Tipped income is already complicated, and it just got more so. With the passage of the One Big Beautiful Bill Act (OBBBA), major tax changes are here in 2025. One of the biggest? Certain tipped employees will no longer pay federal income tax on their tips.

- From 2025 to 2028 certain tipped employees can deduct cash tips up to $25,000 when filing federal returns.

- Employers must continue withholding, remitting, and reporting tips for 2025 with no immediate payroll changes.

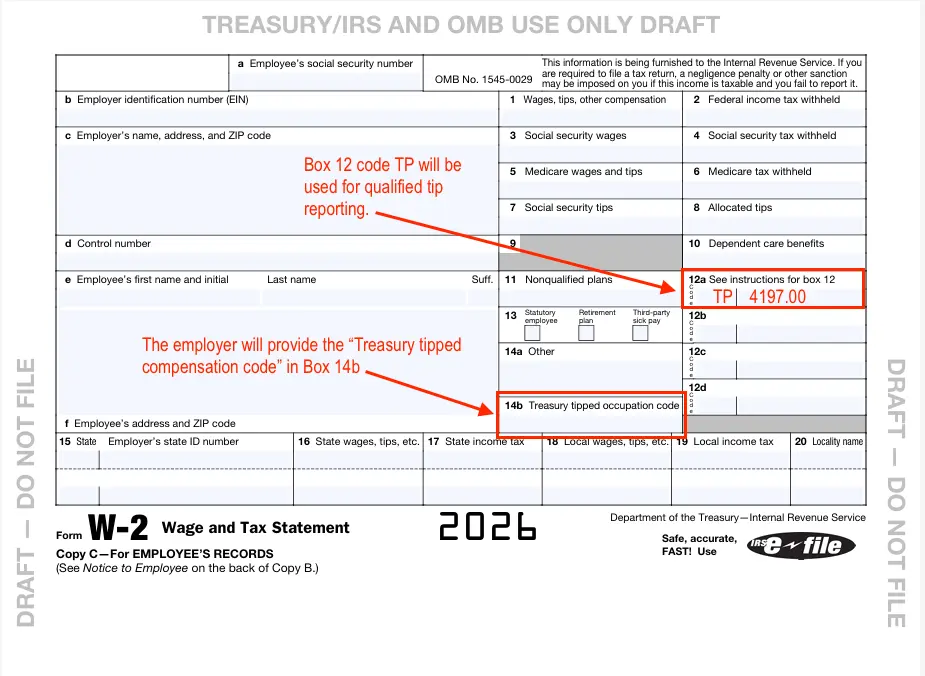

- 2026 forms update: new W-2 codes (TP, TT, TA) and Box 14b tipped occupation codes for qualifying jobs.

- Qualification is narrow: occupations must be customary tippers before Dec 31, 2024, with a $160,000 high-earner cap.

The new law, signed by President Trump on July 4, 2025, also introduces a deduction for no tax on overtime pay, increases the standard deduction, establishes Trump Accounts, and increases the child tax credit. But for service workers and their employers, the “no tax on tips” provision is the headline change.

Here’s what to know.

Skip Ahead

- Overview of tipped income and current tax rules

- What are the “no tax on tips” changes?

- What type of occupations qualify for the tip tax deduction?

- What tipped employees don’t qualify under the new tax deduction?

- How should employers handle the “no tax on tips” in payroll?

- Changes coming to the 2026 Form W-2

- “No tax on tips” FAQs

Overview of tipped income and taxation

Some employees (e.g., restaurant servers, nail technicians, etc.) regularly and customarily receive tips as part of their compensation. If an employee regularly receives more than $30 in tips per month, they are officially a tipped employee under the Fair Labor Standards Act (FLSA).

Customers typically leave cash tips or electronic tip payments (e.g., via credit and debit card), or employees can receive tips from a tip pooling agreement. According to the IRS, these are all considered “cash tips.”

Employers must pay tipped employees at least the tipped minimum wage, which varies by state. The tipped minimum wage is a lower hourly rate than the regular minimum wage.

How do taxes on tips work? Employees must report all tips to their employers if they receive $20 or more tips during a month. All reported tips are subject to federal income, Social Security, and Medicare taxes (plus state and local taxes, where applicable).

As the employer, you must withhold taxes from the employee’s tipped income, remit it to the proper agencies, and report the income and taxes on Form 941 and the W-2 form for employees.

What are the “no tax on tips” changes?

Starting in 2025 and going through 2028, cash tips that an individual receives in an occupation that traditionally and customarily receives tips qualify for a federal income tax deduction for the total tipped income received.

Tipped deductions max out annually at $25,000. Also, for self-employed tax payers, the deduction cannot exceed the individual’s net income from the trade or business the tips were earned.

| Several states are also noodling a no tax on tips and overtime law. |

|---|

| Several states (e.g., Alabama, North Carolina, and New Jersey) have also proposed legislation to eliminate state income tax on tips and overtime pay. |

What type of occupations qualify for the tip tax deduction?

The IRS has made it clear that eligible occupations must have customarily received tips on or before December 31, 2024. In other words, they’re basing it on tipping patterns from the prior year.

The Secretary of the Treasury will publish the final official list of jobs that qualify for the tax deduction by October 2, 2025. The following is the preliminary list published by the Department of Treasury August 27, 2025:

Tipped Occupations & Codes

Beverage & Food Service

- 101 — Bartenders

- 102 — Wait Staff

- 103 — Food Servers, Nonrestaurant

- 104 — Dining Room & Cafeteria Attendants and Bartender Helpers

- 105 — Chefs and Cooks

- 106 — Food Preparation Workers

- 107 — Fast Food and Counter Workers

- 108 — Dishwashers

- 109 — Host Staff, Restaurant, Lounge, and Coffee Shop

- 110 — Bakers

Entertainment & Events

- 201 — Gambling Dealers

- 202 — Gambling Change Persons and Booth Cashiers

- 203 — Gambling Cage Workers

- 204 — Gambling & Sports Book Writers and Runners

- 205 — Dancers

- 206 — Musicians and Singers

- 207 — Disc Jockeys, Except Radio

- 208 — Entertainers and Performers

- 209 — Digital Content Creators

- 210 — Ushers, Lobby Attendants, and Ticket Takers

- 211 — Locker Room, Coatroom, and Dressing Room Attendants

Hospitality & Guest Services

- 301 — Baggage Porters and Bellhops

- 302 — Concierges

- 303 — Hotel, Motel, and Resort Desk Clerks

- 304 — Maids and Housekeeping Cleaners

Home Services

- 401 — Home Maintenance and Repair Workers

- 402 — Home Landscaping and Groundskeeping Workers

- 403 — Home Electricians

- 404 — Home Plumbers

- 405 — Home Heating and Air Conditioning Mechanics and Installers

- 406 — Home Appliance Installers and Repairers

- 407 — Home Cleaning Service Workers

- 408 — Locksmiths

- 409 — Roadside Assistance Workers

Personal Services

- 501 — Personal Care and Service Workers

- 502 — Private Event Planners

- 503 — Private Event and Portrait Photographers

- 504 — Private Event Videographers

- 505 — Event Officiants

- 506 — Pet Caretakers

- 507 — Tutors

- 508 — Nannies and Babysitters

Personal Appearance & Wellness

- 601 — Skincare Specialists

- 602 — Massage Therapists

- 603 — Barbers, Hairdressers, Hairstylists, and Cosmetologists

- 604 — Shampooers

- 605 — Manicurists and Pedicurists

- 606 — Eyebrow Threading and Waxing Technicians

- 607 — Makeup Artists

- 608 — Exercise Trainers and Group Fitness Instructors

- 609 — Tattoo Artists and Piercers

- 610 — Tailors

- 611 — Shoe and Leather Workers and Repairers

Recreation & Instruction

- 701 — Golf Caddies

- 702 — Self-Enrichment Teachers

- 703 — Recreational and Tour Pilots

- 704 — Tour Guides and Escorts

- 705 — Travel Guides

- 706 — Sports and Recreation Instructors

Transportation & Delivery

- 801 — Parking and Valet Attendants

- 802 — Taxi and Rideshare Drivers and Chauffeurs

- 803 — Shuttle Drivers

- 804 — Goods Delivery People

- 805 — Personal Vehicle and Equipment Cleaners

- 806 — Private and Charter Bus Drivers

- 807 — Water Taxi Operators and Charter Boat Workers

- 808 — Rickshaw, Pedicab, and Carriage Drivers

- 809 — Home Movers

What tipped employees don’t qualify under the new tax deduction?

The Fair Labor Standards Act definition of a tipped employee (anyone who regularly earns more than $30 per month in tips) is used to determine whether an employer can pay an employee the lower tipped minimum wage.

However, the “no tax on tips deduction” in “The One, Big, Beautiful, Bill” uses a much narrower definition of who qualifies. So, even if someone meets the FLSA standard for being a tipped employee, they may not qualify for the federal tip deduction.

Employees who don’t qualify for the “no tax on tips” deduction:

- High earners: This is defined as making over $160,000 per year. This cap applies regardless of how much tip income is earned.

- Jobs where tipping isn’t customary: Examples of non-qualifying jobs are, hotel front desk or concierges, retail workers, gig workers. This will be defined by the Secretary of State by October 2025.

- Employees who don’t report tips to their employer.

- Nonresident aliens: Typically, foreign nationals who don’t meet the substantial presence or green card test.

How should employers handle the “no tax on tips” in payroll?

Will your restaurant payroll software update following the new no tax rule? The IRS has announced no payroll or withholding changes apply for the 2025 tax year. If you run payroll for tipped employees, you’ll continue withholding, remitting, and reporting taxes on tips exactly as you always have.

Why? Because the new tip deduction doesn’t reduce taxable income when tips are earned. Employees can only claim it later, when they file their 2025 federal tax return in 2026.

According to the IRS, tipped employees who qualify for the tipped tax deduction can use the amount in Box 7 of their 2025 Form W-2 (Social security tips), along with their own tip records, to figure the tip amount they may be able to claim as a federal income tax deduction when they file their 2025 return.

However, it doesn’t mean employer are off the hook entirely: The new W-4 for 2026 has an updated Deductions Worksheet in response to the new tax deduction. The deductions worksheet for step 4(b) now includes fields for estimated tip income and the estimated “and-a-half” portion of overtime, as well as other new fields. Employees who expect to benefit from the deduction may choose to adjust their Form W-4 to lower their withholding. You’ll need to update payroll accordingly.

Changes coming to the 2026 Form W-2

The IRS has released a draft of the 2026 Form W-2, and it includes new fields tied to the “no tax on tips” law. These apply to 2026 wages (W-2s issued in January 2027):

- Box 12 gets new codes:

- TP for qualified tips

- TT for qualified overtime pay

- TA for contributions to the so-called “Trump Accounts” (another OBBBA benefit)

- Box 14 updates:

- Box 14a will remain as the informational box for reporting information such as state disability insurance taxes withheld, S Corp health insurance premiums.

- Box 14b will hold a “tipped occupation code” so the IRS can match the deduction to approved tipped jobs.

For employers, 2025 is a transition year: you’ll still report tips and overtime the old way, but the IRS expects employers to reasonably approximate these amounts so employees can claim them. The 2026 W-2 will catch up and include the proper boxes and codes.

💡 District of Columbia employers shouldn’t be confused about the emergency bill passed on December 3, 2025 decoupling from the One Big Beautiful Bill. This won’t affect how you are tracking and reporting tips (or overtime) for federal compliance. This decoupling means qualified tip and overtime deductions generally will not apply at the D.C. income tax level.

Timeline: No Tax on Tips

2025

- Employers report and withhold on tips as usual.

- Employees claim the deduction when filing their 2025 return.

- Employees may adjust Form W-4 to offset tipped tax deduction.

2026

- New W-2 Box 12 code TP for tips.

- Box 14b added for tipped occupation code.

- New 2026 Form W-4

- Employer reporting aligns with the new deduction.

“No tax on tips” FAQs

Yes, tips are still being taxed in 2026. However, the One Big Beautiful Bill Act, (signed on July 4, 2025), provides a federal income tax deduction for cash tips earned by qualifying tipped employees. This deduction will be applied when tipped employees file their yearly income taxes.

Not quite. Although qualifying tipped employees would be able to claim a tax deduction equal to the amount of cash tips received, tips are still subject to Social Security, Medicare, state and local payroll taxes. State tax on tips may go away if states pass their own legislation.

According to the IRS, cash tips include tips received from customers, charged tips (e.g., credit and debit card charges), and tips under a tip-sharing arrangement.

Employees must report all tips to their employers if they make $20 or more in tips.

The IRS has announced that no tax form changes will take effect for the 2025 tax year.

There won’t be new withholding tables for Tax Year 2025 related to the new law. Still, employers should be prepared for W-4 changes that tipped employees make in anticipation of the tipped tax deduction they will receive when filing their taxes and for the new 2026 W-4 form for employees.

The IRS mentions a new Schedule 1-A (Form 1040) in its draft of the 2026 Form W-2, and there is a draft of Schedule 1-A in review as of December, 1, 2025. Tipped employees should plan on using Schedule 1-A for the 2025 tax season to claim these deductions.

Running payroll is hard, especially when tax laws change. Patriot’s payroll software streamlines the process, saving you precious time and headaches. Get your free trial today!

This article has been updated from its original publication date of May 15, 2025.

This is not intended as legal advice; for more information, please click here.