Taking on an independent contractor is different than hiring an employee. There are differences in the forms you must gather, wage reporting, and how you pay contractors vs. employees. So, how do you run contractor payroll if it’s different from paying employees? Read on to learn the answer to that question and more.

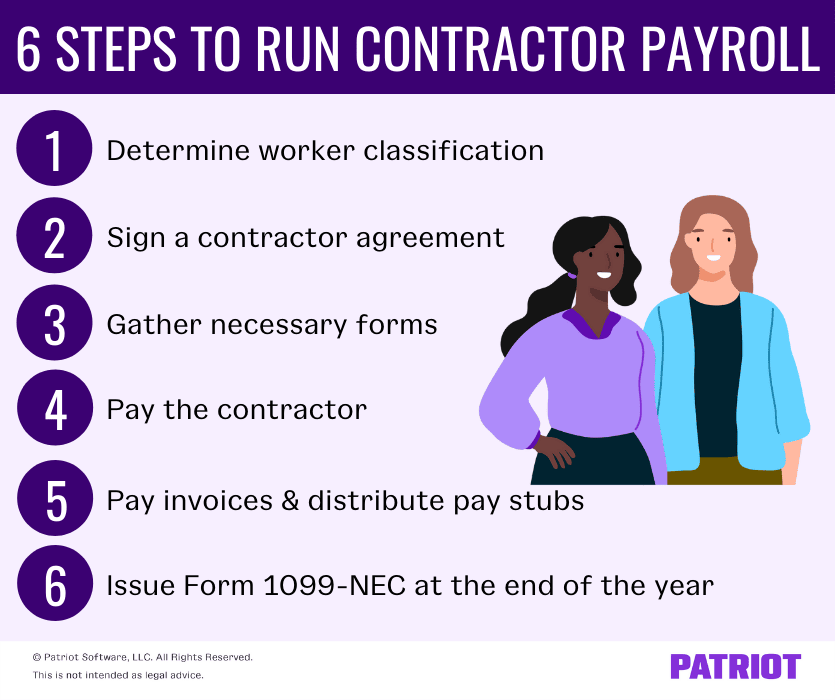

How to run contractor payroll: 6 Steps

If you have independent contractors and W-2 employees, it can be a hassle to process two separate transactions to ensure you pay everyone correctly. So, paying independent contractors through payroll (e.g., via software, using spreadsheets, etc.) can simplify the process. But when you run independent contractor payroll with W-2 employee payroll, be aware of the differences in how you process the two. Take a look at the six steps for running contractor payroll the right way.

1. Determine if the worker is an employee or a contractor

Worker classification determines your employer responsibilities and how you may pay workers. To determine if your worker is an independent contractor, follow the Department of Labor’s six-part test. You can get started by asking yourself questions like:

- Do I control the work they perform (e.g., when, where, and how often they work)?

- Does my business have financial control over the worker (e.g., providing necessary equipment)?

- What is the relationship between my business and the worker (e.g., permanent, temporary, benefits provided, etc.)?

- Does the worker perform essential business tasks or supplementary tasks?

- Who determines how the work should be done, the worker or the employer?

An independent contractor dictates their:

- Working hours and availability

- Methods of performing work

- Type of equipment

Independent contractors are also typically working on a temporary contract. They do not receive employee benefits, such as health insurance or retirement. And, they generally accept work for your business at a flat fee they determine.

If a worker meets the classification as an independent contractor, you must treat and pay them accordingly.

2. Sign an agreement with the contractor

Because independent contractors are not employees, they set their own rates. They may provide you with a contract or a work agreement to sign.

Typically, a work agreement details:

- Hourly or job rates

- If the contractor requires an upfront deposit

- How to pay the contractor (e.g., direct deposit or check)

- Timelines for the project

- Goals and deliverables

Before signing the agreement, sit down with the contractor to ask any questions or request any changes you deem necessary.

3. Gather necessary forms

Once you determine that a worker is a contractor and sign an agreement, you must receive Form W-9, Request for Taxpayer Identification Number and Certification. Form W-9 is similar to the employee Form W-4, Employee’s Withholding Certificate. It provides you with necessary tax filing information for the worker to report wages for them.

The W-9 form provides the worker’s:

- Name

- Business name, if different from their actual name

- Business entity (sole proprietor, S corporation, C corporation, partnership, LLC, etc.)

- Exemptions

- Address

- Taxpayer Identification Number (Social Security number or Employer Identification Number)

- Certification (signature and date)

Keep Form W-9 for your records. Do not send the form to the IRS. You need this form to complete Form 1099 at the end of the year.

4. Pay the contractor

Again, paying an independent contractor is different from paying a W-2 employee. When paying contractors, do not:

- Withhold payroll taxes

- Pay employer taxes (e.g., federal unemployment tax)

As independent contractors are not employees, you do not withhold any payroll taxes from their checks unless you receive notice from the IRS or state to do so. Do not withhold:

- Federal income tax

- Social Security tax

- Medicare tax

- State income tax

- Local tax

Because you do not withhold taxes from contractor wages, you also do not contribute to:

- Federal unemployment tax

- Social Security tax

- Medicare tax

- State unemployment tax

Therefore, there are no gross wages or net wages with independent contractors. Instead, the wage amount in the contractor’s work agreement is the amount the contractor receives. For example, you hire a contractor and agree to pay them $2,000 for the work they do for your business. Because you do not withhold or pay any payroll taxes on their wages, you pay a flat amount of $2,000.

If you pay a contractor in payroll and also pay employees, withhold and pay taxes for the W-2 employees only. Using payroll software? Ensure you correctly classify contractors in the system before processing payroll. That way, the software will not calculate and withhold any taxes for contractor wages.

5. Pay invoices and distribute contractor pay stubs

Technically, you do not issue a pay stub for 1099 employees. Instead, the independent contractor pay stub is the invoice the contractor sends and you pay. But if you pay a contractor through payroll, you may be able to download a check stub to issue to the contractor with their invoice.

There are no federal laws requiring employers to distribute pay stubs to employees or independent contractors. And, state laws may vary. Check with your state for more information.

Contractors may specify in their contractor work agreements that they should receive a pay stub when paid. If so, issue a stub to the contractor when you pay their invoice for their services.

6. Issue Form 1099-NEC at the end of the year

At the end of the year, you must issue the correct Form 1099 to your contractor. Typically, you must give Form 1099-NEC to your contractors for performing nonemployee work for your business.

You must send copies of Form 1099-NEC to the contractor by January 31, or the next business day if it falls on a weekend. File Copy A of the form with the IRS by January 31, too.

Can you run payroll for a contractor through software?

Paying your contractors through payroll software may save you time and simplify the process. You can pay contractors and employees in the same payroll instead of running two when you pay contractors using payroll software.

If you choose to pay contractors through payroll, look for a software program that allows you to process both employee and contractor payments in one payroll. And if your contractor would like to receive pay stubs, check to see if you can print contractor pay stubs, too.

This is not intended as legal advice; for more information, please click here.