It’s no secret that prices are on the rise. Inflation or not, rising costs are common in business. And as an accountant, you likely have partners (e.g., a payroll partner), office space, equipment, and other expenses that are prone to price increases. So, what do you do if you’re hit with a price increase?

You put a lot of time, energy, and research into setting your accounting practice fees. In some cases (but not all!), you may need to raise your own fees to keep up with increasing prices.

Read on to learn what you can do to protect both your bottom line and client loyalty.

3 Ways to handle rising costs

When your expenses rise, you need to first gather information. Is the price increase temporary or permanent? When does it take effect? What’s the reason for it? Knowing why you’re getting hit with a price increase can help you make a more informed decision on how to handle it in your practice.

Next, dig into how this increase in costs will impact your practice. Take a look at your current budget and determine how much more you’ll be paying each month and year with the increased prices.

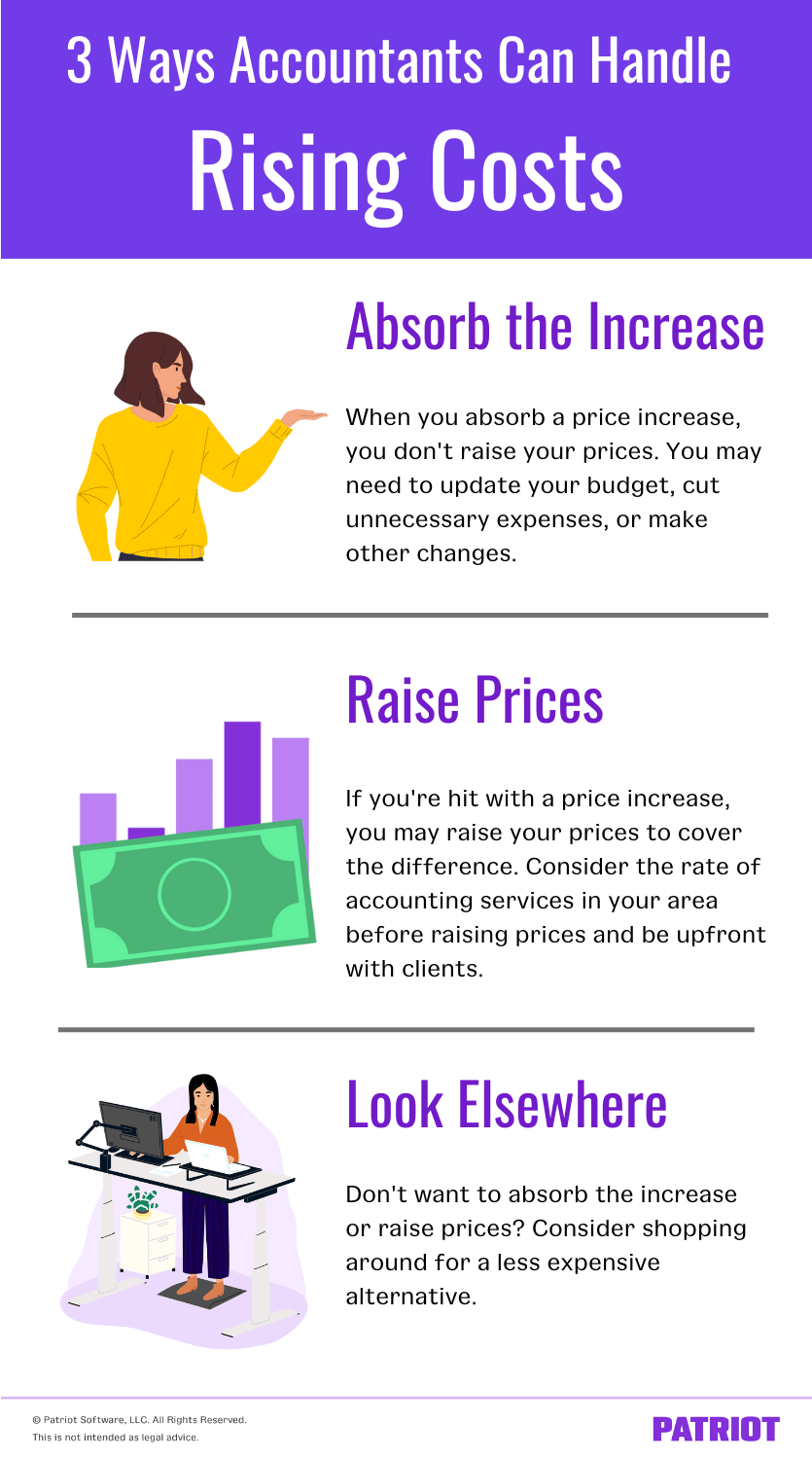

After you gather information and assess the impact the new pricing will have on your practice, you have three basic options:

- Absorb the rising costs

- Raise prices

- Look for an alternative

1. Absorb the rising costs

One way you can respond to an increase in costs is to simply absorb it. This means you don’t raise your prices, so clients continue paying the same fee.

By absorbing rising costs, you might be able to avoid having disgruntled clients or losing clients altogether. However, keeping your accounting fees the same in the face of a price increase lowers your profit margin. And keep in mind that, if the price increase lasts longer than you planned, you may have to raise prices later.

Absorbing the rising costs means you may need to:

- Update your budget

- Look for other expenses you can cut

- Adjust your hours or availability

But by absorbing the costs, you do not need to:

- Update your pricing fees (e.g., online)

- Notify clients of any pricing changes

2. Raise prices

If rising prices are too high, or if they’ll significantly cut your profits, you may consider raising your own prices.

But be warned: Raising your accounting service fees could hurt your client base. Some clients may then begin looking for a new accountant. To help mitigate potential loss, be upfront with your clients and consider adding something of value (e.g., extended office hours).

Not sure how much is too much? To start, accountants charge an average of $175 per hour for services. But, rates can range from $60 to over $400 per hour.

If you’re worried about raising your accounting practice fees (that you worked so hard to put together!) and overcharging clients, do some research. Determine the rate of accounting services in your area. And, consider whether you’ve added new credentials (e.g., CPA) or gained new experiences since you last set your fees.

3. Look for an alternative

If absorbing the price increase and raising prices aren’t an option, or if you want to see what else is out there, consider looking for an alternative.

Is there a less expensive vendor out there? Or, does your current vendor charge less on a different product or service?

When shopping around for less expensive options, consider factors such as quality and whether there’s a price lock.

What’s the best way to handle increasing prices?

So, what’s your best course of action if your accounting practice is hit with inflation in business? Like anything, there’s no standard right and wrong answer.

You need to consider factors like:

- The amount of the price increase

- How it will impact your firm

- How raising your own prices could impact your clients

- Whether you’re able to negotiate with your vendor

And, remember to weigh the pros and cons of your three options for handling rising prices:

| Pros | Cons | |

|---|---|---|

| Absorb the Costs | -Does not impact clients -Does not require you to update your pricing fees | -Lowers your bottom line |

| Raise Prices | -Helps you avoid taking a financial hit | -Could make clients upset and may result in them looking elsewhere |

| Look for an Alternative | -Does not impact clients financially -May help you avoid taking a financial hit | -Time commitment |