When you first start a business, the last thing you’re thinking about is leaving it. But, life gets in the way of plans. That’s why you need an exit strategy before starting your small business. Exit strategies help make sure you, your business, and investors are protected.

There are a number of exit strategies for small business you might consider. The path you choose depends on a unique set of circumstances, like business size.

What is a company exit strategy?

An exit strategy, or plan, outlines how a business owner plans on selling their investment in their business. Exit strategies help business owners have an out if they want to sell or close the business. Entrepreneurs must create a business exit plan before starting a business and tweak it as the business grows and the market changes.

So, where does your strategy go? Include your exit strategy in the financial section of business plan.

You especially need a strong exit strategy if you plan on seeking small business financing. Investors and lenders want to know that their money is protected if your business fails.

If nothing else, the central question your business’s exit plan needs to answer is:

- How will you protect business investments and limit losses?

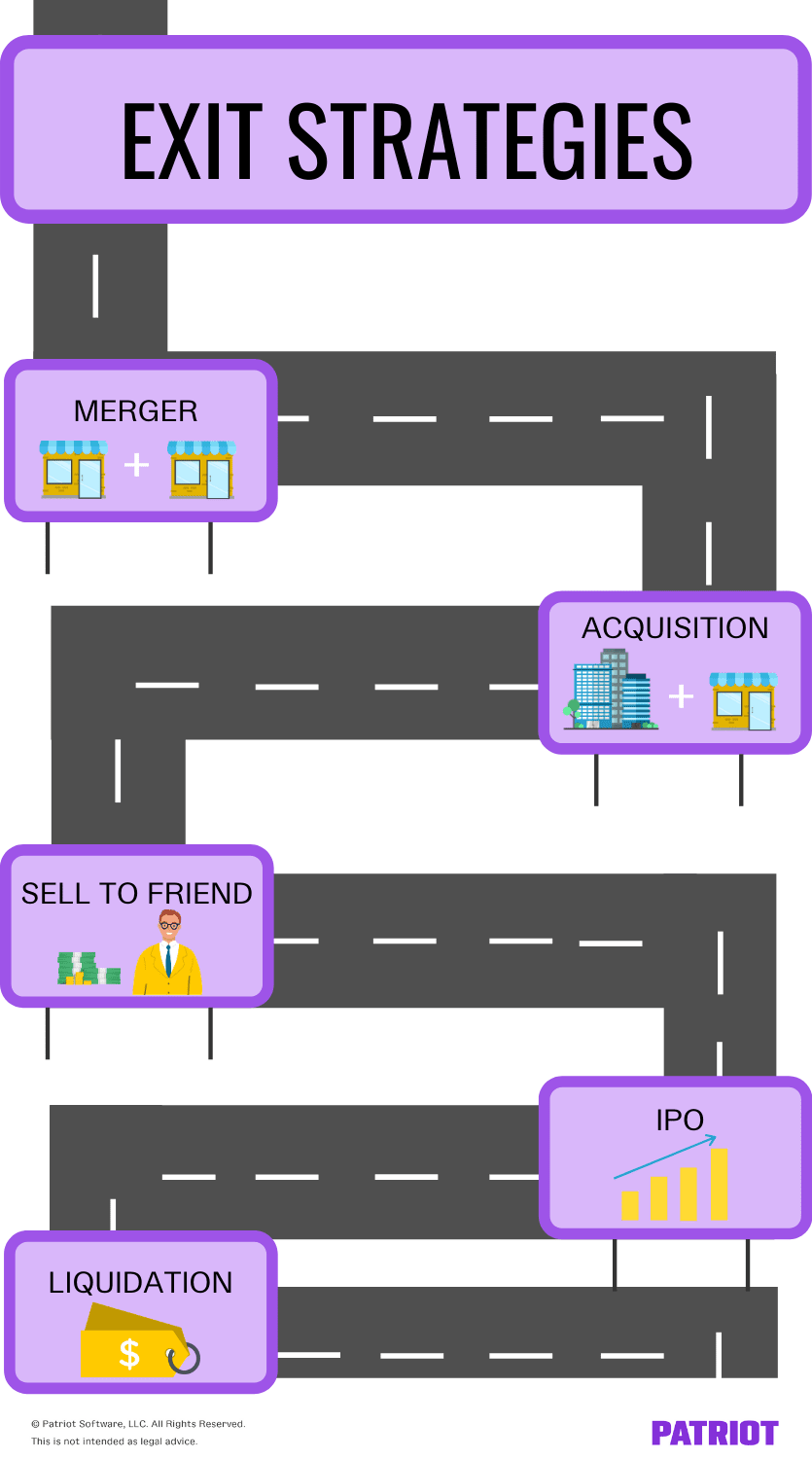

Small business exit strategies

Whether you’re writing your business plan for the first time or updating it, take a look at these types of exit strategies. Remember to weigh the pros and cons of each to determine if it’s feasible.

1. Merger

In a merger, two businesses combine into one. Mergers increase your business’s value, which is why investors tend to like them.

To go through with a merger, you still need to be a part of the business. Through a merger, you will be an owner or manager of the new business. Your employees might be employed by the new merged business. But if you want to sever your ties with your business, a merger is not the best exit strategy for you.

There are five main types of mergers:

- Horizontal: Both businesses are in the same industry

- Vertical: Both businesses that are part of the same supply chain

- Conglomerate: The two businesses have nothing in common

- Market extension: The businesses sell the same products but compete in different markets

- Product extension: Both businesses’ products go well together

Before you merge businesses, make sure that the new business is a good fit with your current one. You could end up losing revenue otherwise.

2. Acquisition

An acquisition is when a company buys another business. With an acquisition exit strategy, you give up ownership of your business to the company that buys it from you.

One of the positives of going with an acquisition is that you get to name your price. A business might be apt to pay a higher price than the actual value of your business, especially if they’re a competitor.

But if you’re not ready to let go of your business, an acquisition might not be the right exit strategy for you. You may need to sign a noncompete agreement promising not to work for or start a new business similar to the one you just sold.

There are two types of acquisition: friendly and hostile. If you have a friendly acquisition, you agree to be acquired by a larger business. However, a hostile acquisition means that you do not agree. The acquiring business purchases stakes to complete the acquisition.

If an acquisition is your exit strategy, your acquisition should be friendly. You likely will attempt to find an acquiring business that you want to sell to.

3. Sell to someone you know

You may want to see your business live on under someone else’s ownership. In many cases, you can sell to someone you know as an exit strategy.

Take a look at some of the people you could sell your business to:

- Family member (e.g., child)

- Friend

- Employee

- Business colleague

- Customer

Before selling your business to someone you know or are acquainted with, consider the drawbacks. You don’t want to jeopardize personal relationships over your business. Disclose things like liabilities and the profitability of your business before a family, friend, or acquaintance buys it from you.

4. Initial public offering

An initial public offering, or IPO, is the first sale of a business’s stocks to the public. This is also known as “going public.”

Unlike a private business, a public business gives up part of their ownership to stockholders from the general public. Public businesses tend to be larger. They also (generally) go through a high-growth period. By taking your business public, you can secure more funds to help pay off debt.

However, going public might be difficult for small businesses because it costs a significant amount of time and money. If you want a fast exit strategy, an IPO might not be the way to go.

To start an IPO, you need to find an investment bank, collect financial information, register with the Securities and Exchange Commission (SEC), and come up with a stock price.

5. Liquidation

Another exit strategy for small business is liquidation. With liquidation, business operations end and your assets are sold. The liquidation value of your assets go to creditors and investors. However, your creditors—not your investors—get first dibs.

Liquidation is a clear-cut exit strategy because you don’t need to negotiate or merge your business. Your business stops and your assets go to the people you owe money to.

If you liquidate your business, however, you lose your business concept, reputation, and your customers. Your business will not live on like in other exit strategy options.

How to write an exit strategy business plan

Again, you must include your exit strategy at the end of your business plan. That way, you can reference it if your business starts going south. And, potential investors can determine if you have a strong plan in place to protect their money if you leave.

When coming up with your exit strategy, consider the following factors:

- Your business structure

- Your business size

- The economy

- Profitability

- Entrepreneurial family members or friends

- Competitors

- Time

Here is an exit strategy example you might include in your business plan:

- Our preferred exit strategy is to merge with another local small business. The business plan supports the possibility of a merge. We believe a product extension merger would be our target exit strategy, but we are also open to a horizontal merger.

Keep in mind that you will update your business plan and exit strategy as your company goals change.

For example, your original exit plan may have been to merge with another business. But after 25 years of owning your business, your daughter says she wants to buy it from you. If you decide to sell instead of merge, update your business plan to reflect your new exit strategy.

Need help staying organized in your small business? Patriot’s online accounting software makes tracking your expenses and income a snap. Keep solid records to have an accurate picture of your business’s financial health. Try it for free today!

This article has been updated from its original publication date of December 27, 2016.