Withholding allowances used to be a way employees could adjust how much money employers take out of their paychecks for federal income tax. Although the IRS removed withholding allowances for federal income tax in 2020, they’re still out there—through pre-2020 W-4 forms and state income tax.

Read More Federal Withholding Allowances Still Axed, But Some State Allowances Live OnPayroll Articles

Payroll Tips, Training, and News

New AZ State Income Tax Form Requires Employer Action

December 15, 2022Arizona employers, you may know that Senate Bill 1828 substantially reduced the state’s income taxes starting with the 2022 tax year. But did you also know that it requires employer action for the 2023 tax year? You must now give all employees—not just new hires—a new AZ state income tax form.

Read More New AZ State Income Tax Form Requires Employer Action

Self-employed Payroll: Paying Yourself When You’re the Boss

December 14, 2022If you’re self-employed, you need to have a game plan when it comes to payroll. Self-employed individuals are responsible for withholding and remitting different taxes than other workers. If you want to ensure you’re compliant, learn more about self-employed payroll.

Read More Self-employed Payroll: Paying Yourself When You’re the Boss

How to Do Payroll: Your Step-by-step Guide on Paying Employees

December 14, 2022If you’re becoming an employer or already have employees, you must learn how to do payroll. Handling payroll is an important employer responsibility with many steps. Familiarize yourself on how to do payroll by learning about what payroll information you need to gather and the steps you need to follow to pay employees.

Read More How to Do Payroll: Your Step-by-step Guide on Paying Employees

Correcting Employment Taxes: What to Do If You Withhold the Wrong Amount

December 14, 2022It’s easy to make mistakes, especially when you have a million and one things on your plate. One error you could make is deducting the wrong amount from employee wages. Correcting employment taxes is necessary if you withhold too much or too little from your employees’ paychecks.

Read More Correcting Employment Taxes: What to Do If You Withhold the Wrong Amount

What’s Your Payroll Tax Deposit Schedule? If You’re Not Sure, Read This

December 7, 2022When you have employees, your responsibility isn’t just to pay them. You also need to pay the IRS their share, too. How often you pay the IRS depends on your payroll tax deposit schedule. But, not all employers follow the same schedule. Your schedule, and thus payroll tax deposit due dates, depends on the type […]

Read More What’s Your Payroll Tax Deposit Schedule? If You’re Not Sure, Read This

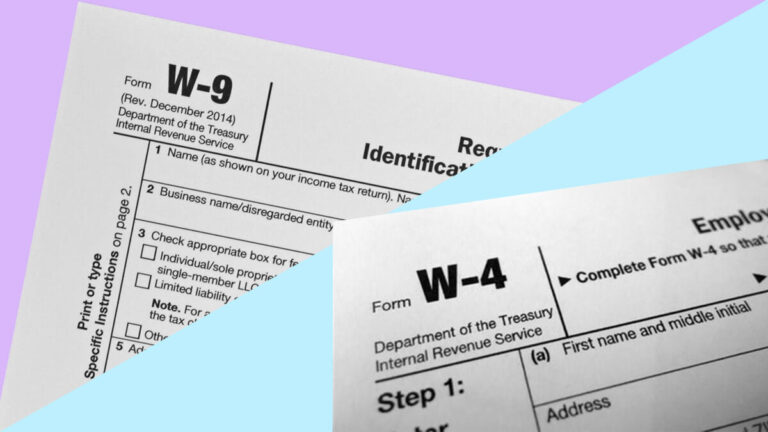

Form W-9 vs. W-4: What Are the Right Forms for Employees and Contractors?

November 30, 2022You must withhold the right amount of taxes on employee wages when paying employees. But what if you need to pay an independent contractor? To keep tax information straight between independent contractors and employees, you need to know the difference between Form W-9 vs. W-4. Read on for the scoop.

Read More Form W-9 vs. W-4: What Are the Right Forms for Employees and Contractors?

FMLA vs. PFL: Different Types of Leave for Your Employees

November 30, 2022When an employee needs to take time off, you may start asking what you need to do as an employer. What are the different types of leave? Do you need to offer FMLA leave? What about PFL? With so many different laws (and acronyms!) about family leave, your role as the employer can be confusing. […]

Read More FMLA vs. PFL: Different Types of Leave for Your Employees

State Tax ID: What Is It, How to Apply, & Beyond

November 28, 2022If you have employees, you have responsibilities—one of which is to obtain a Federal Employer Identification Number (FEIN). But, that’s not the only identifying number you need. More than likely, you also need a state tax ID number.

Read More State Tax ID: What Is It, How to Apply, & Beyond

‘Tis the Season of Giving: How to Handle Holiday Gifts to Employees

November 23, 2022Your business might offer sales and seasonal offerings whenever a holiday rolls around. Or, you could decorate your office, retail space, or remote work location with some festive cheer. No matter how you celebrate the holidays, don’t forget to celebrate your employees, too. Holiday parties, gifts, and bonuses are great opportunities to give back to […]

Read More ‘Tis the Season of Giving: How to Handle Holiday Gifts to Employees