Thanks to COVID-19, remote work is gaining popularity across the globe. And if remote work is a whole new ballgame for your business, you may be wondering what you need to do differently to pay your workers who telecommute. Read on to learn what aspects you need to keep in mind when paying remote employees.

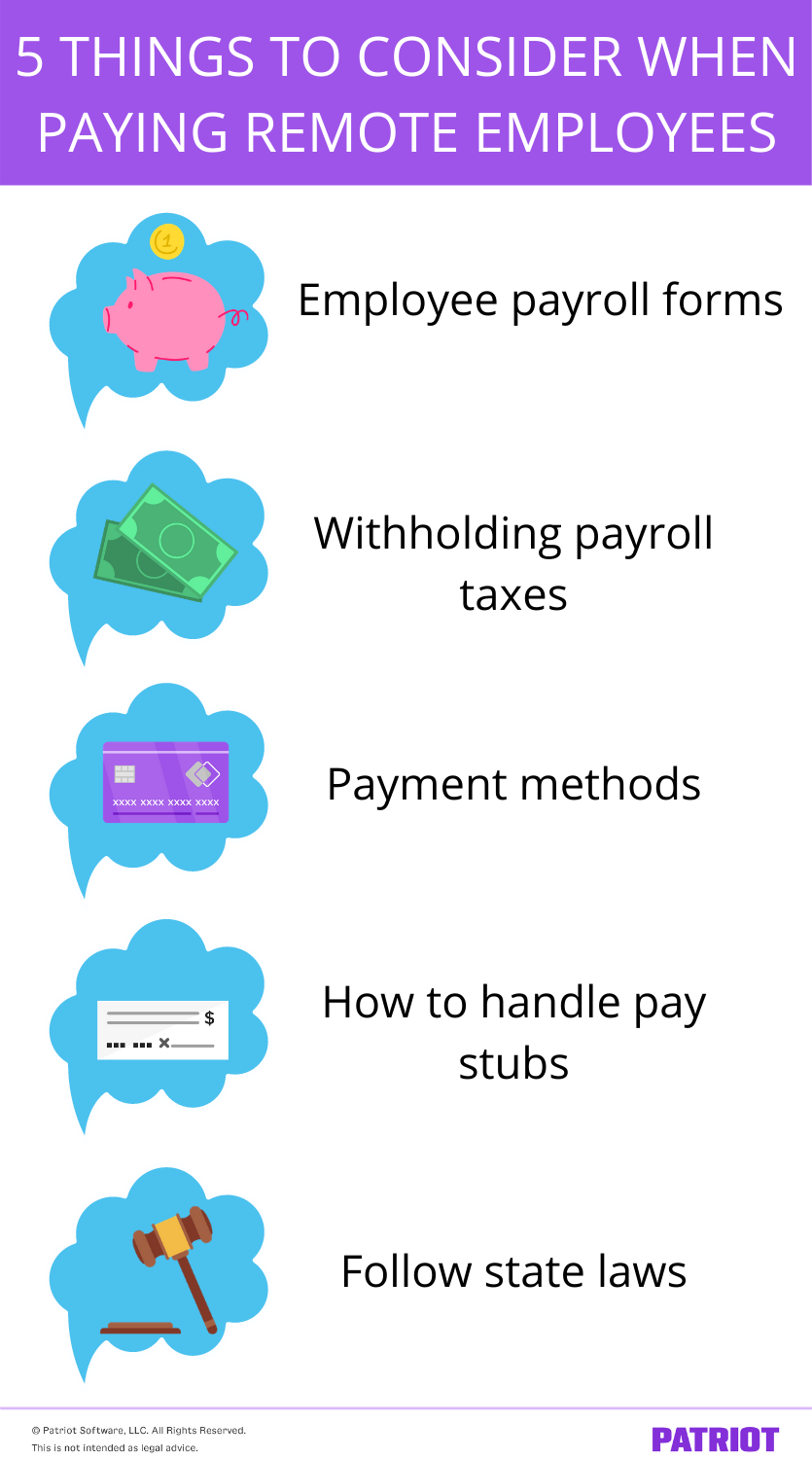

Paying remote employees: 5 things to think about

Whether you’re thinking about taking your team fully remote due to the coronavirus or are experimenting with hiring remote workers, consider a few things when it comes to paying remote employees. Check out our handy dandy list below to find out what you need to consider when paying remote workers.

1. Employee payroll forms

As an employer, it’s your responsibility to have certain documents in your records for each employee. Remote employees are no exception to this.

Keep the following forms on file for all of your employees (remote or not):

- Form I-9: Confirms your employees are legally allowed to work in the U.S.

- Form W-4: Determines employees’ federal income tax withholding.

- State W-4 form, if applicable: Determines state income tax withholding for employees.

You may also require your employees to fill out company-specific forms, such as employee handbook acknowledgment or direct deposit forms.

If your team is just going temporarily or permanently remote, you should already have these employee documents. Double-check your records to ensure you have the applicable documents on file for each employee. Keep in mind that you must keep all payroll records for at least three years.

If you’re hiring remote workers, have newly hired employees fill out each applicable employee form during their onboarding process.

Consider utilizing an employee portal so remote employees can electronically (and securely) fill out their forms. If you don’t have a portal option, have the remote employee send you a copy of their forms in a password-protected document.

2. Withholding the proper payroll taxes

Every time you pay an employee, you need to withhold payroll taxes. Taxes you typically need to withhold from employee wages include:

- Federal income tax

- Social Security tax

- Medicare tax

Depending on the state, you may also need to withhold state and local income taxes from employee wages.

If you hire an employee who lives and works from home in another state, do your research to find out what taxes you must withhold for that specific state. Additionally, you may need to register with the remote employee’s home state to withhold and deposit payroll taxes to the correct agencies (e.g., state, local, and unemployment agencies). If you have multiple remote workers in a number of states, register with the tax agency in every state.

The city or state your business is located in may also have a tax reciprocity agreement with the employee’s home city or state. If you hire an employee who lives in one state but works in another, check to see if there are any state reciprocity agreements.

If you plan on having your current employees temporarily or permanently work from home and they all live and work in the same state as your business, continue withholding the correct payroll taxes for your state.

3. Payment methods

When it comes to paying remote employees, you have a few options to consider. You can pay remote workers via:

- Direct deposit

- Pay card

- Mobile wallet

- Check

- Cash

Out of the above, direct deposit is the most popular method. If your remote employees prefer an alternative to direct deposit, pay cards or mobile wallets are also good options. Of course, you can always go with the good, old-fashioned paper check. You can either mail remote employees their checks (if they live out of state). Or, you can give remote employees the option of picking up their checks on a specific date (e.g., every other Friday).

Before you decide on a method, do your research on pay laws (e.g., pay card laws by state) to ensure you’re compliant with the state’s rules. And, think about which payment method would be the most secure. For example, if your employee lives and works out of state, cash probably isn’t the best option if you need to mail the employee their pay.

If your team is simply moving from an office environment to working from home, don’t worry about changing payment methods unless you find it necessary to make adjustments (e.g., switch from paying cash to direct deposit).

| Download our FREE guide, Compare Different Methods of Paying Employees, to learn more about various payment options for employees! |

4. How to handle pay stubs

Part of your responsibility of paying employees is distributing pay stubs. For those of you who don’t know, a pay stub is the part of a paycheck that lists details about the employee’s pay (e.g., gross wages, deductions, net pay, etc.).

Before your workers go remote or you hire remote employees, narrow down how you plan on handling pay stubs. You can:

- Mail stubs to employees

- Send them electronically (e.g., via email)

- Let employees access electronic pay stubs through an online portal

Also, brush up on your pay stubs requirements by state to ensure you’re compliant with federal and state laws. Some states may require employers to provide employees their pay stubs in a specific format (e.g., written or printed pay stubs).

| Want more information about pay stubs? Check out our FREE guide, Understand Your Pay Stub Responsibilities. |

5. Follow state laws

Just like any other employee, make sure you are following pay and employment laws for remote employees, especially if they live/work out of state.

Laws you need to keep on your radar may pertain to:

- Minimum wage laws

- Mandatory direct deposit

- Pay frequency

- Local income taxes

- Workers comp requirements

- State-specific taxes

Check with the state to find out what laws you need to follow as an employer. To make following various state’s laws easier, consider investing in payroll software to take care of the calculations for you.

Looking for an easy-to-use and affordable payroll system? Patriot’s online payroll lets you run payroll in three steps. Opt for our Full Service payroll services, and we will take care of withholding and depositing taxes for you. Get your free trial now!

This is not intended as legal advice; for more information, please click here.