Does this sound familiar? You ask an employee to run a few errands for the office. They end up with a $10.79 coffee shop bill, $56.99 at the office supply store, and $25.28 at a local pizza joint. Sure, you plan to repay them. But how much do you know about employee expense reimbursement?

Receipt submission, repayment, and taxes are all things to consider. With the proper expense report procedure, you can prevent confusion and align your team.

What is an employee expense reimbursement?

An employee expense reimbursement is money employers give to cover certain business-related costs. For example, an employee who runs business errands might request a mileage reimbursement to cover gas.

Federal law doesn’t require reimbursements (unless the expenses cause the employee’s pay to drop below minimum wage). But, paying employees back for business expenses is common in many companies. Not to mention, some states, including California and Iowa, require certain expense reimbursements.

Types of expense reimbursements include:

- Mileage

- Relocation assistance

- Supplies

- Uniforms

- Meals and entertainment

- Lodging

- Educational assistance

- Cell phone

Before you reimburse employees for business expenses, you need a policy detailing the process. You also must know whether or not to withhold taxes from the amount.

Reimbursement of expenses: Taxes

So, are reimbursements taxable? Often, reimbursements are not taxable—but it all depends on your plan type.

There are a few types of plans businesses can use for reimbursements:

- Accountable: Reimbursements aren’t taxable

- Nonaccountable: Reimbursements are taxable

- Per diem: Reimbursements up to a certain amount aren’t taxable

Taxable reimbursements are subject to income, FICA, and unemployment taxes.

Accountable plan

Reimbursements paid under an accountable plan are not subject to taxes. To be considered an accountable plan, the employee must:

- Have paid or incurred allowable expenses while performing services (and, it’s a payment for the expense and not an amount you would have otherwise paid to the employee as wages),

- Substantiate the amount, time, place, and purpose of the expense within a reasonable period (i.e., within 60 days after incurring it), AND

- Return any amount over the substantiated expense within a reasonable time (i.e., within 120 days after incurring it)

Under an accountable plan, you should reimburse employees within 30 days of when they incur the expense.

Say an employee spent $29.99 on a new business laptop charger. They provide you with a receipt within 60 days that details the amount, time, place, and purpose. You reimburse them $29.99, the exact price of the charger. This type of reimbursement falls under an accountable plan and is not subject to taxes.

Nonaccountable plan

Reimbursements paid under a nonaccountable plan are subject to taxes. You have a nonaccountable plan if:

- The employee doesn’t have to substantiate expenses within a reasonable time

- The employee isn’t required to return excess amounts within a certain amount of time

- You pay an amount regardless of whether you expect the employee to have a business expense

- You pay an amount you would otherwise pay as wages

Let’s say an employee requests reimbursement for gas but does not provide a receipt. You pay a lump sum of $50, which may be greater than their business expense. This type of reimbursement falls under a nonaccountable plan and is subject to taxes.

Per diem

Per diem is a fixed allowance that covers travel-related expenses (e.g., lodging, meals, and incidentals).

There is an established per diem rate. Reimbursements below this rate aren’t taxable. However, you must still report these nontaxable payments in box 12 of Form W-2 using code “L.” Check out the U.S. General Services Administration website for the current per diem rates.

Any amount that exceeds the per diem rates is subject to taxes.

Creating an employee reimbursement policy

Create an expense reimbursement policy so employees know what expenses are reimbursable. Your policy should also detail the process for submitting expense reimbursement requests. And let employees know when and how they can expect their reimbursement.

Here are some questions your reimbursement policy should answer:

- Who’s eligible?

- What are covered work expenses?

- Are there reimbursement limits?

- How do employees submit reimbursement requests?

- What type of information do employees need to substantiate? (e.g., amount, time, place, purpose)

- How do employees receive reimbursements? (e.g., in the next payroll?)

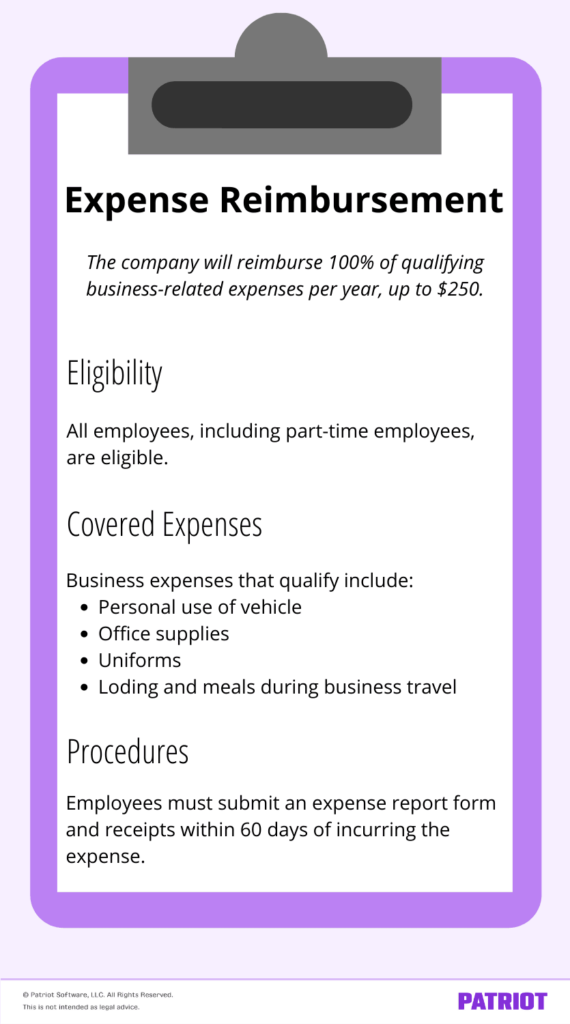

SHRM, the Society for Human Resource Management, provides a sample expense reimbursement policy. Their example includes four sections: purpose/objective, eligibility, covered expenses, and procedures.

Example

Here’s an example of an employee expense reimbursement policy:

Process for paying reimbursement expenses

Handling reimbursement claims, payouts, and records can quickly become a full-time job if you don’t have a process.

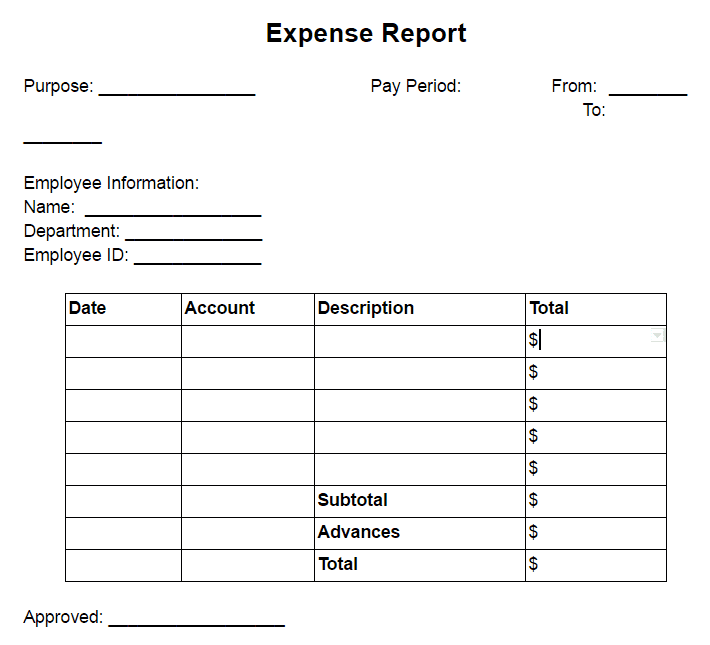

Expense report

An expense report is a form employees use to track their purchases. Employees can complete the expense report and turn it in with their receipts.

Typically, expense reports ask for information like the purchase date, amount, and purpose of the product or service.

How should your expense report look? Take a look at the following expense report template:

Reimbursement request submission

Decide how employees should submit their expense reports and supporting documents, such as business receipts and invoices.

Set clear guidelines surrounding:

- Deadlines for submitting reimbursement requests

- What types of supporting documents you accept

- How employees can submit receipts to you (e.g., via email or an online portal)

Reimbursement approval

Decide who will approve (or deny) reimbursement requests. Will it be you or an HR professional?

Your reasons for approving or denying a claim should align with what’s in your policy. For example, you might deny a claim if the employee does not provide their original receipt.

Also, decide what happens if you deny a request (e.g., if you’ll let employees resubmit their reimbursement claim).

Paying out the reimbursement

How will you pay employees back? And, how soon will you give employees their reimbursement?

Often, employers combine reimbursement payments with the employee’s regular earnings in payroll. That means you can pay an expense reimbursement on the same check or direct deposit with the employee’s taxable earnings. To simplify this process, consider using online payroll.

Recordkeeping

Paying out the reimbursement doesn’t mean you can throw away the expense report and receipts.

Store records securely so you can substantiate your business claims (like small business tax returns). You can use HR software to manage paperless files for employees. And, some accounting software lets you securely upload files and receipts to attach to the transactions in your books.

Are you looking for a better way to pay out reimbursements? Try Patriot’s payroll software and run payroll using our easy three-step process. Sign up today and enjoy a free trial!

This is not intended as legal advice; for more information, please click here.