Filing taxes can be a bear. Between deadlines, line items, and completing forms, there is a lot of information to know. And whether it’s your first time filing taxes for small business or you’re a seasoned business owner, you may have some questions. So if you’re looking for answers on how to file a business tax return, keep reading.

What is a business tax return?

If you own a business, you need to file a company tax return. A business tax return reports your company’s income, tax deductions, and tax payments. All businesses must file tax returns. And, you are responsible for filing your return annually with the IRS to calculate your business’s tax liability.

The specific form you file depends on your type of business entity and which deductions you claim on the return. For example, you may be able to claim the home office tax deduction by attaching Form 8829, Expenses for Business Use of Your Home, depending on your business.

How to file a business tax return

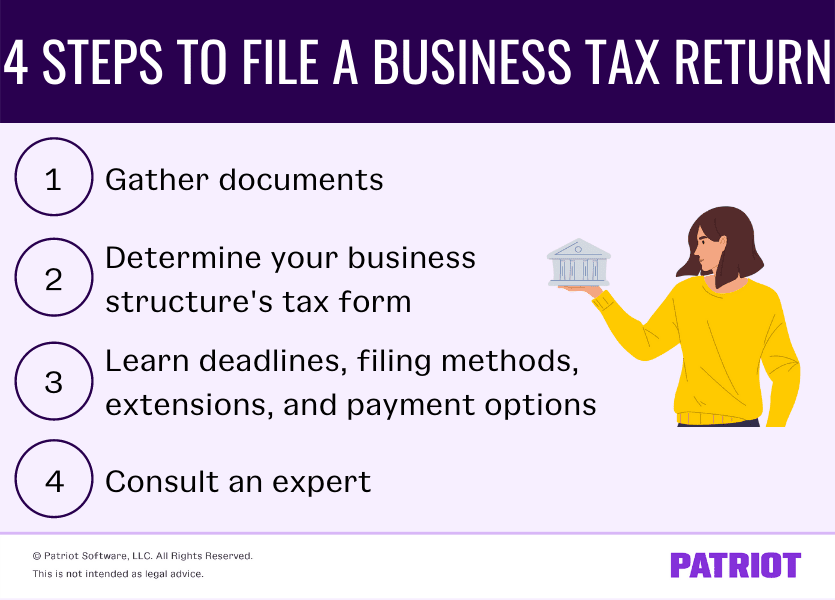

Again, tax return forms vary by business structure. But, the general process includes four standard steps:

- Gather documents

- Determine your business structure’s tax form

- Learn deadlines, filing methods, extensions, and payment options

- Consult an expert

1. Gather documents

How to file business taxes also depends on the information you have, not just your business structure. Before you begin the process, gather the necessary documents to help you fill out your business tax filing form(s):

- Taxpayer identification number (TIN)

- Financial records

The reports are easy to find if you’re using accounting software to organize your bookkeeping throughout the year. Using another method (e.g., spreadsheets) or an accountant? Find or request the documents you need.

Remember to update your books throughout the year to prevent end-of-the-year scrambling.

Taxpayer identification number

You must identify your business on your tax return. Include your business’s nine-digit taxpayer identification number when filing returns. There are several types of TINs, including Social Security numbers and Employer Identification Numbers (EINs).

If you have employees or structured your business as a corporation or partnership, you must have an EIN. You can apply for an EIN through the IRS’s website.

Did you lose your tax identification number? First, look through old documents that might contain your TIN, such as a past tax return or statement. If you still can’t find your TIN, contact the IRS.

Financial records

Before filing your return, you need complete financial records, such as financial statements and supporting documents (e.g., receipts).

The financial statements accurately report your business’s income and expenses on your tax return. Some of the records you should gather include income statements, balance sheets, and supporting documents, such as receipts.

Income statement: Shows the business’s revenue and expenses throughout the year. Use your income statement to complete the income section of your company tax return. And, claim write-offs, such as the business loan interest tax deduction, by using the expenses portion of the income statement.

Balance sheet: Shows assets, liabilities, and equity. Report your annual income from business operations using the balance sheet.

Supporting documents: Any documents that support the information in your other financial records. In case of an audit, supporting documents back up the claims on your tax returns.

2. Determine your business structure’s tax form

Got your paperwork ready to go? Great! Now, you need to know which form to file. Remember that individuals use Form 1040, U.S. Individual Income Tax Return, to file their personal taxes. But, what forms should your company use?

Each type of structure uses a different form to report profits and losses:

- Sole proprietorships: The sole proprietor tax return is Schedule C, Profit or Loss From Business. Attach Schedule C to your personal income tax return.

- Partnerships: The partnership tax return is Form 1065, U.S. Return of Partnership Income. IRS Form 1065 is an information return that must be filed by the partnership and all members of the partnership with their Form 1040. The partnership also distributes Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc., to all partners. Partners use Schedule K-1 to complete parts of their individual returns.

- Corporations: Most corporations (e.g., C Corp tax return) use Form 1120, U.S. Corporation Income Tax Return, to file their company tax returns. However, the S Corp tax return uses Form 1120-S, U.S. Income Tax Return for an S Corporation.

- Limited liability companies (LLCs): An LLC’s tax return depends on how the business is taxed. When setting up an LLC, owners choose if they want the LLC to be taxed as a corporation. If taxed as a corporation, LLCs must use Form 1120. Otherwise, single-member LLCs file Schedule C, and multi-member LLCs file Form 1065.

3. Learn deadlines, filing methods, extensions, and payment arrangements

After you complete the tax forms, you must file the forms with the IRS. Like with the type of form you file, your tax filing due date depends on your business structure.

Deadlines

Some years, the deadline falls on a weekend or holiday. If the tax return deadline falls on a weekend or holiday, your deadline is the following business day.

March 15:

- Partnerships and multi-member LLCs must file Form 1065 with the IRS and distribute Schedule K-1 to partners

- S Corps must file Form 1120-S

April 15:

- Sole proprietors and single-member LLCs submitting Schedule C

- Corporations that end their year on December 31 must submit Form 1120

If you own a corporation with a tax year that ends on a date other than December 31, your due date is the 15th day of the fourth month after the end of your tax year. However, if your fiscal tax year ends on June 30, you must file Form 1120 by the 15th day of the third month after the end of your tax year (i.e., September 15).

Filing methods

You can file your small business tax return by mail or through the IRS’s e-File system. Depending on your business, you might be required to e-File. And, you can make tax payments through the IRS’s Electronic Federal Tax Payment System (EFTPS).

Extensions

Consider filing a business tax extension if you need to push back your tax return deadline.

If you file Form 1065, you may also request a six-month extension on Schedule K. However, the six-month extension does not change the date you must distribute tax form K-1 to all applicable individuals (i.e., March 15).

Payment arrangements

If you are unable to pay your taxes, contact the IRS to make payment arrangements.

4. Consult an expert

Still unsure of how to file your business taxes? You’re not alone. Consider hiring an accountant or other tax professional to help you prepare and file your tax returns. Professional advisors can help you accurately file, deduct write-offs, and claim deductions.

This article has been updated from its original publication date of November 29, 2016.

This is not intended as legal advice; for more information, please click here.