The news is out: President Biden authorized advanced child tax credits, and many parents are already receiving payments in their bank accounts. But, what is the big deal about the child tax credit 2021 plan? And, why should you know about it as a business owner? We’ve got the scoop on the child tax credit and how it can benefit you and your employees.

What is the child tax credit?

The IRS child tax credit is a tax benefit for American taxpayers who have qualifying dependent children. This tax credit decreases the tax liability for taxpayers on a dollar-for-dollar basis. In addition, child tax credits are based on income taxes, not payroll taxes.

Since 1997, the child tax benefit has reduced the amount of taxes taxpayers owe at the end of the year. Between 1997 and 2021, the federal government changed and expanded the benefit several times. In 2021, the benefits temporarily changed in response to COVID-19.

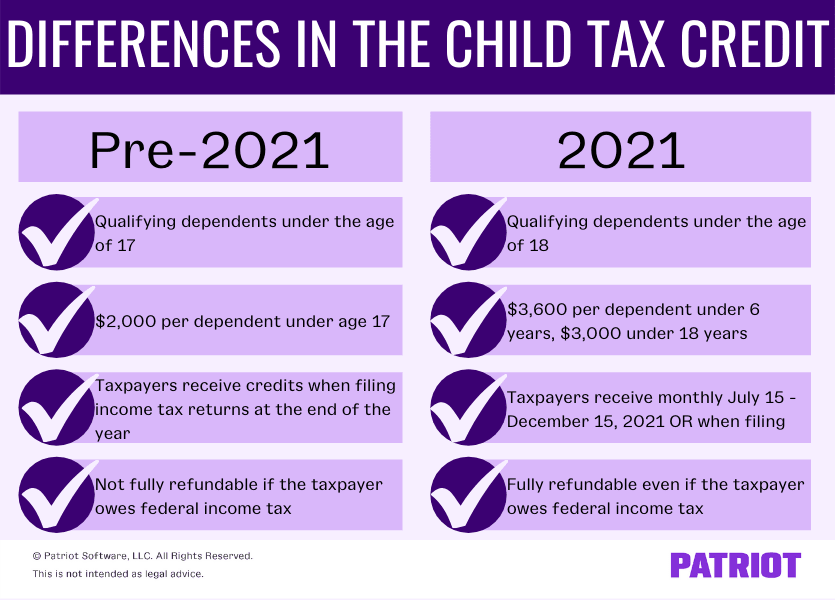

Child tax benefit pre-2021

Before 2021, taxpayers could claim qualifying dependents if the dependent met specific conditions, including:

- Being under the age of 17 by December 31 of the applicable tax year

- Being a taxpayer’s child (biological or adopted), stepchild, eligible foster child, brother, sister, step-sibling, half-sibling, or a descendant of any of those (e.g., grandchild)

- Living with the taxpayer for more than half of the tax year*

- The dependent not paying for more than half of their living expenses for the year

- Being claimed as a dependent of the tax filer’s income tax return

- Not filing a joint tax return with the taxpayer

- Being a U.S. citizen, U.S. national, or U.S. resident alien

*The government considers a child to have lived with the taxpayer for more than half of the tax year if the child was born or died in the tax year and lived with the taxpayer for half of the time they were alive.

Child tax credit 2021

As part of the American Rescue Plan (ARP), the expanded child tax credit is temporary for 2021. Notable changes to the tax credit include:

- Child tax credits are fully refundable, regardless of how much taxpayers owe on their 2021 taxes

- An increase in the benefit from $2,000 to $3,600 for children under the age of six and $3,000 for children under the age of 18

- No cap on the credit amounts taxpayers can claim if the filer has multiple children

- Children under the age of 18 are now included in the tax credit*

- Eligibility for receiving advance tax payments between July 1, 2021 and December 31, 2021

* Before the 2021 expansion, the child tax credits covered dependents under the age of 17.

Parents with eligible dependents can choose to wait until they file their 2021 tax returns to receive the entirety of the child tax benefit. Or, taxpayers can elect to receive payments on the 15th of every month, starting on July 15, 2021 and through December 15, 2021.

Taxpayers who choose to receive monthly installments receive half of the tax benefit in direct payments and the second half when filing their income tax returns.

The child credit 2021 plan includes a special lookback period. Typically, the IRS calculates the credit based on the current year’s tax returns. However, COVID-19 impacted the average income for many families. So, the IRS allows taxpayers to determine their tax credit based on 2019 income. The provision benefits those whose 2020 income may make them ineligible for the expanded credit.

Parents with $0 in income may also qualify for monthly child tax credit payments under the 2021 plan. Typically, the payments are automatic, and taxpayers must opt out to receive the payments on their tax returns. Caretakers and parents who have not filed for tax years 2019 or 2020 must sign up to receive tax credits for those years.

Why is the child tax credit important?

When the child tax credit went into effect in 1997, the purpose was to help ease the financial burden of raising children.

Under the original benefit law, taxpayers received the credit when filing taxes. Credits either reduced the amount of taxes owed or gave taxpayers a refund. The 2021 child tax credit stimulus goes further and provides direct relief to families in payment installments.

So, why is the tax credit important? The purpose of the tax credit is to assist low and middle-income earners with the costs incurred from raising children. The American Rescue Plan expanded child tax credit stimulus estimates a 45% reduction in the number of children living in poverty.

The new rules aim to reduce the impact of the COVID-19 pandemic on families who have lost jobs or had their working hours reduced.

How can the child tax credit benefit employers?

Now that we’ve covered what the tax credit is, you may be asking how this can benefit you as an employer. While it’s true that the new child tax credit benefits workers and their families individually, there are some benefits for businesses, too. Specifically, the benefits are for business owners who meet the criteria for the child tax credit.

You may not be able to add the child tax credit to your business’s books, but you can use the tax credit to benefit you personally. And, those benefits roll over into your working life.

For example, you can use the child tax credit stimulus payments to pay for daycare. It’s no secret that many employers are struggling to maintain enough of a workforce to operate at full capacity. As the owner, you may be putting in more working hours each week as a result.

If you have children, they may need to be in daycare or after-school programs while you work. You can use the child tax credit payments to pay for daycare or programs for your children. And, employees who work for you can choose to do the same.

Need a simple solution to streamline your books? Patriot’s online accounting software makes it as easy as 1-2-3. Start your FREE trial today!

This is not intended as legal advice; for more information, please click here.