You’re struggling to find good, quality candidates to fill an open position. Or, you’ve found the perfect candidate and want to sweeten the job offer. What do you do? In either case, you may consider offering a sign-on bonus.

But before you advertise a $500, $1,000, or $5,000 (you get the picture) sign-on bonus, you may have some questions. How do sign-on bonuses usually work? Are sign-on bonuses taxed? What are common jobs with a hiring bonus?

…And so on. Read on to learn everything you need to know before offering a sign-on bonus to new employees.

What is a sign-on bonus?

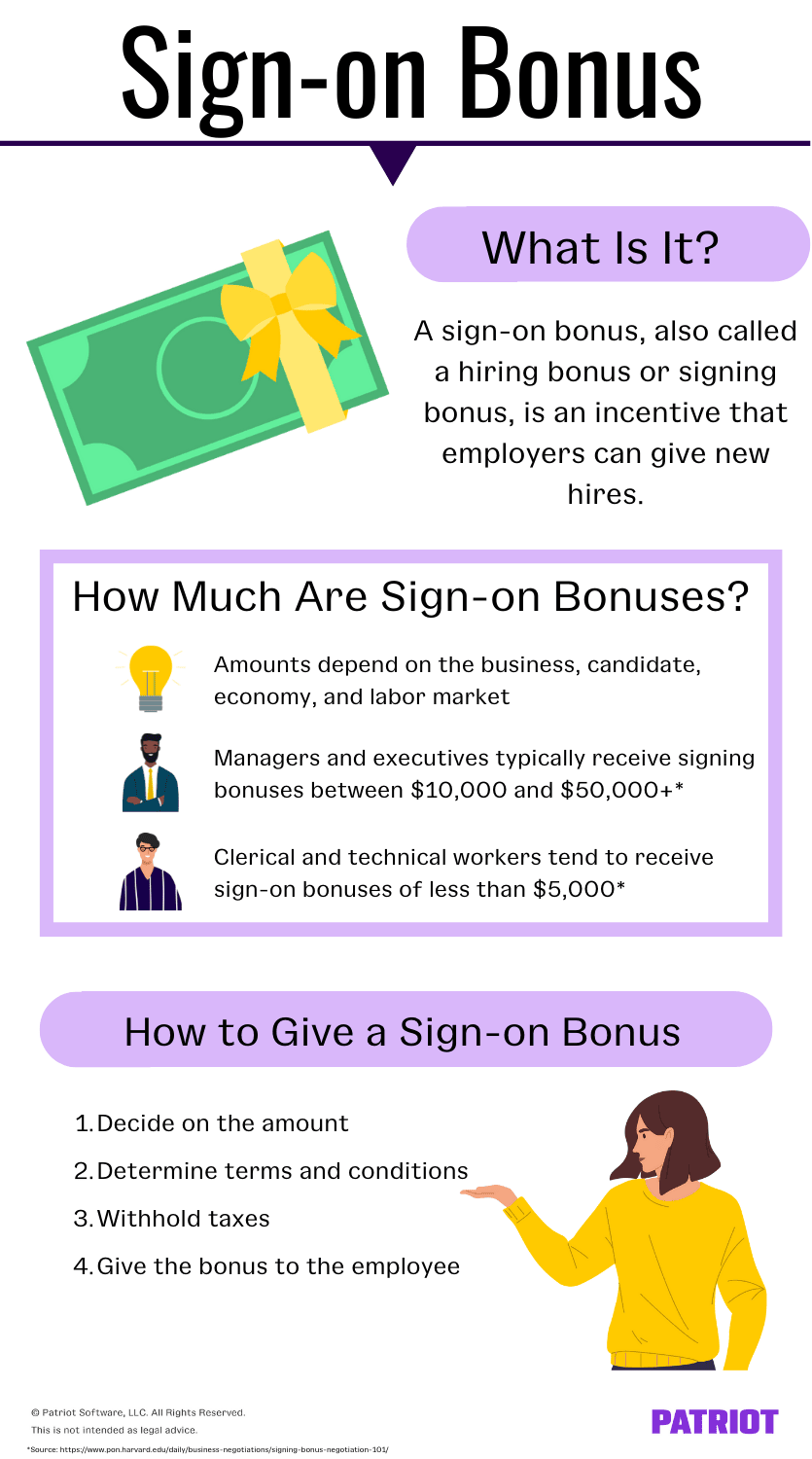

A sign-on bonus, also called a hiring bonus or signing bonus, is an incentive that employers can give new hires. Employers can use sign-on bonuses to attract and hire employees. Generally, signing bonuses are a one-time lump sum payment. However, some employers may spread the payment out over time.

You may use a sign-on bonus to:

- Entice a candidate with multiple job offers

- Attract essential employees, like a manager or C-suite executive

- Recruit workers during labor shortages

- Offset a salary that’s lower than the candidate wants

Typically, employers reserve sign-on bonuses for specific candidates. However, hiring bonuses became more common during and after the COVID-19 pandemic and Great Resignation. In July 2022, 5.2% of all job postings on Indeed advertised a signing bonus, more than three times higher than in July 2019.

How much are sign-on bonuses?

According to Harvard Law School, managers and executives typically receive signing bonuses between $10,000 and $50,000+. Clerical and technical workers tend to receive sign-on bonuses of less than $5,000.

Sign-on bonus amounts may vary, depending on factors like the:

- Business

- Candidate

- Labor market

- Economy

For example, McDonald’s is offering an up to $500 sign-on bonus. Walgreens is offering hiring bonuses up to $75,000 to pharmacists in some markets.

Some hiring bonuses are a percentage of the candidate’s annual compensation. For example, a candidate who makes $100,000 may receive a 10% signing bonus of $10,000.

Jobs with sign-on bonus

It may not make sense for all employers to offer candidates a signing bonus. Again, you might decide to offer the payment to key candidates, during low unemployment and high labor shortages, or to someone juggling multiple offers.

You may decide against giving signing bonuses to employees in high turnover positions or temporary workers.

So, what are the jobs where signing bonuses are typically the most common?

According to a July 2022 study by Indeed, these are the top eight occupational sectors advertising hiring bonuses, along with the percentage of job postings advertising them:

- Nursing (18.1%)

- Driving (15.1%)

- Dental (14.7%)

- Veterinary (13.5%)

- Medical technician (12.6%)

- Physicians and surgeons (11.4%)

- Childcare (11.3%)

- Personal care and home health (11.3%)

Another interesting thing to note from the report? The report also found that job postings for “high remote positions” are the least likely to advertise a signing bonus (compared to “low remote” and “medium remote positions”). That means that employers who offer other workplace benefits, like the ability to work remotely, may be less likely to entice candidates with a bonus.

How to give a sign-on bonus in 4 steps

So, you’re sold on signing bonuses and what they can do for your business. Now what? Now, it’s time to give the bonus—with a little prep work, of course.

1. Decide on the amount

Before telling candidates about your sign-on bonus, you need to decide on the amount. Again, signing bonuses range from a few hundred to tens of thousands of dollars (and up).

To help you choose a fair and attractive amount, ask yourself questions like:

- What can I afford?

- Is this a difficult-to-fill position that’s in high demand?

- Will I offer a standard sign-on bonus amount to all candidates?

- How much experience does the candidate have?

- Am I willing to negotiate a salary increase with the candidate?

2. Determine terms and conditions

The last thing you want is to pay out a signing bonus (especially if it’s $75,000!) and watch the employee quit after a month.

Set signing bonus terms and conditions to safeguard your business—and its bottom line. For example, you may require that the employee:

- Complete a provisional period before distributing the bonus

- Return the bonus (all or some) if they leave before a certain time period

- Return the bonus (all or some) if they do not meet expectations

3. Withhold taxes

Signing bonuses, like other types of bonuses, are taxable. So, you must withhold sign-on bonus tax before giving it to the employee.

Like regular wages, you must withhold:

- Federal income tax

- State and local income tax, if applicable

- Social Security and Medicare taxes

But, there is a caveat. Bonuses are a type of supplemental wage. As a result, you can withhold a flat 22% supplemental tax rate for federal income tax. Or, you can add together the employee’s bonus and regular wages and withhold taxes on the combined amount using IRS income tax withholding tables.

Not the amount you want to give? Gross it up!

You promise the employee a signing bonus of $10,000. But after tax withholding, that amount is a lot … less. What do you do?

You can do a tax gross-up to give the employee the full promised bonus amount. A gross-up increases the total gross amount of compensation. That way, the amount after taxes is the full sign-on bonus amount (ta-da!).

4. Give the bonus to the employee

You’ve brought the employee on board. Now, it’s time to give them the bonus.

This step’s a pretty easy one. Give the bonus to the employee based on your terms and conditions.

If you said you’d give the bonus one month after they start, make sure to run a special payroll at the right time. And if you said they’d receive the bonus via direct deposit, well, pay them via direct deposit.

Make bonus payments—and your entire payroll process—easier with Patriot Software! Run payroll in three simple steps using our award-winning payroll software. Get your free trial today!

This is not intended as legal advice; for more information, please click here.