stock Dork, stressed the importance of proper classification of employees, saying,

A big mistake many small business owners make is misidentifying what employees are. Many different obligations don’t actually apply to contractors. Payroll tax, for instance, is only obligated for actual employees. There are small nuances though, and it’s important to do your tax law research beforehand.”

How to avoid the mistake

Use the Department of Labor’s (DOL) six-part economic realities test to determine if a new worker is an independent contractor or an employee. And, use the IRS’s three-prong test.

Still unsure? File Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. When you file Form SS-8, the IRS notifies you of the proper employee classification.

2. Incorrectly classifying exempt workers

You can classify employees one of two ways: exempt vs. nonexempt. What is the big difference between exempt and nonexempt employees? You do not pay overtime wages to exempt employees. Federal law requires that you pay nonexempt workers overtime wages when they work more than 40 hours in a workweek. State laws may differ.

When you incorrectly classify a nonexempt worker as exempt, the worker misses out on overtime wages. As a result, you owe a worker back wages for overtime if they are actually a nonexempt employee. And, you could pay fines or penalties.

How to avoid the mistake

Carefully review Fair Labor Standards Act (FLSA) guidelines for employee exemption. An employee may fall under one of the following exemptions:

- Executive, administrative, or professional exemption

- Computer exemption

- Outside sales exemption

- Highly compensated employee exemption

States may have stricter guidelines on who may or may not be considered exempt. Contact your state for more information.

3. Miscalculating overtime wages

Are your workers correctly classified as employees? Are the workers also correctly classified as nonexempt employees? If so, you must pay them overtime wages. And, you must calculate overtime correctly.

The FLSA requires employers to pay employees 1.5 times their regular rate of pay, also known as time and a half, for any hours worked beyond 40 hours in a workweek. For example, if you pay a worker $10 per hour, you must pay them $15 per hour of overtime ($10 X 1.5).

States may have different guidelines for time and a half. For example, California requires overtime pay for any employee who works more than eight hours in a workday.

Some cities may also have overtime wage laws that differ from state and federal laws.

Failure to pay overtime wages to employees who earn them may result in penalties and interest. And, you will owe back wages to the employee.

According to John Li, Co-founder and CTO of Fig Loans, overtime calculations are crucial. He said:

If you fail to calculate your employee overtime correctly, you may be liable to pay back liquidated damages. That’s a load of cash for a small business owner to fork over, so calculate these hours properly and have employees sign off on their timesheets.”

How to avoid the mistake

First, check with state and local laws to verify overtime wage guidelines for where your business is located. If you have employees in other cities or states, check the laws for where those employees are located, too.

Second, carefully monitor your employees’ work time. Consider using time and attendance software to add up and track your employees’ hours each day and week. If you do not use a software program to track hours, double-check your math when adding up employee hours.

4. Using the wrong tax rates

Tax rates can change each year (and some do!). Unfortunately, those changes can cause payroll issues (and a mistake on paycheck) if you do not keep track of the tax rate changes.

When you pay the wrong rate, you must make up the difference in owed taxes. And, you might also have to pay late fees, penalties, or interest on the taxes you owe.

Here are some payroll taxes you might need to update your rates for:

- Federal income tax

- Social Security tax

- Medicare tax

- Federal unemployment tax

- State income tax

- State unemployment tax (SUTA)

- Local income tax

Depending on where your business and employees are located, you might owe additional taxes (e.g., occupational privilege tax).

How to avoid the mistake

Because some states send notices each year to alert employers to tax rate changes, open and review all mail from the state or local governments. And, regularly check the employment tax rates.

Don’t have the time to check government websites or accounts to monitor tax rate changes? Consider signing up for payroll software. Online payroll software should automatically update with new tax rates each year. However, business-specific tax rates (e.g., SUTA) may still require you to verify your new yearly rate through your online business account or mail.

5. Using the incorrect payroll frequency

When you hire employees, you set a pay frequency for the employees’ paychecks. The pay frequency can be weekly, biweekly, semimonthly, or monthly. The federal government does not have set rules on how frequently you must pay your employees. However, you may have state pay frequency requirements.

An incorrect payroll frequency can result in penalties or fines for your business.

And, remember to pay your employees on time. Failure to follow a strict pay frequency can result in employees losing trust in you.

How to avoid the mistake

Check your state payroll frequency laws to ensure your pay frequency is allowed by your state. Then, set a regular pay frequency and stick to it. You may have separate pay frequencies, depending on the work your employees do. If you do, remember to separate the employees and pay them according to schedule.

Consider setting a reminder for when to run payroll as well as when to pay employees. For example, you may use direct deposit to pay your employees. Let’s say it takes four days to process direct deposit for payroll. Run your payroll four days in advance to ensure that you pay your employees on time.

Do you pay your employees with paper checks? Mark your calendar for the pay dates and distribute the checks on the pay date. Make plans to distribute checks for pay dates you will be out of the office. And, consider writing a policy on how employees can expect to be paid if they are out of the office on payday.

This article has been updated from its original publication date of December 27, 2017.

This is not intended as legal advice; for more information, please click here.