Business owners have a lot of taxes to know. Sales tax is another one to put on the list. Understand sales tax and how it works for your business to avoid potential penalties. And, that includes knowing if your particular company has to charge sales tax at all. So, let’s answer, “Do I have to charge sales tax?”

Do I have to charge sales tax?

Generally, sales tax is subject to specific laws. So, do you have to charge sales tax? When to charge sales tax depends on several factors. Nexus, state laws, what you sell, etc., all impact whether or not you need to charge sales tax.

This article will answer questions like:

- What are the states that don’t have sales tax?

- What is economic nexus?

- Do I have to collect sales tax if I sell online?

- Do I have to charge sales tax if I paid sales tax?

- What is the difference between sales tax on products and sales tax on services?

- Do I have to charge sales tax for services?

1. What are the states that don’t have sales tax?

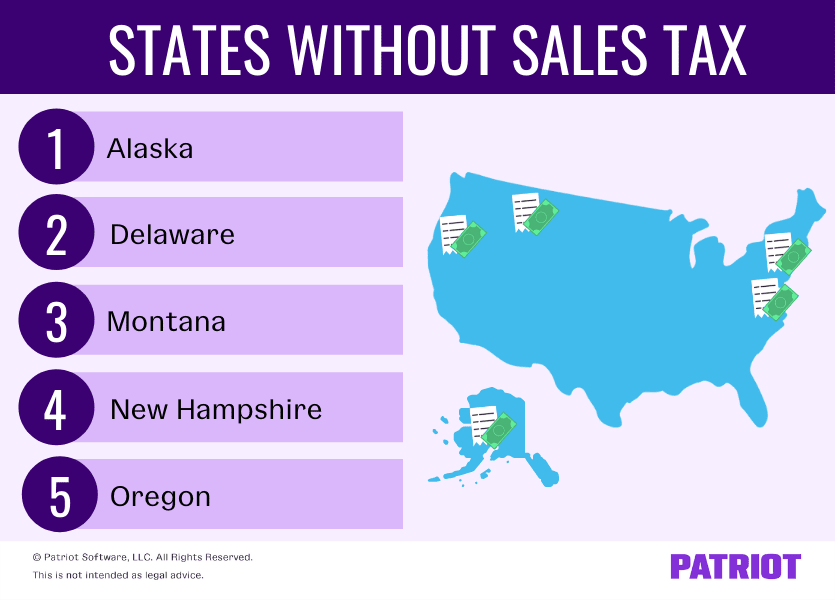

Most states generate revenue using sales tax. As a matter of fact, 45 states plus D.C. have sales tax. Five states do not have sales tax.

States without sales tax include:

- Alaska

- Delaware

- Montana

- New Hampshire

- Oregon

But, states without sales tax may include other taxes or allow certain localities to impose their own sales tax on goods and services. For example, Alaska does not have a state sales tax, but Juneau has a 5% sales tax.

Some states only have sales tax for specific products, such as alcohol or tobacco. Check with your state for more information.

2. What is economic nexus?

Nexus is the presence a business has in a specific location (e.g., city or state). Businesses may have nexus in a state if they sell goods or provide services there. A sales tax nexus determines if a business has a presence in a location and must collect sales tax from customers.

Economic nexus is a type of sales tax nexus for online sales. So, businesses must collect sales tax in the state where the customer is if they earn revenue or meet specific sales thresholds in that state. Companies may also have a physical location in a state for economic nexus, meaning that it’s not limited to digital commerce.

Say your business is in Anchorage, Alaska. You do not have sales tax at your business’s home location. But, you sell winter coats online to customers in other states. You sell enough coats to customers in Wisconsin to establish economic nexus. You must collect sales tax from your customers.

3. Do I have to collect sales tax if I sell online?

Again, economic nexus is sales tax nexus for online sales. So, sales tax for online sales comes down to if your customer lives in a state with sales tax. You must also meet specific thresholds to register with the state to remit sales tax from online sales.

For example, your business sells T-shirts online from your warehouse in Ohio. You sold $105,000 worth of T-shirts to customers in Colorado in 2021. The threshold for economic nexus in Colorado is $100,000 in sales. You must register with the state for a sales tax permit so you can collect and remit sales tax to the state.

Say that you made the same amount of sales in 2021 to customers in California. The threshold for California is $500,000 in sales. Because you only made $105,000 in sales to California, you do not need to register with the state to collect and remit sales tax.

4. Do I have to charge sales tax if I paid sales tax?

Do businesses have to charge their customers sales tax if they paid it when they originally purchased the goods to sell? In short, yes.

Say your business buys candles from a wholesaler. You pay sales tax on the purchase your company makes. Then, you charge your customers a sales tax when they purchase the candles from your business.

If your business sells in a state with sales tax, you must charge customers at the point of sale, regardless of the sales tax you paid when purchasing the items to sell. Remit sales tax from your customers according to your depositing and filing schedule (e.g., quarterly) with the state.

5. What is the difference between sales tax on products and sales tax on services?

Typically, sales tax has only applied to the purchase of tangible goods, not professional services provided. However, that’s been changing as some states shift to include services in their state sales and use tax laws.

Most states use the same sales tax rate for both goods and services (if they impose a sales tax on services). Check with your state for more information regarding sales tax rates and exemptions.

6. Do I need to charge sales tax on services?

Most states do not explicitly include services in their sales tax laws. Only four states have language to include services in sales tax laws:

- Hawaii

- New Mexico

- South Dakota

- West Virginia

States without sales tax do not tax either goods or services. So, the 41 remaining states may tax services, depending on the type of service provided. For example, North Dakota applies a sales tax to amusement and recreation services (e.g., amusement parks). But, the state does not apply sales tax to business services (e.g., extermination services).

Check with your state for more information.

This is not intended as legal advice; for more information, please click here.