Want to claim 401(k) tax credits worth up to $16,500? Ready to attract and retain employees with a better benefits package that lets them save for retirement? If so, you might be interested in starting a 401(k). But to do that, you need to know how to set up a 401(k) in your small business.

Benefits of starting a 401(k)

A 401(k) plan is an employer-sponsored retirement option that lets employees contribute pre-tax dollars (aside from a Roth plan) to their accounts. As a result, the contribution reduces an employee’s tax liability and lets them save for retirement. But what about the business benefits of setting up a 401(k)?

Setting up a 401(k) for small business can help you:

- Attract and retain employees: 68% of private industry workers have access to employer-provided retirement plans. Providing a 401(k) plan can help you stay competitive as an employer.

- Expand your employer benefits, tax-free: Employer matching and nonelective contributions to retirement plans are not subject to Social Security and Medicare taxes.

- Claim tax deductions: Eligible small businesses who start a new 401(k) plan and/or add an automatic enrollment feature to any 401(k) plan can lower their tax liability through 401(k) tax credits.

- Stay compliant in your state: For some employers, offering a retirement plan isn’t a choice. Your state may require that you offer employees a retirement plan, like a 401(k).

One of the reasons small businesses hesitate on starting a 401(k) is the time and cost commitment. Recognizing this, Congress passed the SECURE (Setting Every Community Up for Retirement Enhancement) Act in 2019. The act incentivizes small employers to begin offering 401(k)s with expanded tax credits.

How to set up a 401(k)

Some employer responsibilities come with setting up a 401(k) plan for a small business. You might be met with some fees for establishing the plan.

Establishment fees typically range from $1,500 – $3,000 but could be more or less depending on the business. Some companies might be able to get the fee waived, but this is typically reserved for large businesses. And remember, thanks to the SECURE Act, you can deduct qualifying setup costs.

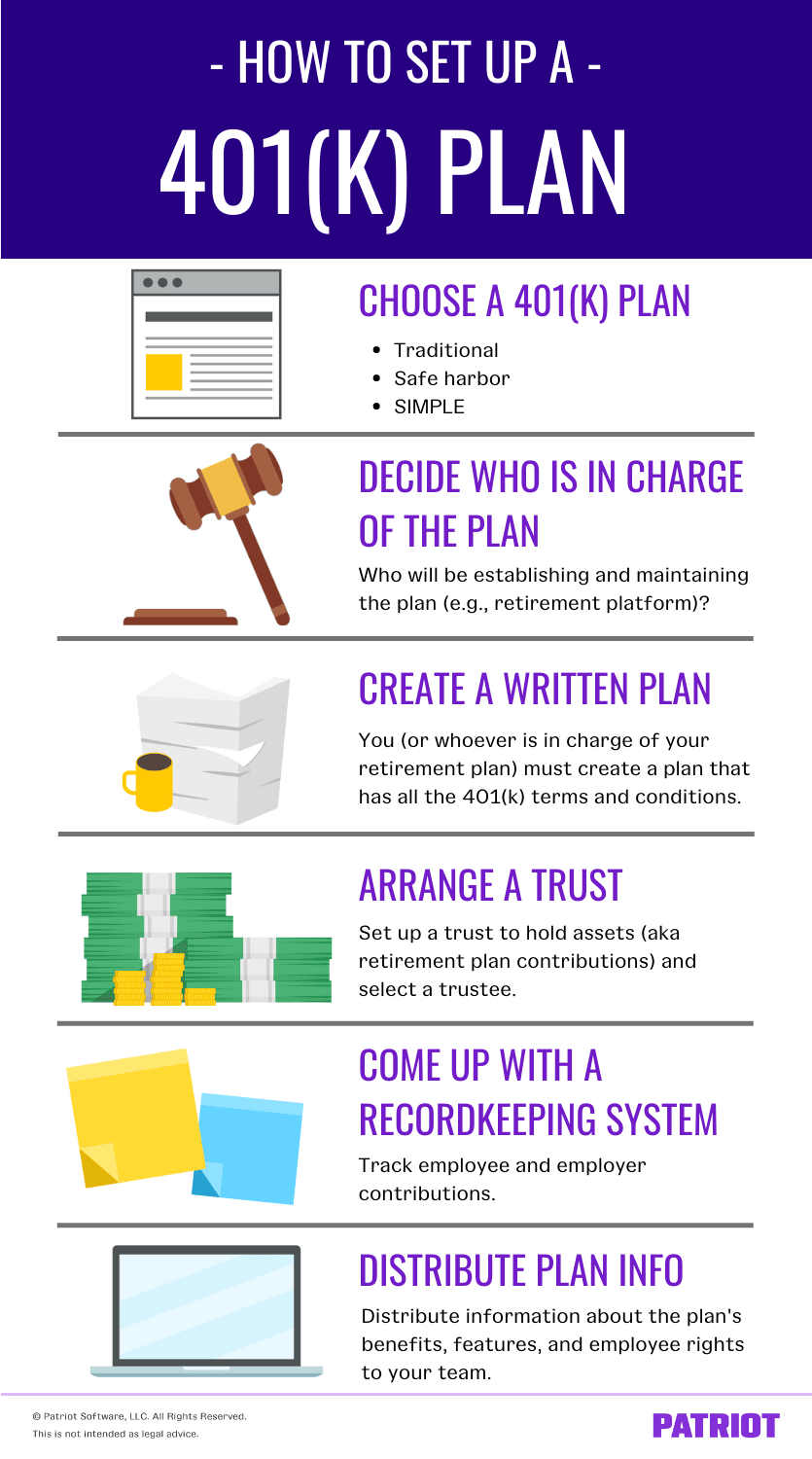

To set up a 401(k) plan, follow these steps:

1. Choose a 401(k) plan

So, you’ve decided on establishing a 401(k) plan. Great! But, there are different types of plans to choose from.

Consider which type of 401(k) plan to offer employees:

- Traditional 401(k)

- Safe harbor 401(k)

- SIMPLE 401(k)

You can also offer a Roth 401(k), which is like a traditional 401(k) plan. However, funds contributed to a Roth 401(k) are on a post-tax basis, meaning you take taxes out of the employee’s wages before taking out their retirement contributions.

Your employer responsibilities vary depending on the plan you choose. You have the same core 401(k) setup responsibilities regardless of which plan you establish at your business.

2. Decide who is establishing and maintaining the plan

Have your heart set on a 401(k) plan? If so, your next step is to decide who will establish and maintain said plan. Sure, setting up the plan and maintaining it yourself could be more cost-efficient, but it is also more time-consuming and error-prone.

To save time and help prevent 401(k)-related mistakes, turn to a professional or financial institution (bank, mutual fund provider, or insurance company).

Pro tip: Can’t decide which type of 401(k) plan is best for your business? Consult potential retirement program administrators for advice.

| Looking to start a new 401(k) plan? It just got easier. Patriot has partnered with Vestwell, a retirement platform trusted by small businesses across all 50 states, to offer payroll with seamless 401(k) integration. You can sign up here to get started or learn more. |

3. Create a written plan

Unless you hire a professional or financial institution to establish and maintain the 401(k), you must create a written plan document. If a professional or financial institution is handling the plan for you, they’ll write the written plan.

The written plan needs to have all the terms and conditions of your 401(k) plan. It’s a legally binding document, so you might want to turn to a professional for help.

Your document needs to list information such as:

- What type of 401(k) plan you’re offering

- What features you want the plan to have (i.e., employee eligibility and contribution amounts)

- The process of contributing funds

- The process of distributing funds to employees

4. Arrange a trust for the plan’s assets

One requirement for starting a 401(k) plan on your own is that you set up a trust to hold assets (aka retirement plan contributions). This guarantees that only the participants and their beneficiaries can use the funds.

When arranging the trust, you need to select a trustee. Deciding on a trustee is an important part of establishing a plan, as they must handle contributions, plan investments, and distributions.

5. Come up with a recordkeeping system

How will you track employee and employer contributions? Come up with a way to track all plan-related info, including:

- Employee and employer contributions

- Earnings and losses

- Plan investments

- Expenses

- Distributions

If you use a professional or financial institution to handle your business’s 401(k), they’ll handle recordkeeping on your behalf. (Bonus points if your retirement platform integrates seamlessly with your payroll software!)

Your recordkeeping system is important for preparing annual reports, which the government requires.

6. Distribute plan information to eligible employees

To get employees to participate in your business’s 401(k) plan, you need to let them know about the plan. Disclose information like the plan’s benefits, features, and employee rights.

Prepare a summary plan description (SPD) to distribute to qualifying employees in the 401(k) plan. This lets eligible employees know what to expect out of the plan.

The SPD should have information on:

- Employee eligibility

- Plan benefits (e.g., pre-tax contributions)

- Contributions

- When employer contributions vest

- Distributions

- Claims

- Employee rights and responsibilities

Maintaining your business’s 401(k) plan

Figuring out how to start a 401(k) for a small business is just the beginning. Keep in mind that there are some recurring employer responsibilities after starting a 401(k) for a small business.

Depending on the type of 401(k) you selected, you’ll need to conduct nondiscrimination testing, make employer contributions, report plan information, and keep up with fees.

Testing

If you have a traditional 401(k) plan, it is subject to annual 401(k) testing to ensure all employees benefit, not just highly compensated employees.

There are two types of tests you need to conduct: Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests. These tests compare salary deferrals of highly compensated employees to non-highly compensated employees.

Contributions

You must make employer contributions if you have a safe harbor or SIMPLE 401(k) plan. Keep in mind that there can be penalties for late 401(k) contributions.

Report

For most 401(k) plans, you need to file Form 5500, Annual Return/Report of Employee Benefit Plan (Form 5500-SF or Form 5500-EZ if applicable). File this annual return electronically.

Distribute reports to participants, as well. Give a summary of material modification (SMM) when employees make changes. And, distribute an individual benefit statement (IBS) to show plan participants their total benefits. Lastly, distribute a summary annual report (SAR) when you file Form 5500 so participants know what you reported to the IRS.

Fees

Keep in mind that the price you pay for a 401(k) plan doesn’t stop with setting it up.

There are three types of fees you might face while maintaining your 401(k) plan at your business:

- Plan administration fees

- Investment fees

- Individual service fees

This article has been updated from its original publication date of July 17, 2017.

This is not intended as legal advice; for more information, please click here.