Business expenses add up—fast. Fortunately, there are extensive tax deductions available for small business owners to offset the cost of running a business. Unfortunately, tax deductions can be complicated and confusing.

Use our small business tax deductions checklist to simplify tax time, check out common FAQs relating to deductions, and get tips.

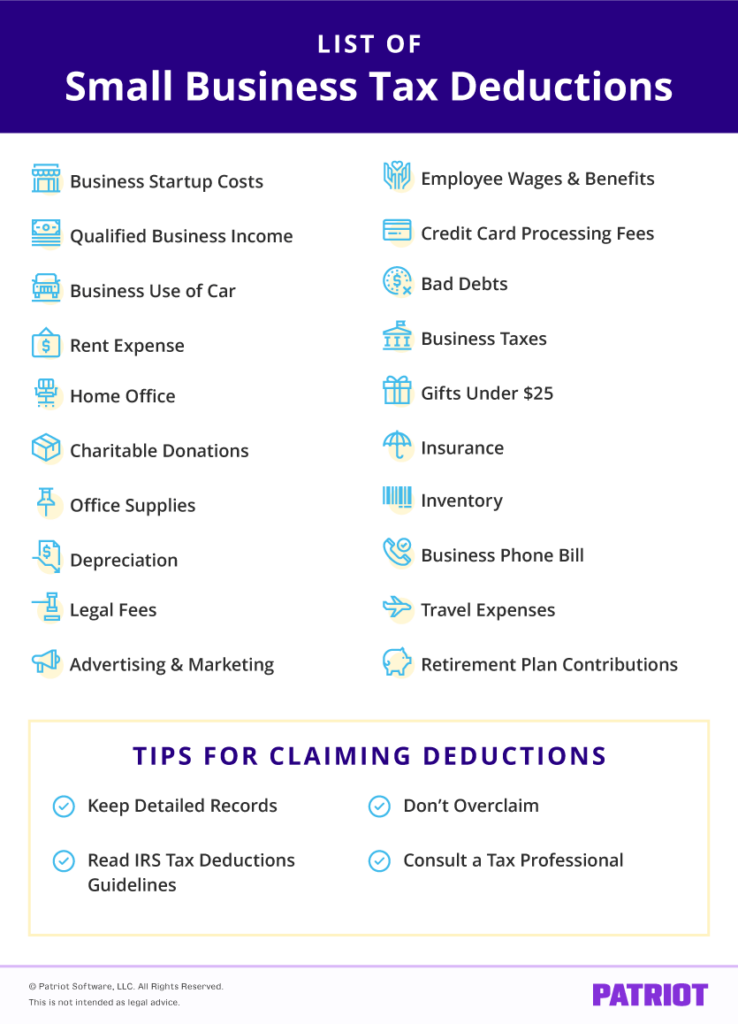

Small business tax deductions checklist

Tax deductions are complicated, but claiming legitimate business expense deductions is key to lowering your tax bill.

This business tax write-off checklist aims to provide beginner information on common types of deductions available. Keep in mind that this is not an all-inclusive list.

1. Business startup costs deduction

Just getting started? There’s a deduction for you! Business owners can deduct up to $5,000 of business startup costs.

2. Qualified business income deduction

Many small businesses—including sole proprietors, partners, and S Corp owners—can deduct up to 20% of their qualified business income (QBI).

This 20% deduction is known as the Qualified Business Income deduction. Keep in mind that there are annual income limits.

3. Business use of car tax deduction

You can claim a tax deduction for the business use of your vehicle. You can only deduct the amount relating to your business expenses. Do not claim a business use of vehicle tax deduction on personal use, such as commuting home from work.

There are two ways you can claim a business vehicle tax deduction:

- Standard mileage rate: If you qualify for and decide to use the standard mileage rate, multiply your business miles driven by the IRS mileage rate, which is set annually.

- Actual expenses: You must keep detailed receipts relating to your actual vehicle costs, such as gas, oil, maintenance and repairs, depreciation or lease payments, insurance, and registration fees.

4. Office space tax deductions

You may be able to claim a tax deduction for the cost of your office space, including both home office and rent expenses.

Rent expense tax deduction: You can deduct your rental payments as a business expense if you have a brick-and-mortar and meet IRS qualifications.

Home office tax deduction: If you work from home, you can claim the home office tax deduction on the portion of your home you use for business purposes. To qualify, you must use the space regularly and exclusively for business, and the space must be your principal place of business.

There are two methods you can use for the home office tax deduction:

- Simplified method: Multiply the square feet of your home office space by the standard deduction rate, up to the IRS limit.

- Actual expense method: Calculate the actual expenses of your home office, including mortgage or rent payments, mortgage interest, real estate taxes, insurance, utilities, repairs, and depreciation.

5. Charitable donations

Donations to qualifying charities may qualify for a tax deduction. Charitable donations can include cash, clothing, property, and vehicles.

Only claim charitable tax deductions on donations you give to qualifying nonprofit organizations. There are also IRS limits on how much you can deduct.

Sole proprietors, partnerships, and LLC owners can only claim charitable contributions on personal income tax returns.

6. Office supplies

You can fully deduct the cost of office supplies like paper, pens, and paper clips. Office supplies can also include computers and business software (e.g., payroll software).

7. Depreciation

Depreciation is a business income tax deduction that lets you spread the cost of an asset over a fixed number of years.

A depreciation tax deduction comes into play when you buy high-cost assets like an office building, machinery, office furniture, and business vehicles.

8. Legal fees

Need to hire a lawyer? You may be able to deduct the fees you pay for their legal services.

Business legal fees must be ordinary and necessary. For example, you may consult a lawyer to help with tax planning, structuring your business, and drafting legal documents.

9. Advertising and marketing

Do you market your business through advertising and marketing campaigns? Examples include digital and print ads. These advertising and marketing costs may be tax deductible.

Advertising and marketing expenses are tax deductible if they are ordinary and necessary to your business. For more information, consult the IRS.

10. Employee wages and benefits

If you have employees, you may be able to claim the cost of their wages and benefits, including:

- Salaries

- Commissions

- Bonuses

- Paid time off

11. Other business expenses

You can deduct other expenses that are ordinary and necessary to run your business. These costs include:

- Credit card processing fees

- Bad debts

- Business taxes

- Gifts to employees and customers under $25

- Insurance

- Inventory

- Business phone bill

- Travel expenses

- Retirement plan contributions

How much can a small business write off on taxes?

The amount you can deduct from your taxes depends on the tax deductions you qualify for. Remember that each deduction has different rules, such as limits.

For example:

- You can deduct up to $5,000 of business startup costs and up to $5,000 of organizational costs paid or incurred.

- The maximum home office tax deduction under the simplified option is $1,500.

- You can deduct up to 20% of your qualified business income for the QBI tax deduction.

Pay attention to each tax deduction’s rules and limits.

What business supplies can you write off on your taxes?

Business supplies that qualify for a tax deduction may include:

- Paper, pens, paper clips, staples, etc.

- Postage

- Books

- Computers

- Business software

- Cleaning products

The IRS lets you deduct the cost of materials and supplies in the tax year you use them. You can also deduct the cost of incidental materials and supplies that you keep on hand in the tax year you purchase them if:

- You do not maintain records indicating when you use them

- You do not take inventory of the amount of supplies on hand at the beginning and end of the year, AND

- The method doesn’t distort income

Keep in mind that supplies used directly or indirectly in manufacturing goods are part of the cost of goods sold. For more information, check out this IRS Fact Sheet on Deducting Business Supply Expenses.

Can I write off my car payment?

Business owners and those who are self-employed can deduct car expenses. You can write off the portion of your car that you use for business purposes.

You can deduct your car’s cost of ownership and operation using the standard mileage rate or the actual expense method.

The standard mileage rate is a flat rate per business mile driven. The actual expense method requires you to calculate and deduct your actual costs for:

- Depreciation (or lease payments)

- Gas

- Oil

- Repairs

- Tires

- Insurance

- Registration fees

- Licenses

Keep in mind that the vehicle tax deduction is no longer available for employees who use their cars for work due to the Tax Cuts and Jobs Act of 2017.

For more information on writing off your business car expenses, consult IRS Topic no. 510, Business use of car.

Are utilities tax deductible for a business?

Utilities—including electricity, gas, trash removal, and cleaning services—can be tax deductible.

You can deduct your brick-and-mortar business’s utility bills. If you use part of your home for business, you can deduct the business part of your expenses for utilities and services. According to the IRS, the business percentage for utilities is typically the same as the percentage of your home that you use for business.

What deduction can I claim without receipts?

Individuals can claim the standard deduction without any receipts. Are there any deductions business owners can claim without receipts?

According to the IRS, you should have records (such as receipts, canceled checks, or bills) to prove your expenses.

However, there are some deductions you may be able to claim without a receipt. For example, the standard mileage rate doesn’t require receipts for expenses like gas and repairs like the actual vehicle expense method.

At the end of the day, always keep records. You should be able to back up all of your claims in case of an IRS audit.

Are business expenses a 100% write-off?

Not exactly.

You can claim a 100% deduction on certain business expenses if you meet the requirements. Examples of 100% deductible expenses include office equipment expenses and gifts to clients and employees that are less than $25 per person (per year).

However, there are IRS limits on how much you can deduct for certain expenses. And, you cannot claim a 100% deduction on all expenses related to your business. For example, you can’t claim a 100% write-off for your home office or for a car that doubles as a business and personal ride.

What is not a business expense for deduction?

Several expenses you incur in business may not qualify for a tax deduction, including:

- Personal expenses

- Fines and penalties

- Lobbying expenses

- Political contributions

- Illegal activity, such as bribes and kickbacks

For more information on what does and does not qualify as a business expense, check out the IRS Guide to Business Expense Resources.

Pro Tip: Divide personal and business expenses by opening a separate business bank account.

Tips for claiming tax deductions

The key to claiming tax deductions is keeping detailed records, knowing how much you’re entitled to, following IRS guidelines, and consulting a tax professional.

1. Keep detailed records

The IRS requires businesses to keep good records. You’ll need to reference your records when it’s time to file your business taxes and claim deductions and credits. You can use accounting software to keep track of everything in one place.

Records include your income statement, receipts, bank and credit card statements, and payroll records.

2. Don’t overclaim

Claiming too many deductions is the most common self-employed audit red flag. Every business deduction you claim must be legitimate and meet the IRS qualifications.

Only claim expenses that are ordinary to your line of work and necessary to run your business. Do not claim 100% business purposes on your vehicle if you use it for personal purposes, too (e.g., commuting between your home and business). Do not claim deductions on charitable donations you make to non-qualifying nonprofits.

Understand IRS guidelines and keep detailed records to avoid the common IRS audit trigger of overclaiming deductions.

3. Read IRS tax deductions guidelines

The IRS is the ultimate authority on tax deductions and credits. Check out the IRS website for guidelines on credits and deductions for businesses.

Review IRS rules for each type of deduction. For example, the IRS lists standard mileage rates for each year, along with situations when you can deduct vehicle mileage.

4. Consult a tax professional

When in doubt, work with a tax professional like an accountant or business tax attorney. Tax professionals can help you prepare tax returns and maximize your tax deductions and credits.

This is not intended as legal advice; for more information, please click here.