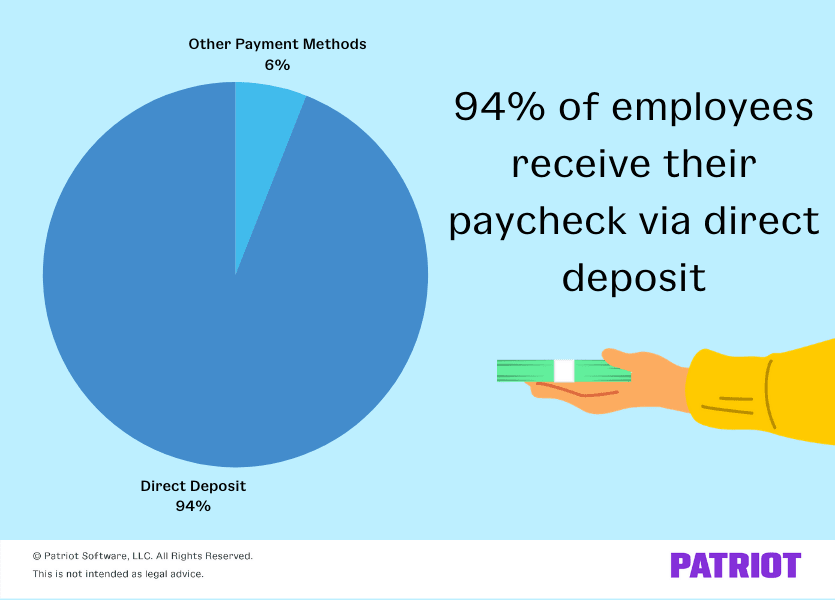

There are a number of options when it comes to paying workers. Have you considered using direct deposit to pay your employees? A lot of other employers have. In fact, more than 93% of employees receive their paycheck via direct deposit.

If you’re part of the 6% of employers not using direct deposit to pay your workers, what’s holding you back? To determine if direct deposit is a good fit for your business, check out the benefits of direct deposit, including the pros for both employers and employees.

Direct deposit: Quick recap

Before we dive into the pros of direct deposit, let’s briefly review what is direct deposit.

Direct deposit is an electronic funds transfer (EFT) that deposits an employee’s wages directly into their bank account. With direct deposit, you can put your employees’ paychecks directly into their bank account.

Direct deposit laws vary from state to state. Some states may allow employers to require mandatory direct deposit while others do not. If you decide to go the direct deposit route, make sure you understand your state’s direct deposit laws as well as federal regulations.

Although the majority of employers already use direct deposit to pay their employees, some different payment methods include:

- Handwritten or printed paychecks

- Cash

- Pay cards

- Mobile wallet

When it comes to paying employees, do your research to find out what method is the best option for you and your employees (e.g., direct deposit vs. check).

Benefits of direct deposit

There are quite a few benefits of using direct deposit to pay your employees. Let’s take a look at some of them, shall we? Check out our breakdown of how direct deposit benefits employees and employers alike below.

Benefits of direct deposit for employers

How can direct deposit benefit you as an employer? With direct deposit, you:

- Don’t have to worry about distributing checks

- Can pay employees from any location

- Save money on supplies (e.g., check stock, ink, etc.)

- Can avoid payroll fraud schemes

- Can pay employees anytime, anywhere

- Don’t have to stress over a complicated payment process

Overall, direct deposit can save you a ton of time and money. Direct deposit is an easy, convenient, and secure option to pay employees.

Benefits of direct deposit for employees

Employers aren’t the only ones who benefit from using direct deposit. Check out a few advantages of direct deposit for employees. Employees:

- Don’t have to worry about misplacing or losing paper checks

- Save time by not having to go to the bank to deposit their paycheck

- Can easily divide the paycheck into several accounts (e.g., $50 goes into savings and the remaining goes into checking)

- Have access to their paycheck right away on payday

- Can receive their pay no matter where they’re at (e.g., vacation, sick days, working from home, etc.)

- Can have a better way to manage their money

Direct deposit is a time-saver for employees. Instead of having to worry about depositing cash or checks into their bank accounts, employees can rest easy knowing that the funds have been securely deposited.

A few direct deposit downsides to consider…

As with anything in business, there are pros and cons of direct deposit. Before jumping aboard the direct deposit train, also weigh the disadvantages of direct deposit.

Some cons of direct deposit include:

- Potential fees: You may need to pay setup and transactions fees for direct deposit.

- Time-sensitive: Collect time cards and run payroll by a certain date so employees can receive their wages on time.

- Preference: Unless you’re in a state that allows you to make direct deposit mandatory, some employees may choose to get paid a different way (e.g., via check).

- Updates: For your employees to get paid, you must have their correct banking information on file and update said information if there are any changes.

Setting up direct deposit: 4 Steps

It’s pretty simple to set up direct deposit—especially if your payroll provider offers it. If you decide to offer direct deposit to employees, follow a few steps to get it implemented.

To set up direct deposit, follow these four steps:

- Sign up with a direct deposit provider (or start the setup process with your payroll provider)

- Gather employee bank account information

- Input employee direct deposit information

- Run payroll and pay employees with direct deposit

Step 1: Sign up with a direct deposit provider

First things first: find a direct deposit provider. Your provider is who will transfer funds from your account to your employees’ accounts.

You may set up direct deposit through your banking institution. But to do that, you may need to open a business bank account if you don’t already have one. Contact your bank to find out your options, as well as pricing and fees.

If you have a payroll provider, check with them to see what kinds of direct deposit options they have available. Some payroll software companies, like Patriot Software, offer free direct deposit options to customers.

To set up your direct deposit with a provider, you will likely need to have to the following information handy:

- Application, if applicable

- Current bank statement

- Business information (e.g., business name and FEIN)

- Voided business check

Step 2: Gather employee banking information

To pay employees via direct deposit, you need to have their banking details so you know what account(s) to transfer the money to.

Gather the following information from your employees:

- Bank account number(s)

- Routing number(s)

- Bank’s name

- Type of account (e.g., Checking or Savings)

Consider using a form to collect this information from your employees. If you use payroll software, employees may be able to fill out their direct deposit electronically through an employee portal.

If an employee wants to split their paycheck into multiple accounts (e.g., 80% checking and 20% savings), have the employee indicate how much they want going to each.

Step 3: Input employee information

After you gather bank details for each employee, you can input it or provide the details to your bank to get direct deposit ready to roll.

If you use payroll software, double-check the information for each employee after you input it to ensure it’s correct. Make sure all employee information is entered before you run payroll with direct deposit for the first time.

Step 4: Run payroll with direct deposit

After you enter all employee information and set up direct deposit, it’s time to run payroll with your new payment method.

Each time you run payroll, your employees will automatically be paid with direct deposit.

Keep in mind that your direct deposit provider might have restrictions and rules on when you need to run payroll by for direct deposit. For example, you might have to run payroll four business days prior to the pay date to ensure your employees receive their pay.

Check with your provider about direct deposit requirements and when you need to run payroll to ensure your employees are paid on time.

Want to experience the advantages of direct deposit? Check out Patriot’s online payroll software. The software is chock-full of features, including free direct deposit, free support, free payroll setup, and a free trial. Try it for free today!

This article was updated from its original publication date of October 24, 2014.

This is not intended as legal advice; for more information, please click here.