When it comes to running payroll, you know there’s a whole process that goes into it. You need to determine your employees’ hours worked, do some calculations, and give out wages. And, you must give yourself ample time to ensure employees receive said wages on payday. So, how long does payroll take to process?

Read on for a payroll processing overview, processing times, and how to speed things up if your payroll takes too long.

What is payroll processing?

Payroll processing is the task of calculating an employee’s wages, withholding taxes and other deductions, and paying employees. Processing payroll, or running a payroll, is a responsibility all businesses with employees share.

To process payroll, you can:

- Do manual calculations

- Use software

- Outsource it

Doing manual calculations is the least expensive but most time-consuming option. Outsourcing payroll (e.g., using a professional employer organization) is the most expensive but least time-consuming option. Using payroll software is the happy medium between the two, as it streamlines payroll without breaking the bank.

Regardless of what method you use to process payroll, you need to understand processing times. So, how long does it take to process payroll?

How long does payroll take to process?

Before you run payroll, you probably want to get an idea of how much time you need to set aside for it. So, how long does payroll processing take?

To answer this question, we need to break down some of the payroll processing steps. Typically, payroll processing consists of:

- Collecting timesheets

- Running payroll

- Waiting for direct deposit to process (if applicable)

Now, let’s go over the possible time it could take you to complete each step in the payroll process.

1. Collecting timesheets

At the end of the pay period, you probably need to collect timesheets from employees before you can add hours to payroll and calculate wages. Timesheets tell you when and how many hours an employee worked. Your employees might use digital or paper timesheets.

So when the time comes to collect timesheets, you might get a lot of this: Waiting. Nudging employees. Physically compiling timesheets from your team.

The amount of time it takes collecting timesheets can take hours to days, depending on how efficient your team is at meeting deadlines and whether you’re using time and attendance software. And if you don’t have a system in place (aka deadlines, submission process, etc.), you’re probably looking at a longer wait time.

2. Running payroll

When you’re ready to run payroll, you need to calculate your employees’ gross wages, taxes, and net pay.

Gross wages are an employee’s total pay before you withhold taxes and other deductions. To calculate an employee’s gross pay, multiply their hours worked (using collected timesheets) by their hourly wage. For salaried employees, you can divide the employee’s annual salary by the number of pay periods in the year.

The next step of running payroll is calculating the employee’s taxes and withholding other deductions. Be sure to subtract any pre-tax deductions before breaking out your tax calculations. Then, calculate the taxes the employee owes (e.g., federal income tax, employee portion of FICA tax, and any state and local taxes). Also, calculate the taxes you owe (e.g., employer portion of FICA tax, FUTA and SUTA taxes, and any state and local taxes). After calculating taxes, remember to withhold post-tax deductions.

Last but not least, subtract taxes and deductions from the employee’s gross pay. This gives you the employee’s net pay (aka the amount they take home).

Whew. Add that all up, and running payroll might take you:

- Minutes

- Hours

- Days

Minutes? Days? What gives! Long story short, your payroll processing time depends on how you run payroll.

You’ll spend less time processing payroll if you use payroll software. If you opt to do calculations manually, expect to set aside more time in your day for payroll.

3. Waiting for direct deposit

Want to pay employees with the ever-popular direct deposit? Great! But, keep in mind that there are direct depositing processing times to account for, too.

Direct deposit processing times vary. Typically, direct deposit takes two or three days. Some direct deposit processing times can take as little as one day (or same-day processing), and others up to four days.

Your processing time depends on how you handle direct deposit (e.g., using software). Understand how long direct deposit takes to process before running payroll. Processing times determine how many days in advance you need to run payroll to make sure your employees receive their wages on payday.

The grand total

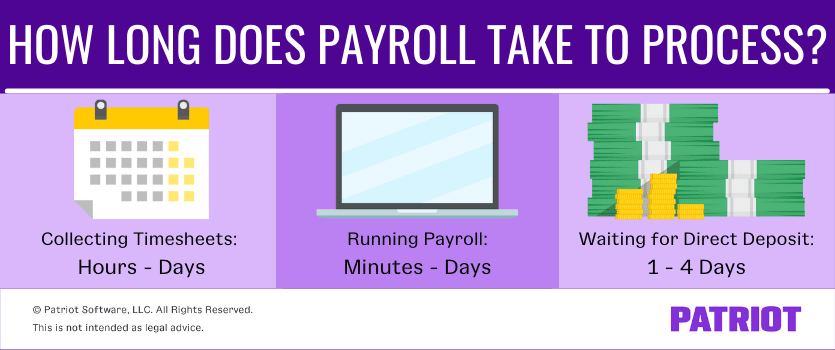

So, all in all, how long does it take for payroll to process? The grand total, complete with ranges, is:

- Collecting timesheets: Hours – days

- Running payroll: Minutes – days

- Waiting for direct deposit: 1 – 4 days

From start to finish, your payroll process could take up to a week. For example, you might collect timesheets on Friday, enter the hours on Monday, and pay employees on Friday.

3 Tips to speed up your payroll processing times

Don’t want to deal with slow processing times? We’ve got a few tricks up our sleeves to help you out, including the following three tips:

- Get into a groove

- Upgrade your payroll processing system

- Invest in time and attendance software

1. Get into a groove

Between the time it takes to collect timesheets to process direct deposit, waiting until the last minute to process payroll can land you in hot water. To avoid a disorganized process, get used to a routine. And by that, we mean to create a payroll calendar and schedule (and stick to it!).

The good thing about payroll is that it’s, for the most part, predictable. You can pay employees weekly, biweekly, semimonthly, or monthly. Once you decide on the pay frequency, you know how often to pay employees and when payday is.

And when you know when payday is, you can figure out what day to collect timesheets and run payroll.

For example, your schedule can look something like this:

- Collect timesheets on day ABC from employees

- Run payroll on day QRS

- Pay on day XYZ

2. Upgrade your payroll processing system

Manually doing calculations can slow down your payroll processing by hours or even days. If you want to streamline the process of running payroll, consider using software.

With payroll software, you simply enter your employees’ hours worked each pay period. The software then calculates their gross wages, taxes, and net wages. These instant calculations not only save you the time of manually doing them yourself, but it can also save you from taking more time to fix any miscalculations you could make.

3. Invest in time and attendance software

If you’re streamlining payroll, why not streamline time tracking, too? Time and attendance software is a fast and easy way for your employees to enter their hours worked.

To shave down some of the time it takes you to process payroll, shop around for a time and attendance system that integrates with payroll software. Once you approve your employees’ hours worked, the system sends the hours straight to payroll, eliminating manual data entry.

This is not intended as legal advice; for more information, please click here.