Accounting can be a daunting task when starting out, especially if you’re not an accountant. And depending on your business, how you must handle accounting can change. So, what are the accounting methods, and how do you choose which method to use for your business’s bookkeeping?

3 Accounting methods

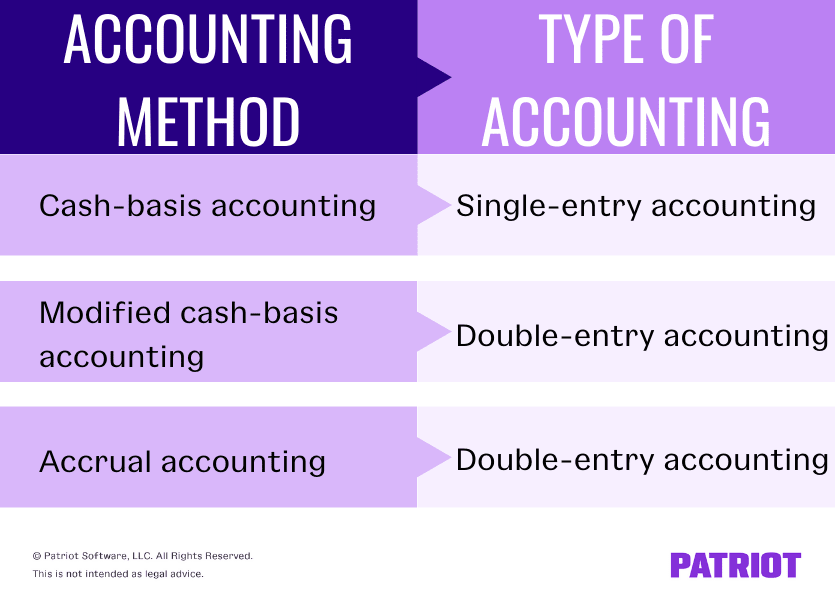

There are two types of accounting to choose from: single-entry and double-entry accounting. And, there are three accounting methods: accrual basis, cash basis, and modified cash basis. Before we can talk about which types of businesses use specific accounting methods, let’s briefly go over the basics.

Single-entry accounting type

Single-entry accounting is just what it sounds like. You record each transaction in your books as one entry. Cash-basis accounting uses the single-entry method (and we’ll get to that in a minute).

The single-entry method most commonly records cash disbursements and cash receipts. If you use single-entry accounting, you record all incoming and outgoing funds in the cash book. And, you typically track assets and liabilities separately.

Double-entry accounting type

In contrast to single-entry accounting, you record two or more entries for every transaction in double-entry accounting. Each transaction consists of a debit and a credit to different accounts. You record a credit in at least one account and enter a debit in at least one other account.

The basis of double-entry accounting is that each transaction has equal and opposite effects on at least two accounts. While double-entry accounting is more complex than single entry, this method can help you:

- Maintain accurate bookkeeping records

- Find and reduce accounting records

- Make better, more informed financial decisions

- See a clear snapshot of your business’s finances

Both modified cash basis and accrual accounting use double-entry bookkeeping.

Cash-basis accounting method

Again, single-entry accounting and cash-basis accounting go hand in hand. Because single-entry accounting is the simplest accounting entry method, cash-basis accounting is also the simplest accounting method. As the easiest method, many small businesses tend to use it for bookkeeping.

With the cash accounting method, you can only use cash accounts. This means you can record things like cash, expenses, and income. But, you cannot track long-term liabilities, loans, or inventory.

How does cash accounting work? You record income when you receive it. And, you only report your expenses when you pay them.

When it comes to reporting taxes, cash basis requires you to report income in the year you receive it. And, you report expenses in the year you pay them.

Accrual accounting method

The accrual method of accounting is much more complex than cash basis. Typically, you want to have some accounting knowledge to use this method.

How does accrual accounting work? You use more advanced accounts, such as accounts payable, current assets, long-term liabilities, and inventory. And, you record income when the transaction takes place, even if you do not receive the funds at that time. You must also record all expenses when you receive the bill, not just when you pay the bill.

For tax purposes, the accrual method requires you to report income in the year you earn it, even if you have not received the funds. And, you deduct expenses in the year you incur them, whether you paid the expenses or not.

Modified cash-basis accounting method

As the name suggests, modified cash-basis accounting is a hybrid accounting method. Modified cash-basis accounting blends cash basis and accrual accounting, making it a happy medium for business owners. Businesses who need to record and balance both short- and long-term transactions find this method ideal.

With the hybrid method of accounting, you can use accounts from both cash and accrual basis, such as cash, current assets, long-term liabilities, and accounts payable. And, you can record short-term items like you can using cash basis. But, you can also enter and track long-term items as you would under accrual.

Picking an accounting method for your business

Now that we’ve covered the different types of accounting and the three accounting methods, let’s answer the big question. How do you know which accounting type and method to use? Thankfully, the IRS sets rules on who can and cannot use each method.

Generally, most businesses can use whichever method of accounting they like. However, the IRS rules state that larger businesses cannot use the cash basis or hybrid method. But, what is a larger business? You cannot use cash-basis accounting or modified cash basis if your business is:

- A corporation (other than an S corporation) with average annual gross receipts for the three preceding tax years exceeding $25 million

- A partnership with a corporation (other than an S corporation) with average annual gross receipts for the three preceding tax years exceeding $25 million

- A tax shelter, as defined by Publication 538

- A qualified personal service corporation, as defined by the IRS

To calculate the gross receipts defined by the IRS, add together the preceding three years’ worth of annual gross receipts and divide the total by three. If the average exceeds the $25 million set by the IRS, you must switch to accrual accounting.

If you start your business using cash or modified cash-basis accounting and exceed the limits set by the IRS for any single tax year, you must change to the accrual basis of accounting.

If your business is public, you must use accrual accounting, per generally accepted accounting principles (GAAP). Public companies include businesses that are filed with the Securities and Exchange Commission (SEC). Companies not listed with the SEC may also choose to use GAAP rules if they want to seek financing or their accounts are scrutinized by a third party (e.g., auditing).

Changing accounting methods

Many small businesses start out using the cash basis or hybrid accounting method because it is easier. But as your business grows, you might feel the need or be required to change your method.

So, how do you change from one accounting method to another? First, adjust your business’s books to reflect the shift from one method to another.

Because changing from accrual to cash-basis is rare, we’ll focus on changing from cash basis to accrual. To make the change in your books, complete the following steps:

- Add prepaid and accrued expenses

- Record any accrued expenses (e.g., unpaid bills and wages earned) for employees who you have not paid yet

- Move any prepaid expenses from the current accounting period to an asset account

- Add accounts receivable

- Add any unpaid customer invoices to your books

- Subtract cash payment, customer prepayments, and cash receipts

- Remove cash payments that pertain to the last accounting period to reduce the current period’s beginning retained earnings

- Reverse prepayments as sales and record the prepayment as a short-term liability until you provide the good or service

- Review and subtract cash receipts received during the current period if a sale began in the previous period. List the sale as a receivable in the previous period. Adjust the current period’s beginning retained earnings

After you complete the change in your books, you must notify the IRS. File Form 3115, Application for Change in Accounting Method, to receive approval for the change. Form 3115 allows you to formally request a change in your accounting method.

File the form sooner rather than later. And, attach your profit and loss statement, balance sheets, and any adjustments from the previous year to the form.

This is not intended as legal advice; for more information, please click here.