When you hire an employee, things don’t always go as planned. You might forget to give a worker new hire paperwork. Or, your employee might make a mistake while filling out a new hire form, like Form I-9.

So, what happens when you or your employee make a mistake on Form I-9? How do you go about fixing it? To avoid penalties and legal problems, learn how to make Form I-9 corrections.

Form I-9 overview

Form I-9, Employment Eligibility Verification, is a form employers use to verify employees are legally allowed to work in the U.S. Before you can authorize employment, you and your employee must fill out Form I-9.

Along with filling out the form, employees must also provide certain identification and documentation. As an employer, you must review the employee’s documents to verify they are accurate and consistent with their I-9 form.

I-9 is broken down into three parts:

- Section 1

- Section 2

- Section 3

The first two sections of Form I-9 must be filled out when you hire an employee. You only need to fill out the last section if you rehire an employee or need to update an employee’s information on the form.

Section 1 covers things like the employee’s personal information, including their name, address, date of birth, Social Security number, and citizenship details. Employees (or their preparer and/or translator) must complete, sign, and date Section 1 on the first day of employment.

Section 2 goes over the employee’s identification and documentation. It’s your job as an employer to ensure the documents and information are genuine and match what the employee wrote on the form.

Form I-9 has a list of employee documents that you can accept. These documents are grouped into three categories:

- List A: Documents that prove identity and work eligibility

- List B: Documents that prove identity\

- List C: Documents that prove work eligibility

To prove citizenship and identity, an employee can either show one document from List A or a document from both List B and List C.

You and your employee must complete Section 2 within three days of the employee’s first day of work.

You only need to fill out Section 3 if:

- You need to update Form I-9 information

- A temporary employment authorization expires

- You’re rehiring a former employee

Beginning May 1, 2020, employers are required to use a new version of Form I-9 with the edition date of 10/21/2019 for all new hires.

Employers do not need to update current employees’ existing Forms I-9 they have on file, unless reverification is required in Section 3. Employers only need to use the new version of Form I-9 for new hires and reverifcation.

To access the newest version of Form I-9, go to the U.S. Citizenship and Immigration Services’s website.

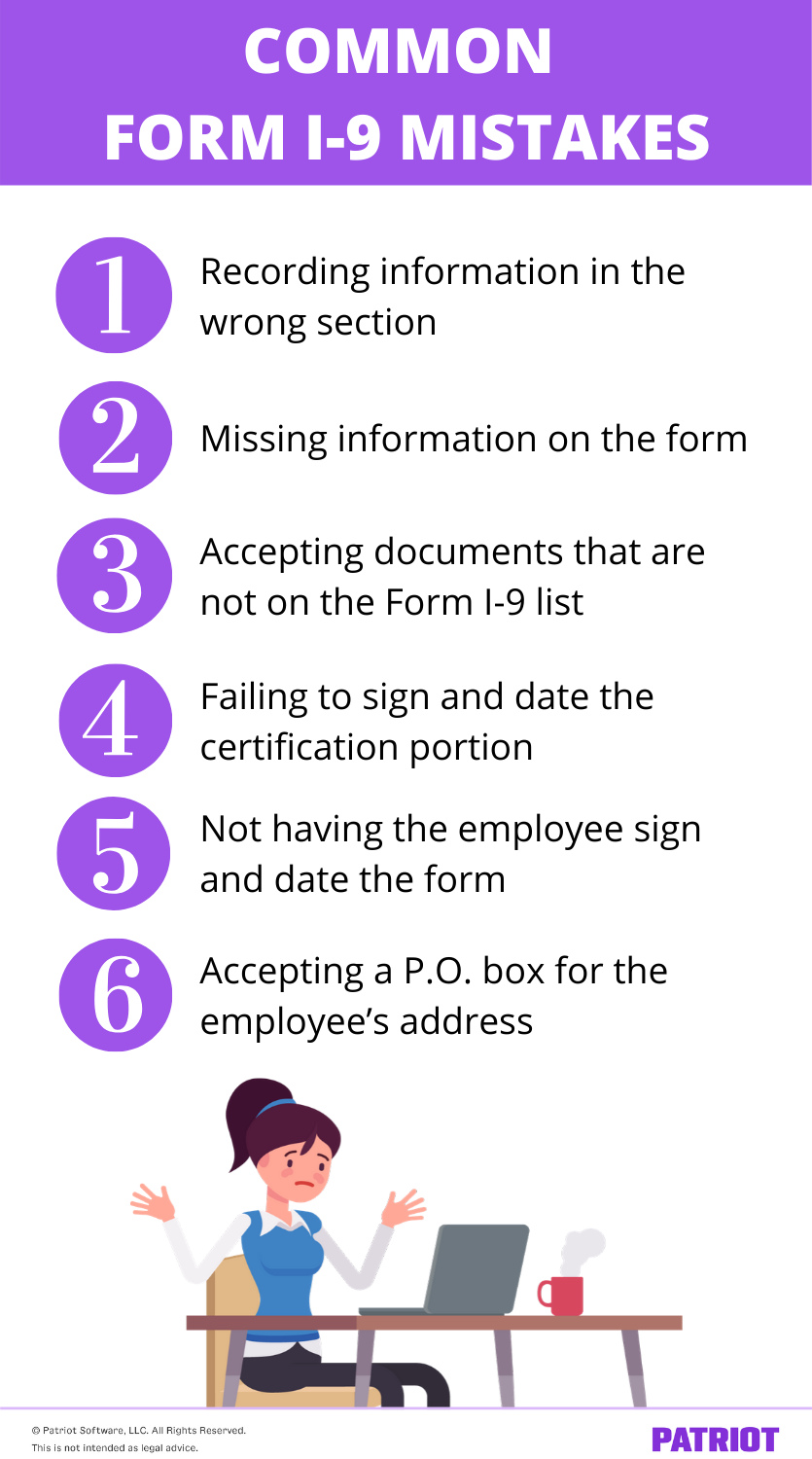

Common Form I-9 mistakes

Even the most seasoned small business owners can make mistakes on Form I-9. Regardless of if you’re new to the business scene or have been in business for many years, there are plenty of Form I-9 mistakes to watch out for.

Beware of the following Form I-9 mistakes:

- Recording information in the wrong section

- Missing information on the form

- Accepting documents that are not on the Form I-9 list

- Failing to sign and date the certification portion

- Forgetting to have the employee sign and date the form

- Accepting a P.O. box for the employee’s address

- Using an old version of Form I-9

Types of violations

How to fix I-9 mistakes depends on the type of violation. Your Form I-9 errors are categorized as either technical or substantive violations.

Technical violations are “minor paperwork errors.” A few examples of technical violations include missing an address, having an incorrect birth year, and placing information in the wrong box or section. You can fix these types of errors on the original form.

Substantive violations are more serious than technical errors. Substantive violations include things like incorrect information relating to work authorization status, missing or incorrect documentation, and missing signatures (both employee and employer). You can’t correct these types of errors on the original Form I-9. Instead, fill out a new Form I-9 to fix these types of issues. Keep in mind that if you make a substantive error, you might be subject to penalties.

Making Form I-9 corrections

When correcting an I-9, keep a few things in mind. Otherwise, you’ll find yourself making even more Form I-9 mistakes. Check out the dos and don’ts below for correcting Form I-9.

| Technical Violations: Dos | Technical Violations: Don’ts |

|---|---|

| Do use different colored ink than the original ink | Don’t use white out or correction tape |

| Do initial and date each correction with the current date | Don’t use black marker to cross out incorrect information |

| Do make it clear that a correction is being made | Don’t backdate missing dates or information |

| Do allow employees to make their own corrections on the form | Don’t get rid of Form I-9 after revising it (keep in your records for at least 3 years) |

| Do draw a single line through an incorrect entry | Don’t forget to double-check the form after it’s corrected |

| Do make sure all of the information is clear and legible | Don’t leave any information blank |

| Substantive Violations: Dos | Substantive Violations: Don’ts |

|---|---|

| Do fill out a new Form I-9 to correct errors | Don’t try to reuse or correct the old Form I-9 |

| Do attach the new form to the older Form I-9 and keep it in your records | Don’t throw out the old version of Form I-9 |

| Do fill out the new form with your employee present | Don’t forget to fill in the new Form I-9 completely |

You might not always need a new form if you or your employee make an I-9 error. You need a new Form I-9 if one of the following scenarios occur:

- The current I-9 is invalid due to missing information or signatures

- The current form is so chock-full of errors that it doesn’t make sense

- Your business was notified that you made a substantive violation

- Form I-9 is missing

- The form has been accidentally destroyed

Form I-9 correction example

Say you’re completing an internal Form I-9 audit and you come across a mistake on your employee’s form.

You see a P.O. box on your employee’s form and remember that employees can’t list P.O. boxes as an address on the form. Because this is a minor error, you can fix it on the original form.

First things first, you’ll want to notify your employee about the Form I-9 issue. Then, go over the form’s mistake and correct it with your employee.

To fix the I-9 mistake, instruct the employee to cross out the erroneous information by drawing a line through the P.O. box address. Then, have the employee add in the correct address information using a different colored pen. Lastly, have the employee initial and date the correction.

After you and your employee adjust the form, keep the form on file for at least three years in your payroll records.

Keep in mind that if your employee has multiple corrections, you will need to have them fill out a new form and attach it to the old Form I-9.

How to prevent Form I-9 errors

Obviously, preventing Form I-9 errors starts from day one. If you want to avoid I-9 mistakes, follow the checklist below when you fill out the form with your employee:

- Check to make sure the form is current (e.g., 2020)

- Ensure every applicable section of the form is filled out

- Make sure that the information is clear and legible

- Double-check that the date in Section 2 matches payroll records

- Verify that employee documentation matches what’s listed on the form

- Check to make sure all signatures (both employee and employer) are on the form

Taking the above precautions can help you avoid making future Form I-9 mistakes and prevent you from having to do more work later on.

When you hire a new employee, don’t forget to add them to payroll! Patriot’s payroll software makes adding new employees a breeze. And, our HR software add-on is perfect for tracking employees’ employment history and storing new hire documents. Try both for free today!

Like what you read? Let’s connect, friend! Like us on Facebook and let’s get talking.

This article has been updated from its original publication date of August 2, 2010.

This is not intended as legal advice; for more information, please click here.