As a business owner, you have the important task of choosing an accounting method to record transactions. One method you can use is accrual accounting. And depending on your business, you may have to use the accrual accounting method to record incoming and outgoing money. So, what is accrual accounting?

What is accrual accounting?

Accrual-based accounting is one of the three accounting methods you can use to record business income and expenses.

The accrual basis is the most complex accounting method. To use the accrual method of accounting, you typically need to have some basic accounting knowledge.

The accrual accounting method uses more advanced accounts, such as:

- Accounts payable

- Long-term liabilities

- Inventory

- Current and fixed assets

- Accounts receivable

In addition to the above accounts, the accrual method uses standard accounts, such as cash, equity, income, and cost of goods sold (COGS).

With the accrual method, you must record income when your transaction takes place, with or without the transfer of money. And, record expenses when you’re billed.

Keep track of money you owe and owed to you. Record accounts receivable to determine funds due from customers and accounts payable for funds you owe to vendors.

Accounts payable

Accounts payable (AP) is money your business owes to other businesses, individuals, and organizations. With accounts payable, you can keep track of credit others have extended to you. Each AP entry is called a “payable.” Payables represent outstanding invoices you need to pay.

For example, say you buy supplies from a vendor and receive an invoice for $100. When you receive the invoice, record the amount as a payable in your books so that your records show your business owes the vendor $100.

Accounts receivable

You might extend credit to customers instead of requiring payments at the time of the sale. Accounts receivable (AR) comes into play when you extend credit to your customers.

Accounts receivable is money owed to your business, but not yet paid. Accounts receivable helps you keep track of credit you extend to customers. An AR entry is called a “receivable.” Your AR entries represent outstanding customer invoices. Record receivables as soon as you make a sale, not when you receive a payment from a customer.

Say you provide a service for a customer and send them an invoice for $250. When you send the invoice, record the $250 as a receivable in your books to show that the customer owes you money.

Double-entry bookkeeping

With accrual accounting, use double-entry bookkeeping to record income and expenses. For double-entry bookkeeping, record two entries for every transaction your business makes. The two entries are equal and opposite.

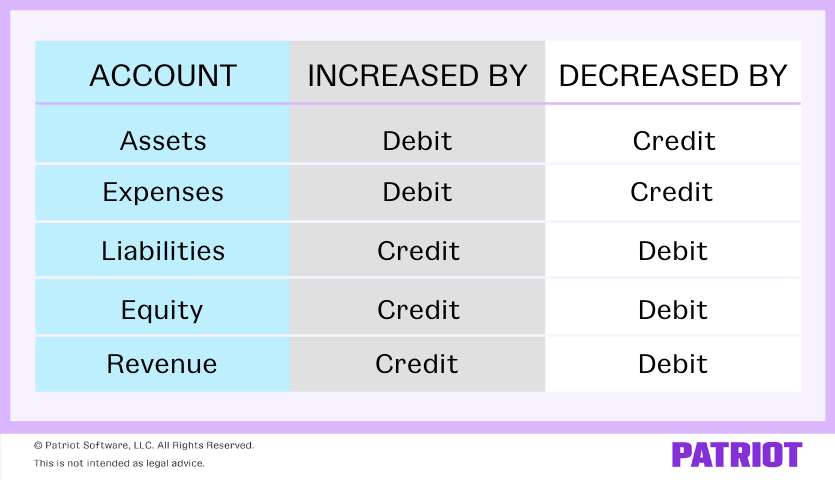

One entry increases an account and the other entry decreases an account. You increase and decrease accounts by recording debits and credits. Some accounts are increased by debits, while others are increased by credits. Check out the chart below to see how certain accounts are affected by credits and debits:

Let’s say you sell a product to a customer and give them an invoice. With the accrual method, record the income when the customer receives your invoice.

Income is an asset since it adds value to your business. Income increases your assets. Because assets are increased by debits, debit the income in your books.

After debiting the income, you need to make another entry. When you sell a product, you lose inventory. Inventory is another asset. The loss of inventory decreases your assets. Assets are decreased by credits, so you must credit the inventory to have two equal and opposite entries in your books.

Accrual accounting rules to keep in mind

As mentioned, certain businesses must use accrual accounting for recordkeeping. So, which companies have to use the accrual method?

Whether or not you’re required to use accrual accounting depends on your business’s average sales. You must use the accrual method if your company has more than $5 million in average sales.

If you don’t make more than $5 million in sales, you can still choose to use the accrual method for your business records. Keep in mind that accounting accrual basis is more complex than the other methods and has more of a learning curve. Before you decide to go the accrual route, weigh the advantages and disadvantages of accrual accounting.

Pros and cons of accrual accounting

Weigh the pros and cons of the accrual basis of accounting before you make any decisions.

Pros of the accrual method

Check out some of the advantages of the accrual accounting method:

- Gives you an accurate snapshot of your business’s overall cash flow

- Shows you a clear picture of your income and expenses to help you make smart financial decisions

- Provides better long-term financial view

- Gives you the option to defer income on your tax return for a potentially larger tax break

Cons of the accrual method

Here are a few disadvantages of accrual accounting:

- More complex than other accounting methods

- Doesn’t show clear image of cash on hand

- Can be more time consuming for beginners

Other accounting methods

The accrual method of accounting isn’t the only bookkeeping option for business owners. Here are two other methods you can use:

- Cash-basis accounting

- Modified cash-basis accounting

Cash-basis accounting

There are many differences between cash vs. accrual accounting. Cash-basis accounting is the simplest accounting method and does not require extensive accounting knowledge. Unlike accrual accounting, the cash-basis method only uses cash accounts, such as equity, income, expense, and (of course) cash.

With cash-basis accounting, you can’t track things like long-term liabilities, current assets, accounts payable, and accounts receivable. Generally, you can’t use cash-basis accounting if you need to track inventory, fixed assets, or loans.

With cash-basis accounting, record income when you receive it. And, report expenses when you pay them.

Modified cash-basis accounting

Modified cash-basis accounting, or the hybrid method, is a mixture of accrual and cash-basis accounting.

Like cash-basis accounting, record income when you receive it, and record an expense when you make a payment. And like accrual accounting, modified cash-basis also uses double-entry accounting.

With modified cash-basis, you can record short- and long-term items. The hybrid method uses both cash and accrual accounts instead of just cash accounts, so it can be more complex than cash-basis accounting.

Accounting can be complex. But, accounting software shouldn’t be. That’s why Patriot made its online accounting software easy-to-use and affordable for business owners just like you. Simplify the way you record transactions in your books by starting a free trial today!

This article has been updated from its original publication date August 24, 2012.

This is not intended as legal advice; for more information, please click here.