As an employer, it’s your responsibility to store records in an employee personnel file. From new hire documents to payroll information, there are a variety of documents (and some confidential information) you need to securely store and have on hand. So, what should be in an employee file?

What should be in an employee file?

Keeping employee documents is a must if you want to stay organized, meet legal requirements, and make decisions (e.g., raises). But legally, you can’t lump all of your employee records in one file—even if it’s for the same employee. There are some requirements for separating information by personnel file. Not to mention, you may need to store some records longer than others.

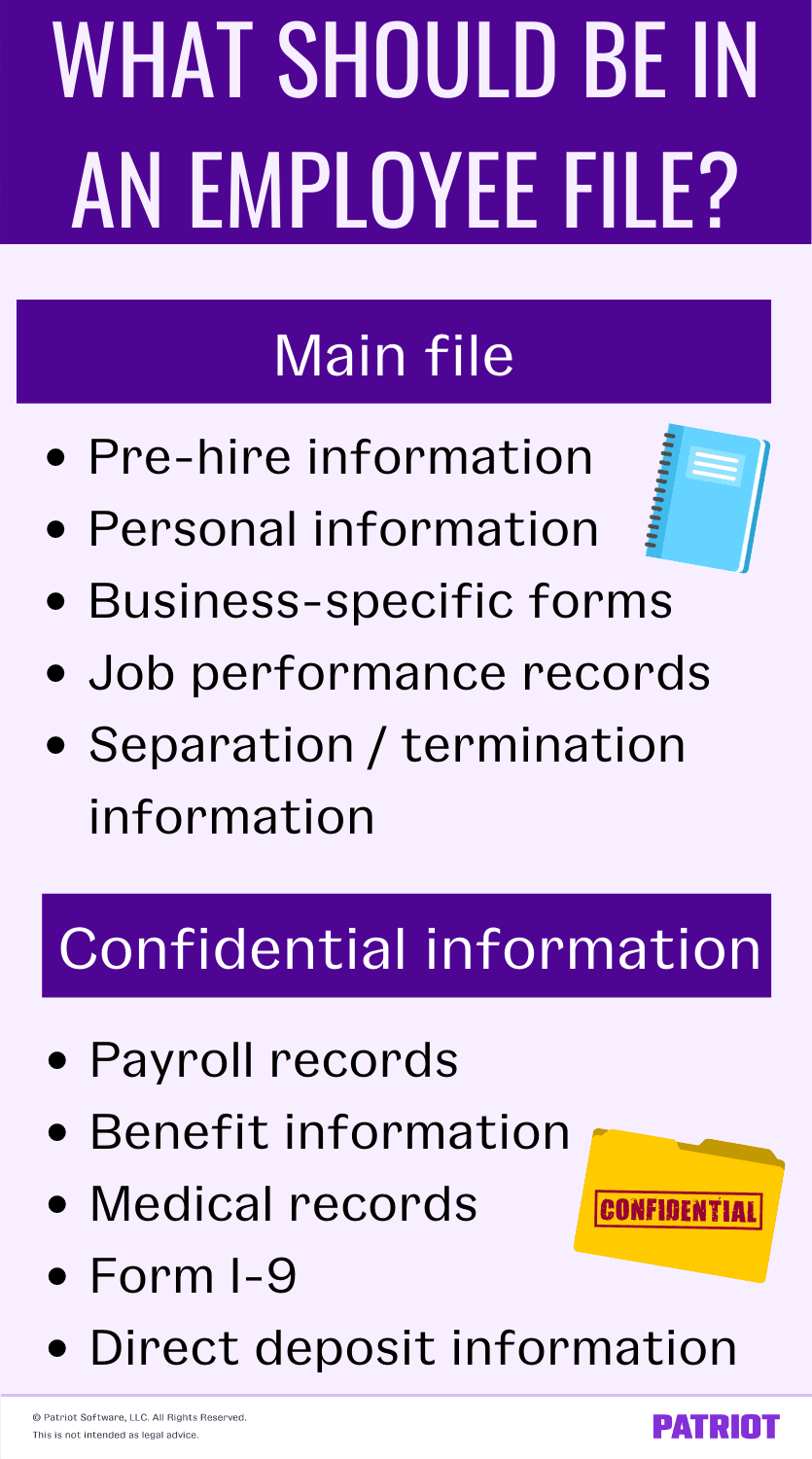

There are a variety of different documents you need to store for each employee. And depending on the type of file and whether it’s confidential, you may need to keep it separate from other files. Here’s what you should typically keep in each employee file:

- Main file

- Pre-hire information

- Personal information

- Business-specific forms

- Job performance records

- Separation / termination information, if applicable

- Confidential information

- Payroll records

- Benefit information

- Medical records

- Form I-9

- Direct deposit information

Main employee personnel file

Keep an employee file for each employee, including terminated employees. The main employee file should not contain any confidential information or forms, such as the employee’s Social Security number or Form I-9. Instead, those go into separate files (which we’ll cover later).

The employee’s main file should contain basic information, like the pre-hire information and signed acknowledgment forms. Take a look at what you should include in an employee’s main file below.

Pre-hire information

When you hire an employee, it’s best to store certain pre-hire information for each worker. That way, you can refer back to it, if needed. When you go through the interview and hiring process for a candidate, you generally collect the following information from them:

- Job application

- Resume

- Interview notes

- References

- Letters of recommendation

When you hire an employee, keep the above information securely stored in the employee’s personnel file. Also, hold onto other hiring documents (e.g., offer letter), and keep them separate from pre-hire information. And, keep in mind that some hiring forms and information should be kept confidential (e.g., Form I-9).

Personal information

Although you shouldn’t keep personal information, like an employee’s SSN, in an employee personnel file, you should keep some personal information readily available.

A couple pieces of personal information you can store in an employee personnel file include:

- Employee contact information (name, address, and phone number)

- Emergency contact details

Business-specific forms

Depending on your business, you may require employees to sign certain acknowledgement forms when they begin working for you. You should keep these signed documents in each employee personnel file for safekeeping.

Here are some acknowledgement forms you may need to collect and store:

- Employee handbook

- Signed contracts or other agreements

- Policy changes

Job performance

A section of your employee’s file should include information about their job performance. To help gauge your employees’ performances, keep the following records for each employee:

- Job description

- Performance evaluations and reviews

- Attendance records

- Job changes and promotions

- Training information

- Warnings and/or other disciplinary actions, if applicable

Separation / termination information

If you terminate an employee or an employee leaves your company, make sure to keep record of it in the worker’s personnel file. If you and an employee part ways, store the following information in their record:

- Exit interview

- Termination information (e.g., reason why employee left or was terminated)

- Last day of employment

- Employee resignation letter, if applicable

- Other exit paperwork

Confidential information

Again, some employee files are confidential and need to be kept separate from the main files. To comply with federal laws, do not keep confidential employee information with the employee’s main file. Instead, keep the records in a separate and secure location. That way, they won’t get into the wrong hands.

Records you should keep confidential includes:

- Payroll records

- Benefit information

- Medical records

- Form I-9

- Other miscellaneous confidential records

Payroll records

Employee payroll records include anything that has to do with paying an employee. This can include:

- Pay rate

- Overtime earnings

- Additional wages, like bonus pay and commissions

- Pay stubs

- Withholding tax forms (e.g., Form W-4 and state W-4 form)

- Expense reimbursement information

- Raise documentation

- Pay periods for wages paid

- Payroll history

- Wage garnishments

- Time cards

- Hours worked

- Remaining time off

Because payroll records are chock-full of personal information, keep them separate from other employee files.

Benefit information

If you offer employee benefits at your business, you need to store the records in a confidential file. And, you need to keep them separate from other files (e.g., payroll records).

If you offer benefits to your employees, store the following information in each employee’s record:

- Benefit information (e.g., health, vision, dental, etc.)

- Enrollment forms for benefits

- Declination forms for benefits

Medical records

The Americans with Disabilities Act (ADA) requires that employee medical records remain separate from other employee records. Keep each employee’s medical records a part from their main file, including:

- Family Medical Leave Act (FMLA) forms and requests

- Doctor slips

- Medical exams

- Leaves of absence

- Workers’ compensation claims

- Disability claims

- Accommodation requests

- Drug test results

- Injury records

Form I-9

Form I-9, Employment Eligibility Verification, is a form that confirms your employees are legally allowed to work in the United States. When you hire an employee, you collect this form and review I-9 documents, along with other new hire paperwork, like Form W-4.

The U.S. Citizenship and Immigration Services (USCIS) recommends you keep Forms I-9 separate from the main file and confidential file. Store all your employees’ Forms I-9 in one file so you have easy access to all of them in the case of an inspection.

Miscellaneous confidential records

In addition to keeping the above files separate from other documentation, you may need to confidentially store other employee records, such as:

- Direct deposit forms and banking information

- Background checks

- Investigation records

- Employee Equal Opportunity (EEO) records (e.g., self-identification forms)

Why do you have to keep employee records?

So, what’s the big deal about keeping employee records, anyway? Well, in some cases, it’s required by law. And in other cases, it can be good to just have the information at your fingertips. Take a look at a few reasons why keeping tidy employee files is oh-so-important.

1. Helps with decision making

Employers need to make decisions like promotions, raises, and demotions. Having employee records like performance reviews, time and attendance records, and similar information helps make those decisions easier.

2. Keeps you compliant with federal, state, and local laws

You are required to comply with certain federal, state, and local regulations as a business owner. For example, the IRS and FLSA require you to keep payroll-related information for a designated amount of time.

To stay compliant with laws, keep information like tax withholding, wage information, and other related forms on hand.

3. Organizes your records

Generally speaking, you must keep employee records to stay organized. Your employees sign off on a lot of different forms during the onboarding process and open enrollment.

If you lose these records, you no longer have proof that your employees acknowledged agreements. If there is a lawsuit or IRS audit, you could face penalties, fines, and court fees without proof of employee acknowledgments.

Storing employee records helps keep all of these documents nice and organized, just in case you need them later on.

How to organize employee personnel file

To organize and store employee personnel records, you can store paper files or have paperless records. Regardless of how you store your records, make sure they are secure (especially the confidential records).

Keep paper files in a safe location, like a locked filing cabinet, and limit who has access to the paper copies. Make sure each employee has their own file so you don’t mix up records. And of course, separate the main employee files from the confidential files.

If you’re not a fan of the idea of storing paper documents, you can go the paperless route instead. Keep paperless employee files by scanning and uploading paper documents to a device, such as a computer. If you use HR software, you may be able to securely store your employee files in the cloud and have automatic back up for your files.

Whatever you do, make sure you have a way to back up your files in case they get damaged or lost (think a flood or your computer crashing).

Can employees access their own files?

At some point, your employees might want access to their employee files. Most states have specific laws regarding the employee’s legal rights to access their files and make copies of documents.

For the most part, employees are allowed access to their files if they make a request. Check your state’s labor department to learn about your requirements and for specific rules.

How long do you need to keep employee files?

By law, you are required to keep employees files for a certain amount of time. The length of time can vary based on the type of record and your state’s recordkeeping requirements. Here is how long you typically need to keep employee files:

- Pre-hire records: One year after you hire someone is the federal standard (including candidates that you don’t hire). Many states require you to keep pre-hire documentation for at least three years

- Background check information: One year

- Payroll records (e.g., wages paid): Three years

- Time cards and work schedules: Two years

- Performance-related information: One year after the employee leaves the company

- Medical records: Three years after the employee leaves the company

- Benefit records: Three years after the employee leaves the company

- Form I-9: Three years after an employee is hired or one year after their employment ends, depending on which is later

- Employment tax documents (e.g., Forms W-4): Four years

- Accident and injury records: Five years

- Separation / termination records: One year

You can keep records for longer than the required amount of time. After all, you can never be too careful. For example, you must keep payroll records for at least three years. But, you can keep them even longer if you’d like.

Keep in mind that some of the above time frames may be longer or shorter depending on your state’s requirements. Check with your state for more information about how long to keep employee files.

On the hunt for a simple and secure way to store your employee files? Patriot’s HR software add-on to our online payroll is the perfect solution. With Patriot’s HR, you can keep all of your employee records and documents securely organized online. And, did we mention that it integrates with our payroll software? Try both for free today!

This article was updated from its original publication date of November 25, 2015.

This is not intended as legal advice; for more information, please click here.