When you create a simple chart of accounts, you might assign a group of numbers to each account category. Assets might use the 100s, liabilities might use the 200s, and so on. There are specific accounts within each category. You will assign each account a more specific number within its category. For example, cash is an asset, so you might label the account as 110.

The government uses a similar process to categorize U.S. businesses. Like the codes in your chart of accounts, the government has assigned SIC codes to group businesses by industry.

So, what is a SIC code, and how can you use it to benefit your business?

What is a SIC code for a business?

The government created the Standard Industrial Classification codes (SIC codes) to identify U.S. businesses. The classification system uses four-digit coded numbers that categorize businesses by industry. Every business can be categorized with a SIC code.

SIC codes were created in 1937. In 1997, North American Industry Classification System (NAICS) codes were created to standardize industry classifications across the U.S., Canada, and Mexico. Despite the introduction and use of NAICS codes, SIC codes are still used in some circumstances.

What is a SIC code used for?

SIC codes are used by governments, lenders, and private businesses.

Federal and state governments might use the codes to track various industries. For example, the federal government might use the SIC codes to compare all manufacturing businesses in an economic study. More frequently, however, governments use NAICS codes for studies and statistics.

You might need your SIC code when applying for government contracts and loans. Some loans and projects might be limited to certain industries or business sizes within industries. Your company SIC code can help you and the government determine if you are eligible.

SIC codes are often used by the Securities and Exchange Commission (SEC). If your business were to ever become public, you would need to know your SIC code.

Lenders might ask for your SIC code when you apply for a loan. The lender might use the code to determine if you are in a high-risk industry.

If you sell products or services to other businesses, you might use SIC codes to identify potential customers. For example, you might want to target potential clients within a certain industry. You use other businesses’ SIC codes to determine if they are good fits to sell to.

When figuring out how to do a market analysis, you might consider using SIC codes. During a market analysis, you will compare your business to similar businesses. By using SIC codes, you can be sure you are actually comparing your business to businesses in the same industry.

Understanding SIC codes

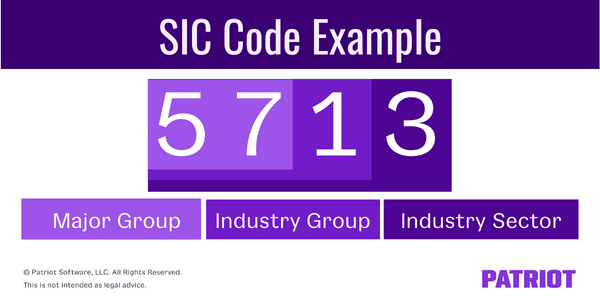

SIC codes have four digits. The first two digits classify the major group. The third digit further defines the industry group. The last digit indicates the industry sector.

You can find your SIC code on the OSHA website by using the SIC search or SIC manual.

SIC example

Let’s say you sell home floorings, such as tile, carpet, and hardwood. To find your SIC code, you’ll look under major group 57 because it includes retail stores that sell home goods, including flooring. Then, you’ll look under industry group 571 because it’s specific to home furniture and furnishings. You’ll then see that your business SIC code is 5713, which categorizes retail stores that sell floor coverings.

Major Group: 57 – Home Furniture, Furnishings, And Equipment Stores

Industry Group: 571 – Home Furniture And Furnishings Stores

Industry Sector: 5713 – Floor Covering Stores

Primary and secondary SIC codes

All businesses have a primary SIC code. This is the main code that categorizes the core industry of the business.

Businesses can also have up to five secondary SIC codes. Secondary SIC codes classify other industries the business is involved in but aren’t the main focus. The secondary industries might overlap with your main industry or they might be unrelated.

Let’s say you own a local grocery store that also has a few gas pumps. Your core business is the grocery store, so your SIC code is 5411. Because you offer filling stations, your secondary SIC code would be 5541.

SIC codes vs. NAICS codes

SIC codes and NAICS codes have a similar purpose, but they are often used differently.

NAICS classifications are more specific than SIC classifications. With NAICS classifications, you can be more specific about a business’s industry.

The U.S. government stopped updating SIC codes in 1987. Some private data companies continue to update the SIC codes to make them even more specific than NAICS codes; however, you should be careful with these updated codes. They are not recognized by the government and may vary between data companies. For government-related purposes, you should only use the government-created list.

SIC codes are commonly used by private businesses to target and market to potential business clients. If you use a private data company to help find potential clients, the company will likely use its updated codes to narrow down the results to better suited potential clients.

For government contracting and statistical purposes, NAICS codes are used more often.

Are you stressed about administrative tasks getting in the way of productivity? Try Patriot Software’s online accounting software. It’s a cost-efficient way to free up potential hours of your time. The software is designed for small business owners, so you don’t have to be an accountant to use it. Sign up for your free trial.

This article is updated from its original publication date of February 27, 2015.

This is not intended as legal advice; for more information, please click here.