Quick: Off the top of your head, how much money is your business bringing in? How much are you spending? At some point, investors, lenders, and (cough) you will need to know. But don’t panic when someone asks about your company’s revenue and expenses. Just whip out your income statement. What is an income statement, you ask?

Your business’s income statement is key to knowing your financial health, getting investments or loans, and so much more. In this article, we’ll go over:

- What is an income statement?

- Parts of the income statement

- How to prepare an income statement

- Income statement example

What is an income statement?

An income statement is a report of your business’s profits and losses over a specific period. It is also called a profit and loss statement (P&L). You can use the income statement to summarize monthly, quarterly, or annual operations.

The purpose of income statements is to show the profitability of your business. That way, you can avoid spending more than you can afford. Use the P&L to see whether you have a net income (yay!) or loss (boo) for the time period on the last line of your income statement. This is known as your company’s bottom line.

The income statement isn’t the sole report you should use to get financial insight into your business. There are three main financial statements:

- Income statement

- Balance sheet

- Cash flow statement

The balance sheet reports on your business’s assets, liabilities, and equity. The cash flow statement reports your company’s incoming and outgoing money to show you how much cash you have on hand. Unlike the balance sheet and cash flow statement, the income statement shows you whether your business has a net profit or loss during a period.

How to use an income statement in business

So, what are income statements used for? Why’s it such a big deal to make income statements in your business?

You can use a P&L to:

- Compare year-over-year (YOY)

- Make changes to your budget

- Measure your strength in sales

- See how much leftover money you have

- Determine what expenses to cut back on

- Secure investments or loans

- Ask your accountant for their advice on making your business profitable

After you generate an income statement, don’t let the information sit on a digital shelf. Use the data for decision-making in your business.

Parts of the income statement

So, what is on an income statement? The income statement format can vary, depending on your business. But, all income statements begin with sales and end with your business’s net income or loss.

Parts of the profit and loss statement include:

- Revenue (income)

- Cost of goods sold

- Gross profit

- Operating expenses

- Taxes and interest

- Net income or net loss

Revenue (income)

Your income statement’s first section is the amount of revenue (i.e., income) your business generated via selling goods or providing services.

Remember to subtract returns and sales discounts from the total amount you earn from sales.

Cost of goods sold

Include your company’s cost of goods sold (COGS) as the next part of your income statement.

COGS include the cost of producing your goods or performing services (e.g., raw materials and direct labor expenses).

Gross profit

Gross profit is the amount you’re left with after subtracting COGS from your business’s revenue. Use the gross profit formula to get your total:

Gross Profit = Revenue – Cost of Goods Sold

Unlike net profit (the bottom line of the P&L), gross profit shows you your company’s profit before subtracting expenses. If you have a healthy gross profit and a significantly lower net profit, you can make expense-cutting decisions.

Operating expenses

How much did you spend on XYZ during the period? Include your company’s various operating expenses on the income statement. Operating expenses are the costs your business incurs during daily operations.

Examples of operating expenses include:

- Employee salaries (not including direct labor)

- Office supplies

- Rent

- Insurance

- Utilities

After you list out your business’s expenses, calculate your total costs during the period.

Taxes and interest

Owing taxes and interest comes with owning a business. The parts of the income statement before taxes and interest show your company’s EBIT, or earnings before interest and taxes.

Net income or net loss

The last line of the income statement tells you how much of a profit or loss your business has during the time period. If the number is positive, the last line should read net income or net profit. If the number is negative, it should read net loss.

Knowing whether you have a net profit or loss determines the changes you need to make in your business. When you have a net loss, work on cutting back expenses and increasing sales. And if you have a net profit, dig into what worked.

How to prepare an income statement

Before you can use the information on your income statement, you need to know how to prepare it.

To prepare an income statement, you need to:

- Understand the common sections to include (check! See above)

- Keep detailed records so you can pull the data

- Decide how to create your P&L (by hand or using software)

Preparing your P&L by hand: If you decide to create your P&L by hand, you can use income statement templates to get the ball rolling. Keep in mind that you must manually enter your company’s revenue, COGS, and expenses during the period and make calculations yourself.

Generating your P&L via software: If you opt for accounting software, you can generate your business’s income statement in a matter of seconds—as long as you have the data in your account for it. And since accounting software streamlines the way you track and manage your business’s incoming and outgoing money, it’s easy to keep up-to-date records.

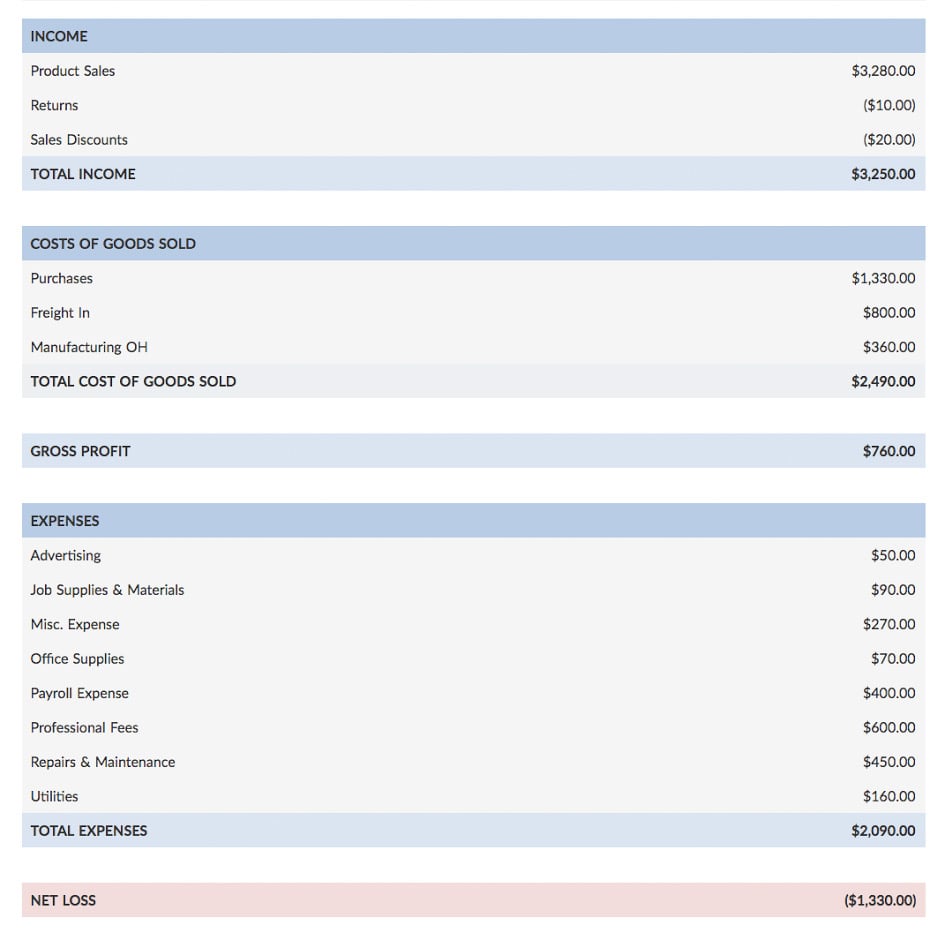

Income statement example

Need a visual to bring home the income statement concept? Here’s a simple income statement you can refer to:

In this example of income statement, the business has a net loss for this time period. The business owner can use this information to cut back on expenses and work toward increasing product sales.

This article has been updated from its original publish date of 11/11/2014.

This is not intended as legal advice; for more information, please click here.