Employers juggle many responsibilities, including calculating and withholding payroll taxes and other deductions. But, what exactly does payroll taxes include? And, how do you know how much to withhold from employees’ wages? If you’re wondering about understanding payroll taxes, never fear—your payroll taxes breakdown is here.

What are payroll taxes?

How do payroll taxes work? Payroll taxes are a specific type of employment tax. Not all employment taxes are payroll taxes. Instead, payroll taxes consist of the Federal Insurance Contributions Act (FICA) tax. So, what is FICA tax?

FICA tax is the combination of Social Security and Medicare taxes. The government uses funds from the two taxes for different programs:

- Social Security tax: Funds benefits for retirement, dependents of retired workers, and the disabled and their dependents.

- Medicare tax: Funds medical benefits for people age 65 and older, the disabled, and individuals with qualifying health conditions.

Social Security and Medicare tax have different tax rates. And, there is an additional Medicare tax for qualifying employees (we’ll get to that later).

What are payroll taxes levied on? Employers must withhold these taxes from their employees’ wages. But, do not withhold the entire amount of each tax from the employee. Employers share the responsibility of paying FICA taxes with their employees. Show payroll tax on paystub for your employees.

Self-employed individuals are not exempt from paying federal payroll taxes. Instead of paying FICA tax, they must pay self-employment tax. The Self Employed Contributions Act (SECA) tax requires self-employed individuals to pay Social Security and Medicare taxes. SECA does not split the tax between employee and employer. Instead, self-employed individuals must pay the entirety of the tax themselves.

Other taxes in payroll

Again, not all employment taxes are payroll taxes. People commonly refer to all taxes deducted in payroll as payroll taxes. But, there are many types of employment taxes.

Employment taxes include:

- Federal income tax

- State income tax

- Local income tax

- Federal unemployment (FUTA) tax

- State unemployment (SUTA) tax

Employees do not pay all employment taxes. And likewise, employers do not pay all employment taxes.

Income taxes only come out of the employees’ wages. Federal unemployment taxes are employer-only taxes. State unemployment taxes are typically employer-only, but some states require both employers and employees to contribute to the tax (e.g., Pennsylvania).

Payroll tax rates

Employees pay the same amount of FICA payroll tax as employers because the total amount is split evenly. Self-employed individuals must pay the entire amount of both taxes. So, how much are payroll taxes for employees, employers, and self-employed workers?

Social Security and Medicare tax rates

To know how much FICA tax to pay or withhold, break it down into the two parts of the tax: Social Security and Medicare.

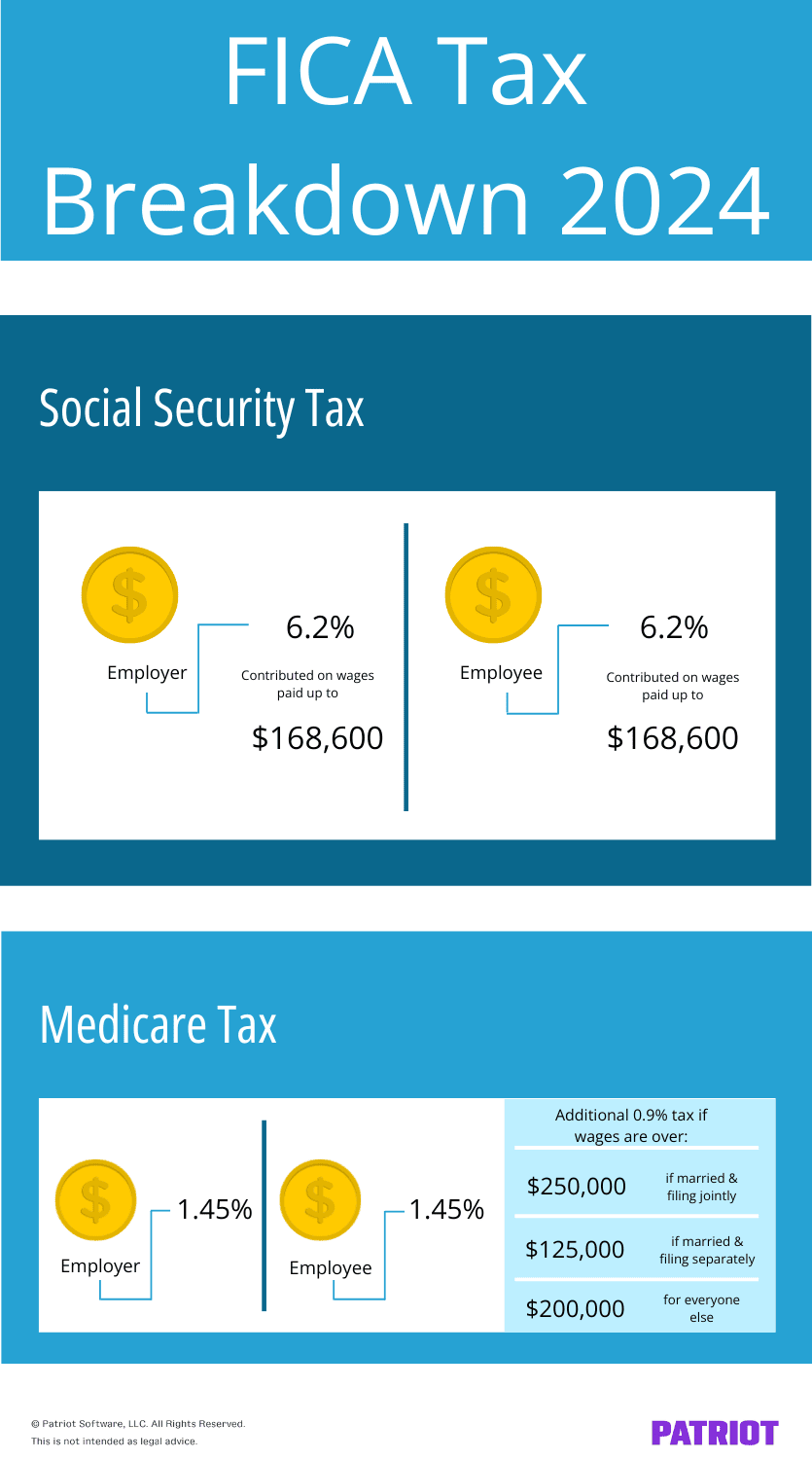

Social Security tax has a higher tax rate. It is a flat 12.4% but only applies up to the Social Security wage base, which typically changes each year. The 2024 Social Security wage base is $168,600. Equally divide the total percentage between you and your employees. Withhold 6.2% from your employees’ wages and contribute 6.2% as the employer (12.4% / 2).

Medicare tax has a flat tax rate of 2.9%. Like Social Security tax, employees and employers equally share the total tax. So, employers and employees each pay 1.45% (2.9% / 2). Unlike Social Security, there is no wage base or cap to the wages subject to the Medicare tax. Instead, there is an additional Medicare tax of 0.9% once employees earn above a certain amount.

Additional Medicare taxes apply to employees based on filing status:

- Married filing jointly: $250,000

- Married filing separately: $125,000

- Single: $200,000

Employers must withhold the additional Medicare tax after an employee earns above $200,000. Employees who earn above the threshold must pay 2.35% for Medicare tax (1.45% + 0.9%). Employers continue to pay 1.45% because the additional Medicare tax rate only applies to employees.

Self-employment tax rate

SECA tax is basically the same as FICA tax, except one person pays the total amount for each tax.

Social Security tax is 12.4% and Medicare is 2.9% total. So, the combined rate for SECA tax is 15.3%.

Self-employment Social Security taxes only apply up to the Social Security wage base.

A self-employed individual must also pay the full 2.9% of Medicare tax. Self-employment wages are also subject to additional Medicare tax (0.9%). If the additional Medicare tax applies, the total tax rate is 3.8% (2.9% + 0.9%). There is no maximum amount of Medicare tax an individual can pay.

Payroll tax FAQs

Still have some questions about payroll taxes? Take a look at some frequently asked questions.

1. Is federal withholding tax a payroll tax?

Federal withholding is a tax calculated during payroll, but it’s not technically a payroll tax. Instead, federal withholding is an employment tax. Another name for federal withholding is federal income tax.

2. Can employers make employees pay the total amount of FICA tax?

No. Federal law requires employers to evenly split FICA tax with their employees. Only self-employed individuals pay the entirety of Social Security and Medicare taxes.

3. What happens if an employee meets the Social Security wage base in the middle of a pay period?

If an employee meets the Social Security employee tax wage base in the middle of the pay period, only calculate the tax on wages up to the amount.

Say an employee receives biweekly paychecks and hits the wage base at the end of the first week of the pay period. The employee’s total paycheck is $6,000. Divide the gross pay by two and apply the Social Security tax to the first half of the gross wages ($6,000 / 2 = $3,000).

This article is updated from its original publication date of October 20, 2015.

This is not intended as legal advice; for more information, please click here.