From selling crafts online to driving for a rideshare app, it seems like everyone has a side hustle these days. To find out what’s behind the trend, our new survey of 1,000 Americans dug into the motivations of the modern gig worker.

The results show that the side hustle is the ultimate financial multi-tool. While many are using it as a smart way to get ahead of rising costs, a new generation is also using side hustles to turn their passions into paychecks. For a growing number of people, side hustles are the perfect way to add a little breathing room to their budget while also building something of their own.

In the wake of recent government shutdowns and waves of layoffs tied to automation and AI, side hustles are becoming more than a passion project; they are a financial lifeline. Across industries, workers are looking for ways to hedge against uncertainty, and the side hustle has emerged as a reliable form of income security. When paychecks pause or positions are cut, having a secondary source of income can mean the difference between stability and struggle. For many Americans, what was once seen as a hobby or creative outlet is now being recognized as an essential part of financial preparedness in an unpredictable job market.

Skip Ahead

- Key findings

- The side hustle is no longer just a side show

- A tale of two hustles: Necessity vs. passion

- The 50-hour work week is the new 40

- So, is the grind worth it? For most, the answer is a resounding yes

- From safety net to launchpad: The new path to entrepreneurship

- For Gen Z, the side hustle is a source of hope

- The inflation antidote: Hustling to beat rising costs

- For Americans, the side hustle is here to stay

- Summary

- Methodology

- Fair use

Key findings

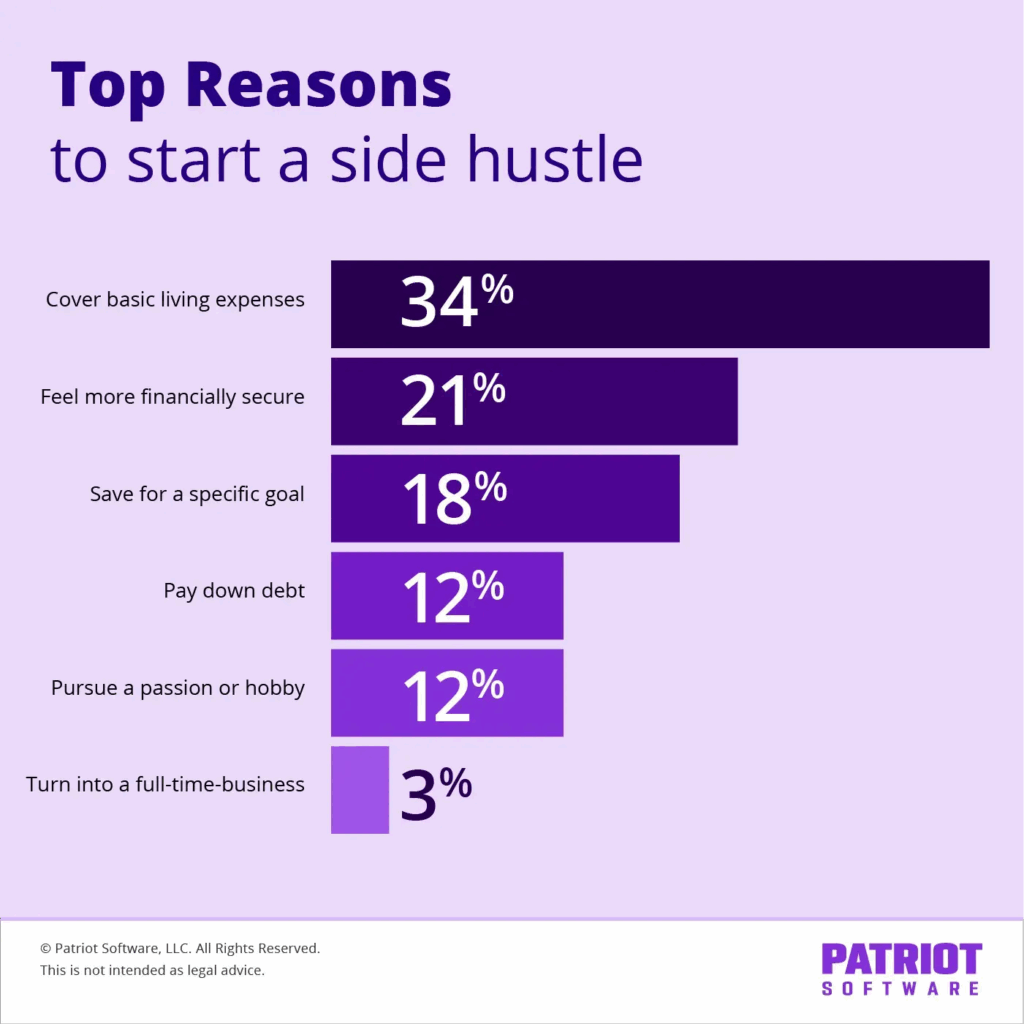

- 34% of side hustlers said the most important reason for starting a side hustle was to cover basic living expenses.

- 19% of Gen Z side hustlers said the most important reason for starting a side hustle was to pursue a passion or hobby.

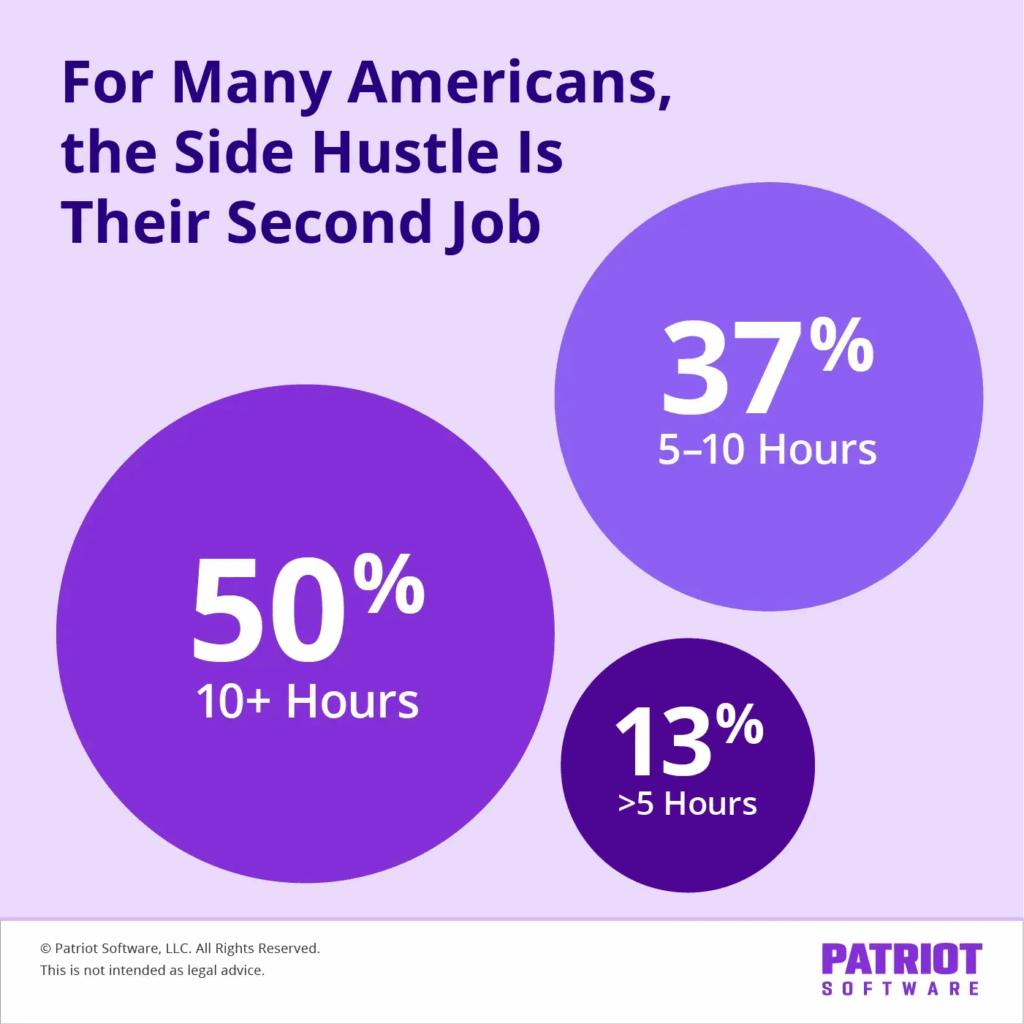

- 50% of full-time employed side hustlers said they spend over 10 hours a week on their side hustle.

- 80% of side hustlers feel more financially secure because of their side hustle.

- 24% of side hustlers are very confident that they could turn their side hustle into a successful full-time business.

- 51% of Gen Z side hustlers said having a side hustle makes them feel more hopeful.

- 60% of side hustlers said recent inflation or rising costs were major influences in their decision to start or keep their side hustle.

The side hustle is no longer just a side show

For many Americans, side hustles aren’t just about extra luxuries; they’re about survival.

- 34% of side hustlers said their top reason for starting was to cover basic living expenses.

- 16% of side hustlers said their extra income is essential, and they could not cover bills without it.

This signals a major shift in the gig economy. These statistics reflects the financial strain many households are under. As wages struggle to keep pace with inflation, basic costs like rent, groceries, childcare, and healthcare have outpaced income growth. For a growing share of workers, a single paycheck simply doesn’t stretch far enough.

Instead of being used to earn “fun money,” side hustles are now becoming an essential financial lifeline in order for people to afford basic needs like groceries, rent, and bills.

A tale of two hustles: Necessity vs. passion

For many Americans, the side hustle isn’t just a creative outlet; it’s a financial lifeline as the cost of living by state rises. Among Gen Z workers, 33% say they took on a side hustle to cover basic living expenses, while another 23% are saving toward specific goals or paying down debt.

But that doesn’t mean passion is off the table. Nearly one in five Gen Z side hustlers (19%) say they started their gig to pursue a hobby or creative interest, showing that even in a challenging economy, the drive to build something meaningful still runs strong.

Today’s side hustle generation is blending practicality with passion, using extra income to stay afloat, while keeping an eye on turning what they love into something bigger.

The 50-hour work week is the new 40

Whether it’s driven by passion or the pressure to pay bills, the commitment to these ventures is staggering. For those already juggling a full-time job, the side hustle is far from a casual hobby.

- 50% of full-time employees with a side gig report spending more than 10 hours every week on their second job.

This effectively adds a part-time job to their full-time responsibilities, pushing their total work week well over 50 hours. Most hustlers spend between 5 – 20 hours per week, with nearly 70% putting in what amounts to part-time job hours.

It underscores the intense dedication and sacrifice required to either stay afloat or get ahead in today’s demanding economy.

So, is the grind worth it? For most, the answer is a resounding yes

While the 50-hour work week has become a reality for many, the extra effort is delivering a crucial and tangible reward: peace of mind.

- 80% of side hustlers report feeling more financially secure because of their additional income stream.

Income levels vary widely: 38% earn $100–$499 per month, but nearly one in four side hustlers bring in $500–$1,999 monthly, showing that for many, side hustling is a meaningful income stream.

This powerful statistic shows that the hustle pays off. For most, that second gig isn’t just extra work; it’s a vital safety net that provides control and stability in a volatile economic landscape.

That security also creates the breathing room some workers need to start thinking bigger, laying the foundation for future opportunities like entrepreneurship. It’s clear that the security gained is seen as a worthy return on the investment of their time.

From safety net to launchpad: The new path to entrepreneurship

That feeling of financial security is powerful, and for a growing number, it’s not just a cushion, it’s a launchpad. Beyond providing immediate stability, the side hustle is breeding a new generation of entrepreneurs.

- 24% of side hustlers report they are very confident they could turn their side gig into a successful full-time business.

The side hustle has become the ultimate low-risk business incubator, allowing aspiring founders to test a concept, build a customer base, and prove their viability before taking the leap, transforming today’s extra work into tomorrow’s main event.

For Gen Z, the side hustle is a source of hope

And while that entrepreneurial dream serves as a launchpad for many, for the youngest generation in the workforce, it represents something even more fundamental.

The data reveals that the side hustle is a powerful antidote to economic anxiety for Gen Z.

- 51% of Gen Z side hustlers said their gig actively makes them feel more hopeful about their future.

In an era often defined by uncertainty, the side hustle provides this generation with a tangible sense of agency and control. For some, that hope extends into transforming creative hobbies into real ventures. While not every Gen Z hustler is looking to start a business, many are building skills and gaining experience that could translate into future startups.

The inflation antidote: Hustling to beat rising costs

While this hope for the future is a powerful motivator, a more immediate economic pressure is acting as a massive accelerant for the entire side hustle economy.

The data reveals a direct link between today’s cost of living and the drive to earn more.

- 60% of side hustlers cite recent inflation and rising costs as a major influence in their decision to start or maintain their gig.

This confirms that for the majority, the side hustle is a primary and necessary strategy to combat shrinking purchasing power. It has become the definitive financial adjustment for Americans working to keep pace in a challenging economy, turning extra hours into essential dollars.

For some, however, these survival-driven hustles can evolve into something more. What begins as a way to cover rising costs can grow into a small business opportunity once stability is restored.

For Americans, the side hustle is here to stay

Far from being a temporary trend, side hustles have become a permanent part of the American work culture.

- 55% of Americans currently have a side hustle.

- 20% say they’ve had one in the past.

- 25% say they’ve never had a side hustle.

This widespread participation shows that hustling isn’t just a response to today’s economic pressures; it’s an enduring strategy for financial stability and personal growth.

Side hustles aren’t going anywhere. They’ve evolved into a fixture of the modern economy, reflecting both necessity and ambition. Whether driven by survival, security, or the hope of building something bigger, side hustles are here to stay as a defining feature of how Americans earn and plan for their future.

Summary

The data from our survey of 1,000 Americans reveals that the modern side hustle is far more than a simple trend. It’s a dynamic and personal tool for navigating today’s economy. While the push of inflation has certainly encouraged many to get started, the pull of passion, the dream of entrepreneurship, and a powerful sense of hope are what keep the movement thriving.

Despite the long hours, the overwhelming feeling of financial security side hustling provides is a worthy payoff. Ultimately, whether it serves as a safety net, a creative outlet, or a launchpad for a full-time business, the side hustle has become a definitive way for Americans to take control and proactively build a more secure and fulfilling financial future

Methodology

To understand how Americans approach side hustles, we surveyed 1,000 adults across the country who either currently have a side hustle or have had one in the past. Participants answered a series of questions about their motivations, time commitments, financial reliance, and future goals related to side hustles. Responses were analyzed by demographic groups, including age and employment status, to identify trends and disparities in how side hustles function as both a financial safety net and a pathway to entrepreneurship.

Fair use

Users are welcome to utilize the insights and findings from this study for noncommercial purposes, such as academic research, educational presentations, and personal reference. When referencing or citing this article, please ensure proper attribution to maintain the integrity of the research. Direct linking to this article is permissible, and access to the original source of information is encouraged.

For commercial use or publication purposes, including but not limited to media outlets, websites, and promotional materials, please contact the authors for permission and licensing details. We appreciate your respect for intellectual property rights and adherence to ethical citation practices. Thank you for your interest in our research.

This is not intended as legal advice; for more information, please click here.