When it comes to your business, keeping up with your finances is a must. And to know where you stand financially, understand how to calculate certain figures, like current assets. Get the scoop on how to calculate current assets for your business and how to use them to evaluate your company’s finances.

What are current assets?

Before you can dive into how to find current assets, you need to learn what current assets are. Here’s a brief rundown.

Current assets are items of value your business plans to use or convert to cash within one year and are considered short-term investments. Businesses sell, consume, and utilize these assets during their day-to-day business operations. A few examples of current assets include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Prepaid expenses

- Short-term investments

- Marketable securities (e.g., stocks)

Some of your current assets may be considered liquid. Liquid assets are assets that you can quickly turn into cash, like stocks.

Current assets help keep your business operating smoothly. You can use them to pay daily operational expenses and other short-term financial obligations. Not to mention, finding current assets can help you get insight into your business’s cash flow and liquidity.

How to calculate current assets

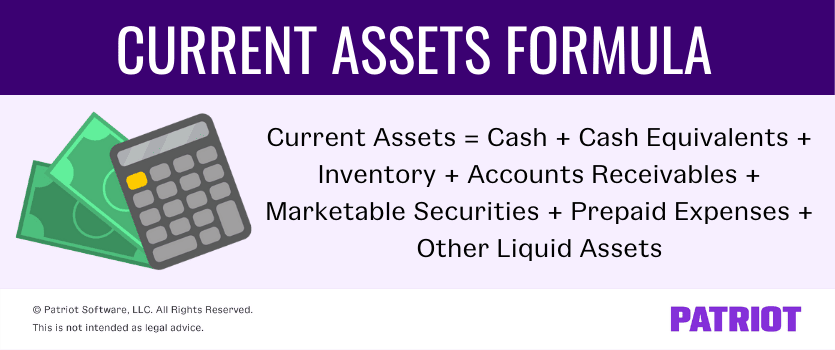

Once you know what you’re looking for, current assets are simple to calculate. To find current assets for your business, use the current assets formula:

Current Assets = Cash + Cash Equivalents + Inventory + Accounts Receivables + Marketable Securities + Prepaid Expenses + Other Liquid Assets

Yes, calculating current assets is as easy as doing a little addition. As long as you know what your current assets are, you’re golden.

Use your balance sheet to help find the amounts you need to compute total current assets.

The best way to evaluate your current assets is to compare them to your current liabilities. Generally, having more current assets than current liabilities is a positive sign because it shows good short-term liquidity. However, having too many current assets isn’t always a good thing. A “good” amount of current assets can also vary by industry and your business’s goals.

After you compute current assets, you can use your findings to calculate other small business ratios, such as:

- Current ratio (Current Assets / Current Liabilities)

- Quick ratio = [(Current Assets – Inventory + Prepaid Expenses) / Current Liabilities]

- Net working capital = (Current Assets – Current Liabilities)

Calculating current assets: Example

Now that you know how to find total current assets, let’s take a look at calculating it in action.

Say your company has the following current assets:

- Cash: $6,000

- Inventory: $500

- Accounts receivable: $1,000

- Marketable securities: $2,000

- Prepaid expenses: $200

- Other liquid assets: $2,000

As a reminder, use the following formula to find your total current assets:

Current Assets = Cash + Cash Equivalents + Inventory + Accounts Receivables + Marketable Securities + Prepaid Expenses + Other Liquid Assets

Current Assets = $6,000 + $500 + $1,000 + $2,000 + $200 + $2,000

Your total current assets for the period are $11,700.

Say your current liabilities equal $8,000. In your case, having more current assets than current liabilities shows that you have a healthy amount of current assets.

Using current assets

Again, your current assets can tell you a lot about how healthy your business’s finances are. Keep these things in mind when finding and using current assets to assess your financial health:

- Current assets only involve assets you can convert to cash within one year, or short-term investments

- Average current assets can vary based on your business’s industry and goals

- Generally, your business should have a 1:1 or greater ratio of current assets to current liabilities

- In many cases, you want current assets to be more than current liabilities, but there is such a thing as having too many current assets

- Your current asset ratio should be no more than 2. A ratio over 2 shows that you’re not investing assets enough

Having a healthy balance between current assets and current liabilities can help you when it comes to:

- Reaching goals

- Applying for business financing

- Fundraising

In short, you can use your current assets to monitor your business’s finances and pinpoint problem areas to make adjustments and improvements.

This is not intended as legal advice; for more information, please click here.