Let’s face it: paying taxes isn’t anyone’s favorite part of running their own business. The process can be time-consuming and filled with confusing paperwork. But, what if there was a way to make paying your federal taxes simple and fast? The good news is that the IRS has an EFTPS system that does just that—and it’s free. So, what is EFTPS, and what can you do with it? Keep reading to learn all about EFTPS.

What is EFTPS?

In 1996, the U.S. Department of the Treasury created the EFTPS website for businesses and individuals to pay their federal tax payments electronically. But, what does EFTPS stand for? EFTPS stands for the Electronic Federal Tax Payment System. The site allows the following individuals or organizations to process federal tax payments:

- Businesses

- Individuals

- Federal agencies

- Tax professionals

- Payroll services

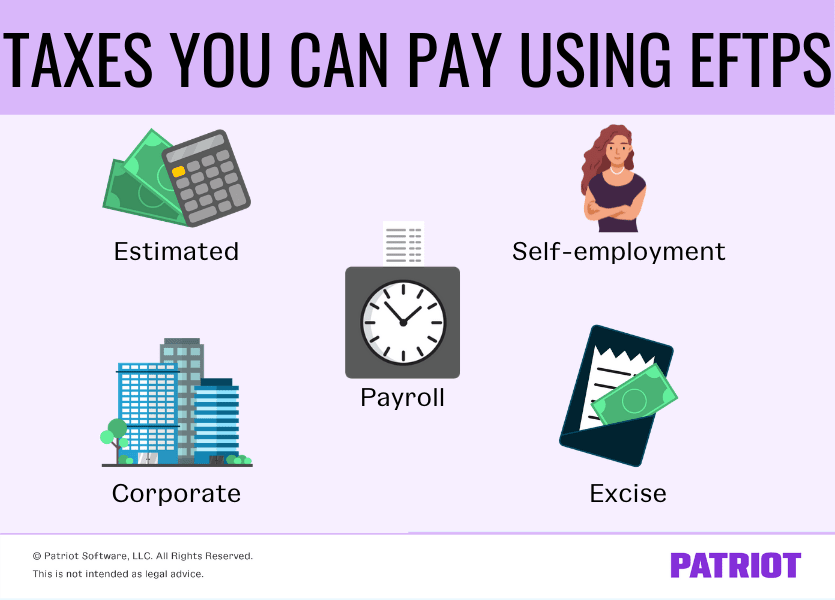

Taxes you can pay using EFTPS

You can pay all federal taxes using the Electronic Federal Tax Payment System. Take a look at the most common federal tax payments small business owners make.

Payroll taxes: You must withhold and remit payroll taxes if you are an employer. Some of the taxes you withhold from your employees include income, Social Security, and Medicare taxes. Because Social Security and Medicare taxes are under the Federal Insurance Contributions Act (FICA), you must also contribute a matching employer portion for FICA taxes. In addition to income and FICA taxes, you also typically need to pay into the Federal Unemployment Tax Act (FUTA) and state unemployment taxes (SUTA) as an employer. You can pay FICA, federal income, and federal unemployment taxes through EFTPS.

Estimated taxes: Unlike an employee, self-employed individuals do not have taxes withheld from income. Instead, you make estimated tax payments for your federal income tax liability if you’re self-employed. Self-employed individuals can make estimated tax payments weekly, monthly, or quarterly using EFTPS.

Self-employment tax: Unless you are incorporated (e.g., corporation), you must pay self-employment tax. Self-employment tax includes Social Security and Medicare taxes.

Corporate taxes: If your business is a corporation, you can use EFTPS to pay your federal corporate taxes.

Excise tax: The federal government has excise taxes for certain goods, such as gasoline and alcohol. If your business sells these types of goods, you may need to collect excise tax from customers at the point of sale. You can use EFTPS to pay the federal excise taxes online or over the phone.

How do you use EFTPS?

So, how does EFTPS work? With the IRS EFTPS, you can sign in 24 hours a day, seven days a week, 365 days a year to make or schedule federal tax payments. The system allows you to schedule payments up to one year in advance.

EFTPS online ensures security through a password, personal identification number (PIN), and Taxpayer Identification Number (TIN). If you are a business rather than an individual, use your Federal Employer Identification Number (FEIN) as your TIN. A TIN can also be your Social Security Number (SSN).

If you need to process a tax payment over the phone, you can use the EFTPS voice response system. When using the phone to make payments, you do not need to enter your EFTPS login password. However, you do need to have your TIN and PIN handy to use the voice response system.

After enrollment (which we’ll talk about later), enter your banking information to transfer funds from your bank account to the EFTPS. In your EFTPS account, you can also:

- Verify your bank account for tax payments

- Change your bank account

- Terminate an EFTPS enrollment you are no longer using

- Pay federal taxes

- View payment history

Enrolling in EFTPS

Before you can make payments using EFTPS, you must enroll on the EFTPS tax processing website. The enrollment process is easy and free.

If you are requesting a new Employer Identification Number (EIN) and indicate you will have federal tax payments, you are automatically pre-enrolled in EFTPS. The IRS notifies you about the pre-enrollment, and you can activate your account after you receive the notification.

If you are not pre-enrolled, you can sign up directly on the website or by calling EFTPS.

You need three pieces of information to enroll in EFTPS:

- TIN: Your taxpayer identification number can be your Social Security number (if you are a sole proprietor) or your business’s EIN

- Bank account and routing number: You can use either a personal or business bank account

- Name and address: If you are paying personal taxes, use your personal information. If you are paying business taxes, use your business’s name and address

How to enroll in EFTPS

After you gather your necessary enrollment information, select “Enrollment” on the website. Because you are enrolling as a business, choose the “Business” option. Enter the requested information and submit your application.

The IRS must verify the information on the application. After the IRS verifies your application, you receive your PIN in the mail within five to seven business days.

After you receive your PIN, you must set your password. To set your password for your EFTPS account, go to the website and select “Login.” Choose the “Need a Password” option on the page. Enter your TIN and PIN into the appropriate sections.

When you log into your account for the first time, you must verify your bank information and enrollment number. Find your enrollment number on the EFTPS letter containing your PIN. After your information is verified, select “Next” and choose your password.

After you create your password, your account is set up, and you can now use it to make your EFTPS payments.

Making tax payments with EFTPS

Remitting your tax payments using EFTPS is a breeze. To do so, log into your EFTPS account and select “Make a Payment.” The website gives step-by-step instructions to complete the payment process.

After you make your payment, you receive a confirmation number that serves as a payment receipt. Save a copy of the receipt for your records. The EFTPS only keeps 16 months of records in your online account. You can review your payment history over the phone or online.

The money transfers on the date that you specify. Again, you can schedule tax payments up to 365 days in advance.

If you need to cancel or change your scheduled payment, you can do so up to two days before the scheduled transfer date. For timely payments using EFTPS, schedule your payment at least one day before the due date by 8 p.m. Eastern Time.

Someone else makes my tax payments for me. Do I still need to enroll in EFTPS?

The U.S. Department of the Treasury does not require anyone to enroll in EFTPS. But, it is still a good idea to have your own EFTPS account to keep track of federal tax payments.

If you use an accountant or payroll software for taxes, you can sign in at any time to make sure that your accountant or payroll company paid your taxes.

As an employer, you are responsible for the timely payments of your federal taxes regardless of outsourcing your payroll. Any late fees or penalties are ultimately your responsibility. Enrolling in your own EFTPS account allows you to monitor payments to ensure that you do not miss or have late payments.

How will EFTPS contact you?

With so many scams out there trying to get your confidential information, you must know how the EFTPS contacts users. Both EFTPS and the U.S. Department of the Treasury correspond through the postal service.

The U.S. Department of the Treasury will never contact you via email. If you receive an email claiming to be from the EFTPS or U.S. Department of the Treasury, it is likely a scam. Do not respond with any personal information. Instead, report the email to the U.S. Department of the Treasury by forwarding it to phishing@irs.gov. Or, call the Treasury directly with the information.

You may receive a phone call from the U.S. Department of the Treasury if you have been in prior contact. But, use caution with phone calls. The IRS or Treasury Department only calls after sending a notice in the mail.

Have no fear about tax remittance for your business. Patriot’s Full Service online payroll software collects, deposits, and files your payroll taxes for you. And, rest easy knowing that Patriot has a tax filing reliability guarantee. Start your free 30-day trial today!

This article has been updated from its original publication date of June 13, 2012.

This is not intended as legal advice; for more information, please click here.