Do you know your Family and Medical Leave Act (FMLA) responsibilities? Now, throw in a holiday. Do you still know how FMLA and holidays work?

Here are some popular questions when it comes to FMLA and holidays:

- Do holidays count toward an employee’s FMLA eligibility?

- Does a holiday count as an employee’s days of FMLA leave?

- Do you have to give employees holiday pay if they’re on FMLA leave?

Read on to get the answers to these top questions about the Family and Medical Leave Act and a company holiday. But first, brush up on your FMLA and holiday pay knowledge. Don’t need the review? Feel free to skip ahead.

Have other payroll questions? Let us answer them.

Get the latest payroll news delivered straight to your inbox.

Subscribe to Email ListFMLA and holiday pay recap

Before we go over how FMLA and holidays work together, understand how they work separately.

What is FMLA?

The Family and Medical Leave Act requires certain employers to give qualifying employees unpaid, job-protected leave. Private employers with 50 or more employees, as well as all public agencies and schools, must provide FMLA to eligible employees.

Eligible employees are those who work for a covered employer for at least 12 months with at least 1,250 hours of service.

Employees can take up to 12 workweeks of leave in a 12-month period for:

- The birth, adoption, or foster care placement of a child

- The care of a spouse, child, or parent with a serious health condition

- A personal serious health condition that makes the employee unable to perform their job

- A situation related to the military deployment of a spouse, child, or parent

An employee can either take continuous or intermittent leave. Continuous leave allows the employee to take their available time at once. Intermittent leave lets qualifying employees take FMLA leave in smaller chunks of time for a single qualifying reason.

What is holiday pay?

Holiday pay is paid time off an employee receives on federal legal holidays. There is no federal law that requires employers to offer employees holiday pay. But, over three in four workers receive paid holidays.

If you choose to offer employees paid holidays, the employee receives their regular wages even though they are not working. Generally, you should create a policy detailing the holidays that apply and which employees are eligible.

Your questions about FMLA and holidays, answered

Recap? Check. Now, it’s time to talk about how holidays can impact an employee’s family and medical leave.

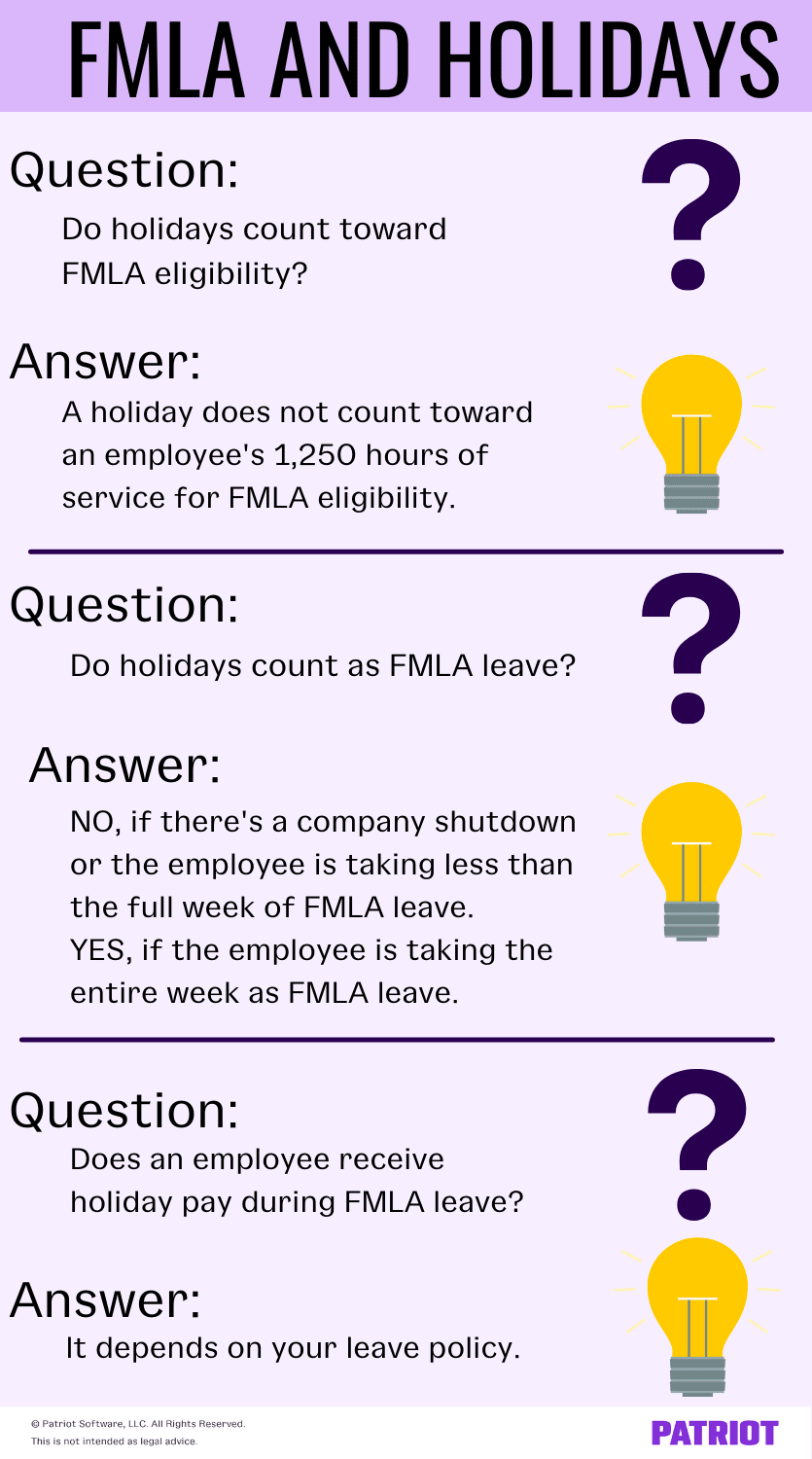

1. Do holidays count toward FMLA eligibility?

Again, an employee is only eligible for FMLA leave if they’ve worked 1,250 hours for an employer for 12 months. So if you offer employees paid (or unpaid) time off for holidays, you might be wondering if these hours count toward the 1,250 total.

Like any other day off from work, a holiday does not count toward an employee’s 1,250 hours of service for FMLA eligibility. Why? Because the employee is not working these days. According to the Department of Labor (DOL):

“The 1,250 hours include only those hours actually worked for the employer. Paid leave

and unpaid leave, including FMLA leave, are not included.”

What can you do to avoid confusion? Track, track, track. Tracking employee hours worked and not worked is key to accurately running payroll and calculating FMLA leave eligibility.

2. Do holidays count as FMLA leave?

Now, your employee is on FMLA leave. They get up to 12 weeks of unpaid leave for their qualifying reason (e.g., childbirth). A holiday your business recognizes with time off happens to fall during the employee’s FMLA leave. Does the employee “save” an FMLA leave day since they would get the holiday off anyway? Or, does the holiday count as FMLA leave?

Whether a holiday counts as FMLA leave or a holiday depends on:

- If there’s a company shutdown

- The employee’s FMLA leave use

Company shutdown

Do you close up shop due to a holiday for an extended period (e.g., one week)? If you have a holiday shutdown at your business lasting one or more weeks, you cannot count those days against the employee’s FMLA leave. This DOL rule also applies to other types of shutdowns (e.g., repairs).

Let’s say an employee is on FMLA leave. You close your business and give all employees off from December 24 – January 2. Because that employee wouldn’t have been scheduled for work, you cannot count this time period as FMLA leave.

FMLA leave use

There’s no company-wide shutdown. But, there is a holiday that falls during a week when an employee is using FMLA leave.

If the employee is taking the entire week as FMLA leave, count the entire week as FMLA leave. Do not count one of the days as a holiday.

If the employee is taking less than the full week of FMLA leave, do not count the holiday as FMLA leave. In this situation, only count the holiday as FMLA leave if the employee was scheduled and expected to work on the holiday and used leave.

You can learn more about whether holidays count as FMLA leave on the Department of Labor’s Fact Sheet #28I.

3. FMLA and holiday pay responsibilities

How does holiday pay while on FMLA work? Does an employee receive holiday pay during FMLA leave?

Because holiday pay is not a federal requirement, the answer to this question depends on one thing: Your policy.

To determine FMLA leave and holiday pay, take a look at your leave policy. Are employees entitled to holiday pay when they use other types of paid or unpaid leave? Your FMLA and holiday pay policy should be the same.

If you would provide holiday pay to employees using non-FMLA leave, the employee is entitled to holiday pay. If you would not provide holiday pay to employees using non-FMLA leave, the employee is not entitled to holiday pay.

For example, your policy for providing holiday pay might depend on whether the employee:

- Takes paid or unpaid leave before or after the holiday

- Was at work the day before or after the holiday

- Is substituting sick or vacation pay for their unpaid FMLA leave on the day before the holiday

Example

Let’s say you provide holiday pay if employees use paid vacation leave before or after a holiday. However, you do not provide holiday pay if employees use paid sick leave before or after a holiday.

The employee substitutes paid sick leave while on unpaid FMLA leave on the day before the holiday. You would not provide holiday pay under FMLA and holiday pay best practices.

Now, let’s say the employee substitutes paid vacation leave while on unpaid FMLA leave on the day before the holiday. You would provide holiday pay.

Want a payroll system that does it all so you don’t have to? When you add Patriot’s HR software and Time & Attendance software add-ons to our Full Service Payroll, you can manage documents online, handle timekeeping, and so much more. Try all three for free today!

This is not intended as legal advice; for more information, please click here.