Help, I can’t pay my employees! If this thought has ever crossed your mind, you know how scary it can be. Realizing you can’t make payroll might make you feel anxious, embarrassed, and helpless.

But, it doesn’t have to.

There are a number of things you can do if you can’t make payroll that could help you pay employees on time.

5 Reasons making payroll might be difficult

Payroll is the biggest expense for many small business owners. In addition to an employee’s salary or wages, you have benefits and taxes you’re responsible for. And if something goes wrong in your cash flow, footing the bill for payroll might not be feasible on your own.

Here are a few situations that could prevent you from being able to afford the high payroll price tag, such as:

- Three-paycheck months: Do you pay employees biweekly? If so, there are two months per year that you have to give the employee three paychecks as opposed to two. You might not have enough cash to cover the third paycheck if you forget to account for it in your budget.

- Natural disasters: A natural disaster (e.g., hurricane, tornado, earthquake, or fire) can close down operations and destroy property. It could prevent you from earning enough to cover your losses—and cover payroll.

- COVID-19: The coronavirus has wreaked havoc on businesses nationwide. It’s forced businesses to temporarily close their doors to comply with health regulations. Not to mention, consumer spending fell by 12.6% in April 2020 because of the virus.

- High accounts receivable: Do you have customers who won’t pay? If so, you likely have high accounts receivable (AR). These receivables could be jamming up your cash flow and making it difficult to pay for your own liabilities.

- Low sales: You will likely go through periods where your sales are low, whether you’re a seasonal business or not. Maybe a large sale fell through. Or, maybe the economy is in a recession. Low sales could be the culprit for not being able to make payroll.

Whatever the case may be, you’re not the only business owner who has struggled to make payroll.

Why paying employees on time matters

It’s important to get employees their earned wages on time. Why? To start, 78% of Americans live paycheck to paycheck, according to one survey.

So if you can’t make payroll, your employees may not be able to pay their own bills—kicking off a vicious cycle. Not to mention, late paychecks could decrease employee effort and morale.

As if that wasn’t bad enough, not making payroll could also kickstart some legal problems for your small business. The Fair Labor Standards Act (FLSA) requires employers to pay non-exempt employees on their regularly scheduled payday. If you don’t, you could be in violation of the FLSA, according to the Department of Labor.

When you violate the FLSA, you might have to pay back wages, back taxes, criminal penalties, damages, attorney’s fees, and court costs. You could also face imprisonment. All of this will cost you much more than if you paid employees on time.

In addition to federal laws on paying employees on time, your state might also set its own rules. For example, there are pay frequency requirements by state that require employers to pay employees within a certain time frame. Consult your state labor department to find out if your state has any additional regulations for employers who can’t make payroll.

What to do if you can’t make payroll

Again, there are alternatives if you can’t afford to pay your employees their paychecks. But before we get into those, your first task is to admit you can’t make payroll to your employees.

Odds are, there are signs in advance that you will come up short on payday. You can often see your business’s accounts draining to zero. The sooner you tell employees, the more time they will have to prepare.

Tell employees about the alternatives you plan to pursue. Let them know how you plan to pay them and what steps you are going to take to get the business back on track. If employees should begin looking for other work, you need to tell them this, too.

You do have something to your advantage that big businesses don’t have. Small businesses often feel like family. You and your employees might know each other well. This family environment could make employees more willing to stay by your side during this turbulent time.

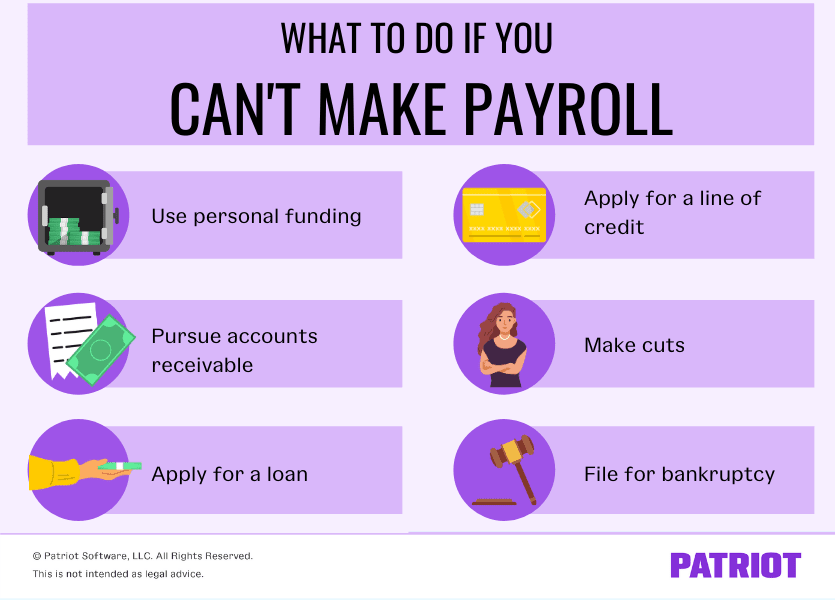

So if you can’t make payroll, you may need to consider the following alternatives:

- Use personal funding

- Pursue accounts receivable

- Apply for a small business loan

- Apply for a line of credit

- Make cuts

- File for bankruptcy

What you pursue depends on your specific situation. Figure out how much money you need. This might help you determine how drastic your financing methods need to be. Remember, part of payroll is paying taxes, so you need money for that too.

1. Use personal funding

If worse comes to worst and you can’t make payroll, look at your personal savings. Can your family afford to invest some money to help your business pay your employees?

If you are able to use your personal savings to fund part of your payroll expenses, determine how much more you need to make ends meet.

2. Pursue accounts receivable

Look at your accounts receivable. Do you have any customers who owe you money?

Customers might be willing to make a payment sooner if you offer an incentive, like an early payment discount. Although this causes you to lose money, it might help you to get paid faster. This is a trade-off that you might have to make if you can’t make payroll.

If customer payments are well overdue, and you’ve exhausted your efforts asking for payment, you might hire a collection agency.

3. Apply for a small business loan

You can try to get a traditional bank loan or a Small Business Administration (SBA) loan. You might also consider asking friends and family for financial help in the form of a loan. Someone could be willing to loan you money with more generous terms than you can find from a traditional lender.

Getting a traditional bank loan can take significant time and energy, which might make it difficult to rely on for making payroll. But some online lending services, like BlueVine, may have a faster turnaround time.

If your business has been impacted by the coronavirus, you may qualify for a Paycheck Protection Program loan or Economic Injury Disaster Loan.

4. Apply for a line of credit

Another option you have for making payroll is to apply for a business line of credit. You can apply for a secured (collateral, lower interest rates) or an unsecured (no collateral, higher interest rates) line of credit.

5. Make cuts

You might have to make pay cuts if you can’t make payroll. First, look at your own earnings. You can suspend your compensation until your business is back on its feet. This also shows your employees that they aren’t the only ones taking a financial hit.

You could reduce the hours employees work, which will reduce their earnings. You can do this by reducing everyone’s scheduled hours, furloughing employees, or asking them to volunteer to take time off.

Remember to pay employees at least the minimum wage to stay compliant with the FLSA.

6. File for bankruptcy

If your business continually struggles to make payroll due to large amounts of debt and low revenue, you may consider filing for bankruptcy.

There are a few bankruptcy options that businesses have, including Chapters:

- 7: Liquidation

- 11: Reorganization

- 13: Court-approved repayment plans

Generally, employees receive priority payment for unpaid paychecks through bankruptcy.

How to prevent the problem in the future

Stressing about making payroll can feel like you’re trapped in a nightmare. When you take advantage of an alternative to run payroll when you can’t afford it, your work isn’t over. It is essentially a small patch on a damaged ship. Make lasting changes before you sink into business wreckage.

If you want to avoid the problem in the first place, consider doing the following:

- Examine your spending habits

- Speed up accounts receivable

- Improve sales

- Create an emergency fund

- Consult an accountant

Take a thorough look at your business’s spending habits. Consider your overhead expenses. Identify all your cash flow problems. You might need to restructure parts of your business.

If your business has an accounts receivable payment policy, look at it. If your policy is too lenient, you might not get receivables in a timely fashion. You will have cash flow problems when customers take a long time to pay you. And, cash flow problems mean you will have less money for payroll and bills.

If you aren’t making enough sales, you might want to do a market analysis. A market analysis can help you understand your customers, competitors, and industry. You can then adjust your goods or services to be more desirable.

For future financial emergencies, build up your business’s savings now. One way to do this is to commit to putting a certain percentage of your business’s income into an emergency fund.

As you prepare your business for the future, you might want to consult an accountant. An accountant can help you understand where your money is going so you can make informed business decisions.

Need a reliable way to run payroll that won’t break the bank? Patriot’s online payroll is fast, simple, and affordable; provides free, USA-based support; and comes with a free trial so you can see for yourself. Start your free trial today!

This article has been updated from its original publication date of February 24, 2016.

This is not intended as legal advice; for more information, please click here.