One major blunder small business owners make is not paying their tipped employees the correct wages. And when it comes to you paying tipped employees overtime, things can get a little more complicated.

So, are you using the correct overtime rate for your employees who receive tips? Read on to learn the right way to calculate overtime for tipped employees.

Recap of minimum wage for tipped employees

Before you can dive into computing overtime pay for your tipped workers, you need to know the minimum amount you can pay them. This is where tipped minimum wage comes into play.

Currently, the federal minimum wage is $7.25 per hour. The federal minimum wage is the lowest amount you can pay an employee per hour of work. But for tipped employees, the Fair Labor and Standards Act (FLSA) makes an exception.

Employers in specific industries (e.g., restaurants) can pay eligible employees (e.g., servers) who receive tips a lower minimum wage.

Federal law states that tipped employees are workers who regularly receive more than $30 in tips per month.

Employers can claim a tip credit toward the federal minimum wage to pay certain employees the tipped minimum wage. The maximum tip credit an employer can claim is $5.12 per hour. This means the federal tipped minimum wage is $2.13 per hour ($7.25 – $5.12 = $2.13).

Not all states follow the federal tipped minimum wage rate. Some states require employers to pay a state-mandated tipped minimum wage that’s higher than the federal minimum wage rate.

For example, the tipped minimum wage in Alabama is $2.13 per hour. On the other hand, the tipped minimum wage in Iowa is $4.35 per hour.

Check with your state to find out what your tipped minimum wage rate is. And, remember that minimum wage rates can change from year to year.

Overtime for tipped employees

If you want to avoid penalties and remain compliant, you need to learn how to correctly calculate overtime pay for tipped employees.

Generally, overtime pay is one and a half times the employee’s regular pay rate. If your employees are considered nonexempt, you must pay them overtime. Under federal law, employees eligible for overtime must receive overtime pay for any hours worked over 40 per week.

Say you pay your employee $10.00 per hour. Their overtime pay rate would be $15.00 per hour ($10.00 x 1.5).

How to calculate overtime for tipped employees

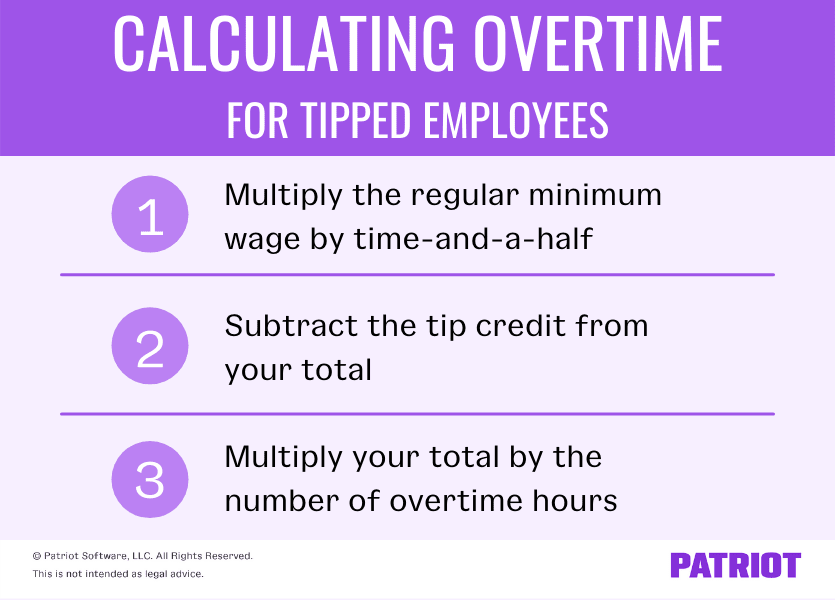

When it comes to calculating overtime for tipped employees, it is not as simple as multiplying the tipped minimum wage by time-and-a-half. There are a few additional steps you need to follow.

Take a look at the steps for calculating overtime for tipped employees below:

- Multiply the regular minimum wage by time-and-a-half (1.5)

- Subtract the tip credit from your total

- Multiply your total by the number of overtime hours

After you find the overtime pay total for your tipped employee, be sure to add it to their regular wage total.

Tipped employee overtime calculation

Confused about calculating overtime wages for your tipped employees? Let’s take a look at the above steps in action.

Say you pay your waiter, Steve, a tipped minimum wage of $2.13 per hour because you can claim a tip credit of $5.12. Steve worked 10 hours of overtime during the week. Use the federal minimum wage ($7.25) to calculate overtime pay for Steve.

First, take the federal minimum wage (not the tipped minimum wage) and multiply it by one and a half.

Minimum wage X 1.5

$7.25 X 1.5 = $10.88

Next, subtract your tip credit total of $5.12 from the above total ($10.88). This will be the rate that you use to calculate the tipped employee’s overtime pay.

$10.88 – $5.12 = $5.76

Lastly, take your overtime rate of $5.76 and multiply it by Steve’s 10 overtime hours.

$5.76 X 10 = $57.60

You must pay Steve $57.60 in overtime wages. Add overtime pay to regular wages to get the employee’s gross pay.

Some states have stricter limits on tips credits. And, as mentioned, minimum wage (both state and federal) and tipped minimum wage rates vary by state. Check with your state to ensure you’re paying employees the correct rate.

Need an easy and affordable way to pay your tipped employees? Patriot’s payroll software has you covered. Streamline the way you process payroll with our simple three-step process. Try it for free today!

This article has been updated from its original publication date of September 25, 2009.

This is not intended as legal advice; for more information, please click here.