The Department of Labor (DOL) enforces more than 180 federal laws. These laws can vary depending on your business and employees. And, some states might have additional labor laws that business owners must follow.

One state that has some unique regulations is California. Read on to learn about California labor laws and how they impact your business.

Common labor laws

Chances are, you have likely heard of some labor laws before. Common labor laws pertain to things like:

- Wages

- Hours

- Workers’ compensation

- Workplace health and safety

The primary goal of labor laws is to protect employees’ rights and set employer obligations and responsibilities. Not following labor laws can result in penalties, criminal charges, or business closure. If you are an employer, make sure you are aware of the labor laws you must follow.

The payroll info you need, right at your fingertips.

Get the latest payroll news delivered straight to your inbox.

Subscribe to Email ListCalifornia labor laws

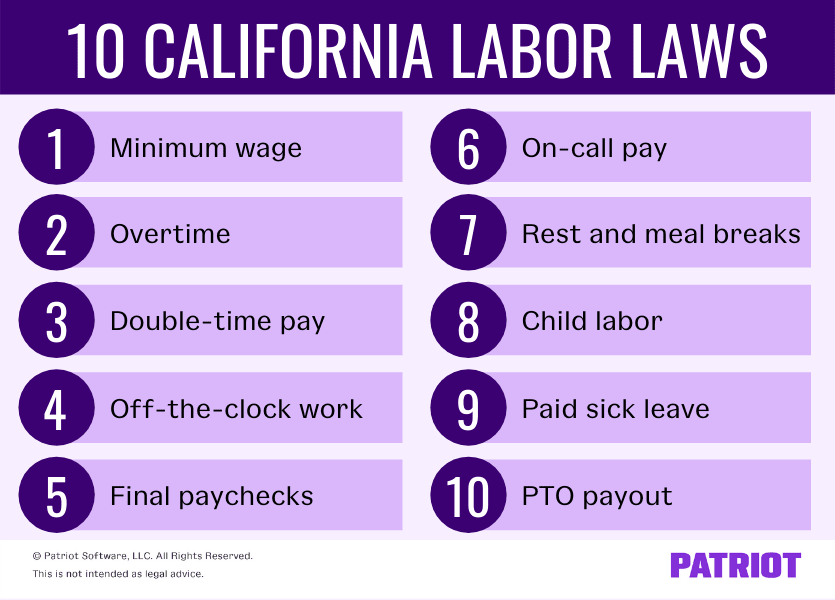

If you’re a California employer, you need to brush up on state labor laws to remain compliant. Take a look at the different labor laws in California below.

1. Minimum wage

Minimum wage is the lowest amount you can pay an employee per hour of work. You cannot pay employees less than the California minimum wage.

California follows a state minimum wage law. The state minimum wage for California is $16.00 for 2024, regardless of how many employees you have. California also has a Fast Food Minimum Wage. Beginning April 1, 2024, all fast food restaurant employees covered under California’s law must receive $20.00 per hour.

Depending on where your business location is, you might have different local minimum wage rates. You must pay employees the local minimum wage if it is higher than the state minimum wage.

Take a look at the California cities impacted by local minimum wage rates below:

- Alameda

- Belmont

- Berkeley

- Burlingame

- Cupertino

- Daly City

- East Palo Alto

- El Cerrito

- Emeryville

- Fremont

- Half Moon Bay

- Hayward

- Los Altos

- Los Angeles

- Los Angeles County

- Malibu

- Menlo Park

- Milpitas

- Mountain View

- Novato

- Oakland

- Palo Alto

- Pasadena

- Petaluma

- Redwood City

- Richmond

- San Carlos

- San Diego

- San Francisco

- San Jose

- San Leandro

- San Mateo

- Santa Clara

- Santa Monica

- Santa Rosa

- Sonoma

- South San Francisco

- Sunnyvale

2. Overtime

Overtime pay is when you pay eligible employees extra compensation for working additional hours.

The California overtime law states that a nonexempt employee is entitled to overtime if:

- They work beyond 8 hours in a workday (up to 12 hours)

- They work more than 40 hours in a week

Nonexempt employees must also receive overtime pay for the first eight hours of work on the seventh consecutive day of work in a workweek.

Like federal overtime laws, overtime pay in California is 1.5 times the employee’s regular pay. If your employee is eligible for overtime, you must pay them one and a half times their hourly rate for each overtime hour.

Say your employee makes $20.00 per hour. Their overtime rate is $30.00 per hour. They worked six hours of overtime during the week. You would need to pay the employee an additional $180.00 in overtime pay ($30.00 x 6 hours).

3. Double-time pay

Employees in California might be able to earn double-time pay, too. A nonexempt employee can receive double-time pay if:

- They work more than 12 hours in any workday

Employees in California can also earn double-time pay for all hours worked more than eight on the seventh consecutive day of work in a workweek.

An employee making $16.00 per hour would earn $32.00 per double-time hour.

4. Off-the-clock work

Under California law, an employer cannot force an employee to work off-the-clock. You must compensate an employee for any hours worked.

5. Final paychecks

In California, if you terminate an employee, you must pay them their final wages on that same day.

If an employee resigns but does not provide more than 72 hours notice, you have 72 hours to issue a final paycheck.

6. On-call pay

On-call time is when an employee must be available in case their employer needs them to work. On-call employees might need to wait around the business or near it.

In February 2019, the case Ward v. Tilly’s Inc. changed how employers must pay employees for on-call time.

California on-call requirements include employees calling to find out whether or not they have to work, even if they aren’t required to work. As of early 2019, “reporting to work” in California includes employees who must report over the phone.

Employees who physically report for work, as well as employees who report over the phone, must receive California on-call pay.

To comply with California on-call laws, you can:

- Schedule employee shifts in advance so they know whether or not they need to work

- Compensate employees who are not working, but had to call in

7. Rest and meal breaks

California employers must provide nonexempt employees with a paid 10-minute rest period for every four hours worked. Rest periods must be given to the employee as close to the middle of the workday as possible.

If a nonexempt employee works more than five hours in a workday, California employers must provide at least a 30-minute meal period. Nonexempt employees who work more than 12 hours in a workday must receive a second meal period of at least 30 minutes. And, employees must receive a paid 10-minute rest period for every four hours worked.

Thanks to Ferra v. Loews Hollywood Hotel, LLC, the California Supreme Court determined that an employee’s “regular rate of compensation” is the same thing as “regular rate of pay” for purposes of calculating meal and rest break premiums. So, what does this mean for California employers? Employers must pay premiums for noncompliant meal, rest, and recovery periods at the “regular rate of pay” rather than the employee’s base hourly rate.

The ruling impacts California employers who have nonexempt employees who receive incentive pay, such as nondiscretionary bonuses, commissions, piece rate pay, or shift differential pay. Because of the ruling, employers should:

- Revisit (and potentially update) meal and rest premium rates

- Check regular rate calculations

- Maintain strict break policies

8. Child labor

California child labor laws restrict the types of jobs minors can have.

California labor laws for minors forbid individuals under 16 from working hazardous jobs and positions involving machines, scaffolding, tobacco, railroads, and acids.

California also restricts the times that minors can work. These times can affect the work times for 12-17 year-olds.

When school is not in session (e.g., holidays or summer vacation), 12 or 13-year-olds may work eight hours per day, but no more than 40 per week. And, they can only work between the hours of 7:00 a.m. to 7:00 p.m. From June 1 through Labor Day, they can work until 9 p.m. You cannot employ 12 or 13-year-olds while school is in session.

An individual 14 or 15 years old can only work a maximum of three hours on a school day outside of school hours. And, these minors can only work a maximum of 18 hours per school week. They can work up to eight hours on non-school days (e.g., weekends, holidays, and vacations). Minors ages 14-15 can work between 7:00 a.m. to 7:00 p.m. during the school year. From June 1 through Labor Day, they can work until 9 p.m.

Minors who are 16-17 can work up to eight hours on non-school days. On school days, they can work up to four hours. Generally, they can work between 5 a.m. to 10 p.m. If the evening comes before a non-school day, they can work until 12:30 a.m.

In most cases, a minor in California will need to provide a work permit to work.

9. Paid sick leave

Paid sick leave laws vary from state to state. California paid sick leave was established in 2015.

All employers must provide paid sick leave to employees who work for them for at least 30 days. Air carrier companies and employers with collective bargaining agreements with employees do not have to offer sick leave to employees.

California employees can use paid sick leave for preventative care or diagnosis, care or treatment of a health condition, or for time after being a victim of domestic violence, sexual assault, or stalking. Employees can also use paid sick leave to take care of a family member with one of these issues. Employers must also provide eligible employees up to five days of unpaid bereavement leave within three months of a family member’s death.

Employees earn one hour of paid sick leave for every 30 hours of work they complete. Employers can set a maximum accrual limit of 80 hours per year and a usage limit of 40 hours (or five days) per year.

Under California law, employers must allow employees to carry over their accrued sick time from year to year. If an employee carries over paid sick leave, the employer can limit the total accrued paid sick leave to 80 hours or 10 days, whichever is more.

10. PTO payout

If employees have paid time off (PTO), the number of days they receive usually accrues over time. Accrued time off is time an employee has earned but has not used yet. Some states regulate PTO accruals. California is one of these states.

In California, employers cannot implement a use-it-or-lose-it policy. This means employers can’t force employees to use their PTO by a certain date. Employers can, however, place a cap on accruals.

California law requires employers to pay terminated employees for accrued vacation time in their final paychecks.

Test your California labor laws knowledge

Think you know everything about California labor laws? Test your knowledge below by matching the laws to their description.

| Laws | Description |

|---|---|

| A. Minimum wage | 1. Provides PTO to employees for certain health situations |

| B. Overtime | 2. Requires employers to pay employees on the same-day or 72 hours after termination |

| C. Double-time pay | 3. Restricts minors from working certain jobs or hours |

| D. Off-the-clock work | 4. Provides two times the employee’s regular rate |

| E. Final paychecks | 5. Gives employees break time depending on hours worked |

| F. On-call pay | 6. Requires employers to pay employees $16.00 per hour ($20.00 for applicable fast food restaurant employees) |

| G. Rest and meal breaks | 7. Compensates employees for reporting over the phone for work |

| H. Child labor | 8. Requires employers to pay employees for accrued vacation time |

| I. Paid sick leave | 9. Provides employees one and a half times their regular rate |

| J. PTO payout | 10. Compensates employees for any hours worked |

Answers: A.6, B.9, C.4, D.10, E.2, F.7, G.5, H.3, I.1, J.8

Want to make sure you’re compliant with labor laws? Patriot’s payroll software tracks overtime and employee wages for you. And, our time and attendance add-on will make paid sick leave and PTO payout a breeze. Get started with your free trial today!

This article has been updated from its original publication date of September 9, 2019.

This is not intended as legal advice; for more information, please click here.