Accounting, taxes, and financial planning are tricky tasks to navigate, plain and simple. Thankfully, there are tools, like accounting software, you can use to streamline your responsibilities. But at some point, you might decide to hire an accountant for their professional guidance.

Not sure if it’s time to hire an accountant for small business?

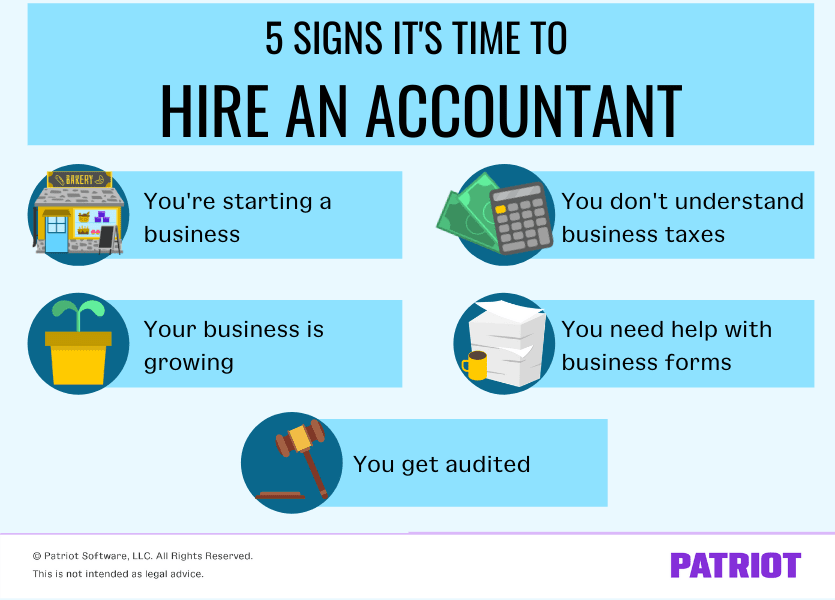

Signs you may need to hire an accountant

You might not need to hire a full-time business accountant, but you may need an accountant’s services periodically or per project.

You’re a business owner, not an accountant. Getting expert advice from an accounting professional can help you check up on your business’s financial health.

Look out for these signs that you need to hire an accountant.

1. You’re starting a business

When you first open a business, you have to make a number of decisions. The choices you make at this stage shape the future of your company.

Hiring an accountant for their expert advice could help you see your best financial options. Not to mention, a professional could help you stay compliant with federal, state, and local regulations.

If you’re not sure how to start a business and don’t want to do it alone, you might turn to a small business accountant to:

- Help you choose your business structure (e.g., sole proprietorship, LLC, etc.)

- Follow government regulations for your structure

- Sign up for new employer accounts

- Provide different financing options

- Walk you through the process of setting up tax accounts

- Get business licenses and permits

Whether you need to obtain financing or not, you should also establish a formal business plan at the start of your entrepreneurial journey. A business plan includes financial reports and projections. An accountant can help you create, understand, and present your business’s financial figures.

2. Your business is growing

Did your sales explode overnight? Steadily rise? Either way, an accountant can help as you grow. A bigger business means more profits—and more spending. But if you fly too close to the sun, you could be hurting your business’s future.

An accountant has the expertise to project how successful your investments will be so you can confidently spend your revenue—without overspending. They can caution you about harmful business purchases and suggest smart investments.

Accountants play a leading role in year-end tax planning for business owners and can help you prevent overspending or under-spending. Their reports could prevent you from making a regrettable investment.

And if you’re experiencing business growth, you might need to update your business plan. A business plan is an ever-changing document that should evolve as your business does. You might talk with an accountant about making key business plan updates.

3. You don’t understand business taxes

Taxes can be confusing, especially if you’re filing your first small business tax return. Make a mistake, and you could wind up with IRS penalties. Not to mention, you could miss out on opportunities to lower your tax bill through tax deductions and credits.

Not sure where to start with your tax return? An accountant can help you make sense of it by:

- Letting you know which tax return form you need to file for your business structure

- Notifying you of filing deadlines

- Finding tax credits and deductions

- Helping you understand your accounting records

You may want to hire an accountant for taxes when you’re just starting your business (or at any stage in business ownership) to help ensure you fill out the forms correctly.

4. You need help with forms

When you’re a business owner with employees, there are a number of forms you need to file with federal, state, or local tax agencies in addition to your business tax return. You must file tax forms (e.g., Form 941) showing how much you paid employees and withheld in taxes.

To help you with this responsibility, you could also sign up for full-service payroll software. Full-service payroll files federal, state, and local payroll taxes on your behalf.

Did you take out a Paycheck Protection Program loan? An accountant can help you navigate the intricacies of applying for loan forgiveness on Form 3508.

5. You get audited

An audit can be a nerve-racking ordeal for business owners. During an audit, the IRS analyzes and exposes your financial history to find discrepancies.

Accountants can review your records and make sure they are accurate. They can reconcile accounts, check for missing information, and run reports to help you avoid tripping IRS audit triggers and keep your books up-to-date, clear, and accurate.

No telltale sign? It might be time, anyway

Sometimes, you don’t need a blaring sign to tell you it’s time to hire an accountant. If at any time you feel unsure about things in your business or want an expert’s opinion, you might consider talking with an accounting professional.

An accountant can help you save time, catch problems early on, and make sense of crucial business information.

Ready to find an accountant for small business? First, you need to learn how to hire an accountant. You can:

- List out what you’re looking for in an accountant

- Look at directories for accounting companies

- Talk with accountants to learn about their expertise and pricing

You might reach out to accountants in your locality. Or, you can hire an accountant online, thanks to digital tools.

Software is a great tool for managing your books and working with a professional. Patriot’s accounting software makes it easy to keep your records up-to-date and pass them along to your accountant. We also offer free setup and USA-based support. Try it for free today!

This article has been updated from its original publication date of March 31, 2016.

This is not intended as legal advice; for more information, please click here.