Before 2020, business owners used one universal form, Form 1099-MISC, to report nonemployee compensation and other types of payments (e.g., rent). But after a 38-year absence, Form 1099-NEC made a return in 2020. So, how do these forms differ? Read on to learn all about Form 1099-MISC vs. 1099-NEC and which form you need to use.

Form 1099-NEC vs. 1099-MISC: Must-know info

If you’re a business owner and pay contractors or vendors, you need to know the differences between Form 1099-NEC vs. 1099-MISC. That way, you can fill out, distribute, and file the correct form.

You might be wondering, Where do I even begin when it comes to Form 1099-NEC vs. MISC? No worries, we’ve put together this handy guide to help you catch up on the differences between the forms. So without further ado, take a look at everything you need to know about Form 1099-MISC and 1099-NEC.

Purpose of each form

Here’s an overview of each form and what type of payments you need to record.

Form 1099-MISC

Form 1099-MISC, Miscellaneous Information, is an information return businesses use to report miscellaneous payments.

File Form 1099-MISC for each person you give the following types of payments to during the tax year:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- At least $600 in the following:

- Rents

- Prizes and awards

- Other income payments

- Cash from a notional principal contract to an individual, a partnership or an estate

- Any fishing boat proceeds

- Medical and health care payments

- Crop insurance proceeds

- Fish purchased for resale

- Payments to an attorney for legal services (NOT fees)

- Section 409A deferrals

- Nonqualified deferred compensation

As of 2020, do not use Form 1099-MISC to report nonemployee compensation. And, do not use Form 1099-MISC for W-2 employees.

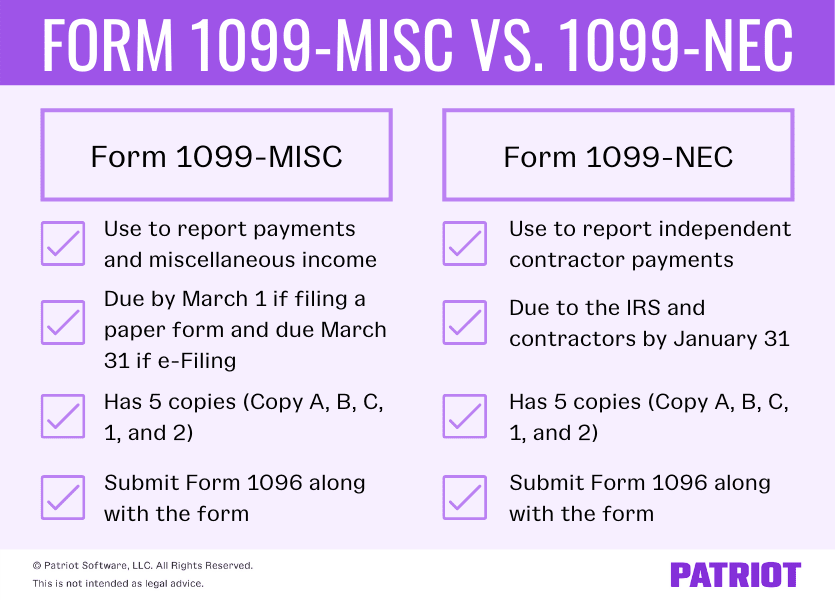

When you file a 1099 form, you also need to complete and file Form 1096, Annual Summary and Transmittal of U.S. Information Returns. Form 1096 is a summary form of all the Forms 1099 you file.

Form 1099-NEC

Form 1099-NEC, Nonemployee Compensation, is a form business owners use to report nonemployee compensation. Only use this form to report nonemployee compensation to independent contractors. Do not report other types of payments.

Form 1099-NEC did not replace Form 1099-MISC. It just took over the nonemployee compensation portion of 1099-MISC.

Before the revival, Form 1099-NEC was last used in 1982. So, why did the IRS bring the 1099-NEC form back in 2020? The short answer: to keep nonemployee expenses separate from Form 1099-MISC and clear up some confusion with due dates.

Again, only use Form 1099-NEC to report nonemployee compensation. Nonemployee compensation includes fees, commissions, prizes, awards, and other forms of compensation for services.

File Form 1099-NEC for each person you paid the following to during the year:

- $600 or more in:

- Services performed by someone who is not your employee (e.g., independent contractor). This includes payments for parts or materials used to perform the services (box 1) OR

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish (box 1) OR

- Payments to an attorney in box 1 (Attorneys’ fees of

$600 or more paid in the course of your trade or business)

You must also file Form 1099-NEC for each person you have withheld any federal income tax (box 4) under the backup withholding rules (regardless of the amount of the payment).

Usually, you must report a payment as nonemployee compensation if all of the following conditions apply:

- You made the payment to an individual who is not your employee

- The payment was for services in the course of your trade or business

- You made the payment to an individual, a partnership, an estate, or a corporation

- Payments to the payee were at least $600 during the year

Fill out Form 1099-NEC if you have any workers you paid $600 or more to in nonemployee compensation.

Like Form 1099-MISC, also submit a Form 1096 summary along with Form 1099-NEC.

Filling out Forms 1099

Before you can fill out Form 1099-NEC and/or Form 1099-MISC, you need to gather some information. Here’s a breakdown of the information you need to have ready for each form.

Form 1099-MISC:

- Your name, address, and phone number

- Your TIN (Taxpayer Identification Number)

- Recipient’s TIN

- Recipient’s name and address

- Your account number, if applicable

- Amount you paid the recipient in the tax year

Form 1099-NEC:

- Your name, address, and phone number

- Your TIN (Taxpayer Identification Number)

- Recipient’s name, address, and TIN

- Total nonemployee compensation

- Federal and state income tax withheld (if applicable)

For more information about filling out Forms 1099, check out the IRS’s Instructions for Forms 1099-MISC and 1099-NEC.

Where to send each form

Send both forms to the IRS. And, Form 1099-MISC and Form 1099-NEC have multiple copies you must distribute to various recipients (e.g., recipient, state, etc.). Fortunately, the copies for Form 1099-NEC and 1099-MISC go to the same places.

Check out where you need to send each copy of Form 1099 (both NEC and MISC):

- Copy A: The IRS

- Copy 1: State tax department, if applicable

- Copy B: Recipient (independent contractor or vendor)

- Copy 2: Recipient (independent contractor or vendor)

- Copy C: Keep in your business records

Deadlines for Forms 1099

Although the forms have some things in common, Form 1099-MISC and 1099-NEC don’t have the same deadlines.

You can file both forms electronically or mail them to the IRS. The mailing address depends on your state. If you plan on e-Filing Form 1099-MISC or 1099-NEC, use the IRS’s FIRE System or IRIS.

The deadlines for Form 1099-MISC are:

- Send copy to the recipient: January 31

- File paper form: February 28

- E-File: March 31

The due dates for Form 1099-NEC are:

- Send copies to worker(s): January 31

- File Copy A with the IRS: January 31

To avoid late-filing penalties, file your forms by the correct filing due date. If the day falls on a weekend or legal holiday, file by the next business day.

What to do if you need to file both 1099-MISC and 1099-NEC

Depending on who you paid during the year, you may be required to file both Form 1099-MISC and Form 1099-NEC.

If you pay an independent contractor nonemployee compensation and also make payments to other workers, separate nonemployee compensation payments from all of your other Form 1099-MISC payments.

If you file both Form 1099-MISC and 1099-NEC, file a 1096 form for both forms. You cannot file one Form 1096 for both Form 1099-NEC and MISC.

This is not intended as legal advice; for more information, please click here.