Let’s face it: everybody makes mistakes. So, if you make a mistake on an employee’s Form W-2, don’t panic. Instead, learn how to correct a W-2 form and take action.

You can correct Form W-2 even after filing it with the Social Security Administration (SSA). Read on to learn types of common W-2 errors and how to amend a W-2 based on the type of mistake.

When do you need a corrected W-2 form?

You need to create an amended W-2 form if you make an error on Form W-2, such as including incorrect names, Social Security numbers, or amounts.

Employers can make Form W-2 corrections on forms sent to employees as well as forms filed with the SSA.

Possible penalties for filing an incorrect W-2

Unfortunately, filing an amended form does not guarantee you’ll walk away penalty-free. You might be subject to penalties if you fail to file a Form W-2 with correct information by January 31.

Penalty amounts depend on when you file a corrected W-2 form. The IRS may exempt you from penalties if you can show reasonable cause for the mistakes.

To avoid or reduce penalties, submit a corrected form as soon as possible after you discover the error on Form W-2.

So, what is the corrected form you need? Form W-2c.

How to correct a W-2 form: W-2c form

To create a corrected W-2 after filing, use Form W-2c, Corrected Wage and Tax Statement. Employers use Form W-2c to correct errors on Forms W-2 filed with the Social Security Administration. Sometimes, you might send Form W-2c to your employee but not the SSA (explained below).

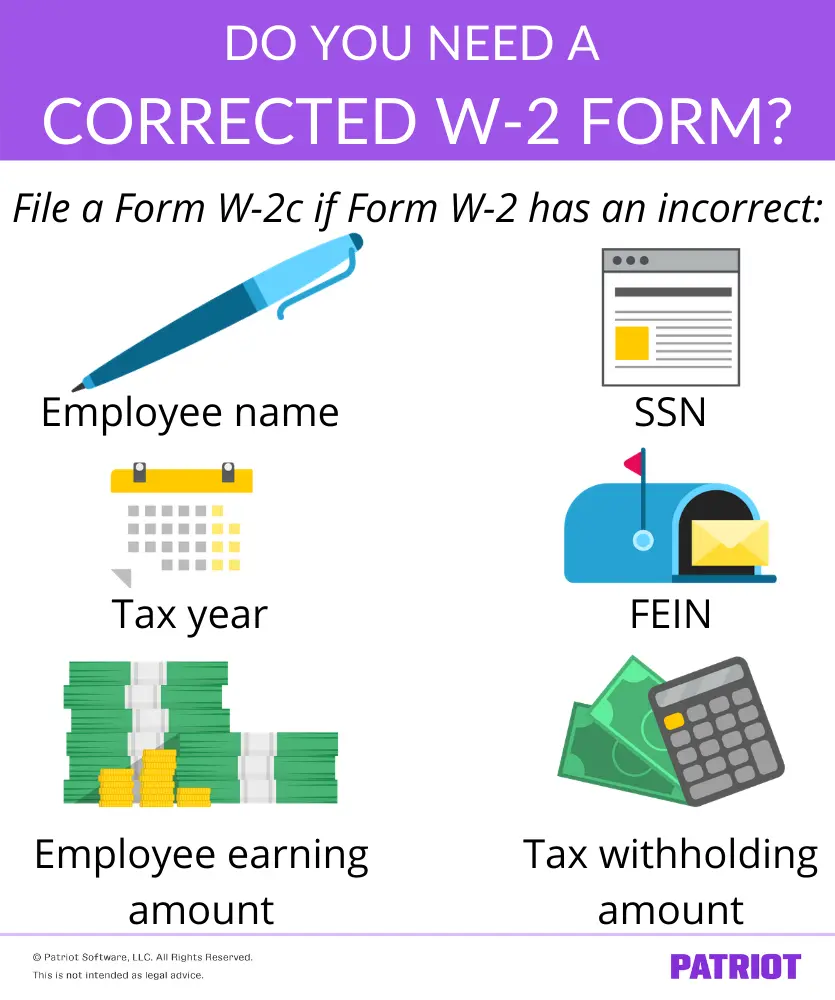

Use Form W-2c to correct mistakes you make on Form W-2, such as incorrect:

- Employee names or Social Security numbers

- Employee address (optional to use Form W-2c)

- Tax year

- Federal Employer Identification Number (FEIN)

- Employee earnings or tax withholdings

You may also need to use Form W-2c if you filed two forms for an employee under your EIN when you only should have filed one. If you filed two forms for an employee under your EIN and the wages on one were incorrect, you’ll also need to use the W-2c form.

How to fill out the W-2c

When it comes to filling out Form W-2c, your first step is to purchase copies of the form. There is a version of the form on the IRS website, but it is for informational purposes only. Do not download and print the form. Instead, buy the W-2 correction form from the IRS or an authorized seller (e.g., office supply store).

Use black ink in 12-point Courier font, if possible, when filling out Form W-2c. The way you fill out Form W-2c depends on what error you need to correct on Form W-2.

Form W-2c includes the same boxes as Form W-2. It asks for things like employer name and EIN, employee name and SSN, and federal, state, and local tax information. But unlike Form W-2, there are two columns for federal, state, and local wage and tax information. One column is for “previously reported” information and the other is for “correct information.”

Correcting a W-2 with the wrong Social Security number

You might be wondering how to correct W-2 with the wrong Social Security number. To correct a Form W-2 with an incorrect SSN (and/or employee name), simply complete boxes a – i on Form W-2c. These boxes show what you previously reported for the employee’s name and SSN as well as the corrections. You do not need to touch the federal, state, or local wage and tax boxes.

To find specific Form W-2c instructions, consult the corrected W-2 instructions in the General Instructions for Forms W-2 and W-3.

Filing Form W-2c

Again, file Form W-2c as soon as you realize there’s an error with your W-2.

You can send paper Forms W-2c or e-File with the Social Security Administration. Generally, you can choose whichever method you prefer. However, the SSA requires you to e-File forms if you have to file 250 or more Forms W-2c.

When you file Form W-2c with the SSA, you also need to send Form W-3c, Transmittal of Corrected Wage and Tax Statements.

Form W-3c is the transmittal form for Form W-2c, just like Form W-3 is the transmittal form for Form W-2. You must submit a single Form W-3c for each group of Forms W-2c that you send.

Always file Form W-3c when you file one or more Forms W-2c (Copy A) with the SSA.

When you don’t have to send Form W-2c to the SSA

You might not have to file Form W-2c with the SSA if you make a mistake on Form W-2. Do not send the W-2c form to the Social Security Administration if you:

- Put an employee’s incorrect address on Form W-2

- Catch a mistake after sending Form W-2 to the employee but before sending to the SSA

You may have less-common situations that don’t require you to send Form W-2c to the SSA, too.

Incorrect employee address

Did you file a Form W-2 showing an incorrect employee address with the SSA? Was all of the other information correct? If you answered “yes” to both of these questions, do not file Form W-2c with the SSA.

If you put the wrong address on the copies of Form W-2 you distributed to your employee, you’ll need to do one of the following (again, do not file Form W-2c with the SSA):

- Issue a new Form W-2 containing the correct address. Write “REISSUED STATEMENT” on the new employee copies

- Issue a Form W-2c to the employee showing the correct address in box b

- Reissue Form W-2 with the incorrect address to the employee in an envelope that says the correct address

Catching a mistake before sending Form W-2 to the SSA

If you catch the mistake after sending Form W-2 to the employee but before sending it to the SSA, the correction process is different. It does not involve Form W-2c.

Instead, mark “void” on Copy A of the incorrect Form W-2 (the copy for the SSA). Then, prepare a new Form W-2 with the correct information. Write “CORRECTED” on the employee copies and distribute them to employees. Send the correct version of Copy A to the SSA (but do not write “CORRECTED” on this copy).

Less-common situations

Do not use Form W-2c to report back pay corrections or to correct Form W-2G, Certain Gambling Winnings.

How to file a corrected W-2: Fast facts

If you want quick information on how to make a Form W-2 correction, take a look at the following things to keep in mind:

- Use Form W-2c to correct (most) mistakes made on Form W-2

- Do not file Form W-2c with the SSA if your only mistake is an incorrect employee address or if you catch a mistake after sending to your employee but before sending it to the SSA

- File Form W-3c when you send Form W-2c to the SSA

- Submit a W-2c form as soon as you realize you’ve made a mistake

- You may incur penalties when you file an incorrect Form W-2

If you use Patriot Software’s Full Service Payroll software, our payroll services will file Forms W-2 for you. You just need to print out the employee copies and give them to your employees. Get a free trial now!

This article is updated from its original publication date of 2/8/2011.

This is not intended as legal advice; for more information, please click here.