Use this article to help you learn about Form 3508. Forms 3508EZ and 3508S are simplified documents, so not all of these steps apply. For more information on the difference between the forms, check out our article, “Form 3508, 3508EZ, or 3508S: Which Version Should You Use for PPP Forgiveness?“

Want to know how much of your PPP loan is eligible for forgiveness? Thanks to the SBA’s release of the Loan Forgiveness Application, you can do the PPP forgiveness calculation for your loan amount.

Whether you’re ready to submit a PPP loan forgiveness application today or just want to get a ballpark figure, read on to learn the process of using Form 3508, and see an example.

Background on the PPP

By now, you’re probably well-versed in the PPP (Paycheck Protection Program). But if you aren’t, here’s a quick refresher.

The PPP was established by the CARES Act, and extended and expanded through a number of laws. It provides forgivable loans to small business owners to help keep employees on payroll.

The loans are fully forgivable if borrowers:

- Use the loan for qualifying payroll and non-payroll expenses during the covered period:

- 60% of the loan for payroll costs (salaries, wages, commissions, tips, bonuses, or hazard pay; benefits; state and local taxes)

- 40% for eligible non-payroll costs (interest on mortgages, rent, utilities, operations expenditures, property damage, supplier costs, and worker protection expenditures)

- Maintain full-time equivalent (FTE) employee levels, rehire employees furloughed or laid off by the end of the covered period, or prove you were unable to due to rehiring rejections or health guidance compliance (*applies to borrowers who took out loans of more than $50,000)

- Do not reduce salaries or hourly wages by more than 25% of the employee’s earnings, or you can bring wages back up by the end of the covered period (*applies to borrowers who took out loans of more than $50,000)

Failing to follow these rules reduces the forgivable portion of your PPP loan. But by how much? Use the PPP forgiveness calculation to find out.

SBA application form for loan forgiveness

Again, this overview is for borrowers who must use Form 3508 for PPP loan forgiveness.

Form 3508 is broken down into the following sections:

- PPP Loan Forgiveness Calculation Form

- Signature page

- PPP Schedule A

- PPP Schedule A Worksheet

- PPP Borrower Demographic Information Form (Optional)

- Instructions for Borrowers

- Forgiveness Amount Calculation

When it comes to PPP forgiveness calculation, you need the PPP Schedule A Worksheet, PPP Schedule A, and PPP Loan Forgiveness Calculation Form (in that order). All of these are in the Loan Forgiveness Application form packet. Borrowers must use all three forms to calculate their loan forgiveness amount.

In short, it’s a lot to take in. That’s why we’re going to go through the calculation process bit by bit.

PPP forgiveness calculation

There are 15 total lines in the SBA’s forgiveness amount calculation, broken up into four main sections. Again, you’ll pull some of the information from PPP Schedule A:

- Calculate payroll and non-payroll costs

- Line 1: Payroll costs

- Line 2: Mortgage interest payments

- Line 3: Rent or lease payments

- Line 4: Utility payments

- Line 5: Covered Operations Expenditures

- Line 6: Covered Property Damage Costs

- Line 7: Covered Supplier Costs

- Line 8: Covered Worker Protection Expenditures

- Make adjustments for full-time equivalency* (FTE) and salary/hourly wage reductions

- Line 9: Total salary/hourly wage reduction

- Line 10: Add the amounts on lines 1-8, then subtract the amount entered on line 9

- Line 11: FTE reduction quotient (Average number of FTEs during the covered period / Average FTEs during the reference period)

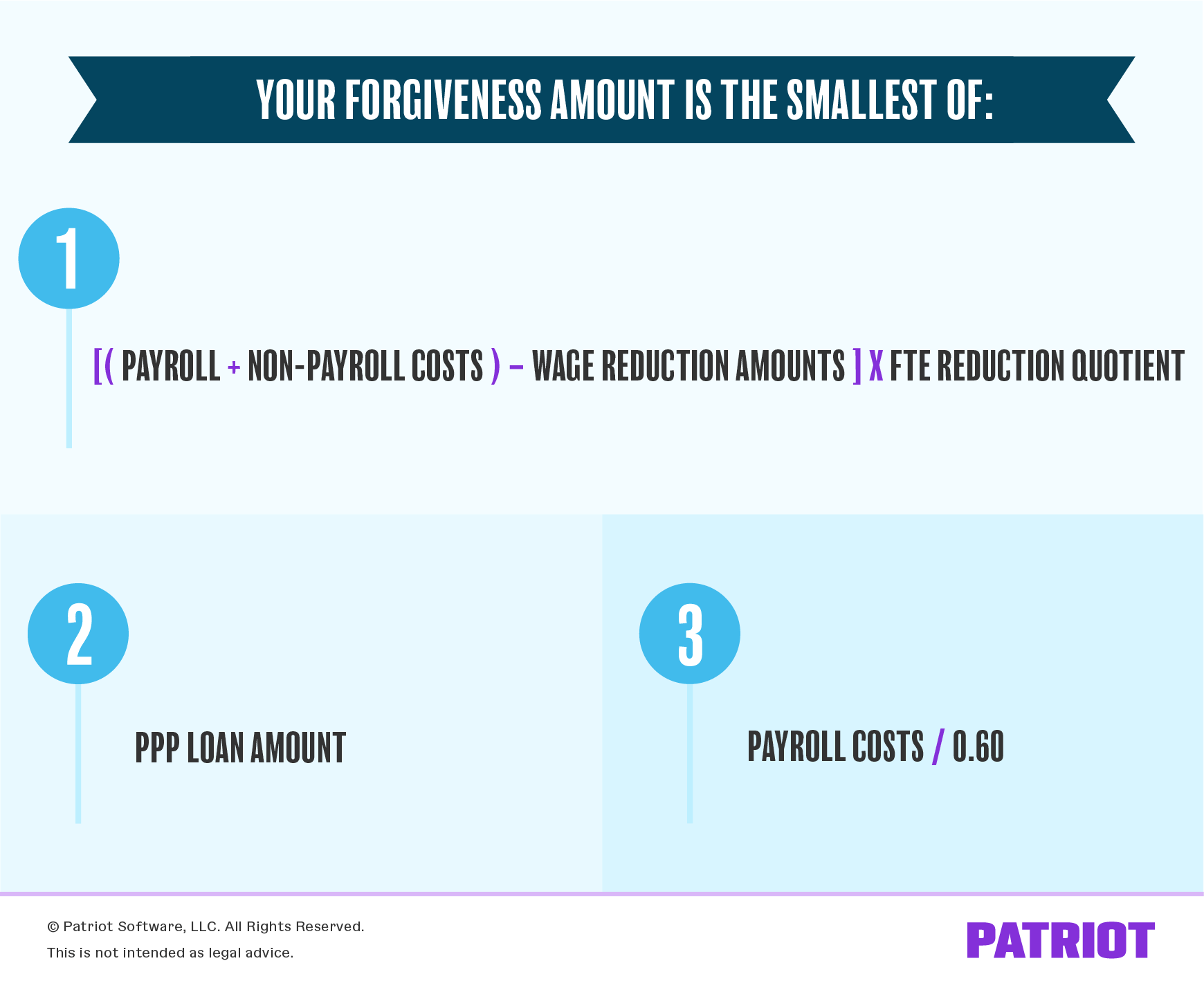

- Calculate potential forgiveness amounts

- Line 12: Modified total (line 10 X line 11)

- Line 13: PPP loan amount

- Line 14: Payroll cost 60% requirement (divide line 1 by 0.60)

- Arrive at the forgiveness amount

- Line 15: Forgiveness amount (The smallest of lines 12, 13, and 14)

*To calculate your FTE, you can use one of the following methods:

- Enter the average number of hours each employee worked per week, divide by 40, and round to the nearest tenth (maximum, 1.0).

- Assign a 1.0 for employees who work 40 hours or more per week and 0.5 for employees who work fewer hours

Let’s talk more about how you’ll arrive at the forgiveness amount by taking a closer look at Lines 1 – 11.

1. Payroll and non-payroll costs

First, calculate your total payroll and eligible non-payroll business costs. Don’t do anything with the 60% payroll / 40% non-payroll requirement yet—that comes later.

Line 1: To calculate your payroll costs, add together the following expenses you had during the covered period:

- The total cash compensation you paid your employees during the covered period

- Employee insurance contributions (employer)

- Employee retirement plan contributions (employer)

- State and local taxes assessed on employee compensation

- Total amount paid to owner-employees/self-employed individuals/general partners

Line 2: Enter the amount of mortgage interest payments you made during the covered period. Only include payments on mortgage interest incurred before February 15, 2020.

Line 3: Enter the amount of rent or lease payments you made during the covered period if you entered into the lease agreement before February 15, 2020.

Line 4: Enter the amount of utility payments you made during the covered period if the service began before February 15, 2020.

Line 5: Enter covered operations expenditures you made during the covered period.

Line 6: Enter any covered property damage costs you had during the covered period.

Line 7: Enter covered supplier costs you had during the covered period (e.g., essential items for operation).

Line 8: Enter covered worker protection expenditures you paid during the covered period (e.g., personal protective equipment).

Keep in mind that you don’t have to report any non-eligible payroll or non-payroll costs you used the loan for. But, you won’t receive loan forgiveness on this portion.

2. Adjustments for full-time equivalency and salary/hourly wage reductions

Next, you must adjust your PPP forgivable amount by any salary/hourly wage and FTE reductions you had during the covered period. To see if you have reductions, compare wage and FTE levels to the reference period you used when applying for the loan.

Line 9: If you have any salary or hourly wage reductions over 25%, enter the amounts here (e.g., $5,000). If you didn’t cut wages, enter $0.00 here.

Line 10: Add your payroll and non-payroll costs from lines 1 – 8, then subtract the wage reduction amount from line 9 (if applicable).

Line 11: If you reduced your FTE employees and don’t qualify for the safe harbor, divide your total average FTEs during the covered period by your average FTEs during the reference period. Enter the quotient (e.g., 0.8) here. If you haven’t reduced your FTEs, enter 1.0 on this line.

3. Potential forgiveness amounts (60% payroll requirement)

Almost there. The three lines of the potential forgiveness amounts section tell you what your loan forgiveness amount should be.

Line 12: To calculate this line, multiply line 10 by line 11. This shows you the total of your payroll and non-payroll costs, minus your wage reduction amounts, then multiplied by your FTE reduction quotient.

Line 13: Simply enter the PPP loan amount you received from your lender.

Line 14: Take your total payroll costs (line 1) and divide it by 0.60. This will determine if you used 60% of your loan for payroll costs like the Treasury and SBA require.

4. Forgiveness amount

Ta-da! You’ve arrived at the final step of the PPP forgiveness calculation. The only thing you need to do is reference the potential forgiveness amounts section.

Line 15: Enter the smallest amount from lines 12, 13, or 14. This is your forgiveness amount.

Example

Let’s say you received a PPP loan worth $200,000. Your average FTEs during the reference period (aka, what you entered on your borrower application) were 15. Your average FTEs during the covered period were 12. You are not eligible for the FTE safe harbor. You didn’t cut any of your remaining employees’ wages.

Here’s a rough breakdown of what you used the PPP loan for:

- $150,000 compensation

- $20,000 health insurance contributions

- $10,000 state and local taxes assessed on wages

- $10,000 rent

- $2,000 utilities

Quick calculation

First, add together your payroll and non-payroll costs:

- $180,000 (gross compensation + health insurance contributions + state and local taxes assessed) + $0.00 (mortgage interest) + $10,000 (rent) + $2,000 (utilities) = $192,000

Next, subtract your wage reduction amounts. Because you didn’t reduce wages, your wage reduction amount is $0.00:

- $192,000 – $0.00 = $192,000

Multiply that number ($192,000) by your FTE reduction quotient. But before you can do that, you need to find your FTE reduction quotient.

So, let’s find the FTE reduction quotient. Divide your FTEs during the covered period (12) by your FTEs during the reference period (15):

- 12 (FTEs during covered period) / 15 (FTEs during reference period) = 0.8

Now you can multiply the total of your payroll and non-payroll costs minus wage reduction amounts by the FTE reduction quotient:

- $192,000 X 0.8 = $153,600

Finally, you must select the smallest amount between the following three options:

- [(Payroll + Non-payroll Costs) – Wage Reduction Amounts] X FTE Reduction Quotient = $153,600

- PPP Loan Amount = $200,000

- Payroll Cost 60% Requirement = $300,000 ($180,000 / 0.60)

The smallest amount is $153,600. Out of your $200,000 PPP loan, $153,600 is forgivable.

Line-by-line calculation

Line 1: Payroll costs | $180,000

Line 2: Mortgage interest payments | $0.00

Line 3: Rent or lease payments | $10,000

Line 4: Utility payments | $2,000

Line 5: Covered operations expenditures | $0.00

Line 6: Covered property damage costs | $0.00

Line 7: Covered supplier costs | $0.00

Line 8: Covered worker protection expenditures | $0.00

Line 9: Salary/Hourly wage reduction | $0.00

Line 10: Total of lines 1-8, minus line 9 | $192,000

($192,000 – $0.00)

Line 11: FTE reduction quotient | 0.8

12 / 15

Line 12: Modified total, multiplying line 10 by 11 | $153,600

$192,000 X 0.8

Line 13: PPP loan amount | $200,000

Line 14: Payroll cost 60% requirement, dividing line 1 by 0.60 | $300,000

$180,000 / 0.60

Line 15: Pick the smallest number from lines 12, 13, and 14 | $153,600

Again, $153,600 out of your $200,000 PPP loan is forgivable.

This article has been updated from its original publication date of June 18, 2020.

This is not intended as legal advice; for more information, please click here.