Do you purchase goods or services for your business? Silly question: Of course you do. And, you might not always pay for the items up front. Instead, a vendor sends an invoice. If you receive invoices, you need to manage your accounts payable. What is accounts payable?

What is accounts payable?

Accounts payable, also referred to as payables or AP, is the money you owe to vendors. You increase your accounts payable when a vendor extends credit to you—aka you purchase something and don’t immediately pay. Track your AP using an accounts payable account. The entries in your accounts payable account are called payables. A payable represents an invoice you need to pay.

Let’s say you buy supplies from a vendor on credit. The vendor then sends you an invoice with a due date for the payment. The AP account in your books shows you which vendors you owe money to.

Record payables if you use accrual accounting. Under accrual accounting, record expenses when you incur them. That means you record an expense as soon as you receive an invoice, not just when you pay the vendor.

Knowing your business’s AP helps you determine if you are profitable. And, accounts payable provides data for budgeting and planning.

By looking ahead at expenses, you can decide when to make large purchases or if you are ready to expand. You can also avoid situations where you do not have enough cash on hand to cover costs.

What type of account is accounts payable?

Invoices generally require payments within 30, 60, or 90 days. As a result, AP is a short-term liability (i.e., a type of liability you pay within one year).

Record accounts payable in your liability account.

Accounts payable and accounts receivable

So far, we’ve talked about AP. It’s only fair we bring up its other half, accounts receivable.

Accounts receivable is money owed to you. Again, AP is money you owe.

When you have an accounts payable, your vendor has an accounts receivable. Likewise, when you have an accounts receivable, your customer has an accounts payable.

Accounts payable aging report

You can use an accounts payable aging report to organize the money you owe to vendors. An accounts payable aging report shows you:

- What you owe

- Who you owe it to

- How old the invoice is (e.g., current or past due)

Here’s an example AP aging report:

| Payee | Current | Past Due 1 – 30 Days | Past Due 31 – 60 Days | Total |

|---|---|---|---|---|

| Office Mart | $373.28 | $373.28 | ||

| Heating Pros | $155.28 | $155.28 | ||

| JB Enterprises | $194.61 | $194.61 | ||

| Bell | $278 | $278 | ||

| Lighting Express | $63.72 | $63.72 | ||

| Paper Supply | $53.99 | $53.99 | ||

| Total | $723.17 | $341.72 | $53.99 | $1,118.88 |

List the vendors you owe money to in the first column. Enter the balances due to each vendor in the appropriate aging column (e.g., past due 31 – 60 days). If you don’t pay an invoice before it becomes past due, move the amount into the correct column. That way, you can see how much of your AP is overdue.

Creating an accounts payable journal entry

You need to record AP transactions in your accounting books using double-entry bookkeeping.

For every business transaction, record two entries. The accounts payable entries balance your books. While one entry increases an account, the other decreases an account.

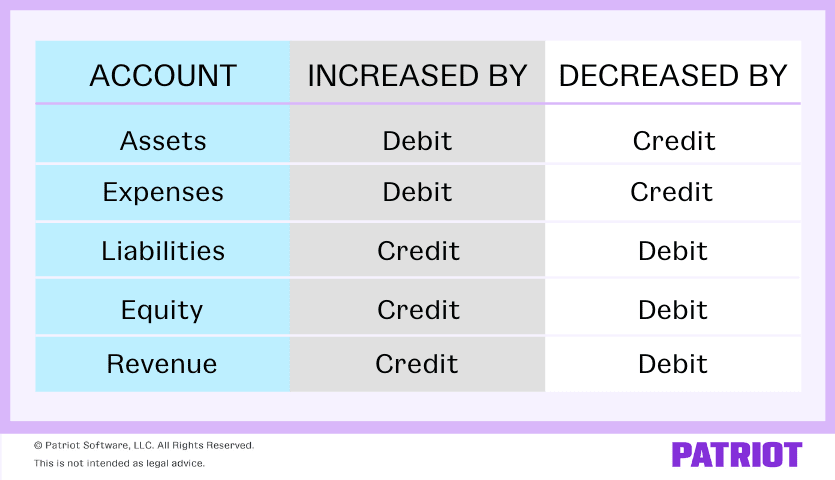

Each time you incur an AP, make two entries. One entry is credited, and the other is debited. Accounting debits and credits affect each type of account differently. Here is a guide to help you:

Again, AP is a liability. Credits increase liabilities. And, debits decrease liabilities.

When you incur an accounts payable, make a journal entry. Because this increases your AP, you must credit the Accounts Payable account. Then, debit the account that represents what the expense was for (e.g., Inventory).

Recap: Before paying off your debt, credit the payable and debit the purchased item.

Keep in mind that you also need to make another journal entry when you pay your invoice. This second entry shows that you’re decreasing your Accounts Payable account.

Debit your Accounts Payable account. And, credit a cash-related account to reflect your decrease in money from making the payment (e.g., Cash or Checking account).

Recap: After paying off your debt, debit the payable and credit a money account.

AP journal entries: Example

Let’s say you bought $100 worth of supplies on credit. Make the following journal entry to reflect your increase in AP and supplies.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Supplies | 100 | |

| Accounts Payable | 100 |

You pay off the $100 debt with cash. Now, make another journal entry showing a decrease in your AP account and your Cash account.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Accounts Payable | 100 | |

| Cash | 100 |

Tips for managing your AP

You have a lot to juggle as you run your business. AP process improvement makes paying vendors easier. And, it can get you back to working on revenue-generating tasks.

Here are five tips for managing payables:

Tip 1: Establish an AP system

Record each invoice using the same method in your books. Set up a system for accounts payable and track your unpaid invoices. Make it clear who you owe, how much you owe, and when the money is due.

Consider using accounting software to streamline your responsibilities.

Tip 2: Look for discount opportunities

Pay attention to early payment discounts from your vendors. Some vendors give money off the total bill for sending early payments.

These discounts can add up. Before paying early, check your bank account to see if you will have enough money left over to operate efficiently.

Tip 3: Set up reminders

Set reminders for invoice due dates to alert yourself when payables are due. This will help you avoid late payments and better manage small business cash flow.

Make a habit of checking payable due dates on a regular basis.

Tip 4: Update your contact information

Keep your contact information current so your vendors can find you. Make sure your website, business card, and other public listings have the correct addresses and phone numbers. When a vendor takes your information, verify that it is accurate.

Tip 5: Maintain vendor relationships

As a business owner, try to maintain good relationships with vendors. Create a reputation of paying your invoices on time.

If you can’t make a payment on time, talk with your vendor to negotiate payment terms. You might be able to go on a payment plan where you pay the money owed in installments.

Do you know there’s an easier way to track your business’s transactions than a spreadsheet? Patriot’s online accounting can streamline everything from recording transactions to generating financial statements. We offer free, USA-based support and a free trial … what do you have to lose? Get started today!

This article has been updated from its original publication date of August 16, 2012.

This is not intended as legal advice; for more information, please click here.