Sometimes, an employee takes on different roles in a business. Has this happened in your workplace? If so, you might be wondering, Can you pay an employee two different hourly rates?

Read on to get the answer to this popular question. And, find out what you need to know about employees with multiple jobs at your business.

Can you pay an employee two different hourly rates?

Long story short: Yes, you can pay an employee different rates of pay. But, what are some situations where it would make sense to provide two (or even more) separate hourly rates?

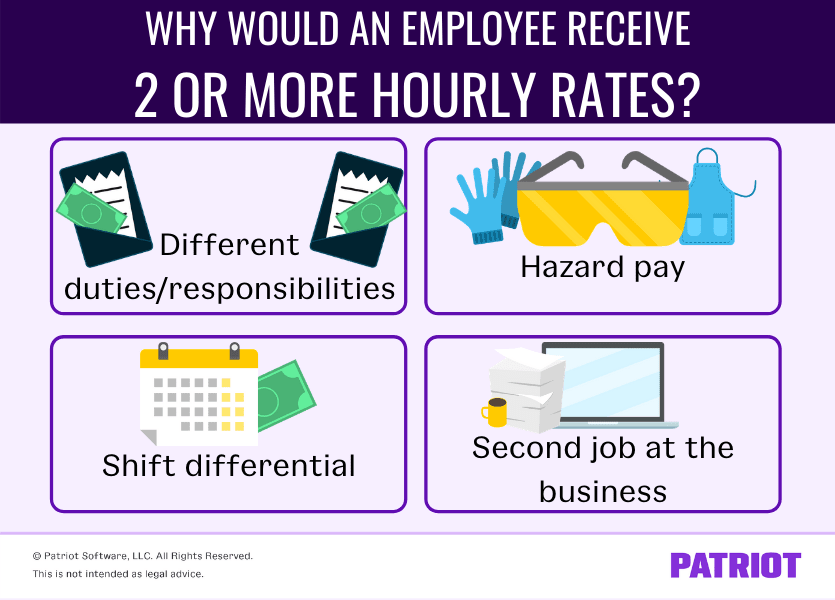

You might pay an employee two or more hourly rates if they:

- Have different duties/responsibilities

- Get hazard pay

- Receive a shift differential

- Take on a second job at your business

Take a look at why these scenarios might require an employee to receive different hourly rates.

Different duties/responsibilities

Do you have a job rotation program in the workplace? Or, does an employee work in different roles within your business during a regular work week? If so, you might pay them two or more pay rates, depending on the work they do.

For example, you might have a restaurant employee who works as a host, waiter, and dishwasher. You pay the employee the tipped minimum wage during their hours as a waiter, a separate wage when they work as host, and a third wage when they wash dishes.

Hazard pay

Does your employee work some hours under hazardous conditions? If so, you may decide you want to offer them hazard pay for those hours. Hazard pay is additional compensation you offer employees. It can be a percentage of wages (e.g., 10%) or a flat rate (e.g., extra $2.00 per hour).

An employee who spends some hours in hazardous conditions and some hours in non-hazardous working conditions receives two different rates: one with hazard pay and one without.

Let’s say an employee works in a construction zone two days per week and in the office three days per week. You offer them hazard pay for the hours worked in the construction zone and non-hazard pay for the hours worked in the office.

Keep in mind that some employers decide to offer a set hazard pay per month (e.g., $200) regardless of which hours the employee works in hazardous conditions. In this situation, the employee receives the same hourly rate, plus a lump sum hazard pay “bonus.”

Shift differential

A shift differential is extra pay for employees who work less desirable shifts (e.g., night or weekend shifts). Like hazard pay, shift differentials can also be a percentage of wages or a flat rate.

You might pay employees a shift differential for certain hours worked and a non-shift differential rate for other hours worked.

Let’s say an employee works the night shift three days per week and the day shift two days per week. Your shift differential rate is an extra $3.00 per hour. The employee’s hourly wage for the day shift is $3.00 less than their hourly pay for night shift hours worked.

Second job

If an employee decides to apply for a second job at your business, you’ll probably pay them a different wage than the wage you pay them for their current position.

Let’s say an employee works for you full time as a salesperson. They decide to apply for an additional part-time job (e.g., evenings or weekends) as a receptionist. You pay a different hourly rate for salespeople than you do receptionists. So, voila! The employee has separate rates.

Questions to ask about employee pay for multiple jobs

Before you decide to pay an employee two or more rates, think about the potential complications. Michael Alexis, CEO of TeamBuilding, says:

One consideration you need to keep in mind of multiple pay rates is that it can create complexities in other compensation factors. For example, how you calculate overtime pay (which will vary from state to state), and what rate your employees are paid for PTO, sick time, parental leave and other benefits and perks. Each of these considerations includes legal compliance as well as policy administration. So, you need to put in the work!”

Ask yourself the following questions to stay compliant and organized.

1. Are both rates above the minimum wage?

First and foremost, you need to make sure both rates are compliant with federal, state, or local minimum wage requirements.

Here are the federal minimum wages:

- Federal minimum wage: $7.25 per hour

- Federal tipped minimum wage: $2.13 per hour

Check to see if your state or locality has a higher minimum wage and tipped minimum wage than the federal rate. You must pay the federal, state, or local minimum wage that is the most generous. The same goes for the tipped minimum wage.

2. Does it make the employee exempt or nonexempt?

Knowing whether an employee is exempt vs. nonexempt is key to correct worker classification. A nonexempt employee is protected under the Fair Labor Standards Act (FLSA), meaning they must receive overtime and minimum wage.

An employee is nonexempt unless they meet all three of the following requirements:

- Receives a salary

- Earns at least $35,568 annually or $684 per week

- Has job duties that are considered exempt (e.g., executive, administrative, or professional)

If an employee receives two different hourly rates, you have your answer: They’re nonexempt. An exempt employee must receive a salary as one of the three requirements.

But, it’s possible for a salaried employee to take on a second job at one business. Here’s the situation you may face:

- Job 1: Salaried

- Job 2: Hourly

What then? Is the employee exempt in one and nonexempt in the other? Under the FLSA, an employee who works for one business can only be one or the other (i.e., exempt or nonexempt).

In this scenario, determine whether the employee’s “primary duty” is exempt or nonexempt. If the primary duty is exempt, the employee is exempt in both jobs. If the primary duty is nonexempt, the employee is nonexempt for both jobs, making them eligible for overtime pay.

3. How will it impact overtime?

If a nonexempt employee earning two different rates works overtime, you need to provide overtime pay. But, which rate do you calculate overtime based on?

When paying an employee two or more different hourly rates, you need to calculate the employee’s weighted overtime.

Under the weighted overtime calculation, find the employee’s hourly weighted average. You can then use their hourly weighted average to determine their hourly overtime rate and wages.

Do you have to use the weighted overtime method? In many cases, you need to. But if you and the employee establish an agreement before they work overtime, you may be able to pay overtime based on the regular rate of the position in which the employee worked overtime.

4. Do I need a policy?

If you want to pay an employee two different hourly rates, you need to evaluate the reasons for the pay difference. You want everything to be fair, after all.

According to Nathan Murphy, Co-founder and Owner of QuizBreaker:

Before paying an employee two or more hourly rates, consider the legal implications of a move like this. Make sure your different hourly rates fall into line with whatever the pay standard is. Considering your employees will likely have different responsibilities for each hourly rate, every type of work has to be evaluated to make sure you’re treating your workers fairly and paying them high enough with each rate.”

Put your evaluation method into writing through a policy. Create a policy that covers the specifics, such as:

- Whether employees are eligible for different pay rates

- How shift differentials work

- How hazard pay works

- Whether employees can take on a second job at your business

- How overtime works for employees with more than one hourly rate

In addition to a policy that goes over general information, you should also give employees detailed documents showing their different pay rates. That way, the employee knows what rate they receive for performing their work.

5. How do I run payroll for employees with multiple rates?

Manually keeping track of hours an employee works can be especially difficult when they receive two or more different rates. Keep detailed records that show how many hours the employee works in each job, their pay rate, and any overtime hours they work.

Use payroll software if you want to avoid manual calculations. Simply enter the hours the employee works for each rate, check your numbers, and run payroll.

Patriot’s payroll makes it easy to manage an employee with multiple pay rates. You can add up to five pay rates for each hourly employee. And, you can say goodbye to calculating that pesky weighted overtime on your own—our software has you covered. Try it for free today!

This is not intended as legal advice; for more information, please click here.