Becoming an employer is an exciting time. But, it also comes with a ton of responsibilities, including running payroll, withholding taxes from employee wages, and following oh-so-important workplace laws. But, which workplace and labor laws do your business need to follow?

Who enforces workplace laws?

Workplace and labor laws help ensure employees are safe and protected in the workplace. There are a few agencies that enforce employment, labor, and workplace laws, including (but not limited to):

- Department of Labor (DOL): Fosters and promotes the well-being of job-seekers, workers, and retirees.

- Equal Employment Opportunity Commission (EEOC): Enforces federal laws prohibiting employment discrimination.

Both of the agencies enforce different workplace laws. For example, the DOL enforces over 180 federal labor laws. But, not every workplace law applies to your business. So, you need to know which ones your company needs to follow to stay compliant.

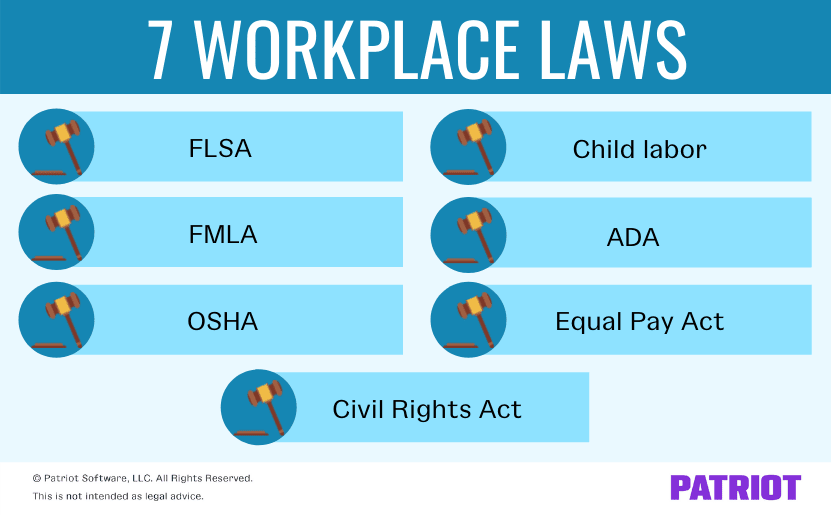

7 Workplace and labor laws to keep in mind

Keeping up with employee protection laws takes time (time that you don’t have as a busy business owner). Luckily, we’ve put together this list of workplace laws to take the stress out of the upkeep. To avoid unintentionally breaking labor, workplace, or employment laws, familiarize yourself with these seven workplace laws.

1. Fair Labor Standards Act

The DOL enforces the Fair Labor Standards Act (FLSA). The FLSA protects employee rights by establishing minimum wage, overtime, and child labor laws and ensures employers fairly treat employees. For example, employers must pay eligible employees overtime, or time-and-a-half, for any hours worked over 40 during a workweek.

FLSA rules impact payroll processing and recordkeeping. They also impact how much employees can work, including rest and meal periods and on-call time.

To ensure you comply with FLSA requirements, brush up on rules about:

- Overtime

- Minimum wage

- Child labor

- Recordkeeping

- Hours worked

- Payroll

2. Family and Medical Leave Act

Another law enforced by the DOL is the Family and Medical Leave Act (FMLA). The FMLA requires public, private, or nonprofit employers with more than 50 employees to grant up to 12 weeks of unpaid leave per 12-month period to eligible employees.

Employees are eligible for FMLA leave when they work for an FMLA-covered employer for at least 12 months and have worked 1,250 hours for the employer during the 12 months.

Eligible employees can use FMLA for:

- The birth, adoption, or foster care placement of a child

- A personal serious health condition preventing the employee from performing their job

- To care for a spouse, child, or parent with a serious health condition

- A situation that requires attention because of military deployment of a spouse, child, or parent

If your business meets the requirements (i.e., has more than 50 employees in a 75-mile radius), you must offer FMLA to eligible employees.

3. Occupational Safety and Health Act

The Occupational Safety and Health Act (OSHA) regulates health and safety conditions

in private sector industries to make sure workplaces do not have any serious hazards. The Department of Labor also enforces the OSHA.

Employers who need to follow the OSHA must provide employees with a work environment that is free from serious hazards. This includes safety (e.g., machinery), chemical (e.g., acid), and biological (e.g., infectious materials) hazards. For example, a business has to follow certain protocols when working with hazardous chemicals (e.g., wear protective equipment).

The OSHA does not cover the following:

- Self-employed workers

- Farms that only employ immediate family members of the farmer’s family

- Working conditions where other federal agencies regulate worker safety under another law

- Employees of state and local governments, unless covered under an OSHA-approved state plan

Some public sector employers must also follow the OSHA. To ensure your company doesn’t break any laws, check to see if you’re required to follow the OSHA at your business.

4. Child labor

Another set of laws the DOL enforces is child labor laws. Child labor laws restrict and regulate how many hours minors can work and which jobs children can have. While the DOL enforces these sets of laws, the federal government sets them under the FLSA.

Child labor laws can impact:

- The age minors can begin working

- What jobs minors can perform

- How much you must pay minors

- How you pay minors (e.g., hourly, salary, etc.)

- The frequency you pay minors

- Rest and meal breaks for minors

Before you employ any minor, brush up on child labor laws to make sure you’re following the rules based on the minor’s age and type of work.

5. Americans with Disabilities Act

The EEOC enforces the Americans with Disabilities Act. The Americans with Disabilities Act (ADA) prohibits employers from discriminating against employees with disabilities in all aspects, including hiring, training, benefits, pay, etc. It also requires employers to provide workers with disabilities reasonable accommodations in the workplace.

Reasonable accommodations for workers with disabilities may include:

- Frequent breaks

- Accessibility in the workplace (e.g., wheelchair ramps)

- Work-from-home options

- Job reassignments

As an employer, make sure you follow ADA in the workplace accordingly. Consider consulting an expert if you have any questions about the Americans with Disabilities Act to ensure you stay compliant.

6. Equal Pay Act

The Equal Pay Act is another law under the EEOC. Under the Equal Pay Act, employers must pay all workers, regardless of gender, equally if they do the same type of work. Pay employees the same wages if they perform equal work and have equal responsibilities. And, make sure other compensation and benefits are fair, too.

To ensure you pay workers fairly and equally, look at your business’s internal equity. Internal equity ensures employees with similar job positions or skills receive similar compensation. To maintain internal equity in the workplace, you can:

- Conduct regular internal audits

- Look at external equity (e.g., look at what other companies pay for similar positions)

- Be transparent

7. Civil Rights Act of 1964

The EEOC also enforces the Civil Rights Act of 1964. Title VII of the Civil Rights Act of 1964 protects applicants and employees from discrimination based on their:

- Race

- Color

- Religion

- Sex

- National origin

You must abide by the Civil Rights Act in all aspects, including during the hiring process. You can’t make hiring decisions based on race, color, religion, sex, or national origin. You also can’t ask certain questions during interviews, such as “What’s your ethnicity?”

Once you hire an employee, you also can’t discriminate based on color, race, etc. For example, you can’t make promotional decisions based on any of the above factors.

This is not intended as legal advice; for more information, please click here.