Small business owners are the backbone of America’s economy. In 2025, they’re facing an unpredictable landscape shaped by inflation, shifting workforce dynamics, new technologies, and differences in state policies that can make or break a venture.

The Patriot Software 2025 Startup Index ranks all 50 states on business-friendliness, using three critical measures: one-year survival rates for new businesses, LLC filing fees, and state tax climate rankings. Together, these factors paint a clear picture of the best states to start a business, and states that present a greater challenge.

National survey data from small and medium-sized business owners shows that inflation, staffing shortages, and AI adoption are reshaping day-to-day operations. These challenges tie directly to state-level conditions. A state with high survival rates and modest startup costs may help offset inflation pressures. A state with burdensome fees or taxes can magnify them.

Skip Ahead

Best states to start a business (and worst): 2025 State Startup Index

Our best states to start a business map and table shows each state’s:

- New business 1-year survival rate (2023-2024)

- Cost of LLC filing fee

- Tax climate rank (1-50, 1 being the best)

- Overall score using the above three factors, normalized to fit a 0-100 scale

| Rank | State | Startup 1-Year Survival Rate (2023-2024) | Cost of LLC Filing Fee | Tax Climate Rank (1-50, 1 being the best) | Index Score (0-100, 100 being the best) |

|---|---|---|---|---|---|

| 1 | South Dakota | 78.5% | $150 | 2 | 72 |

| 2 | North Carolina | 79.5% | $125 | 9 | 70 |

| 3 | Montana | 76.4% | $35 | 5 | 68 |

| 4 | Florida | 77.0% | $125 | 4 | 67 |

| 5 | Wyoming | 75.7% | $100 | 1 | 67 |

| 6 | Indiana | 78.0% | $95 | 10 | 66 |

| 7 | Washington | 86.4% | $200 | 35 | 65 |

| 8 | Michigan | 76.8% | $50 | 11 | 64 |

| 9 | Utah | 75.7% | $59 | 8 | 63 |

| 10 | Kentucky | 78.1% | $40 | 18 | 62 |

| 11 | Arizona | 77.1% | $50 | 14 | 62 |

| 12 | New Hampshire | 74.6% | $100 | 6 | 60 |

| 13 | West Virginia | 79.1% | $100 | 22 | 59 |

| 14 | California | 86.0% | $70 | 48 | 59 |

| 15 | Oklahoma | 77.2% | $100 | 19 | 56 |

| 16 | Iowa | 80.2% | $50 | 33 | 56 |

| 17 | Texas | 77.8% | $300 | 13 | 54 |

| 18 | Tennessee | 78.3% | $300 | 15 | 54 |

| 19 | Wisconsin | 78.3% | $130 | 24 | 54 |

| 20 | North Dakota | 76.0% | $135 | 17 | 53 |

| 21 | Alaska | 73.7% | $250 | 3 | 53 |

| 22 | Mississippi | 75.5% | $50 | 20 | 53 |

| 23 | Delaware | 76.5% | $110 | 21 | 52 |

| 24 | Missouri | 72.9% | $50 | 12 | 52 |

| 25 | Idaho | 74.6% | $100 | 16 | 52 |

| 26 | Pennsylvania | 79.0% | $125 | 31 | 51 |

| 27 | Nebraska | 78.2% | $100 | 30 | 50 |

| 28 | Nevada | 75.8% | $425 | 7 | 48 |

| 29 | Virginia | 75.6% | $100 | 25 | 47 |

| 30 | South Carolina | 76.7% | $110 | 29 | 46 |

| 31 | Colorado | 75.1% | $50 | 27 | 46 |

| 32 | New Mexico | 73.8% | $50 | 23 | 46 |

| 33 | Illinois | 78.1% | $150 | 37 | 42 |

| 34 | Georgia | 75.6% | $100 | 32 | 41 |

| 35 | Oregon | 74.4% | $100 | 28 | 41 |

| 36 | Kansas | 74.7% | $160 | 26 | 41 |

| 37 | Ohio | 76.5% | $99 | 36 | 41 |

| 38 | Arkansas | 75.5% | $45 | 38 | 38 |

| 39 | Maine | 75.9% | $175 | 34 | 37 |

| 40 | Alabama | 77.2% | $200 | 39 | 36 |

| 41 | Louisiana | 75.6% | $100 | 40 | 35 |

| 42 | Maryland | 76.9% | $100 | 45 | 34 |

| 43 | New Jersey | 78.5% | $125 | 50 | 34 |

| 44 | Rhode Island | 76.0% | $150 | 41 | 33 |

| 45 | Vermont | 75.9% | $155 | 43 | 31 |

| 46 | Hawaii | 73.8% | $50 | 42 | 30 |

| 47 | New York | 77.8% | $200 | 49 | 29 |

| 48 | Connecticut | 75.3% | $120 | 47 | 27 |

| 49 | Minnesota | 72.3% | $155 | 44 | 20 |

| 50 | Massachusetts | 76.4% | $500 | 46 | 15 |

Key findings from the Patriot Software 2025 Startup Index

- 52.2% of small business owners say inflation and rising costs are their biggest threat.

- 62.2% remain optimistic that 2025 is a good year to launch a business.

- 38.3% report difficulty hiring and retaining reliable employees.

- 51% are already using AI tools, especially in marketing and social media.

- 33% have delayed hiring to save on expenses.

These findings provide context for the rankings. Entrepreneurs weighing where to start a business can use this Index to see how statewide conditions intersect with national economic realities.

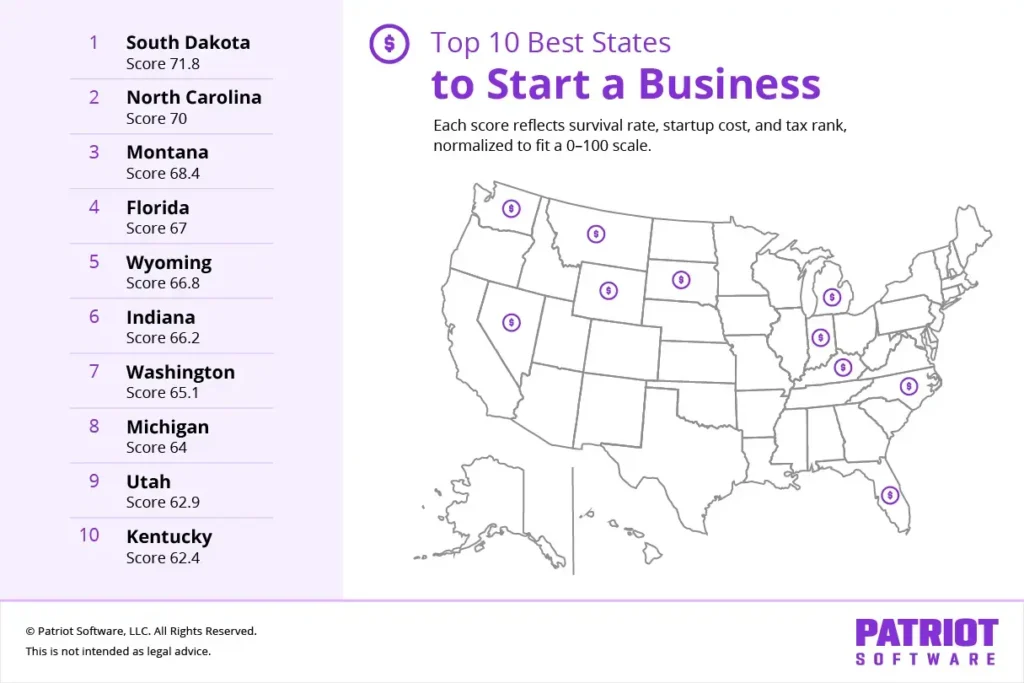

The 10 best states to start a business

- South Dakota – 78.5% survival, $150 LLC fee, Tax Rank #2

- North Carolina – 79.5%, $125, Tax Rank #9

- Montana – 76.4%, $35 (lowest fee), Tax Rank #5

- Florida – 77.0%, $125, Tax Rank #4

- Wyoming – 75.7%, $100, Tax Rank #1

- Indiana – 78.0%, $95, Tax Rank #10

- Washington – 86.4% survival (highest nationwide), $200, Tax Rank #35

- Michigan – 76.8%, $50, Tax Rank #11

- Utah – 75.7%, $59, Tax Rank #8

- Kentucky – 78.1%, $40, Tax Rank #18

Washington beats Silicon Valley in startup survival

Washington’s one-year startup survival rate is a staggering 86.4%, the best in the country. By comparison, California sits far lower. Washington’s high survival rate reflects its deep pool of tech talent, venture capital, and culture of innovation.

But high costs remain a challenge. The state ranks #35 in tax climate and has one of the highest minimum wages nationwide. Small businesses here often find early traction but must carefully manage payroll and taxes to keep momentum.

Montana entrepreneurs pay just $35 to launch

Montana’s $35 LLC filing fee is the lowest in the nation. Beyond affordability, Montana has quietly become a startup hub, ranking #1 in 2024 for new businesses per capita (106 per 100,000 residents).

The average new employer business in Montana has just 3.9 employees, reflecting a culture of lean, community-driven entrepreneurship. Owners who prioritize sustainability over fast scaling will find Montana especially appealing.

Wyoming tops tax rankings, cementing startup haven status

Wyoming earns its #1 spot in the Tax Foundation’s State Business Tax Climate Index. Wyoming does not have the following taxes:

- Corporate income tax

- Personal income tax

- Franchise tax

- Inventory or occupation tax

This means more cash stays in small business owners’ pockets to reinvest. The $100 LLC fee and strong privacy protections add to Wyoming’s appeal. For entrepreneurs willing to operate outside of major markets, Wyoming offers one of the most tax-friendly environments in the U.S.

North Carolina quietly emerges as a startup stronghold

With a 79.5% survival rate and a corporate income tax of just 2.25% (set to phase out entirely by 2030), North Carolina is both stable and forward-looking.

The state’s Research Triangle provides deep R&D resources, while its infrastructure supports long-term growth. CNBC ranked it #1 in its “Top States for Business” list in 2023. For entrepreneurs, North Carolina blends short-term security with long-term opportunity.

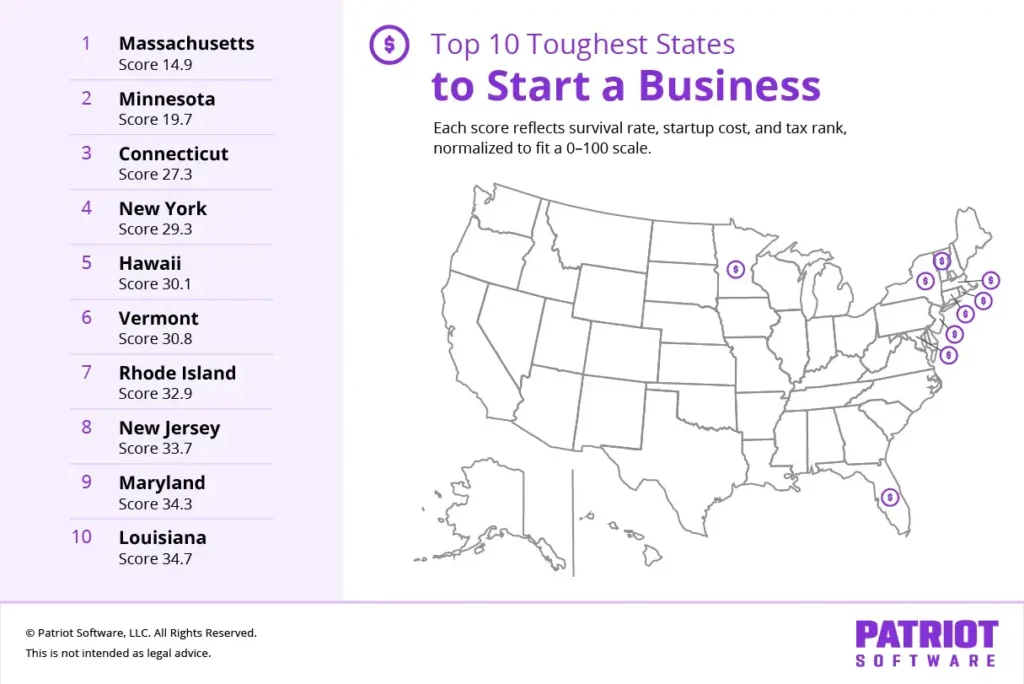

The 10 toughest states to start a business

- Massachusetts – 76.4% survival, $500 LLC fee (highest in U.S.), Tax Rank #46

- Minnesota – 72.3%, $155, Tax Rank #44

- Connecticut – 75.3%, $120, Tax Rank #47

- New York – 77.8%, $200, Tax Rank #49

- Hawaii – 73.8% survival (lowest nationwide), $50, Tax Rank #42

- Vermont – 75.9%, $155, Tax Rank #43

- Rhode Island – 76.0%, $150, Tax Rank #41

- New Jersey – 78.5%, $125, Tax Rank #50

- Maryland – 76.9%, $100, Tax Rank #45

- Louisiana – 75.6%, $100, Tax Rank #40

Minnesota has the steepest first-year failure rate

Minnesota startups face the toughest first year, with 27.7% failing to survive. Rising costs and workforce shortages weigh heavily on entrepreneurs.

However, those who make it through the first year often thrive long-term, with Minnesota ranking #1 for five-year survival. It’s a high-barrier but potentially rewarding environment.

Massachusetts entrepreneurs pay the nation’s heaviest entry fee

Launching an LLC in Massachusetts costs $500, the highest in the U.S. When paired with a #46 tax climate ranking, it’s easy to see why small businesses struggle to establish roots.

Boston’s innovation ecosystem is strong, but these high upfront and ongoing costs create barriers for entrepreneurs with limited capital.

Hawaii has the lowest startup survival rate in the U.S.

Only 73.8% of Hawaii startups survive year one, the lowest rate nationwide. High costs of living, reliance on imports, and a tourism-heavy economy make business stability elusive.

Even with a modest $50 LLC fee, ongoing operating costs strain small businesses. For owners here, creativity and adaptability are essential.

New Jersey survives year one but loses on taxes

New Jersey’s 78.5% survival rate suggests many businesses get through their first year. But the state’s tax climate ranks #50, the worst in the country. Heavy income, property, and corporate tax rates create long-term barriers to scaling.

National trends reshaping entrepreneurship

Inflation surpasses competition as top business threat

52.2% of entrepreneurs identify inflation and rising costs as their biggest challenge, compared to just 27.8% pointing to competition. Rising costs for materials, rent, and payroll are hitting small businesses harder than their rivals.

Optimism persists despite headwinds

62.2% believe 2025 is a good time to start a business. Notably, 40.8% of these optimists admit the conditions are challenging but still see opportunity. This optimism reflects resilience and confidence that good ideas and smart planning can still find success.

Half of new business owners turn to AI

51% of small business owners say they’ve adopted AI tools for marketing and social media. Many report that these tools save money and boost profits. For small teams, AI is not just a trend—it’s a practical solution to stretch limited resources.

Workforce struggles hold back growth

38.3% of owners report difficulty finding and keeping employees, while 23% list labor shortages as a top business threat.

The consequences are clear:

- 32.8% delay hiring

- 24.8% reduce employee hours

This workforce crunch forces many new businesses to pause growth plans just to stay stable.

One in three freezes hiring due to cost pressures

33% of small business owners delayed hiring in the past year. Inflation and economic uncertainty push many to protect cash reserves, even if it slows growth.

Mass business migration is underway

68% of entrepreneurs have moved or plan to move their business across state lines within three years. More than one-quarter (26.4%) are planning a move within the next 12 months.

The search for better taxes, fewer regulations, and friendlier business climates is reshaping where small businesses take root.

Conclusion

The Patriot Software 2025 Startup Index shows how state-by-state differences shape the entrepreneurial journey. Washington, Montana, Wyoming, and North Carolina provide environments where small businesses can thrive, while Massachusetts, Minnesota, Hawaii, and New Jersey pose steep hurdles.

At the same time, national pressures (rising costs, hiring struggles, and the adoption of AI) remain central to daily operations. For today’s entrepreneurs, success depends not only on hard work and resilience but also on choosing the right environment to match their resources and growth goals.

Methodology

This ranking draws on three measures:

- New business 1-year survival rate (40%) – Bureau of Labor Statistics (March 2023–March 2024)

- Cost of starting a business (20%) – LLC filing fees by state from LLC University

- Tax friendliness (40%) – State rankings from the Tax Foundation’s 2024 State Business Tax Climate Index

Each factor was normalized to a 0–100 scale, weighted according to importance, and combined into a composite score to rank states on business friendliness.

Fair use

Users are welcome to utilize the insights and findings from this study for noncommercial purposes, such as academic research, educational presentations, and personal reference. When referencing or citing this article, please ensure proper attribution to maintain the integrity of the research. Direct linking to this article is permissible, and access to the original source of information is encouraged.

For commercial use or publication purposes, including but not limited to media outlets, websites, and promotional materials, please contact the authors for permission and licensing details. We appreciate your respect for intellectual property rights and adherence to ethical citation practices. Thank you for your interest in our research.

This is not intended as legal advice; for more information, please click here.